Follow us on Telegram for the latest updates: https://t.me/mothershipsg

Property tax in Singapore will increase in 2023.

The increase is the result of the upward revision of the annual values (AV) of most residential properties, which include private property and HDB flats, from Jan. 1, 2023, to reflect the rise in market rents.

The Ministry of Finance said in a Dec. 2 press release that the AV revision is part of Inland Revenue Authority of Singapore’s (IRAS) annual review of properties to compute the property tax payable.

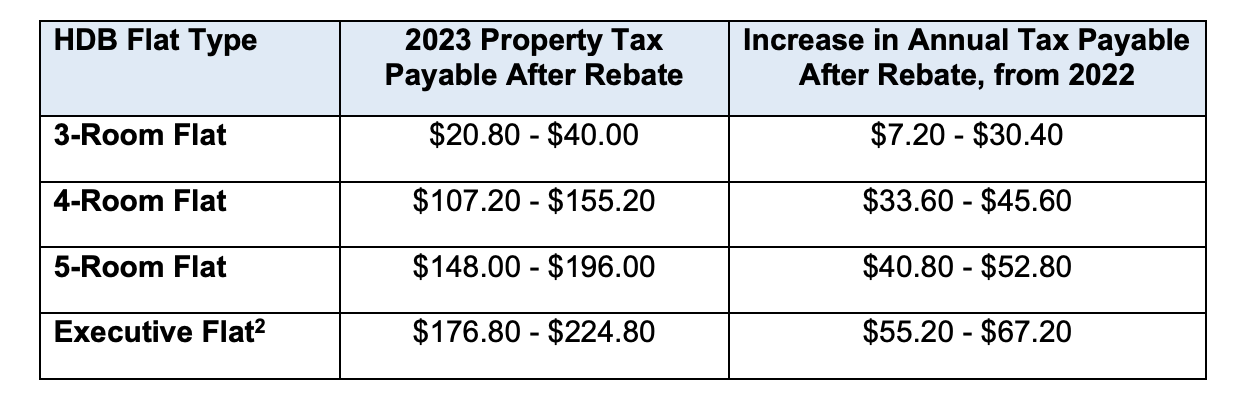

The majority of owner-occupiers in HDB flats will pay between S$30 and S$70 more in property tax compared to 2022, after taking into account the one-off property tax rebate for all owner-occupied HDB and private homes.

The increase in property tax after the rebate will be higher for those with more expensive properties.

As announced in Budget 2022, the property tax rates for 2023 will be made more progressive from Jan. 1, 2023, with higher value and non-owner-occupied residential properties being taxed at higher rates.

MOF added that since the last revision of the AV at the beginning of 2022, market rents of HDB flats and private residential properties have risen by more than 20 per cent.

Residential property AV will be revised accordingly to reflect this increase.

One-off property tax rebate in 2023

To help mitigate the rise in property tax payable amidst concerns about global inflation and the rising cost of living, the government will provide a one-off 60 per cent property tax rebate for all owner-occupied properties.

The rebate is capped at up to S$60.

All owner-occupied residential properties will receive the rebate.

The rebate will be automatically offset against any property tax payable in 2023.

How much more do you have to pay?

All one-room and two-room HDB owner-occupiers will continue to pay no property tax in 2023 as their AV remain below S$8,000.

Photo from IRAS

Photo from IRAS

The property tax payable is derived by multiplying the property tax rate with the AV of the property.

As a concession, owner-occupiers enjoy lower property tax rates for their homes, while all non-owner-occupied residential properties -- including second homes and those held for renting out or investment -- are taxed at higher residential tax rates.

All property owners will receive their property tax bills by the end of December 2022.

The 2023 property tax must be paid by Jan. 31, 2023

Social support schemes will not be affected

Social support schemes, such as the GST Voucher scheme, MediShield Life premium subsidies, and Workfare Income Supplement Scheme, will not be affected by the revision of AV in 2023.

AV as of 2022 will be used to determine scheme eligibility in 2023.

Approach IRAS if facing financial difficulties before Jan. 31, 2023

Property owners facing financial difficulties may approach IRAS for assistance and discuss a suitable payment plan.

This must be done before Jan. 31, 2023.

Top photo from Unsplash

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.