Follow us on Telegram for the latest updates: https://t.me/mothershipsg

The Progress Singapore Party (PSP) proposed an “alternative” Budget during the Budget debate in Parliament on Feb. 22.

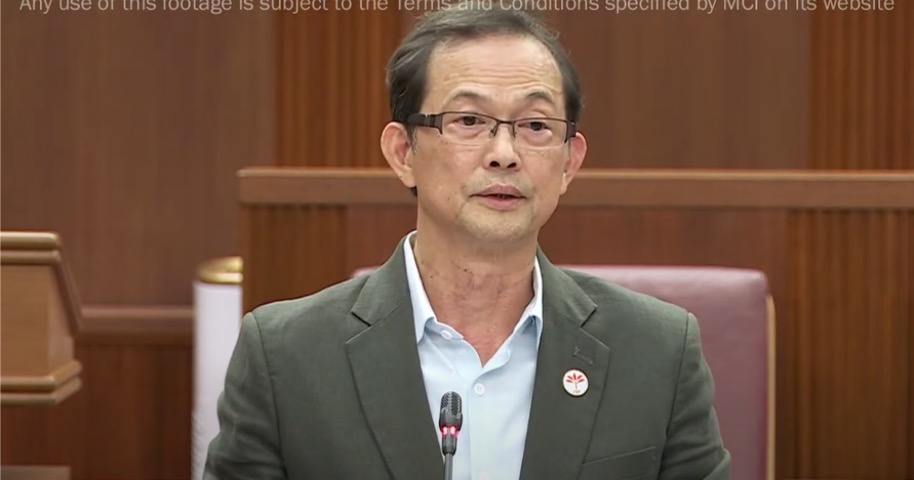

Non-Constituency Member of Parliament (NCMP) of the PSP, Leong Mun Wai, outlined the details of the alternative Budget.

PSP's housing schemes

He first called for the PSP's Affordable Housing Scheme and the Millennial apartment scheme to "reset” housing policy.

The schemes echoed the proposal he presented to the House on Feb. 6.

CPF Housing Grant not the best solution: Leong

Leong agreed that young Singaporeans need help with affordable housing.

However, he opined that the increase in CPF Housing Grant announced during Budget 2023 would not be the best solution as it would inflate the housing market and necessitate higher CPF grants in the next round, and the cycle will repeat itself.

Leong said that Singapore needs a more “fundamental solution”, i.e. his party's.

According to him, the schemes will allow Singaporeans in each generation to enjoy affordable housing without having to sacrifice their future retirement.

Promoting Financial Security of Middle Class

Leong said PSP’s alternative Budget will prioritise the financial security of the middle class.

Leong claimed that middle-class Singaporeans are "overtaxed relative to their income", saying that they paid a wide range of indirect taxes despite the low personal income tax.

He cited examples such as the Goods and Services Tax (GST), Certificate of Entitlement (COE), domestic helper levy and others.

Leong claimed that this compares unfavourably to the top 10 per cent and bottom 20 per cent of income earners.

Tax increases, including GST hike, should be reversed: Leong

As such, he proposed that some of the tax increases should be reversed, including reverting the GST to 7 per cent and property taxes for owner-occupied properties to be restricted to those with an annual value of more than S$50,000.

He added that the stamp duty increase will be limited to properties that are worth more than S$3 million and the ARF increase will be limited to cars with an Open Market Value (OMV) of more than S$60,000.

“PSP believes that if tax increases are really necessary, they should be targeted at the wealthy individuals and corporates,” Leong added.

Nationalising MediShield and CareShield schemes

Leong also proposed that under this alternative Budget, S$4 billion will be set aside for the nationalisation of the Medishield and Careshield schemes, as healthcare expenses are the second-largest drain on the CPF savings of Singaporeans, behind housing.

This was previously proposed by the PSP in 2021, he said.

“By taking over the whole healthcare insurance, we hope the government will be in a better position to develop an optimal healthcare system together with the new Healthier SG initiative,” he said.

Securing job prospects for Singaporeans

Leong said the government should be mindful that Singaporeans “are disadvantaged when competing with Employment Pass holders (EPs) who are exempted from CPF contribution”.

As such, PSP proposed to introduce a S$1,200 monthly levy on EP holders in the alternative Budget to “level the playing field between Singaporean and foreign employees”.

This too was previously proposed by the PSP in 2021. The levy is estimated to generate additional revenue of S$2 billion to $3 billion.

Leong also criticised previous job training schemes by the government for displaced workers, but praised the Job Skills Integrator scheme announced by Wong in the Budget.

“It's unrealistic to expect all Singaporeans who have been displaced by foreign PMETs to acquire totally new skills, and join new sectors,” he added.

S$1,800 minimum “living wage”

PSP would also increase the amount of “compassionate spending” for low-skilled workers and disadvantaged segments of society by proposing a $$3 billion budget for a “living wage”.

According to Leong, this would guarantee a minimum monthly take-home pay of S$1,800 for all Singaporean workers. Again, this was previously proposed by the PSP in 2021.

The PAP's Progressive Wage Model scheme could remain, but it would be to help workers to achieve a higher wage level than the living wage.

In addition, Leong said that the PSP would also propose a budget of S$1 billion to double ComCare payouts.

This would also provide an allowance to caregivers and stay-at-home parents in recognition of their sacrifices and contribution to society.

Leong concluded by inviting Singaporeans to "judge the merits" of the PSP's alternative Budget.

Although he did not confirm it, the two PSP NCMPs would presumably not be voting in support of Lawrence Wong's Budget 2023.

Related story:

Top image from MCI YouTube.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.