Follow us on Telegram for the latest updates: https://t.me/mothershipsg

Here's a quote famously attributed to legendary scientist Albert Einstein: "You do not really understand something unless you can explain it to your grandmother."

Of course, there is much in life that we don't really understand, and don't need to understand.

It's good enough to know you should charge your phone's dead battery, while quite unnecessary to understand exactly how the electrolyte helps transmit an electrical charge between anode and cathode.

Online shopping is a complicated space

But the online space — particularly the online shopping space — has become a complicated network comprising companies selling their goods directly to customers, third-party platforms where sellers can list products, and even platforms where consumers can sell new or used items to each other.

Besides sellers, there are at least just as many ways to pay — credit/debit cards, bank and non-bank e-payment service providers, and so on.

Arguably, this makes for a complicated enough landscape to navigate, even before we get to ShopBack's offerings.

This increasingly-cluttered and competitive e-commerce situation is what ShopBack founders Henry Chan and Joel Leong find themselves having to navigate as they steer the eight-year-old startup in the direction of profitability — a goal that can be elusive even for far more established tech startups.

Making money out of giving away money

Chan and Leong met as undergraduates at the National University of Singapore (NUS).

Although they were from different faculties (Engineering, and Arts and Social Sciences respectively), they met at NUS's Sheares Hall.

Another common experience they shared was their involvement in NUS Overseas Colleges.

The pair cite the programme, which is aimed at exposing students to entrepreneurship and tech startups, as showing them that it could be "a very viable career".

After graduating, they both embarked on their respective career paths, with each of them — and other members of Shopback's founding team — doing a stint at e-commerce platform Zalora at some point.

Chan and Leong look back on those early days at the fashion and e-commerce giant as a crucial part of ShopBack's genesis.

"We really saw the pain points for retailers, especially e-commerce retailers, to grow new customers," said Chan, adding that they knew that with time, the sector was only going to get bigger.

In Chan's words, the question they sought to answer was: "How then can we build up a platform that can be a win-win-win for users and merchants and us as a platform?"

And so, come 2014, the two went on to start ShopBack together.

Since then, ShopBack has grown into a regional business, with a newly-opened regional HQ building in Pasir Panjang that is attractively fitted out.

Photo courtesy of ShopBack.

Photo courtesy of ShopBack.

Photo courtesy of ShopBack.

Photo courtesy of ShopBack.

And while it began operating in the e-commerce market, ShopBack has since expanded into the offline space, allowing its users to get cashback and discounts on purchases in physical retail shops.

It has even been able to turn a profit in some of the 10 markets where it operates.

In other words, the two NUS graduates have somehow made money out of giving away money.

How ShopBack works for customers

For those unfamiliar with the platform, ShopBack users earn cashback (a small fraction of the purchase price) when transacting through the platform.

Users then cash out their earnings directly to a linked bank account.

Every little bit adds up, as Chan can attest to, having chalked up over S$18,000 in earnings from ShopBack-facilitated transactions over the years.

If you're prone to thinking that nothing in life comes free, you might suspect that there has to be a catch somewhere — and rightly so.

Like most other e-commerce products, ShopBack's diverse range only work with some level of access to your personal and financial data.

Of course, you don't have to understand all of ShopBack's nuts and bolts to enjoy deals and cashback.

But, having some level of basic understanding is important before you authorise them to charge your credit card, track your online and offline shopping habits, and hold on to your cash.

How to understand ShopBack?

According to Chan and Leong, it's most appropriate to describe ShopBack as being in the business of advertising.

Chan spoke about how he would explain the business model to someone of another generation, saying:

"If I were to describe this to my mum, I would say that we are no different from any other advertising business.

Just that we share a percentage of our advertising fees with users as cashback."

In other words, Chan sees ShopBack primarily as a platform on which users discover merchants to visit and spend with.

He explains that if a merchant has a budget to advertise to grow its business, ShopBack is one possible channel, alongside more established players like Facebook, Google, and other advertising platforms.

Leong says a segment of ShopBack's merchants comprises smaller players who might not have the resources for a loyalty programme of their own.

"A lot of them are standalone F&B stores, and if you're gonna ask them, 'Hey, come up with your own loyalty programme,' that's not going to work."

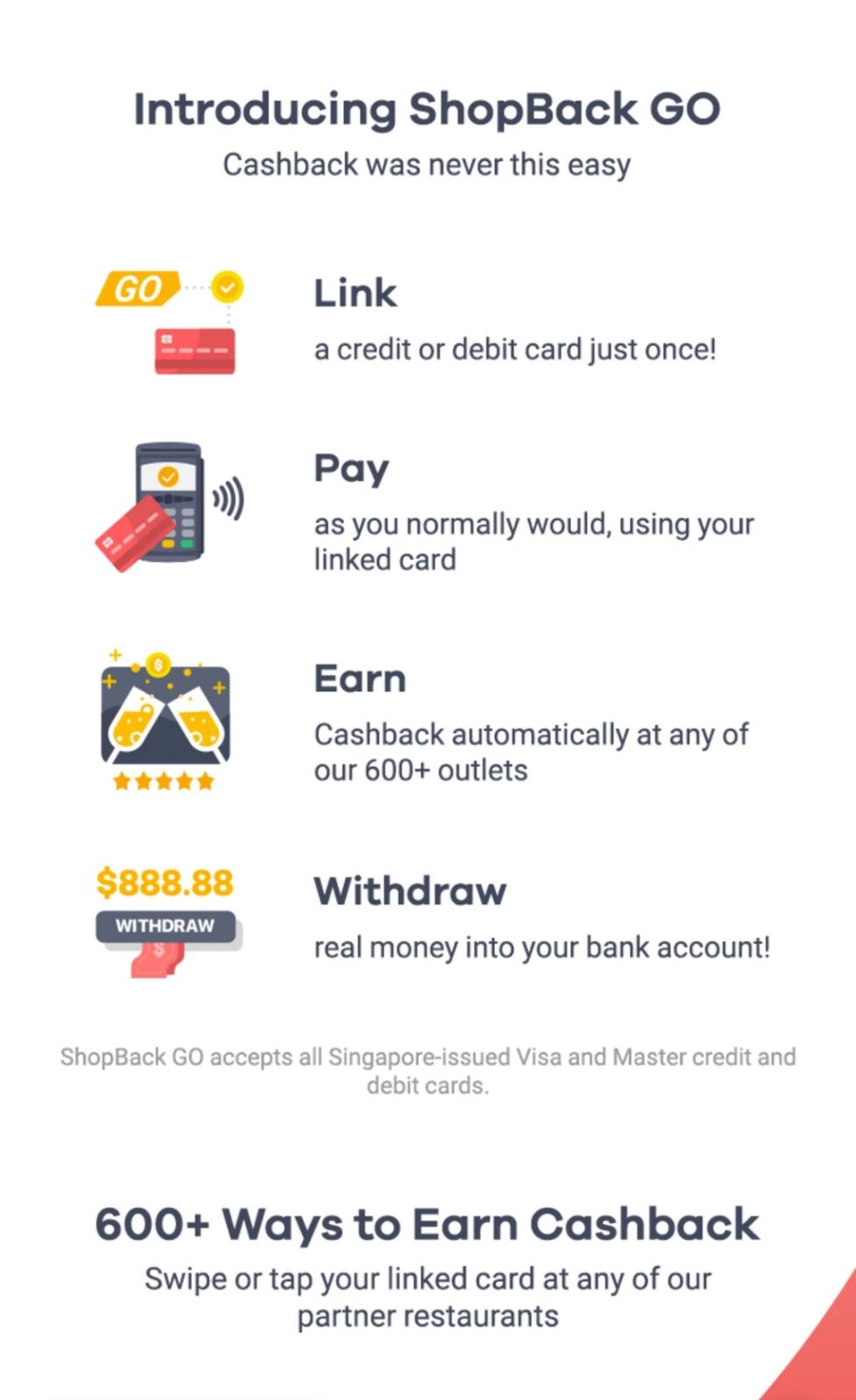

Thus, Leong explains, ShopBack now gives users the option of paying through the app in physical stores, provided they link their credit or debit card.

Merchants can tap on this to create a fuss-free loyalty programme, by enabling ShopBack Pay so customers earn cashback for repeat visits.

Merchants only charged for successful sales

What differentiates ShopBack from other advertising platforms is the fact that merchants are only charged when there is a successful sale, says Chan.

Elsewhere, advertisers might get charged based on whether their ads are seen or clicked by potential customers, he points out.

Leong adds:

"If you think about it, why do merchants or partners work with us? Because we're able to drive demand and sales for them. That's the core of this, and because we're able to drive demand for them, we get paid.

And when we get paid, we can share part of it with customers, and customers are happy."

What about ShopBack transactions that don't start on its platform?

But ShopBack's discount mechanisms are varied and diverse, with some of its products doling out cashback without requiring customers to have found the merchant on ShopBack to begin with.

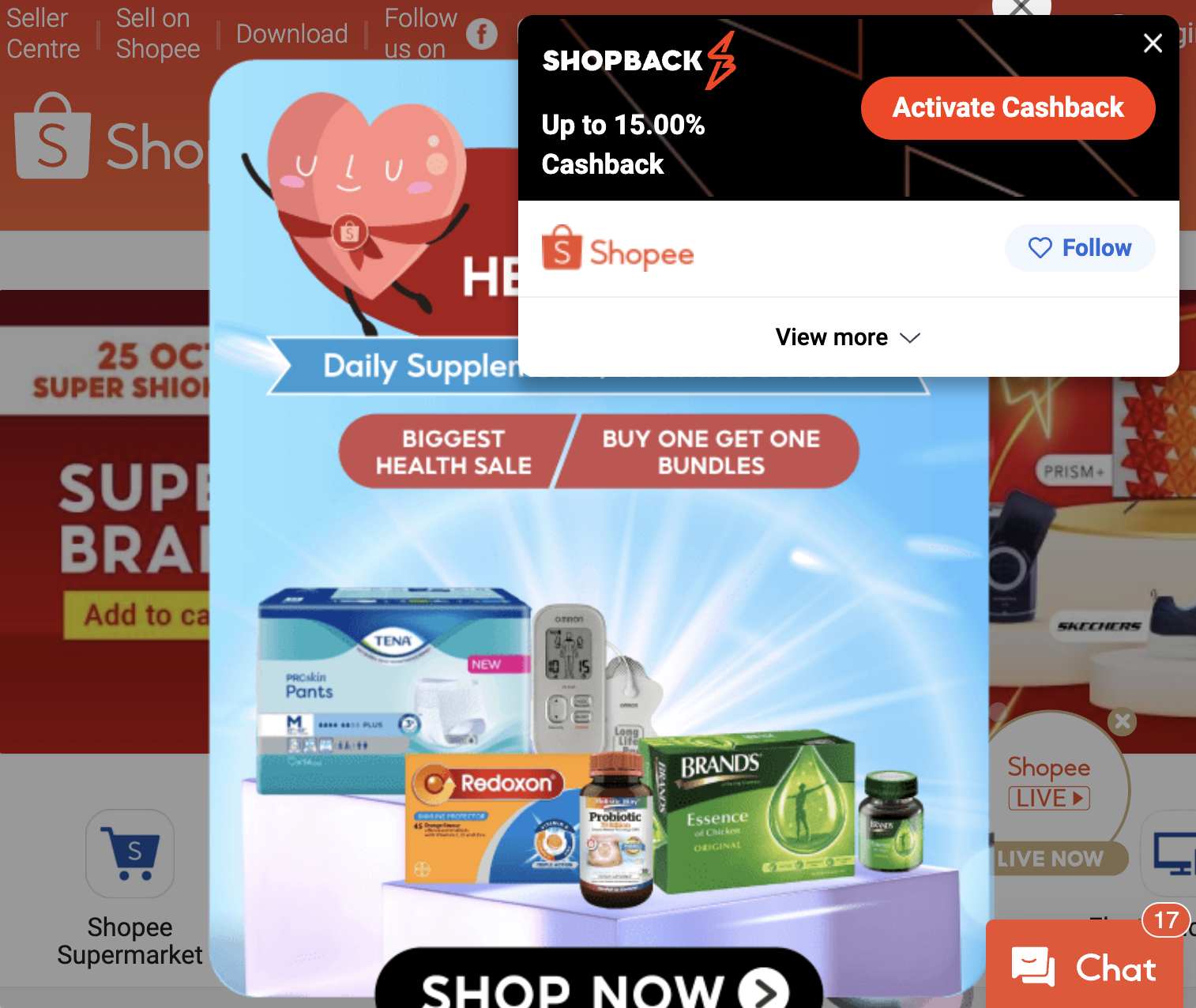

Take, for example, the ShopBack browser extension. Once enabled, it prompts you to sign in to get cashback when it detects that you are on the website of a merchant partner.

The ShopBack browser extension alerting users to "activate cashback" by signing in. Screenshot via Shopee website with ShopBack browser extension enabled.

The ShopBack browser extension alerting users to "activate cashback" by signing in. Screenshot via Shopee website with ShopBack browser extension enabled.

Even if you visited the merchant without any awareness that it has partnered with ShopBack, you'd still get the cashback.

In the offline space, an offering called "ShopBack GO" (launched in 2018, and since rebranded to ShopBack In-Store) promised cashback on any transaction at a range of merchants, provided the credit card used to pay has been pre-registered with ShopBack.

[caption id="" align="alignnone" width="978"] A ShopBack GO poster from yesteryear. Image via ShopBack.[/caption]

A ShopBack GO poster from yesteryear. Image via ShopBack.[/caption]

Putting myself in the shoes of a skeptical merchant-partner, I asked Chan and Leong how it would have helped a merchant to have to pay a fee for ShopBack's involvement in a transaction that would have occurred anyway.

Leaning forward in his swivel chair, Chan tells me that one of the initial goals for ShopBack GO was to make things "seamless for the user" by encouraging them to link their credit cards to the app.

"Sometimes I think we introduce features that could be very good, very seamless. And then we need to tweak and evolve as we go."

ShopBack GO's rebranding to ShopBack In-Store means that it now includes other functions that were not present in 2018 when ShopBack GO was first introduced, for example, ShopBack Pay, and In-Store Vouchers, among other features.

ShopBack Pay, for example, requires users to fire up the ShopBack app and pay with an in-app wallet in order to get rewards, cementing ShopBack's involvement and justifying its fee.

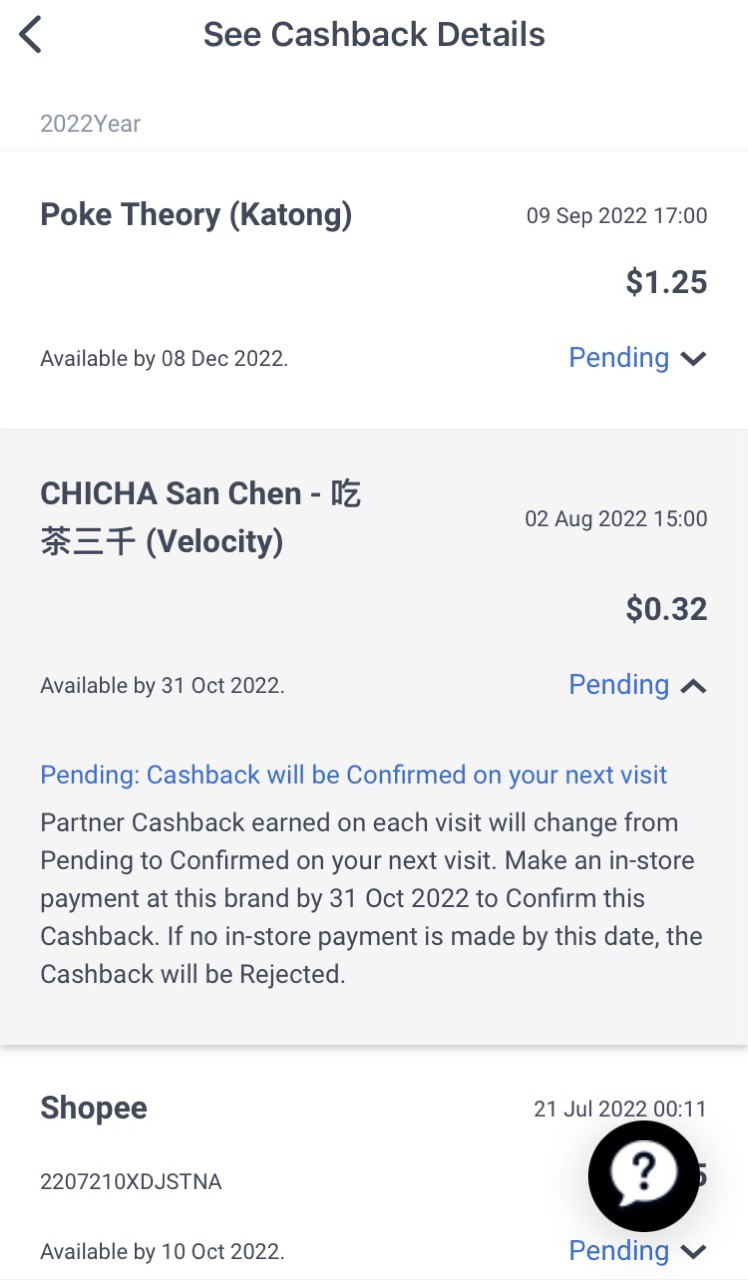

Logging into my account after the interview, I see that the set-and-forget mechanism from the days of ShopBack GO has been replaced by one with an overt loyalty element.

Some of my cashback records from transactions at ShopBack merchants' physical stores have in fact been declined, as I did not return to those merchants before the cashback expired.

Other cashback amounts are stated as "pending" until I make another transaction.

This is a departure from the "traditional" cashback awarded automatically for online purchases.

I contemplate another visit to CHICHA San Chen at Velocity.

Balancing and rebalancing

The founders explain the need to continually maintain a balance between the three big stakeholders: ShopBack, Users, and Merchants, which Chan and Leong refer to with the handy acronym "S, U, and M".

They walk me through their ShopBack voucher offering, a recent example of how balance can be achieved.

As sales dropped with more staying home during the Covid-19 pandemic, many merchants faced cashflow issues. To address that, ShopBack gave them the option to sell vouchers on the platform.

"Basically it was just selling gift cards or vouchers upfront, then merchants get the cash early. And it definitely helps them in a time when there's a cash crunch," says Chan.

While there's nothing so revolutionary or innovative about the concept of selling vouchers, ShopBack users lapped it up – purchasing S$100 million worth, over a 12-month period.

It's quite a large sum in a relatively short time, and Leong says it's "pretty cool," but points me back to how the scheme value-adds to each stakeholder.

Users who buy vouchers get discounted prices, and merchants are helped with cashflow while generating sales. In the meantime, ShopBack, the platform, adds another successful product to its repertoire.

While keeping all three happy is the foundation of ShopBack's success, the equation starts with U: Users.

After all, they explain, it is only when a certain critical mass of users start to rely on ShopBack as a platform that merchants will see value in ShopBack's services.

"We try to build solutions, or try to simplify things for the user, so that they can shop more. If they shop more, it's beneficial for us as well as for the merchants and the user," says Leong.

Good surprises

ShopBack's voucher scheme is the latest in a line of successes that leads Leong to remark: "I think we surprised ourselves very nicely over the last five years."

"And I hope that we can continue to surprise ourselves in good ways," he adds.

While Leong and Chan are both clear that ShopBack will continue to be focused on products centred around shopping — with buy-now-pay-later (BNPL) being a recent product addition — they are sure that the markets where they operate and the services they provide will “definitely” change and iterate.

Screenshot via Mothership video.

Screenshot via Mothership video.

Leong recalls a point when ShopBack was only in three or four markets, with just over 100 employees.

"Five years ago, if you told us we would be seated here in our own campus, our building, we'll be in 10 markets, we'll have a thousand team members, we'll drive sales for over 10,000 merchants, I actually will tell you to fly kite lah."

Now, five years on, ShopBack has — at least to its founders — achieved the unimaginable.

But they have their sights set on a point in the future, from which they can look back on 2022 and say the same.

"The best part is that where we are at now, it's still early days. So much more room to grow," says Leong.

Top image screenshot via Mothership video

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.