Follow us on Telegram for the latest updates: https://t.me/mothershipsg

An increase in Singapore's Goods and Services Tax (GST) will kick in from January 2023, from 7 to 8 per cent, and to 9 per cent in 2024.

While the matter was recently debated extensively in Parliament, Ho Ching has also chimed in with her views on the reserves and GST in a Nov. 26 Facebook post.

GST would've climbed even higher without reserves: Ho Ching

The former CEO of Temasek explained that without the country's current reserves, which have been "saved, invested and grown over generations," the GST would have to climb to an even higher 12 per cent in order to make up for the S$20 billion of spending capacity given by the Net Investment Returns Contribution (NIRC) framework.

The NIRC comprises:

- Up to 50 per cent of the Net Investment Returns (NIR) on the net assets invested by GIC, Monetary Authority of Singapore, and Temasek

- Up to 50 per cent of the Net Investment Income (NII) derived from past reserves from the remaining assets

The investment returns from the reserves are spent in areas like education, healthcare, and transport infrastructure.

Ho, the Chairperson of Temasek Trust, then went into detail about the impact of the investments returns from reserves.

Based on a couple of conservative estimates, she calculated that the government supplements its spending with around S$6 billion to S$8 billion of Temasek's returns.

This is because the NIRC framework allows for 50 per cent of the expected long term rate of real return.

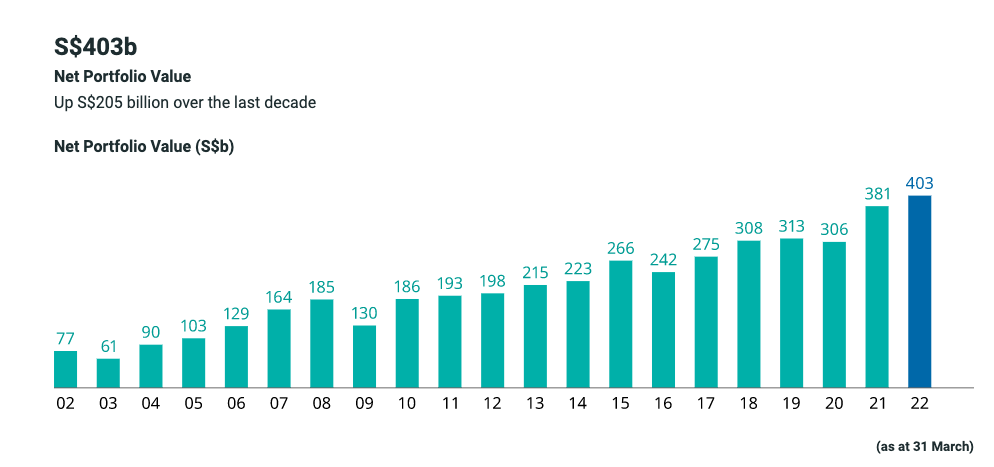

Taking Temasek's long term real rate of returns as four per cent, up to two per cent of Temasek's current net portfolio value (S$403 billion this year) returns a figure of around S$8 billion.

Alternatively, a more conservative valuation of Temasek based on its retained earnings would return a figure of around S$6 million — namely, two per cent of S$300 billion.

Source: Temasek website.

Source: Temasek website.

According to Ho, our current GST of seven per cent added about S$12 billion to the country's coffers on 2021.

That would make one per cent equivalent to an additional S$1.7 billion in revenue.

"So S$6-S$8 billion of NIRC contribution from Temasek would translate to three to five per cent more in GST," Ho reasoned.

Additionally, Ho said, all three sources of tax revenue —GST, corporate income tax, and personal income tax—are each less than the NIRC contribution of about S$20 billion.

Let's not kill the golden geese

Ho said that by taking 50 per cent of NIRC for spending, Singapore already has "50 per cent less for reinvestment for more future income".

This remark is likely to be in reference to calls from opposition Members of Parliament (MPs) to increase the proportion of NIRC for spending.

The Workers' Party (WP) had suggested during the budget debates earlier this year to adjust the NIRC framework, for NIRC to be raised to 60 per cent from the current 50 per cent.

This was also mentioned in WP MP Jamus Lim's latest forum letter in Zaobao, though he noted that altering the NIRC to 60 per cent was only one of the levers WP had offered as alternative strategies for raising revenue.

Ho concluded by saying,

"Let’s not be greedy for more, and kill the golden geese that help us keep our tax burden lower than most countries, other than those who can benefit from oil reserves or other natural resources".

Top photo via Temasek, Mike Enerio on Unsplash

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.