Follow us on Telegram for the latest updates: https://t.me/mothershipsg

The Government passed a Goods and Services Tax (Amendment) bill to increase the GST to 8 per cent in 2023, and to 9 per cent in 2024, from the current 7 per cent, in Parliament yesterday (Nov. 7).

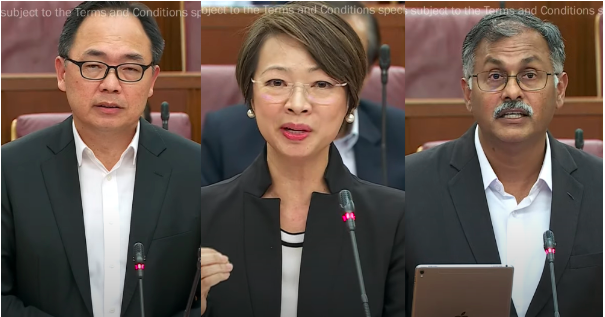

The opposition MPs who were present recorded their dissent.

Several Members of Parliament (MPs) from the ruling People’s Action Party (PAP) stood in support of the Bill, at the same time disagreeing with the opposition’s position on not raising the GST.

WP’s reasons and alternatives

MP for Bukit Panjang Single Member Constituency (SMC), Liang Eng Hwa, laid out the Workers’ Party (WP) position on GST and the alternatives that the party gave.

According to Liang, WP resisted the increase in GST for the following reasons:

- Currently, the cost of living in Singapore and inflation are high, hence the rise in GST should not add to these costs;

- the GST is regressive and hurts middle and low-income earners; and

- There are alternative sources of revenue for the government other than raising the GST.

Liang further cited WP’s alternative solutions published in the party’s publication, The Hammer, which suggested:

- Raising the Net Investment Returns Contribution (NIRC) from 50 per cent to 60 per cent;

- Use a portion of land sales for recurrent expenditure and raise property taxes for more expensive properties;

- Increasing corporate tax revenue in compliance with Base Erosion and Profit Shifting BEPs 2.0; and

- Raise other taxes like carbon tax and sin taxes.

Government acknowledges and understands high cost of living

In response to the opposition’s position, Liang said that the government acknowledges that inflation is high and that costs have been increasing.

He further stated that the GST will add to the already increasing costs.

“The Government would have to make sure that we have the stable base of revenues that can cover our long-term recurring expenditures; especially healthcare as our population ages rapidly over the next few years,” he said in his speech.

Hence, the Government’s strategy, according to Liang, is to strengthen its resources, which include raising the GST rate, but at the same time balance this increase with a two-prong approach to cushion the effect to low-and-middle-income household against both GST and cost of living.

Support measures introduced to cushion impact of GST increase

As such, the Government had introduced a slew of support packages to assist the impact of GST increase and cost of living, including S$560 million in Budget 2022, additional S$1.5 billion package in June, S$1.5 billion in October, which summed up to be S$3.5 billion in targeted support provided by the government.

For the GST increase, the Government had pledged Assurance Package amounting to S$6.64 billion, which effectively delays the GST increase by 10 years for the majority of residents, and 10 years for those in the lower-income bracket.

DPM Wong subsequently announced that the Assurance Package will be topped up with an additional S$1.4 billion, reaching about S$8 billion.

Unfair to younger generation if NIRC rate increased

As for the alternatives put forth by WP, Liang made reference to Deputy Prime Minister Lawrence Wong’s budget 2022 round-up speech as being “very helpful” in understanding the situation.

He said that raising the NIRC from 50 per cent to 60 per cent basically means that the Government put back lesser into the reserves.

“It also means less for our young people when they get older,” Liang added.

In the same vein, MP for West Coast GRC, Foo Mee Har, said that it would be “unfair” to future generations if the Government were to “raid our reserves” and leave them with less.

“It would be wrong for us to contemplate taking more and leaving less for the next generation. This is particularly at a time when the world is getting more divided and dangerous, because of contentious geopolitics, disrupted supply chains and existential climate change challenges. Those coming after us would need more, not less, of a buffer of financial resources, to secure their future,” she said.

Foo noted contributions from our reserves to fund public expenditures has already doubled in 10 years, ballooning from about $8 billion in 2011 to $20 billion in 2021.

She noted that since 2016, Singapore’s reserves had already become the single largest contributor to the Budget.

“Increasing our dependency on the reserves to fund expenditures will further tilt the balance towards unhealthy concentration risk,” she added.

Foo also cited that during the Covid-19 pandemic, the Government drew about S$37 billion from the reserves to fight the pandemic and that the Government is “unlikely to be able to put back” what was drawn down anytime soon.

WP vote against GST increase a “blunt knife: Murali Pillai

Murali Pillai, MP for Bukit Batok SMC described WP’s vote against the increase of GST as a “blunt knife”.

He said that WP’s disagreements do not cut well as there are points of consensus from both parties on several issues, namely the need for higher levels of social spending in the future and the need to raise revenue to meet the expenditure.

Where the two parties differ, according to Pillai, is whether the GST “should and can” be a source of revenue.

“No political party in this House has a monopoly on care and concern for the welfare of Singaporeans, especially low and middle-income groups, the sandwiched class, the elderly who need heavily subsidised healthcare, as well as the young Singaporeans who need to see a future and opportunities in Singapore,” Pillai added.

Raising GST an “act of true political courage” by PAP

He viewed from a historical perspective, that raising the GST was an act of “true political courage” by the PAP.

Pillai cited the WP dismissed the rise in GST rate as “unnecessary” or in “bad timing”.

“We are not so naive as to think that the GST will gain us political favour, we know that it will be a tough pill,” he said, and added that yet the Government still ask this from the people of Singapore.

“We ask this because there are hard immovable economic and fiscal realities in public life, that can be either sugar-coated beyond recognition or presented in their true form,” Pillai said, and added that from 1993 to 2022, it has always been the latter.

“We ask this at this difficult time, because we truly believe that it will give us a fairer and more progressive way of financing our government, and build a stronger foundation for our nation,” he added.

Related stories:

Top images screenshot from MCI/YouTube

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.