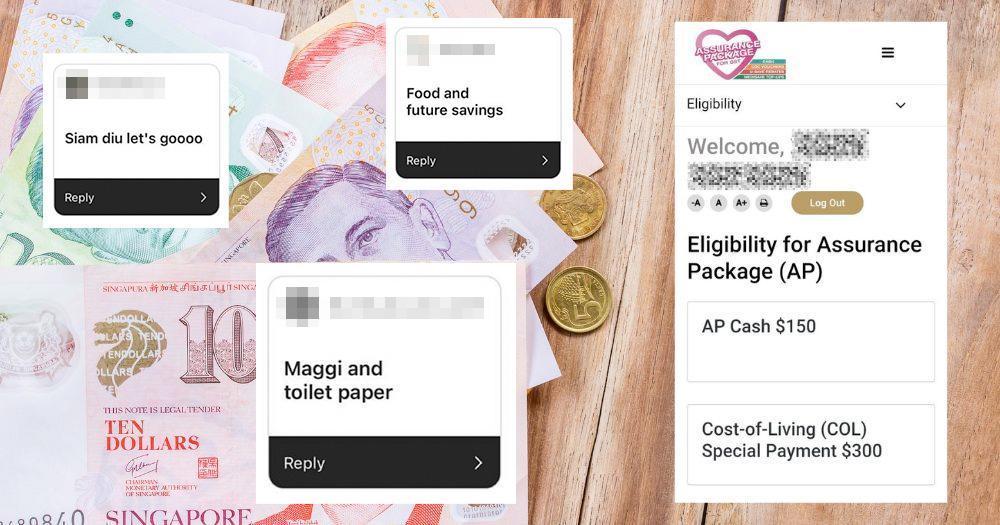

From Dec. 5, 2022, Singaporeans are receiving up to S$700 as part of the government’s Assurance Package (AP) Cash and the one-off Cost-of-Living (COL) Special Payment schemes.

The payouts are part of Deputy Prime Minister and Finance Minister Lawrence Wong’s plan to cushion the impact of the GST hike and help us deal with the rising cost-of-living respectively.

Under these schemes, every Singaporean aged 21 years and above in 2023 will receive cash payouts of up to $700, depending on his or her income and property ownership.

For AP Cash, every Singaporean aged 21 years and above in the reference year will receive cash payouts amounting to between $700 to $1,600, depending on his/her income and property ownership. The payouts will be disbursed over five years, from 2022 to 2026 starting from December 2022.

This year’s payouts consist of both cash transfers from the AP and additional one-off cost-of -living payments for eligible Singaporeans with more targeted at supporting lower to middle-income groups.

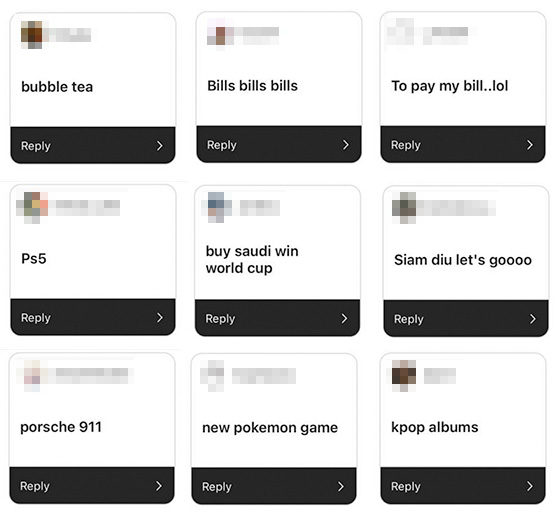

But how are young people using additional funds?

I took to Instagram to find out:

As you might expect from this totally unscientific, non-rigorous survey, not all the responses were sensible or prudent:

Can’t say I endorse any of these choices, but whatever floats your boat I suppose.

Offsetting wedding expenses

But after sifting through the responses, I began to see some interesting ones.

Such as:

Conveniently, my friend Nigel, 30, intends to do the same thing, making it easy for me to find out how the injection of some funds from the government will bolster his and his fiance’s big day.

Nigel will be receiving S$450 in total from the AP Cash and COL Special Payment — all of it will be used to offset wedding expenses.

“Every bit counts, as we’re trying our best to keep costs manageable,” he told me.

“It’ll help us to not be stingy about things like wine and drinks for our guests, which we think will make a difference for this happy occasion.”

Travelling overseas

While Nigel and his bride look forward to a happy future, another friend I spoke to, 31-year-old Olivia said she’d be using the money for an overseas trip. She too will be receiving S$450.

Like many Singaporeans who were stuck in the little red dot over the pandemic years, Olivia is well and truly getting in her revenge travelling.

In fact, many of the responses to our Instagram poll said they would be using the cash payouts for an overseas getaway.

For Olivia, who relatively recently moved out of her parent’s house, overseas trips are no longer something she could do on impulse.

Instead, now there were bills and housing expenses to consider. Was it financially responsible for her to go on a getaway when she could spend the money on groceries, for example?

That’s why discovering that she was about to receive some money from the government came as a nice surprise, allowing her not to feel so bad about taking a break from work and travelling.

“Now I’m really looking forward to my trip to Japan,” she said.

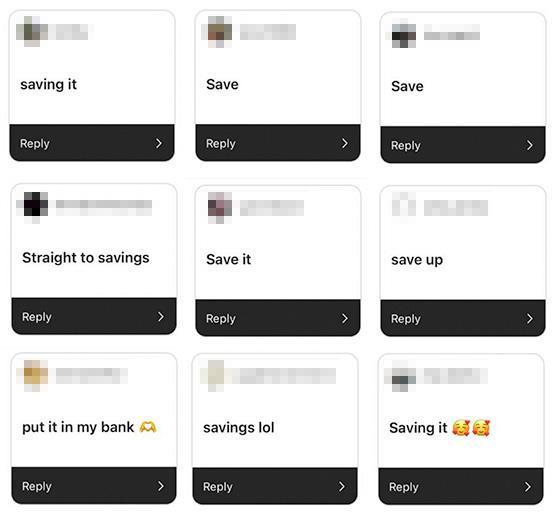

A sensible use of the extra cents

Yet the responses to this — once again — totally unscientific, non-rigorous survey the most common thing young Singaporeans was doing with the payout was to save it.

It was no surprise to me that my most logical and forward thinking friend — 27-year-old Tanya — was doing the same.

“I don't think I'll use it for anything specific,” she said when I asked her what she was doing with her payout.

“I’ll probably just let it sit in my account. I'm not the type who will say ‘Yay I got extra S$150 therefore i'm going to spend an extra S$150 this month,’ you know?

This makes perfect sense: no flashy impulse buys or purely indulgent purchases, though if that’s what you want all power to you. Instead, Tanya is putting her payout to work where it was intended to when the AP was announced — to cushion the impact of the GST hike.

“I’ll use it as a cash buffer because it'll be credited into my spending account instead of my savings, so if I spend more on a certain month or find something I wanna buy next time there's this buffer,” Tanya elaborated.

“Wow, this must be in the top three most boring answers,” she concluded.

But hey, nothing wrong with a boring answer — especially when a non-boring one looks like this:

Initially announced by Wong during Budget 2022 earlier this year, the S$6.6 billion AP aims to help offset the increase in GST expenses from the impending GST hike. Wong announced in November that the Assurance Package will be topped up with an additional $1.4 billion to $8 billion taking into consideration the elevated inflation situation, and we can expect more details at Budget 2023.

In total, the AP for GST will offset at least five years of additional GST expenses from the GST hike for the majority of Singaporeans households, and about 10 years for lower-income households, said Wong. Besides cash payouts, the AP also comprises Community Development Council (CDC) vouchers, additional GST Voucher (GSTV) – U-Save, and MediSave top-ups.

In addition, in October 2022, Wong further announced a new S$1.5 billion support package for all Singaporean households to cope with higher inflation and cost of living concerns.

Among the measures, which include support for lower to middle-income groups, was a Cost-of-Living Special Payment of up to S$500 in cash for 2.5 million eligible adult Singaporeans.

To find out how much you are set to receive, read this:

Writing this Ministry of Finance-sponsored article made the author question his own financial decisions.

Top image adapted from Canva and govbenefits website.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.