Follow us on Telegram for the latest updates: https://t.me/mothershipsg

The Singapore government will offset 75 per cent of the increase in CPF contribution rates that lower-income platform workers will make to their Ordinary (OA) and Special Accounts (SA) in 2024, as it moves such workers' CPF scheme in line with the rest of the labour force.

"I know that some platform workers are concerned about the impact of the CPF changes on their take-home pay," said Senior Minister of State for Manpower Koh Poh Koon during the Committee of Supply debate on Mar. 1.

The changes to platform workers' CPF contributions were first announced by Deputy Prime Minister Lawrence Wong during this 2023 Budget Statement.

Encouraging lower-income workers -- those earning S$2,500 or less per month -- to opt into the new CPF scheme sooner rather than later, Koh said those who did so would receive stronger support.

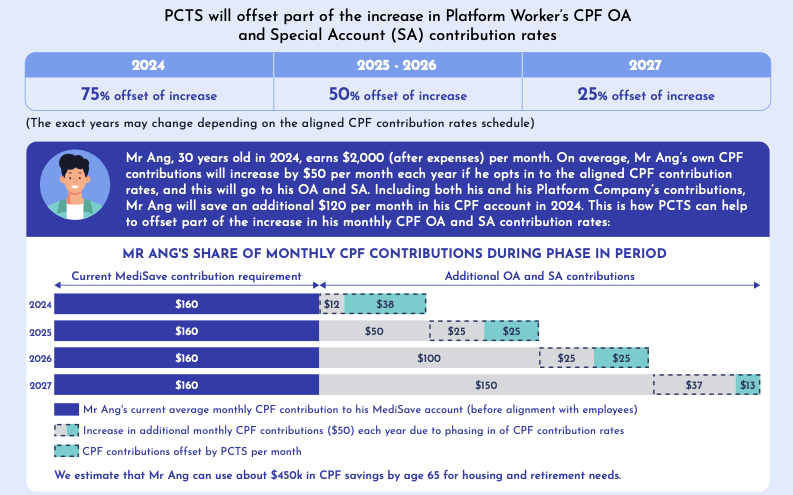

The scheme — titled the Platform Workers CPF Transition Support (PCTS) — involves a 75 per cent offset in 2024, which tapers down over subsequent years: 50 per cent in 2025 and 2026, and finally 25 per cent in 2027.

Image from the MInistry of Manpower

Image from the MInistry of Manpower

Responding to a question from Progress Singapore Party Non-constituency Member of Parliament Hazel Poa, Koh said the government will implement the additional CPF contributions evenly across five years.

"At around 2.5 percentage points per year for platform workers, and 3.5 percentage points per year for platform companies... We will calibrate this further if necessary."

Building up platform workers' CPF accounts

Gradually moving platform workers' and companies' CPF contributions in alignment with that of employees and employers was one of a series of recommendations made by the Advisory Committee on Platform Workers and accepted by the government in November 2022.

"In principle, platform workers of the same age and income as employees should be able to achieve a similar level of retirement adequacy through their CPF savings, if they have worked the same number of years," said Koh on Mar. 1.

"However, unlike employees, platform workers only make MediSave contributions on their own and do not receive CPF contributions from platform companies today."

The new scheme will help workers build up their savings in the CPF OA and SA, Koh said.

"It also ensures a level playing field for all companies operating in the same field in Singapore and allows platform workers to receive similar basic protections as employees."

The increased contribution rates — set to be implemented in the second half of 2024 — will be mandatory for all platform workers born on and after 1995; workers born before can choose to opt-in.

Koh clarified that those who opt-in will not be able to renege on their commitment thereafter.

Those who earn between S$50 and S$500 per month will also be able to receive CPF contributions from platform companies without having to make CPF contributions themselves.

More WIS payments

In addition, Koh announced that the Workfare Income Supplement (WIS) — a scheme that encourages eligible workers to build their CPF savings by supplementing income and savings through cash payments and CPF contributions — would be increased for platform workers, once again matching those of employees.

"This means that eligible platform workers could receive up to S$4,200 per year, an increase from S$2,800 per year today, with 40 per cent given in cash compared to the 10 per cent today," said Koh.

Workers will also receive their WIS payments monthly instead of yearly, as a result of companies deducting CPF contributions with increasing regularity.

Psssst! Follow us on LinkedIn for more stories like these.

Top image adapted via Grab & Foodpanda magazine

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.