Singaporeans are growing increasingly confident of their ability to live till 100 years old.

This was one of the key findings of the ”Digital for 100: Harnessing technology for longer lifespans“ survey commissioned by Prudential Singapore.

Confident about one’s longevity

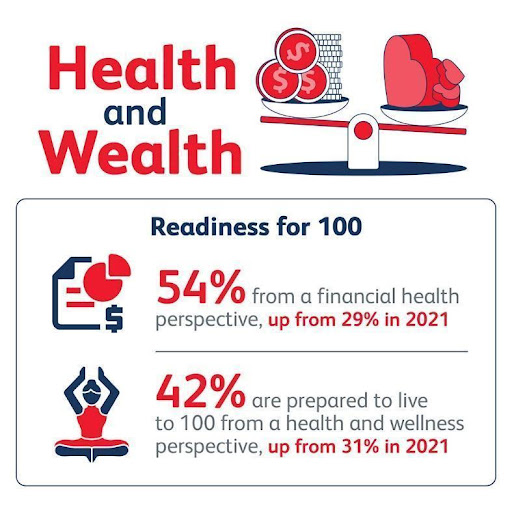

Decidedly upbeat, some 54 per cent of respondents also said they expect to be able to fund their longevity on the road to 100 years old from a financial health perspective.

This figure is substantially higher than the 29 per cent positive response registered in 2021 during the troughs of a health crisis.

From a health perspective, 42 per cent of the respondents said they are prepared to live to 100 years old.

Overall, in terms of health and wealth, people appeared more confident about their future prospects.

Conducted with 800 Singapore residents between June and July 2022, the respondents fell into four age cohorts:

- 25 to 34

- 35 to 44

- 45 to 54

- 55 to 65

Male and female respondents were evenly split.

Those who responded were distributed among different income groups ranging from S$0 to S$25,000 to S$200,000 and over.

via Unsplash

via Unsplash

Digital tools important to live well

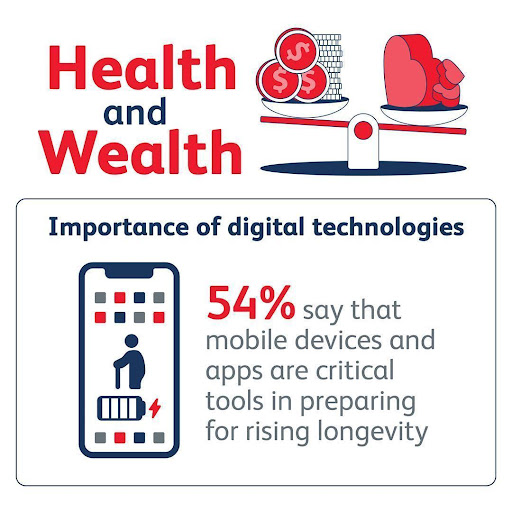

The survey’s most salient finding was that some 54 per cent of respondents felt that mobile devices and apps were the most important tools in helping them manage health and wealth more effectively — to live well for longer and get the most out of life.

This optimism could be influenced in part by Singapore's public health and economic resilience.

But credit also went to greater trust in and the ability to navigate digital technology for helping people to monitor and improve their personal health and finances.

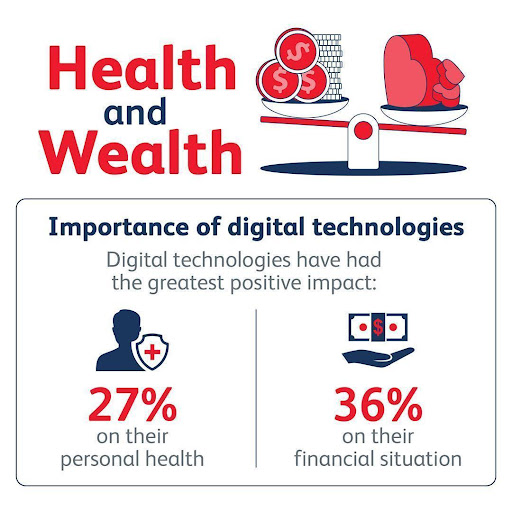

Out of those who are using technology to manage their well-being, 27 per cent said digital tools have had the greatest positive impact on their personal health, and 36 per cent on their financial situation.

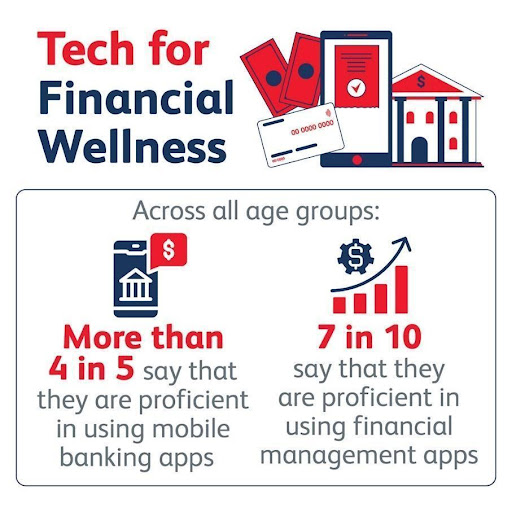

Proficient in using personal fintech

Moreover, the respondents’ self-assessed proficiency in using personal finance technologies was impressive for some platforms.

Drilling down the numbers, 85 per cent of respondents said they were skilled at using mobile banking apps, while 70 per cent said they were skilled in financial management apps.

Respondents also said digital tools have helped them to better manage their bank accounts, pension (CPF), investments, and insurance needs.

Using digital tools to support long life spans

Across the board, respondents placed considerable importance on the use of personal health and finance technologies in their efforts to better prepare for a longer life span.

Wearable fitness devices have become almost ubiquitous, given that Singapore residents are the most avid adopters of smartphones in the world.

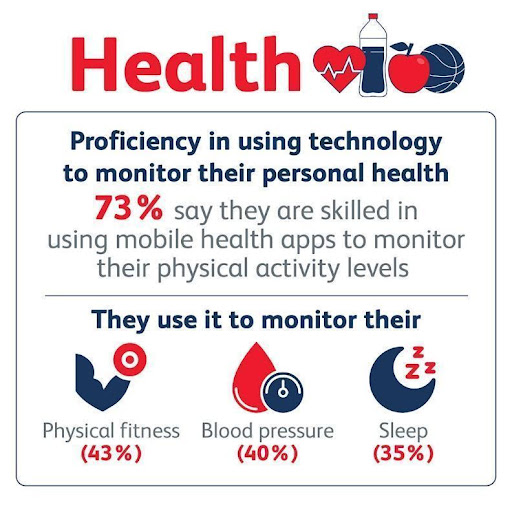

On the health front, 73 per cent said they were well-versed in using technologies, such as apps for keeping tabs on their physical health.

They also used technology for monitoring physical fitness, blood pressure, sleep, diet, and for managing chronic diseases, such as diabetes.

The proficiency in using wearable fitness trackers was 76 per cent, while wearable health monitors was 72 per cent.

Some 67 per cent were good at using mental health tools, such as apps that measure stress and anxiety levels, and monitor moods.

via Unsplash

via Unsplash

Is age a differentiator when it comes to use of digital technology?

The younger and older cohorts expressed similar proficiency levels when it came to mobile and online banking.

Some 82 per cent of respondents aged 55 to 65 years old and 89 per cent aged 25 to 34 years old consider themselves proficient with mobile banking apps.

When it came to using online banking websites, 84 per cent aged 55 to 65 years old and 91 per cent aged 25 to 34 years old claim similar proficiency.

It was, however, the younger respondents who were more likely to claim proficiency than older ones when using robo-advisors, share-trading apps, and crypto platforms.

When it came to robo-advisers, 52 per cent of those aged 25 to 34 years old claimed proficiency, while only 37 per cent of those aged 45 to 54 and 55 to 65 did likewise.

With digital asset trading platforms, the most confident were those aged 35 to 44 years old, with 53 per cent judging their proficiency as good or excellent, while only 36 per cent did so for those aged 55 to 65.

When it came to purchasing health insurance or life insurance, financial technologies were of greatest help for those aged 25 to 34, with 40 per cent saying so.

Only 12 per cent of those aged 55 to 65 years old agreed.

One other finding gleaned was that managing one's personal investment portfolios was more important to those who were mid-career, with 35 per cent for those aged 35 to 44 and 41 per cent for those aged 45 to 54 indicating so.

On the other hand, respondents closest to retirement were more likely than others to value technology in managing their Central Provident Fund (CPF) account.

Pulse app to start your financial planning journey and be ready for 100

Those looking for wealth solutions can consider tapping Pulse, an app developed by Prudential.

Launched in April 2020, the Pulse app is a digital health and wellness app that is designed to leverage technology to help users manage their health and wealth.

Pulse offers a suite of health and wealth solutions, and is free to download for anyone aged 18 and above.

To promote physical health and encourage people to maintain healthy habits, Pulse also runs challenges that reward users for adopting a healthy lifestyle.

Users can accumulate reward points that can be redeemed as vouchers with selected merchants.

For instance, Challenge Your Pulse is a series of walk, run, and ride geolocation-based challenges from August to September 2022.

Individual users were required to check in at various checkpoints along one of the five curated routes to complete a weekly challenge.

Users were rewarded with points which could be instantly converted to retail vouchers, and can look forward to challenges that will be run periodically throughout the year.

In the future, Pulse will continue to connect with users and empower them to take charge of their health journey through innovative engagements.

Benefits of Pulse

With both health and wellness features, Pulse is designed to empower users to better manage their health and wealth.

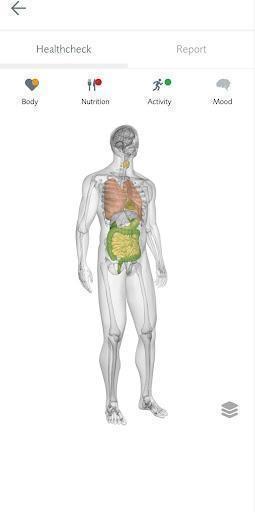

Pulse’s Healthcheck

Pulse’s Healthcheck

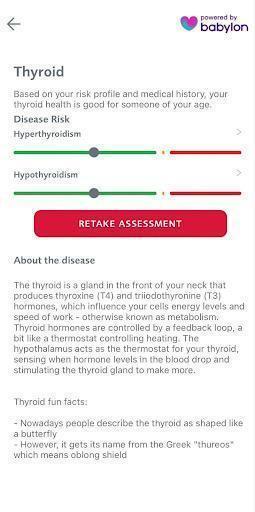

Pulse's Symptom Checker

Pulse's Symptom Checker

Users can access healthcare services, such as the AI-powered Healthcheck and Symptom Checker to assess one's health.

The Healthcheck feature allows users to better understand their overall health status and long-term disease risks based on input, such as lifestyle habits, diet and medical history.

They will get a report that includes suggestions on how to cut down disease risk and improve their overall well-being.

When they use the Symptom Checker, they can gain insights into possible health conditions based on the symptoms experienced, and recommendations on next steps.

Such features are useful as more Singaporeans are becoming more conscious about their health.

Pulse also offers mood trackers, quizzes, and content related to mental wellness, to help users better understand and manage their mental health.

The app’s wealth features include tools, such as an AI-powered assistant, Ruby, that will support users in their financial planning journey.

Users can also use the Goal Setting tool to achieve the finances they need for the future.

From shorter-term expenses such as accumulating enough for a destination holiday, to longer-term life events, such as retirement planning, users just need to select their goal, and let the app compute the rest.

Other features include Wealth Score, a simple tool to help users assess their current financial health and provide suggestions to improve the score, as well as a budgeting tool.

Pulse users can also connect with a Prudential financial consultant for in-depth financial planning review based on their goals.

With many in Singapore engaging in various investment strategies and growing various portfolios at once, tracking one’s personal financial situation digitally has never been easier and more crucial.

Users can also turn to the app as a means to instil discipline in sticking to one's wealth plans for the short and long term.

Prudential customers can also get a 360-degree view of their insurance protection, savings and investment plans and change their contact details easily.

To get started, the Pulse app is just a click away on the phone.

You can download the Pulse app on the Google Play or Apple Store.

This article was brought to you by Prudential Singapore.

Top photos via Unsplash & Prudential

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.