Follow us on Telegram for the latest updates: https://t.me/mothershipsg

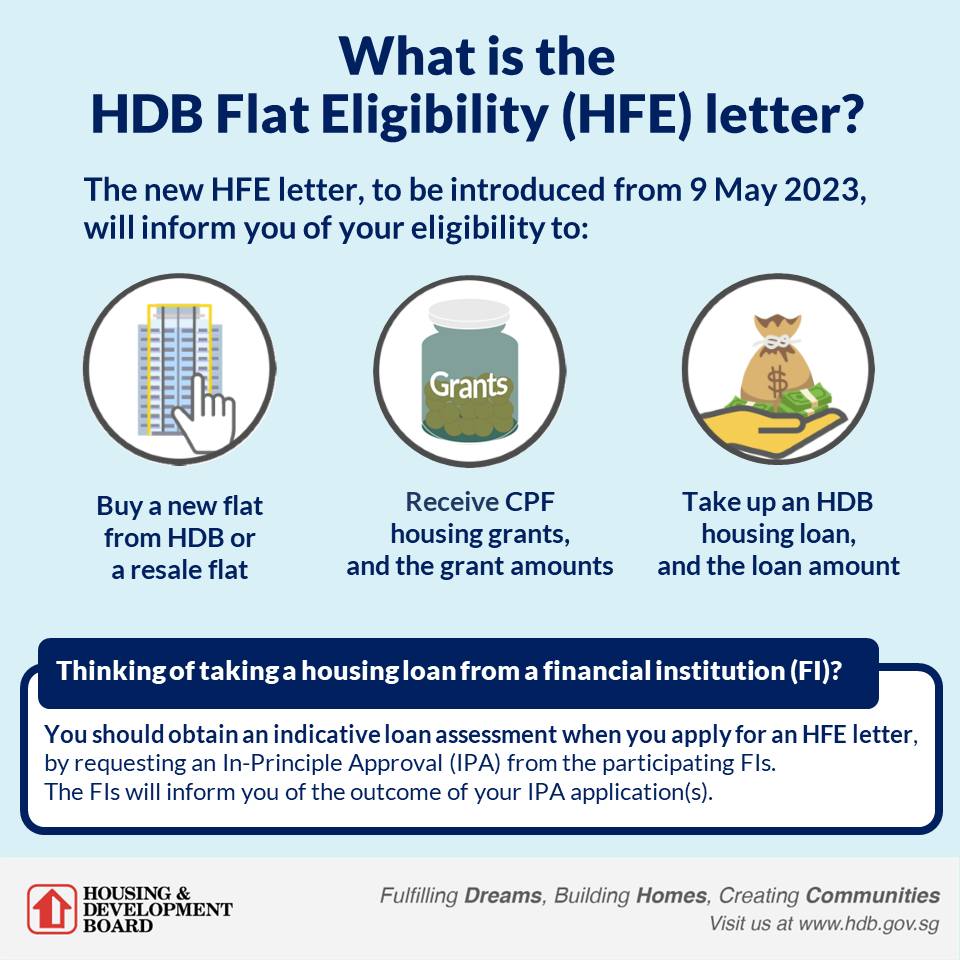

To make the buying process simpler and more convenient, the Housing and Development Board (HDB) will be replacing the HDB Loan Eligibility Letter (HLE) with the new HDB Flat Eligibility (HFE) letter from May 9, 2023.

Currently, HDB assesses flat buyers' eligibility for flat purchases, CPF housing grants and HDB housing loans at different stages of their home-buying journey.

However, under the new scheme, flat buyers' eligibility will be assessed via a single application before they start on their journey.

In a press release on Apr. 28, 2023, HDB explained that this would "bring about more certainty and convenience to flat buyers" by providing "greater clarity upfront on their housing budget and financing options".

Image via HDB

Image via HDB

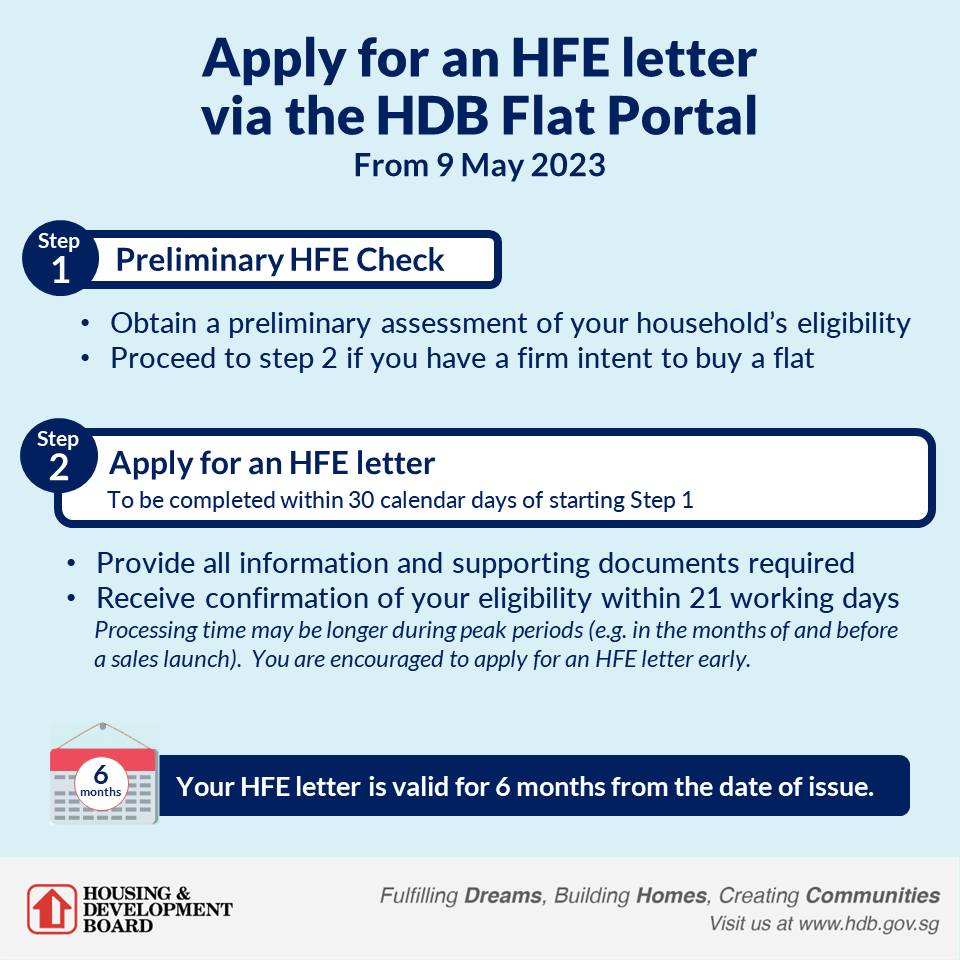

Two steps in new process

There are two steps to the HFE letter application process, which must be completed within 30 days of each other.

Step 1:

The first step requires flat applicants to log in to the HDB Flat portal using their Singpass, and HDB will provide applicants with an instant preliminary outcome, based on their personal information from MyInfo, including their eligibility to purchase a flat and what CPF housing grants and HDB housing loans they can take up.

Flat applicants can then proceed to the second step of applying for an HFE letter in the same session or within 30 calendar days of starting the first step.

Step 2:

In the second step, applicants will use Singpass to retrieve their personal particulars from Myinfo to complete the HFE letter application. They will also be guided to upload supporting documents where required.

Applicants will receive the HFE letter within 21 working days and be notified via SMS to log in to the HDB Flat Portal when it is ready.

The HFE letter will be valid for six months from the date of issue and is required for applying for a flat during an HDB sales launch or open booking.

Resale flat buyers will also need the HFE letter before obtaining an Option to Purchase (OTP) and when they submit a resale application to HDB.

Image via HDB

Image via HDB

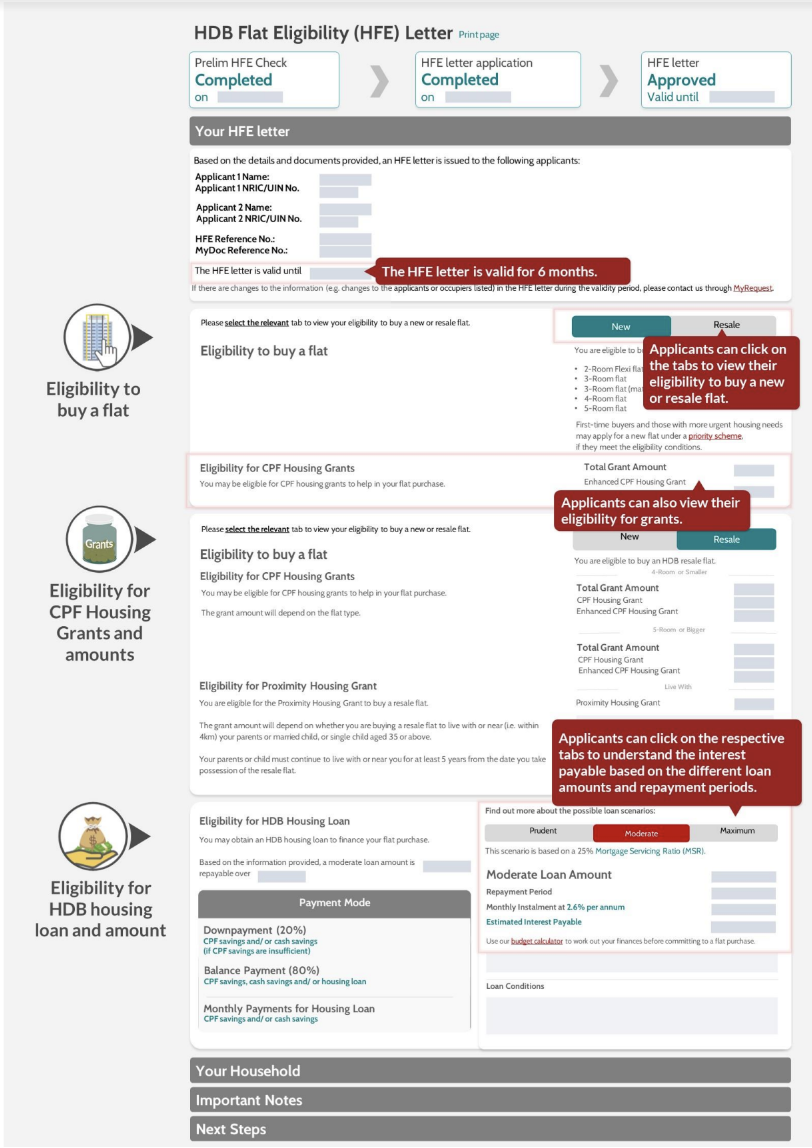

A sample of the HFE letter:

Image via HDB

Image via HDB

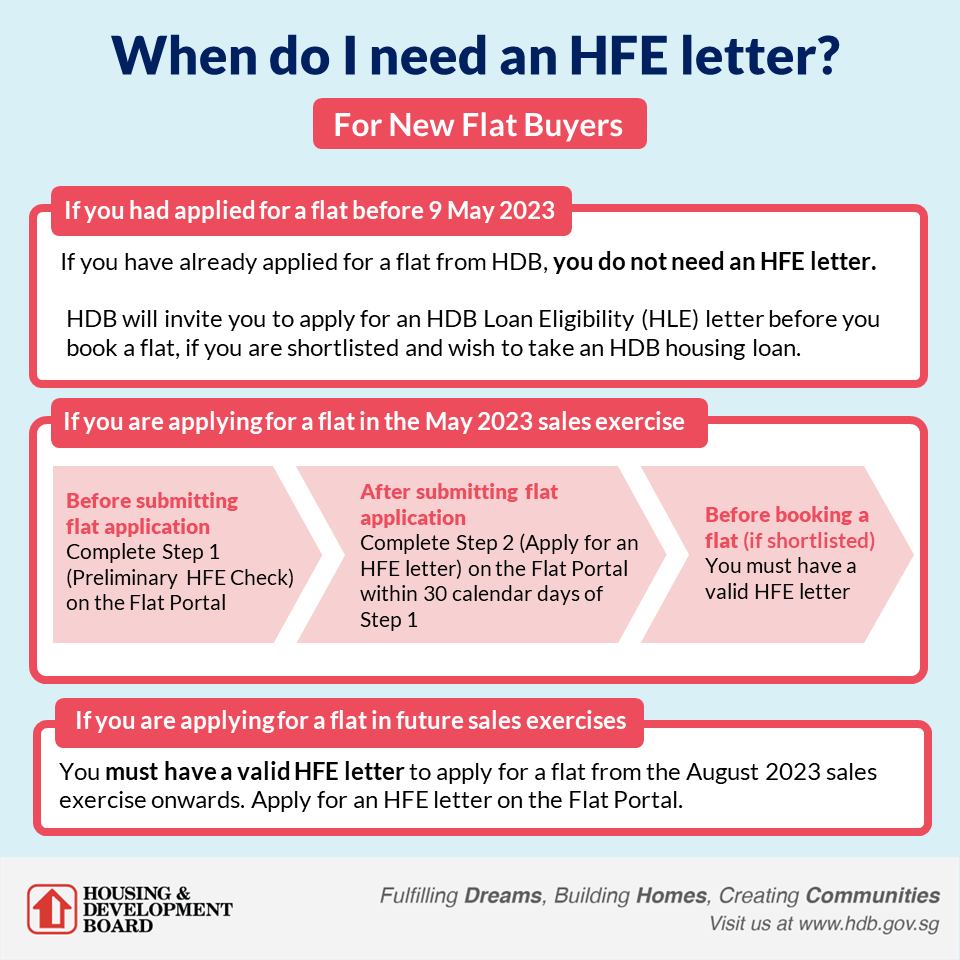

How it affects current applications

New flat buyers

New flat buyers who apply before May 9 will not need an HFE letter, but will be invited to apply for an HLE letter should they wish to take up an HDB housing loan.

Those looking to book a flat from a May 2023 sales launch must obtain a valid HFE letter before booking the flat.

Image via HDB

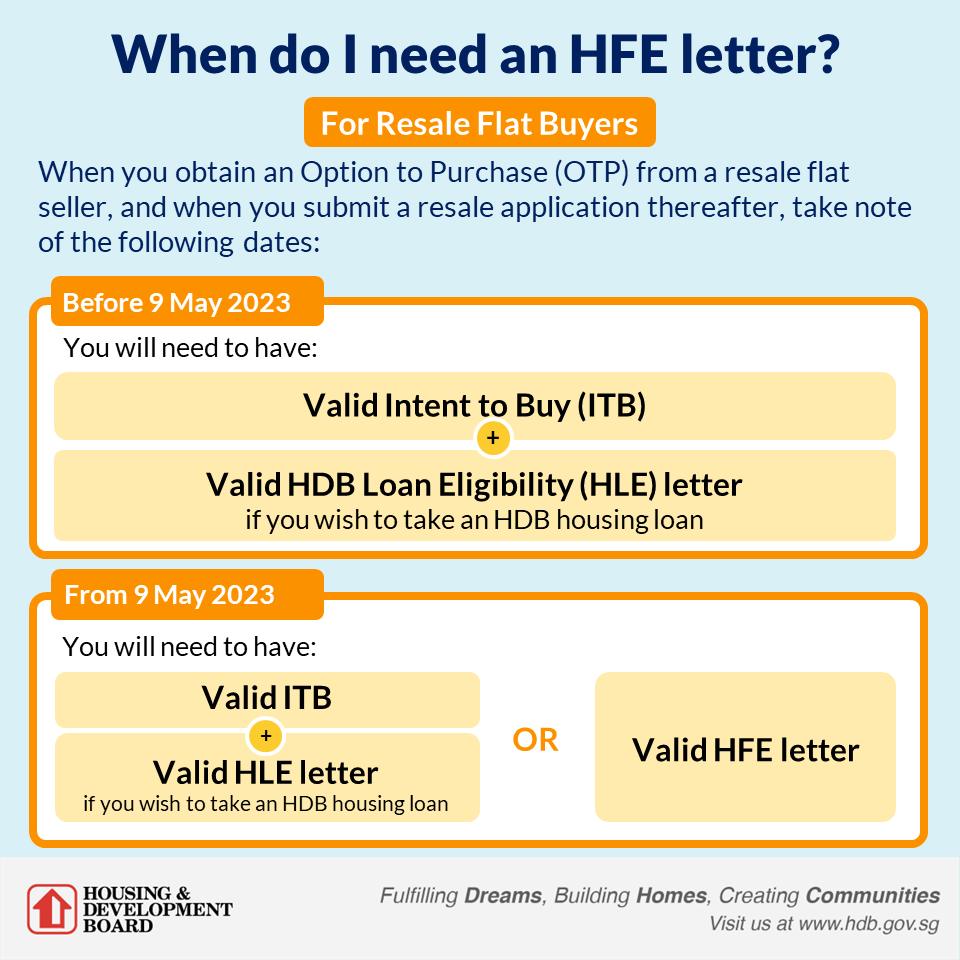

Resale flat buyers

From May 9, 2023, resale flat buyers who do not have an Intent To Buy (ITB) will need to obtain an HFE letter before they obtain an OTP from a flat seller and submit the resale application to HDB.

Those who already have an ITB and want to take up an HDB housing loan but do not have a valid HLE letter will also need to obtain an HFE letter.

Resale flat buyers with an ITB who either have a valid HFE letter or are not intending to procure a housing loan from HDB can proceed with their resale application.

Image via HDB

Image via HDB

Other improvements to the HDB portal

In addition to the HFE letter, HDB will also be rolling out several improvements to the HDB Flat Portal on May 9, 2023, such as an integrated loan application service with participating financial institutions.

The portal will also have features to guide flat buyers, who can receive "personalised information" on their flat application.

HDB explained that the information will help them plan and prepare at different stages of their flat purchase journey, such as working out their financial/ payment plans early.

The HDB Resale Portal will also be integrated into the HDB Flat Portal to provide convenient transactions between flat sellers and buyers.

Top image via Shi Min T/Unsplash

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.