Follow us on Telegram for the latest updates: https://t.me/mothershipsg

The Housing and Development Board (HDB) prices Build-To-Order (BTO) flats with affordability in mind, which means a profit margin is not applied to costs.

Rather, housing affordability is determined by HDB looking at the household incomes of buyers and the selling prices of the flats on offer, the statutory board and the Ministry of National Development (MND) said in a joint statement on Dec. 7.

The statement was made in response to media queries on how BTO flat prices are determined, and the development costs incurred by HDB.

How is household income used to determine affordability?

The statement said HDB looks at the resident household incomes, and compares them with the range of flat types and selling prices on offer at every BTO launch, using benchmarks such as the Mortgage Servicing Ratio (MSR), which refers to the proportion of monthly income used to service mortgage instalment payments.

Such benchmarks consider a range of different household incomes, both above and below the median household income level, to ensure a wide range of BTO flats for first-time homebuyers with different housing needs and budgets, the statement said.

HDB also offers housing grants, tiered by household incomes, to eligible first-time buyers, providing "targeted" help to those who need it most.

HDB and MND added that for the first half of 2022, 90 per cent of flat buyers who collected keys to their new flats in non-mature estates and more than 80 per cent of such buyers for mature estates used 25 per cent or less of their monthly income to service their HDB loan instalment payments, meaning that they had an MSR of 25 per cent or lower.

This also means that these flat buyers can service their HDB loans using their monthly Central Provident Fund (CPF) contributions, with little or no cash outlay, according to the statement.

What about the selling prices of BTO flats?

HDB and MND said selling prices of new BTO flats will not be uniform, as BTO projects are launched every year in different housing estates across the island.

The prices will therefore have to take into account the different attributes and locational factors of the flats on offer at each BTO launch.

This also ensures fairness for the buyers as these HDB flats can be bought and sold in the resale market after the five-year Minimum Occupation (MOP) period, with the locational and other flat attributes reflected in the resale prices, and any benefits accruing to the flat owner or seller.

Elaborating on the process of pricing new BTO flats, the statement said HDB first establishes the market value of the flats by considering the prices of comparable resale flats nearby, which is influenced by prevailing market conditions, as well as the individual attributes of the flats.

HDB then applies a "significant subsidy" to the assessed market values to ensure that new flats are affordable for flat buyers.

The difference in prices between the comparable resale flats and subsidised flats broadly reflects the market subsidies provided for the new flats, after accounting for differences in attributes, which include tenure.

HDB's subsidies will also move in tandem with resale prices

In addition, besides the varying attributes of new flats across BTO projects, market conditions may also fluctuate between BTO launches.

The extent of market subsidies applied by HDB will therefore vary across BTO projects in different launches, the statement said.

Such variation protects homebuyers from market fluctuations and ensures that BTO flats remain stable and affordable, MND and HDB added.

Hence, when resale prices move up, HDB will also need to increase market subsidies in tandem to keep BTO prices affordable.

HDB and MND said, "The market subsidies have been factored into the selling prices of BTO flats, and flat buyers should consider the selling prices, alongside their housing budget and personal preferences, when deciding on a flat purchase."

A similar approach has also been adopted for the Prime Location Public Housing (PLH) projects.

As new flats in prime locations naturally command higher market values, PLH flats are priced with additional subsidies, according to the statement.

This is on top of the market subsidies accorded to all BTO flats, to keep PLH flats affordable to a larger group of Singaporeans, especially first-timers.

HDB and MND further pointed out:

"For parity with other BTO flat owners who are not accorded these additional subsidies and to reduce windfall gains, PLH flat owners will need to pay a fixed percentage of the higher of the resale price or valuation of the flat to HDB, upon sale of their flats, to reduce any excessive windfall gains."

HDB's approach is "fundamentally" different from private developers

The statement also highlighted how HDB's pricing approach is "fundamentally different" from that of a private developer's cost-based approach for private residential developments, which takes into account provision for a profit margin.

For HDB, its flat pricing approach is "totally separate and independent" from the BTO projects' development costs.

By increasing the subsidy applied in a rising property market, HDB has kept BTO flat prices relatively stable, the statement pointed out.

Such was the case, even in the past two years where construction costs increased by almost 30 per cent.

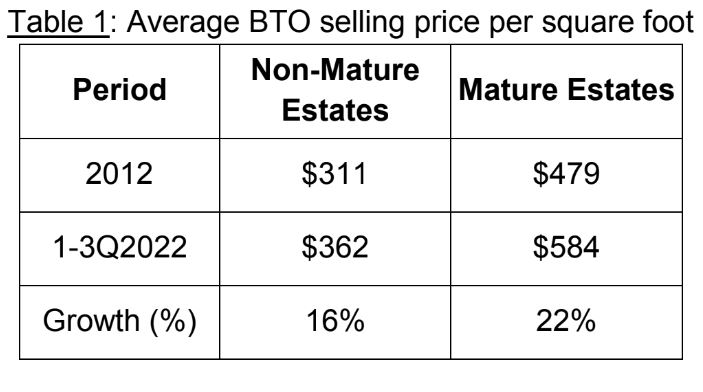

Further highlighting that such a practice was not just applied during the past two years of the pandemic, HDB and MND said the increase in BTO flat prices before grants, from 2012 to the first three-quarters of 2022, has kept within the growth in resident household incomes.

Average selling prices per square foot for BTO flats over the span of a decade in 2012 (before grants) and the first three quarters of 2022 (before grants). Screenshot via MND and HDB

Average selling prices per square foot for BTO flats over the span of a decade in 2012 (before grants) and the first three quarters of 2022 (before grants). Screenshot via MND and HDB

From 2012 to 2021, the median resident employed household income grew by 26 per cent. Meanwhile, the resident employed household income at the second income deciles grew at a faster rate during that period, by 32 per cent.

The statement also noted, "On top of the subsidy applied, HDB provides housing grants to help targeted demographic groups achieve their home ownership aspirations, and housing grants have also increased several times over the same period."

HDB pays fair market value for public housing land

As for land costs, the statement said HDB pays fair market value for land that is developed into public housing.

The fair market value is determined independently by the Chief Valuer in accordance with market conditions and established valuation principles.

Explaining the differences between land used for public housing and private residential use, the statement said the former is meant for providing affordable homes to Singaporeans, and buyers of public housing flats are subject to more restrictions than buyers of private residential flats.

The price of land for public housing is thus lower compared to the land price for private housing in the same locality, said the statement.

This differential reflects the more stringent eligibility criteria and conditions that buyers of public housing must meet in terms of income, citizenship, and minimum occupation period, and so on.

Proceeds from HDB’s land purchase are also paid back into the Past Reserves, which are in turn invested to generate returns for future generations of Singaporeans.

Total development cost cannot be fully covered by selling prices of flats

As for the total development cost, which includes construction and land costs, it cannot be fully covered by the selling prices of flats because these flats are highly subsidised.

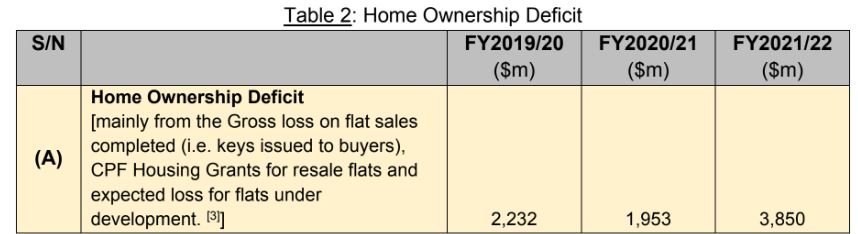

"That is why HDB incurs significant deficits every year in its Home Ownership Programme, which are reflected in HDB’s Annual Reports found on the HDB InfoWEB," the statement said.

As an example, HDB and MND said that for the 2021/2022 financial year, HDB recorded a deficit of about $3.85 billion in its Home Ownership Programme.

The S$3.85 billion deficit stems mainly from the gross loss on flat sales completed, where keys are issued to buyers in the financial year, disbursement of CPF housing grants to eligible resale flat buyers, and expected loss for flats that commenced development in the financial year.

Screenshot via MND and HDB

Screenshot via MND and HDB

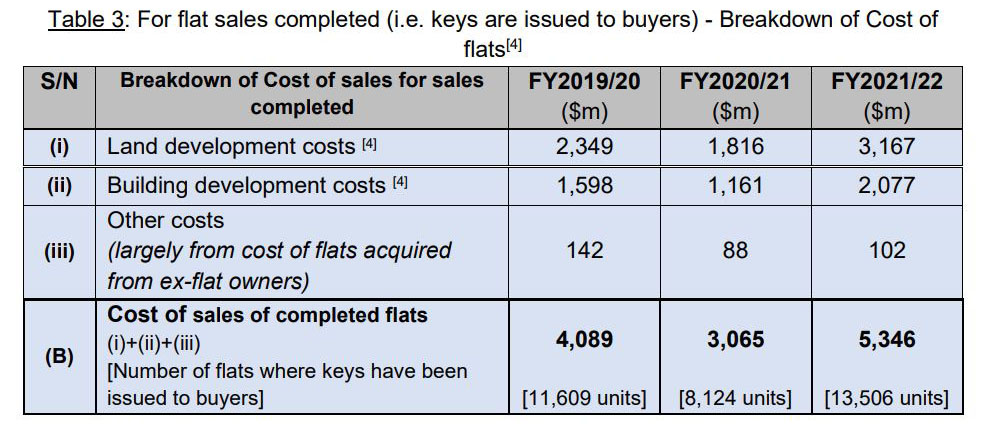

The statement also pointed out that HDB's cost of flat sales completed came up to a total of S$5.346 billion, and comprises largely $3.167 billion for land development costs, and $2.077 billion for building development costs.

The remaining S$102 million is attributable to the costs of flats acquired from ex-flat owners.

Screenshot via MND and HDB

Screenshot via MND and HDB

Information on BTO projects and pricing is available to the public

The statement also stated that at each BTO launch, the recently transacted prices of comparable flats are shared, alongside the selling prices for each BTO project.

"These prices clearly show that each BTO project is priced substantially lower than comparable resale flats, due to the significant subsidies applied," MND and HDB said.

Relevant price-related information for different family archetypes is also provided, with each BTO launch having illustrations to show how homebuyers with different household incomes can afford different flat types.

Such information is generally not made available for private residential development projects.

Both MND and HDB noted that the statutory board also publicly shares information on the construction and development costs of its BTO projects on the following platforms:

- The construction cost of every HDB BTO project is public information, as successful tenderers by contract sums are published on the HDB InfoWEB and in GeBIZ. This is not the case for residential projects by private developers.

- HDB also publishes the cost of building flats and the revenue from the sale of flats in its Annual Report. This is similar to listed companies of private developers which release aggregate figures on costs and profits in their Annual Reports.

- However, a key difference is that HDB’s annual report captures development loss from its homeownership programme, while private developers’ annual reports mostly show profits, which reflects HDB's primary pricing principle of ensuring affordability.

Top photo via HDB/Facebook

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.