Follow us on Telegram for the latest updates: https://t.me/mothershipsg

The SimplyGo initiative, introduced by the Land Transport Authority of Singapore (LTA), allows commuters to use their bank cards on public transport instead of EZ-Link cards.

They also no longer need to top up their cards at MRT stations and bus interchanges, and some banks even offer attractive cashback on fares.

This means commuters can carry one less card around, but can also track expenditure and pay for transport with one less app.

However, the obvious convenience of the scheme comes with some not-so-obvious pitfalls, as one TikTok user recently discovered.

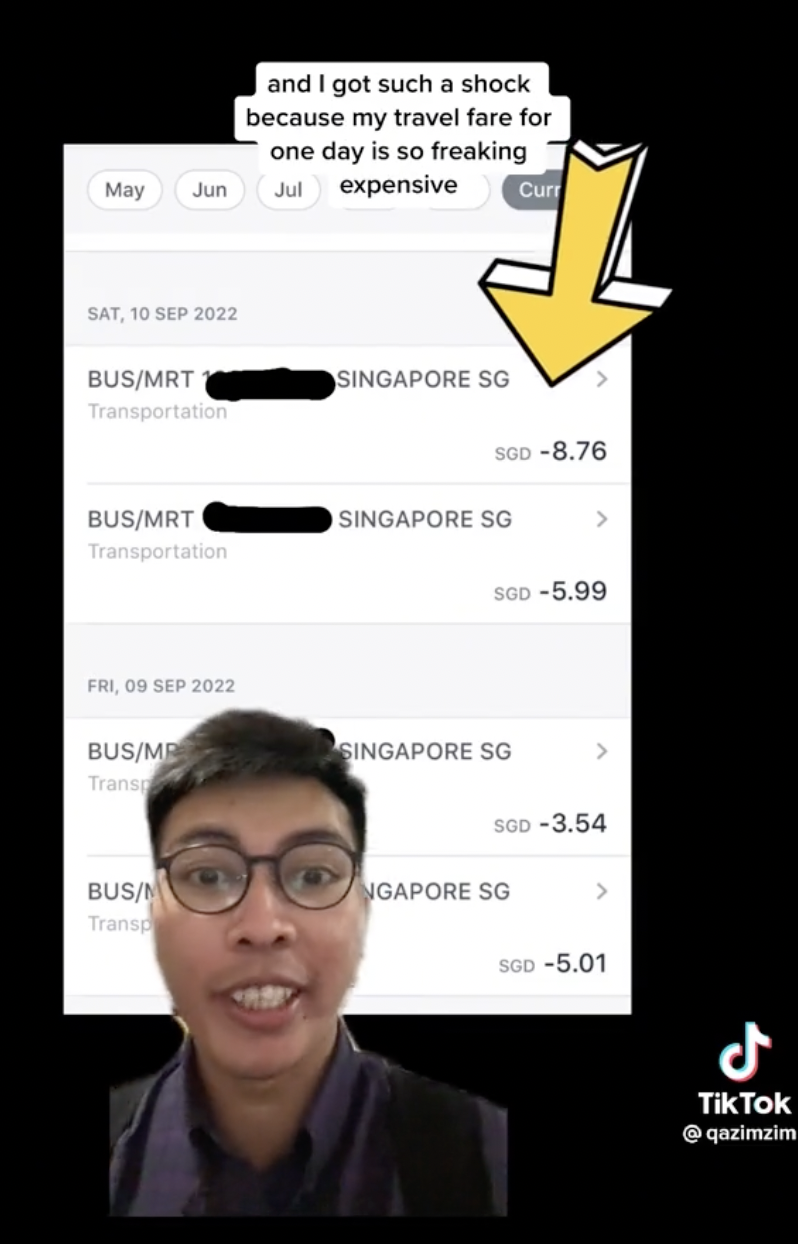

The TikTok user, @qazimzim, found out the hard way that he was getting charged as much as S$14 for one day's worth of public transport fares.

Screenshot via @qazimzim on TikTok.

Screenshot via @qazimzim on TikTok.

At an estimated cost of S$2 per trip, he should only have been paying S$4 to S$5 for one day, instead of S$14.

"Not me saving up on Grab and paying $15 for buses LOL," he quipped in the caption.

Same card on different devices

After checking his bank records, he realised that the higher-than-expected fares came about because he had been using the same bank card on both his phone and smart watch.

He shared that he would typically use his bank card for public transport, via his Apple Watch.

However, that there were instances where he tapped in with his watch, but tapped out using his phone as the former was "jammed" when he was exiting.

According to records on the SimplyGo app, this would be considered as two different transactions, even though it was the same bank card used on both devices.

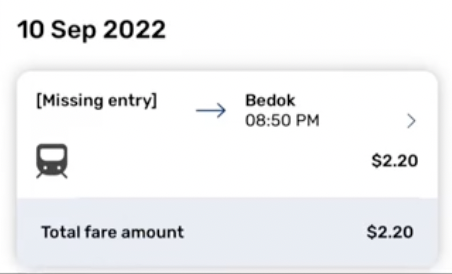

This led to him being charged S$2.20 for each transaction:

Screenshot via @qazimzim on TikTok.

Screenshot via @qazimzim on TikTok.

"Now we all know!! I’m not that smart a citizen after all 😅" he said in another comment.

S$2.20, according to the FAQs on SimplyGo's website, is a "flat fare" imposed on commuters who have either a missing entry or exit for rail journeys. This is regardless of the distance travelled.

For buses, a commuter with a missing entry would be charged from the first stop of bus route to the point of exit, while those with missing exits would be charged from the point of entry to the end of the bus route, the FAQs add.

Others shared similar experiences

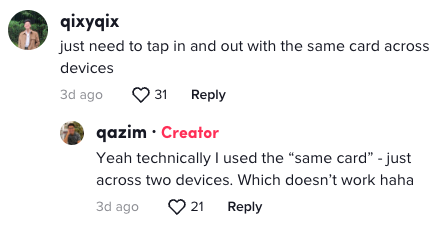

Comments on @qazimzim's TikTok post indicated that he was not the only person with this experience.

A number of other users said they "wasted money" or lost track of their transport expenses, having been in the same situation.

Solutions offered included using a physical EZ-Link card, or simply not linking one's bank card to any device.

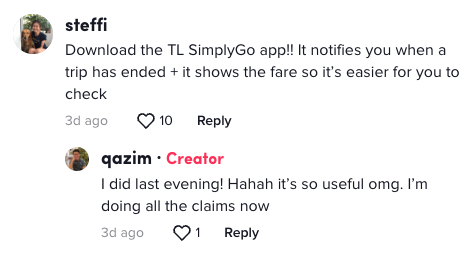

Another helpful tip was to download the TransitLink SimplyGo app and be notified of one's fare when trips have ended.

@qazimzim also shared that he was filing claims for the overpaid travel fares through the app.

Commuters warned to use same card

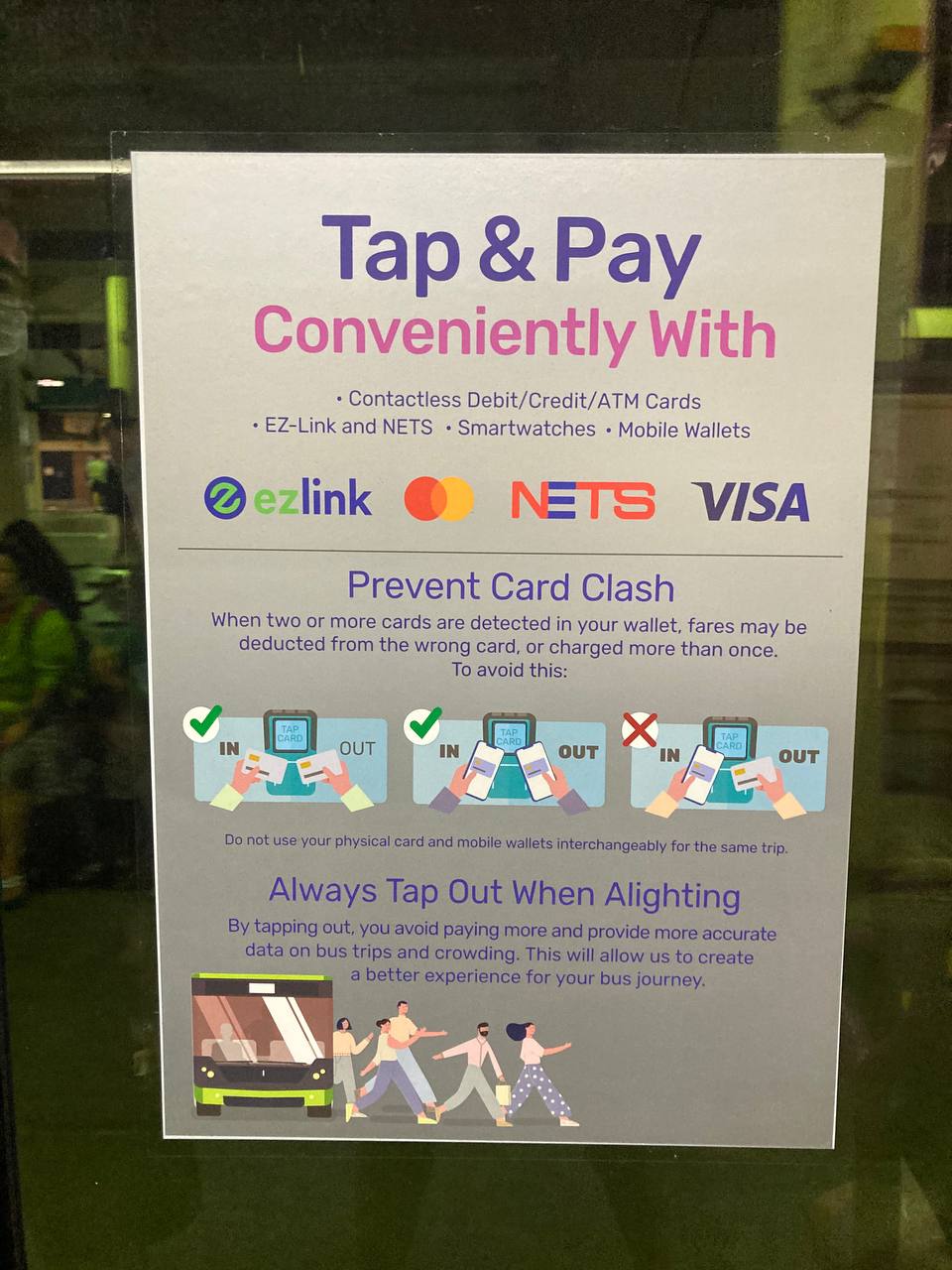

You might be aware of posters like this on buses:

The poster warns against "card clash", should one tap out with more than one card detected in their wallet.

"Do not use your physical card and mobile wallets interchangeably for the same trip," states the poster.

In reply to a comment that he needed to tap in and out with the same card to avoid this situation, @qazimzim clarified that he had indeed used the same card, although he had set up two different devices (his phone and watch) to pay with the card.

Turns out, the card is not recognised as being the same card, when registered on different devices' virtual wallets.

Why is the same card not recognised across different devices?

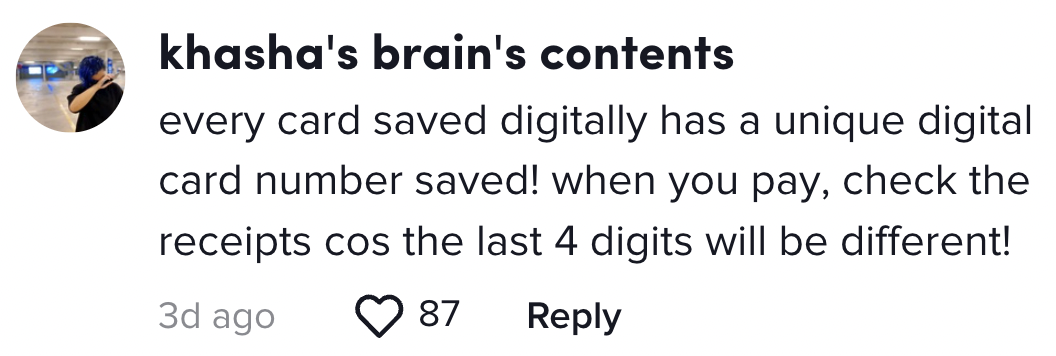

One commenter explained that when devices are set up for payment, unique digital card numbers are used instead of the actual credit card number.

This is a feature of virtual wallets that is said to increase security.

Virtual wallets use encrypted, device-specific numbers

"When you make a purchase, Apple Pay uses a device-specific number and unique transaction code. So your card number is never stored on your device or on Apple servers," explains Apple on its website.

Similarly, for Google Pay, the technology used on Android devices, Google says that "when you tap to pay with your phone, Google Pay uses an encrypted number instead of your real card number so your info stays secure."

And Samsung, which has its own proprietary payment solution, also boasts that "Samsung Pay adds a level of security to your payment information that physical cards don't have."

Top image by Andrew Koay and via Unsplash

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.