Follow us on Telegram for the latest updates: https://t.me/mothershipsg

Deputy Prime Minister (DPM) and Finance Minister Lawrence Wong announced in his Budget Statement 2023 that he will be making further adjustments to the tax system.

This comes a year after Wong has made announcements to the staggered increase in Goods and Services Tax (GST), the raising of personal income tax rates for top income-earners, as well as property tax rates for higher-value owner-occupied residential properties and all non-owner-occupied residential properties.

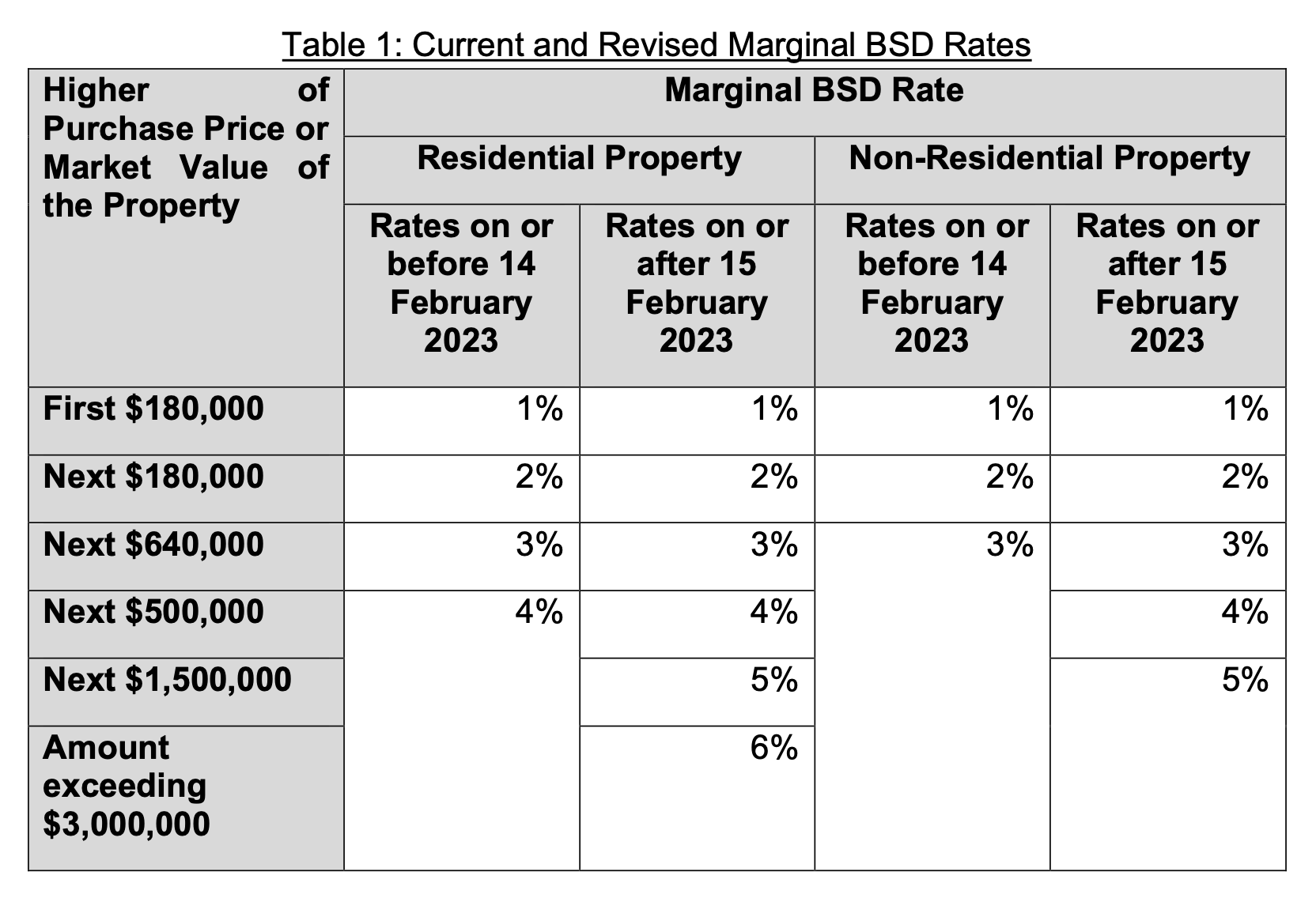

The adjustments include introducing higher marginal buyer's stamp duty (BSD) rates for higher-value residential and non-residential properties.

Table from MOF

Table from MOF

Residential properties valued in excess of S$1.5 million to have BSD increased by 1-2 per cent

For residential properties, the portion of the value of the property in excess of S$1.5 million and up to S$3 million will be taxed at 5 per cent, while that in excess of $3 million will be taxed at 6 per cent — up from the current rate of 4 per cent.

These changes are expected to affect 15 per cent of residential properties.

The Additional Conveyance Duties regime will also be adjusted accordingly, he said.

Non-residential properties valued in excess of S$1 million to have BSD increased by 1-2 per cent

As for the non-residential properties, the portion of the value of the property in excess of S$1 million and up to S$1.5 million will be taxed at 4 per cent, while that in excess of S$1.5 million will be taxed at 5 per cent — up from the current rate of 3 per cent.

These changes are expected to affect 60 per cent of non-residential properties, Wong added.

Wong highlighted, "The changes to the BSD regime will apply to all properties acquired from tomorrow. This is expected to generate an additional S$500 million in revenue per year. But the actual amount will depend on the state of the property market."

Transitional provision

However, some cases will instead enjoy a transitional provision where the BSD rates on or before 14 February 2023 will apply.

In order to qualify, cases will have to meet all of the following conditions:

- The Option to Purchase (OTP) was granted by sellers to potential buyers on or before Feb. 14, 2023

- This OTP is exercised on or before Mar. 7, 2023, or within the OTP validity period, whichever is earlier

- This OTP has not been varied on or after Feb. 15, 2023

Correspondingly, the Additional Conveyance Duties for Buyers, which applies to qualifying acquisitions of equity interest in property holding entities will be raised from up to 44 per cent to up to 46 per cent.

Fortifying Singapore's fiscal position

Wong said that the Ministry of Finance (MOF) recently published a paper on Singapore's medium-term fiscal projections.

He noted that Singapore's expenditure projections have not taken into account additional policy moves that the government may make in the future.

He added that if there are further such increases in spending, they will need to be funded by additional revenues to ensure a balanced budget for the medium term.

Wong said that the approach to raising revenues will be a fair and inclusive one, and it will be based on collective responsibility.

Top photo by Milin John via Unsplash

Here's a video you might be interested in...

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.