Let’s be real, most people don’t enjoy buying insurance.

It’s one of those nagging little things that everyone has to do at some point, but few people actually derive pleasure from it. Much like getting your teeth checked at the dentist or listening to your mum tell you what her mahjong kakis have been up to. For three hours.

But unlike long-winded anecdotes about the new flat Aunty Jenny’s son bought, health insurance actually comes in useful.

If you think about it, health insurance is one of the “surest bets” you can make. It’s incredibly hard to guess the right six numbers from one to 49, but it’s fairly certain that unless you’re a superhero of some kind, you will run into disease or injury at some point in your life. Especially as you get older.

At this stage of my life, as a working millennial who cried tears of joy at the 2022 Superbowl half-time concert featuring Dr Dre, Snoop Dogg and Eminem, the ravages of time are never far from my mind.

At any moment, I could meet with a severe disability that could put me out of a job, or leave me unable to care for myself. Long-term care insurance has become a necessity, not a luxury.

But here’s the thing -- the human mind isn’t always rational. I know getting a good insurance plan is important, but there’s always something that seems more important to get done. A work assignment, a family obligation, or some errands to run.

Even the thought of sifting through the myriad plans and policies out there just makes me want to put it off till another day.

Chances are you know at least one kid from school who’s now working as an agent, and would be more than happy to explain the details to you.

But before you go ahead and set up that coffee catch-up, you may want to learn a bit more about CareShield Life first.

CareShield Life

CareShield Life is provided by the Ministry of Health. It is a national long-term care insurance scheme that provides basic financial protection against severe disability.

Anyone born in 1980 and after is automatically covered once they turn 30 or from Oct. 1, 2020 (whichever is later).

Anyone born between 1970 and 1979, on ElderShield 400 and not severely disabled will be automatically enrolled into CareShield Life from 1 Dec 2021. Those who are not automatically enrolled can choose to be enrolled if they are not severely disabled.

This means that if you, like me, know how to sing the “Captain Planet” and “Teenage Mutant Ninja Turtles” theme songs by heart, you’re most likely covered too.

If these guys were your heroes growing up, you’re probably covered by CareShield Life. Screenshot from YouTube.

If these guys were your heroes growing up, you’re probably covered by CareShield Life. Screenshot from YouTube.

If you’re thinking that CareShield Life sounds familiar, the government introduced a similar scheme back in 2002, called ElderShield.

The difference is that ElderShield only provides fixed payouts of $400 per month for ElderShield 400 or $300 per month for ElderShield 300, and has a limited duration of up to 72 months (six years) or 60 months (five years) for its payouts respectively. By any measure, CareShield Life is better.

So what does it do exactly?

What you get out of CareShield Life

If you become severely disabled (let’s hope not, but it could happen), and make a successful claim, you’ll receive a monthly payout that supports your long-term care costs for as long as you are severely disabled.

Payouts are higher and increase annually until the policyholder is 67 years old, or successfully makes a claim, whichever is earlier. This means that you don’t need to worry about inflation making your insurance plan inadequate with time. The monthly payout started at S$600 in 2020 and is now S$624 in 2022.

There is a serious risk of the average Singaporean falling victim to severe disability as a result of a sudden disabling event, such as a stroke or an injury to one’s spinal cord.

As one ages, there is also a greater likelihood of other threats like age-related conditions such as dementia, diabetes and other chronic diseases that could result in the need for long-term care. Statistics from the Ministry of Health put it at a one in two chance. That’s akin to a coin flip.

According to an article by CNA in 2021, citing MOH figures:

“A family looking after a severely disabled senior at home could pay up to $3,100 per month, including transport and consumables before subsidies. This is higher than the median full cost of $2,400 for looking after the same person in a VWO (Voluntary Welfare Organisation) -run nursing home.”

If severe disability does befall someone, CareShield Life will provide at least some financial assistance while they sort things out.

Small sum to pay for bigger protection

Now some people may point out the fact that they have to pay premiums every year. And they would be right.

But the premiums are worth it as it gives you and your family members a peace of mind. And it can be fully paid through MediSave anyway, which means that your pocket isn’t directly affected.

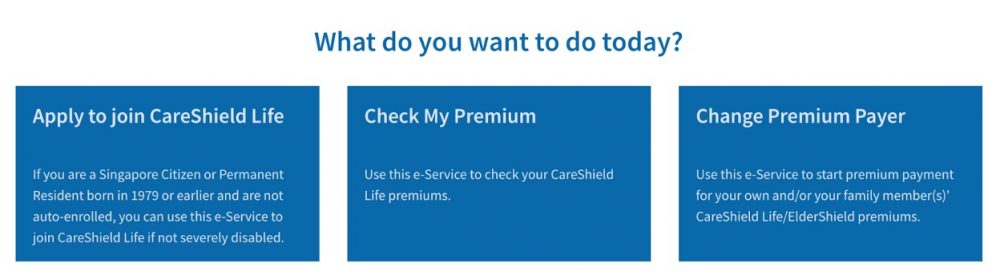

You can check out the premium you pay each month with this online calculator, under the “Check My Premium” section.

Mine’s around S$160, but yours may be a little different.

How to pay

Your CareShield Life premiums can be paid fully by MediSave. You can also use your MediSave to support the CareShield Life premiums of your family members (e.g. spouse, parent, child, sibling or grandchild).

You can also choose to top up yours or your family members’ Medisave account with cash.

Premiums are paid from the age one joins up to the age of 67, or for a minimum of 10 years, whichever is longer. If a claim is successfully made, you stop paying.

Depending on your family’s financial circumstances, there may be various premium subsidies and support to pay premiums. For Singaporeans who face difficulties paying for their CareShield Life premiums, the government will provide premium subsidies and support. This will ensure that no one will lose coverage from CareShield Life due to genuine inability to pay premiums.

Singaporeans are therefore afforded some degree of protection from the potentially overwhelming costs of long-term care.

Take the first step

You’re probably at that point in your life where nothing seems more urgent than your work or family responsibilities.

But life is unpredictable, as we could suffer from severe disability at any point, due to old age or adverse health conditions. CareShield Life is a good way of providing basic support for the long-term care needs of yourself or your loved ones in the event of severe disability.

Consider checking out the website (careshieldlife.gov.sg) to find out if you are enrolled into CareShield Life, and find answers to any other questions you may have at careshieldlife.gov.sg. You can also consider if CareShield Life would be suitable for your parents’ needs and encourage them to join the scheme if suitable.

A staff member will be able to answer all your questions at the Healthcare Hotline, 1800-222-3399 and press option "3".

Operating hours are from Monday to Friday (excluding public holidays), 8:30am to 5:30pm.

And if you’d prefer to write a message instead, you can do so at this online form.

Top image by locrifa on Pexels. Body images courtesy of MOH.

This is a sponsored article by MOH.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.