Follow us on Telegram for the latest updates: https://t.me/mothershipsg

Scammers are offering money changing or cross-border money transfer services online, the Singapore police warned on Dec. 23.

Since January 2022, at least 116 victims have lost at least S$1 million, when they engaged these unknown parties to change money or perform cross-border money transfer services, the police revealed.

Modus operandi

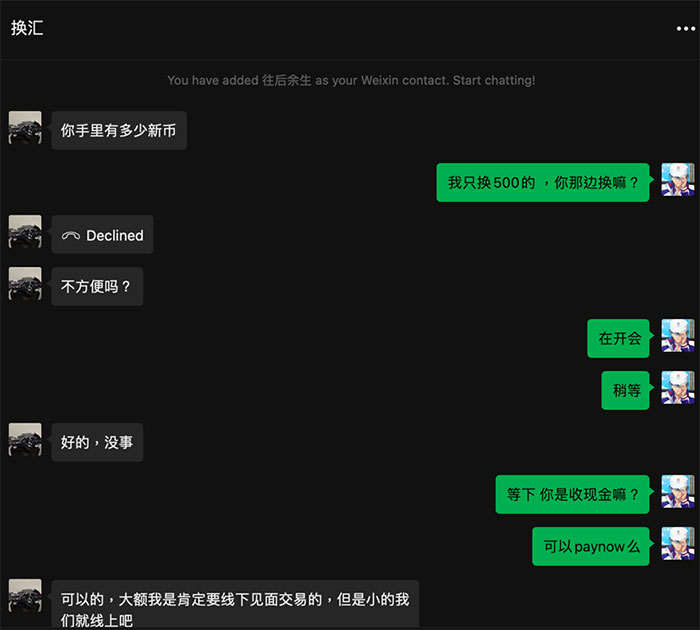

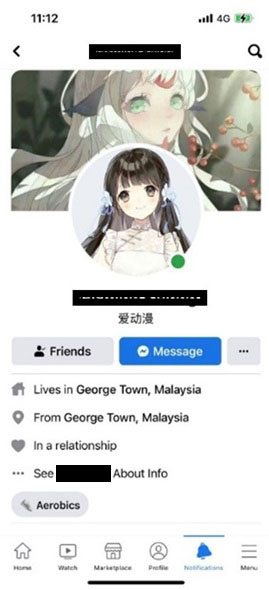

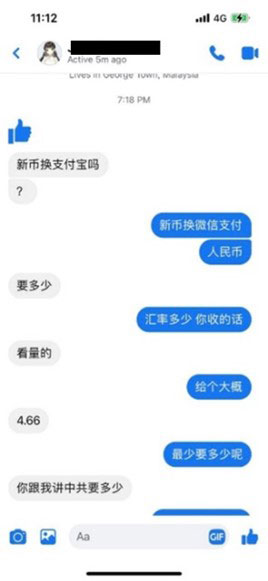

Victims would be enticed by favourable exchange rates offered by scammers providing money changing or cross-border money transfer services on e-commerce or social media platforms, such as WeChat, Facebook or Carousell.

These scammers would request for the victims to transfer money to a bank account.

The victims would realise they had been scammed when they did not receive the currencies they had exchanged, or when the intended recipients of the transfer did not receive the funds.

The police said they would like to encourage members of the public to utilise the services of payment service providers licensed by the Monetary Authority of Singapore (MAS).

Members of the public can refer to the list of payment service providers licensed by the MAS.

Unlicensed payment service operators are not subjected to strict anti-money laundering and counterterrorism financing measures.

Money collected from the public may become co-mingled with illicit proceeds from crimes, such as scams.

If the co-mingled funds are sent to the beneficiaries’ account, the account may be frozen or seized and subject to scrutiny by the authorities, the police added.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.