Follow us on Telegram for the latest updates: https://t.me/mothershipsg

In Financial Year (FY) 2021, the Housing Development Board (HDB) incurred its largest ever net deficit of S$4.367 billion, before government grants.

This is the highest ever deficit recorded in Singapore's public housing history, in the period beginning on April 1, 2021 and ending on March 31, 2022.

The findings were released on Oct. 31 as part of HDB's Annual Report.

Government's commitment to keeping public housing affordable and accessible: Desmond Lee

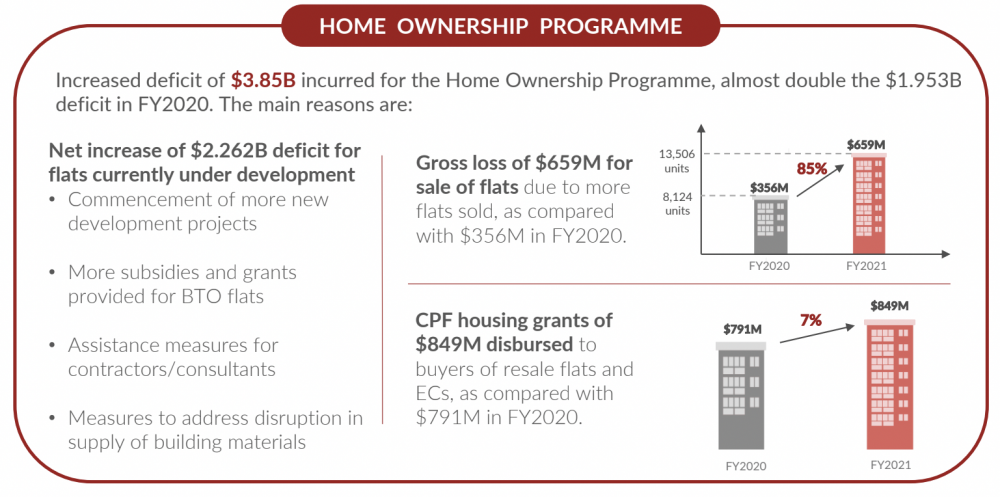

Of the S$4.367 billion, S$3.85 billion was incurred under the various home ownership schemes for public housing.

This includes the development and sale of flats, as well as the disbursement of housing grants.

It is also substantially more than FY 2020's deficit of S$2.346 billion.

Minister for National Development Desmond Lee said that the deficit shows the government's commitment to ensuring, in real terms, that public housing remains affordable, accessible and inclusive.

Calling home ownership "a key national priority", Lee added that the government continues to build and sell new HDB flats at below-market prices, increasing market subsidies over this period to keep Build to Order (BTO) flats relatively stable and providing housing grants to eligible buyers of both new and resale flats.

Breakdown of deficit

Here's the breakdown of the S$3.85 billion deficit incurred for home ownership:

- Net increase of S$2.262 billion in "foreseeable loss" for flats currently under development, including the commencement of new development projects, accompanying subsidies and grants, and pandemic-related costs like managing supply chain disruptions.

- Higher gross loss of S$659 million for sales completed (i.e. keys issued to buyer) in FY2021 as compared to FY2020.

- S$849 million in CPF housing grants disbursed to buyers of resale flats and Executive Condominiums (ECs) in FY2021, as compared to S$791 million in FY2020.

Pic from HDB.

Pic from HDB.

Costs largely absorbed by HDB

HDB attributed the larger-than-usual deficit to the significant subsidies and grants disbursed, as well as the higher loss incurred in the development and sale of flats.

For instance, while construction costs have gone up by about 30 per cent since FY 2019, these have largely been absorbed by HDB.

"Most first-timer buyers therefore use less than a quarter of their monthly income to service their housing loans, and close to 90 per cent of first-timer families service their HDB loans using CPF with little or no cash payments," HDB stated.

HDB's chief executive officer Tan Meng Dui, said in a background briefing that new HDB flats are not priced based on total development costs, which combine construction and cost of land.

"Overall, the amount that HDB collects from the sale of flats in every financial year is less than the total development costs incurred," he said.

Ramping up supply of public housing

Tan also said that HDB will continue to provide public housing that is affordable and accessible to Singaporeans.

He added that to meet the strong demand for housing, HDB has ramped up the supply of Build-to-Order (BTO) flats and will launch up to 23,000 flats per year in 2022 and 2023. This is an increase from the 17,000 flats launched in 2021.

Of these, about 12,800 flats will be launched in non-mature estates, which are generally more affordable. HDB is also prepared to launch up to 100,000 flats in total from 2021 to 2025, if the need arises.

"This means that potential buyers will not only be able to secure more BTO flats in a wider range of locations, but they will also be able to select from a larger pool of affordable flats," he said.

First-timers will continue to be prioritised, such as increasing the flat quota for them. HDB will continue to closely monitor the market and take "necessary measures" to ensure a "smooth and sustainable" resale market.

Aims to cut down on waiting time and BTO delays

With regards to waiting times, HDB also aims to further cut down on BTO delays.

Tan pointed out that the proportion of delayed BTO projects has dropped from 80 per cent a year ago to the current 50 per cent.

Median waiting times have dropped since four to five years at the peak of the pandemic, to between four and four-and-a-half years.

"We will continue to work hard to reduce the delays to BTO projects, without compromising safety and quality," he said.

Top image via Shermin Ng/Unsplash and Gov SG YouTube.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.