Follow us on Telegram for the latest updates: https://t.me/mothershipsg

A man in Singapore recently unlocked a new fear among bank customers here after he claimed that his deposit of S$6,000 into a cash deposit machines (CDMs) was not credited to his UOB (United Overseas Bank) account for around 19 hours.

Subsequently, after being told to wait a few days for a reply from the bank's customer service staff, the frustrated customer took to Facebook to share more about his experience.

Screenshot via Facebook

Screenshot via Facebook

What happened

According to his Facebook post, the man, who goes by the username, Daniel Sim, deposited S$6,000 to his bank account via a CDM at UOB's Bukit Batok Central branch on Mar. 2 at 10:37pm.

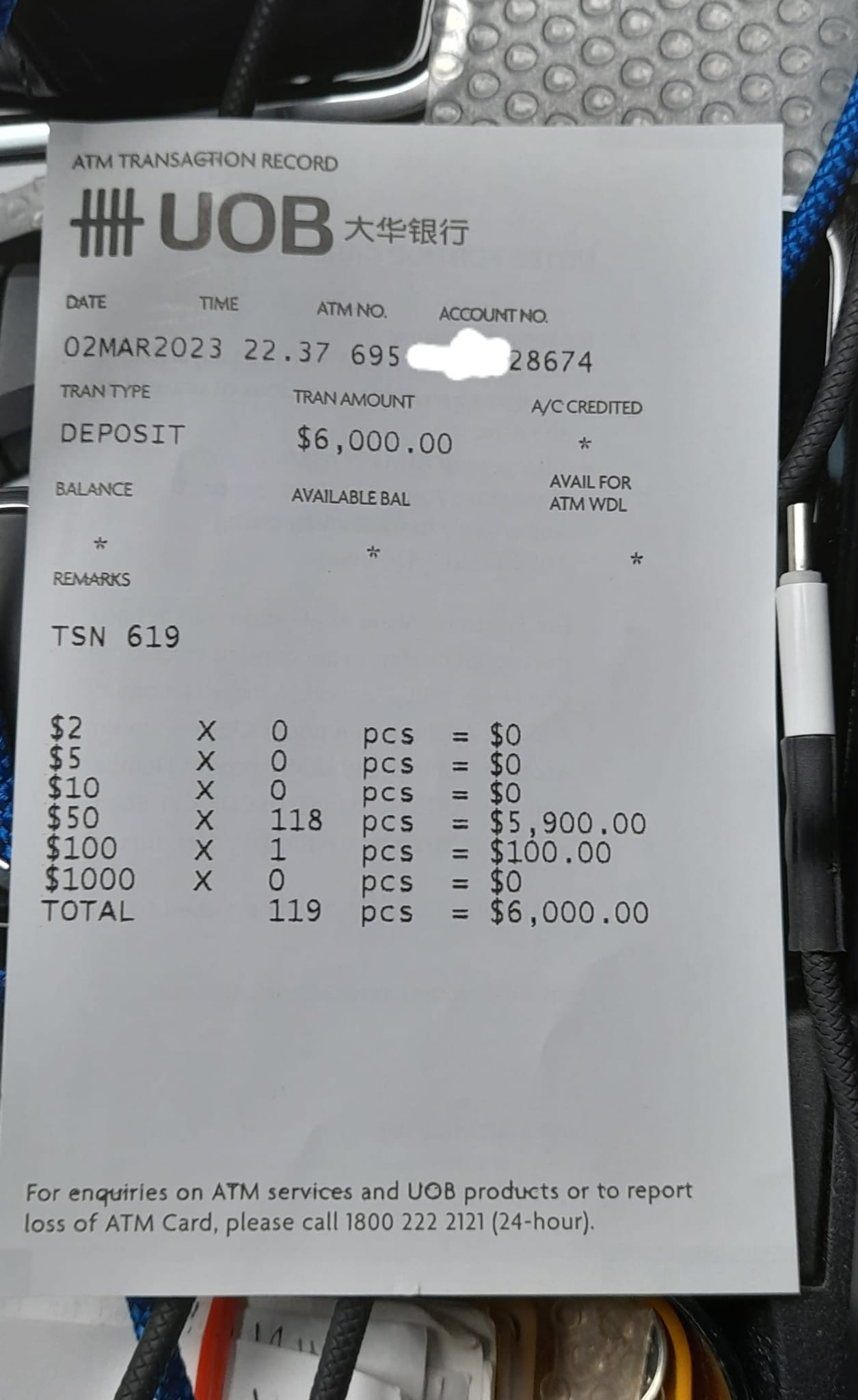

He also uploaded a photo of his receipt together with the Facebook post to support his claims.

Image via Daniel Sim/Facebook

Image via Daniel Sim/Facebook

While the deposit amount was clearly printed on the receipt, it omitted the account credited and balance, unlike usual receipts.

Nevertheless, Sim did not think much about it and left the scene after completing the transaction.

Money not credited at all

However, at around 6pm the next day, he came to the shocking realisation that the money was not credited to his account at all.

When Sim dialled the UOB call centre at 7pm for help, he said he was put on hold for around 20 minutes before a customer service officer finally attended his call, Sim claimed.

Upon hearing the complaint, Sim claimed the officer responded that she would ask the relevant department to call him back and shared that the waiting time would be seven working days.

While on the phone, Sim said he felt the officer was being "extremely rude" to him, so he requested the officer's duty manager to call him back.

At around 8:50pm, the duty manager called Sim and reiterated her colleague's response by asking him to wait three to seven working days for the follow-up.

Without having the matter solved on the spot, Sim found his back and forth with the bank "very inefficient" and questioned how customers can put their trust in UOB's services.

At the end of his post, Sim also called on his fellow Singaporeans to reconsider banking with UOB.

Comments from Facebook users

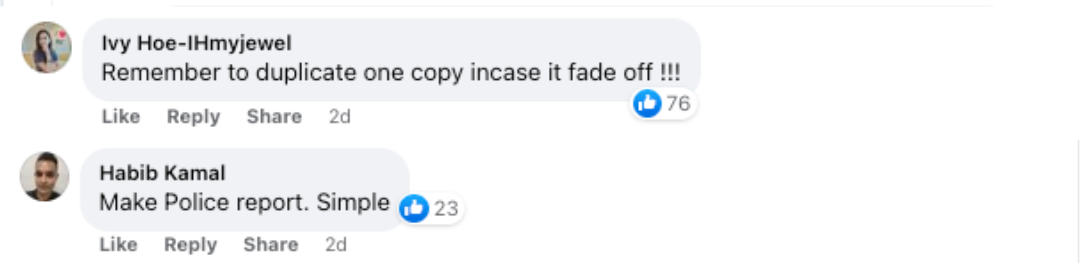

Sim's experience triggered a wide range of reactions from others in the comments section.

Many offered him tips that may help to get his money back, such as filing a police report and safekeeping the evidence by duplicating a copy of the receipt in case the numbers fade out.

Screenshot via Facebook

Screenshot via Facebook

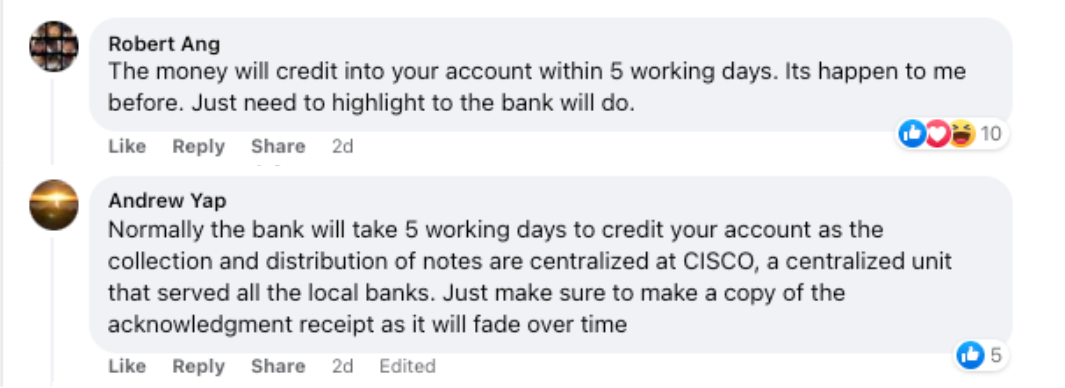

Others, however, claimed that it is normal for the bank to take five working days to credit the deposit to the customer's account, and all Sim needs to do is flag the matter to the bank.

Screenshot via Facebook

Screenshot via Facebook

UOB response

In response to Mothership's queries, a UOB spokesperson said the bank has apologised to the customer for his experience.

The sum was credited to the customer’s account on the morning of Mar. 6, and he has been duly informed.

The spokesperson also explained that the cash deposit issue faced by this customer is uncommon, and the bank will make every effort to resolve such cases speedily.

"We would like to assure customers that money deposited in our cash deposit machines is safe. In rare instances where there is machine failure, they should contact us immediately at 1800 222 2121. We will investigate and credit their accounts upon reconciliation as soon as we can,” the spokesperson added.

Top images via Google Maps & Daniel Sim/Facebook

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.