Follow us on Telegram for the latest updates: https://t.me/mothershipsg

A GetGo user took to Facebook to warn others about the platform after incurring a heavy bill for an accident.

The Mothership reader said he was involved in a "small accident" at Novena Square 2 car park while driving a rented Ssangyong for five hours on Feb. 16.

In his own words, he turned too soon when leaving the parking lot and "grazed a white Mercedes" next to him.

He reported the incident to GetGo's customer service immediately and returned the car at the end of the rental period.

That night, an "accident reporter" from GetGo inspected the car and found there was "a graze" and "some damage to the paint".

He settled the matter privately with the Mercedes driver -- compensating him S$288 after the driver shared that the workshop had quoted him S$150 for the repair.

For reference, here's how the damage to the Mercedes looked like:

And here's a photo of the damage to the GetGo car:

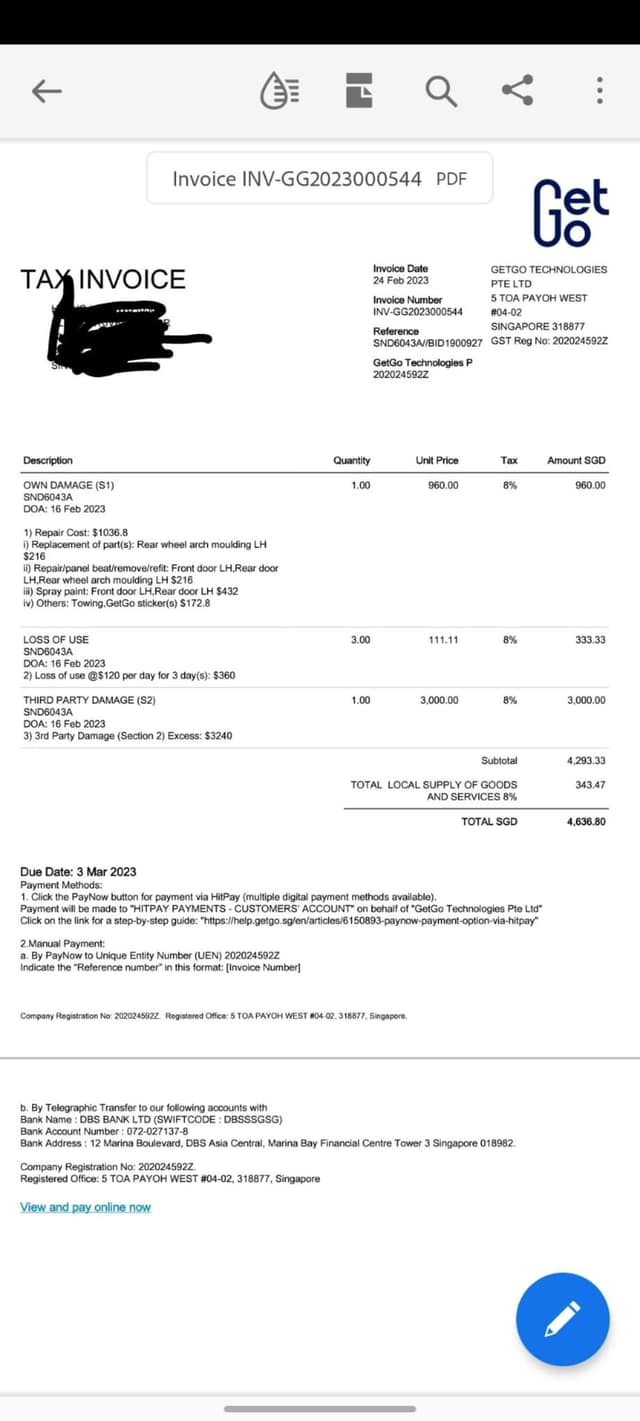

Bill from GetGo

On Feb. 25, he received a bill from GetGo. It was a staggering S$4,646.80.

"It shocked me till my jaw dropped," he wrote.

He disputed against the cost, stating that the repair cost of S$960 is a few times higher than what a regular workshop would charge.

"This bill is just too absurd to believe," he insisted.

He was also confused how he was charged for "loss of use" for three days starting Feb. 16 (which amounted to S$333), as he had noticed that the car was available for rent on Feb. 18 on the GetGo app.

To top it off, the man said he found it ironic that when he recently went to check on the car, it was still unrepaired.

The largest chunk of the bill was "third-party damage" -- a whopping S$3,000.

He questioned: "I settled privately with the other party. Where is the amount derived from?"

He told Mothership:

"Rental car companies abuse their power to charge customers who get involved in a car accident at their whim. There are many horror stories about it. And it seems no regulations or measures have been taken against them."

According to GetGo's website, the standard insurance excess for experienced drivers, which users are expected to pay out of pocket in the event of an accident, is S$3,240.

GetGo likely to waive third party damage after appeal

The man said he submitted an appeal form to clarify with GetGo regarding the bill.

After speaking a representative, he said it was still "not very clear" to him how the charges were calibrated.

The representative reportedly told him the repair cost is quoted by their workshop partner.

According to him, they said that they are unable disclose any documents and they would need to check with the operations team regarding the loss of use charge.

"I said I will only pay when I receive the workshop's bill invoice," he told Mothership.

However, he managed to acquire a mutual agreement form from GetGo, which he signed with the Mercedes driver.

He told Mothership it was very likely the company will remove the third party damage from the bill.

In response to Mothership's queries, GetGo said it has reached out to the user and provided any assistance needed.

"We adhere to the industry practice of collecting the costs of Third-Party Damage Excess in the event of at fault and shared liability cases.

However, we do provide the option for Mutual Settlement in minor accidents where both parties explicitly agree that they will not be claiming against each other’s insurance. In the event that our user is not at fault, as determined by the insurer, we may not open the option for Mutual Settlement. Upon submission of proof of private settlement between both parties, the Third-Party Damage Excess cost will be removed from the bill.

We highly recommend that our users consider taking the Collision Damage Waiver (CDW), which can reduce Third-Party Damage Excess costs by 50 per cent in the event of an accident."

Responses

The incident was also posted on Singapore Road Vigilante Facebook page, garnering over 200 shares and 500 comments.

Many took the opportunity to air their views about car sharing platforms, saying that billing users for such accidents is how they make money.

One told the Getgo user to be grateful, as the bill could have been worse.

Another person shared that they recently found themselves in a very similar situation but failed to appeal against the bill.

Others recommended him to avoid car sharing and simply take public transport or take a taxi to get around.

All images courtesy of Mothership reader

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.