Follow us on Telegram for the latest updates: https://t.me/mothershipsg

Core inflation in S'pore continued to rise, with a 5.3 per cent year-on-year increase in September 2022, according to a press release by the Monetary Authority of Singapore (MAS) and the Ministry of Trade and Industry (MTI) on Oct. 25.

Core inflation increased

Core inflation in Singapore is based on the prices of a fixed basket of goods and services.

A 5.3 per cent rate of inflation in September 2022 means that the prices of that fixed basket are up by 5.3 per cent, as compared to September 2021.

This basket does not include the prices of accommodation and private transport, which tend to be more volatile. Core inflation is meant to capture generalised and persistent price changes, driven by underlying demand conditions.

It therefore provides useful information for monetary policy, which aims to ensure medium-term price stability.

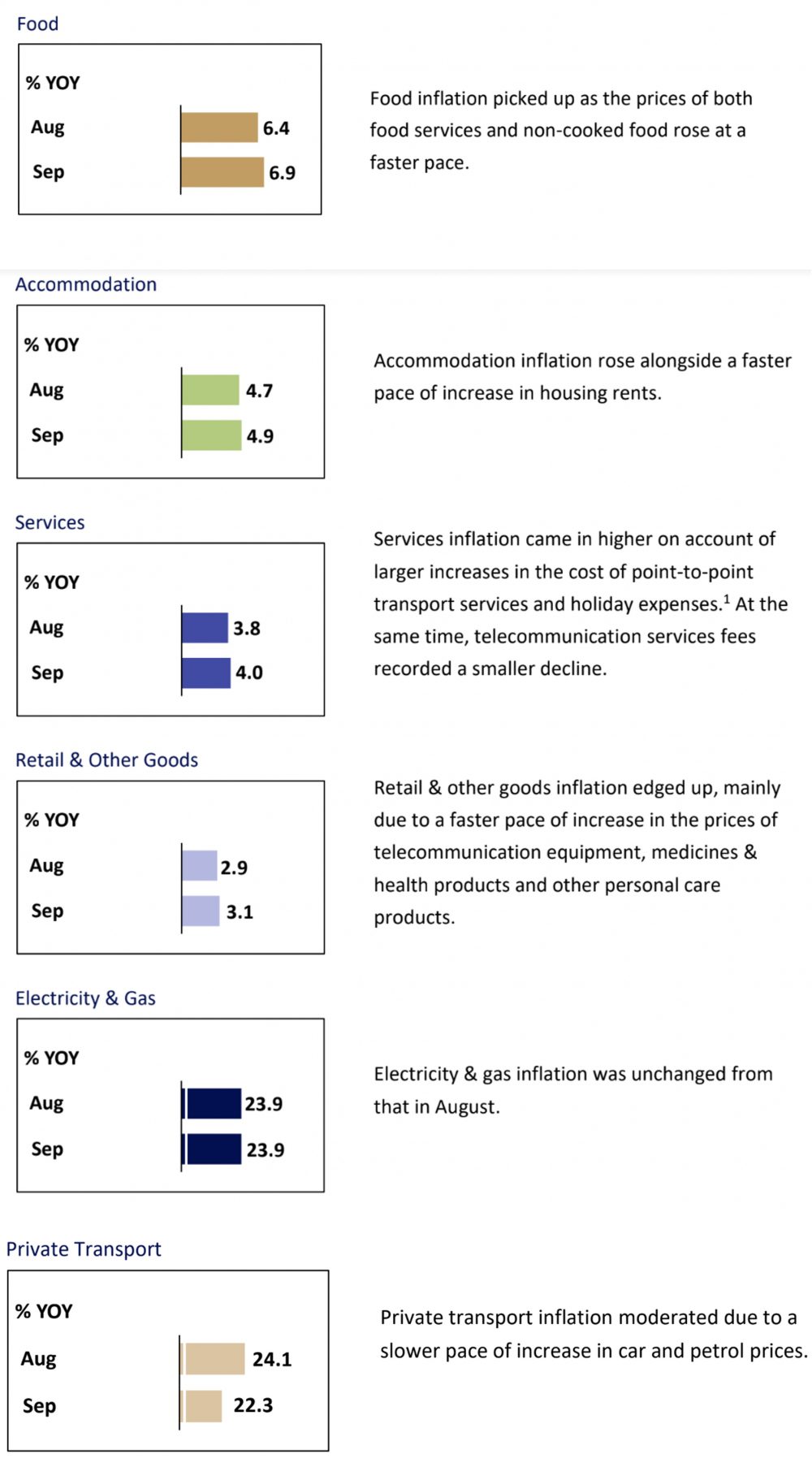

"The pickup in core inflation was on account of larger increases in the prices of food, services and retail and other goods," MAS and MTI stated.

Core inflation increased by 0.5 per cent on a month-on-month basis, which means it increased by 0.5 per cent in Sep. 2022 as compared to Aug. 2022.

CPI-All Items inflation y-o-y rate remains unchanged

Tracking the cost of private transport and accommodation together with core inflation gives you the Consumer Price Index – All Items inflation rate.

This was recorded at 7.5 per cent in September 2022, year-on-year. This is the same year-on-year rate seen in Aug. 2022. In other words, Aug. 2022 saw a 7.5 per cent increase in prices as compared to Aug. 2021.

According to MAS and MTI, CPI-All Items inflation remained the same as that in August, as lower private transport inflation was offset by higher inflation for food, accommodation, services and retail & other goods.

However, it represented a 0.4 per cent increase month-on-month, comparing September 2022 to August 2022.

Here's a look at the various changes:

Pic from MAS and MTI.

Pic from MAS and MTI.

Turbulent global situation

According to MAS and MTI, demand conditions in major economies have "softened", while supply chain frictions continue to ease.

The prices of energy and food commodities have come down from their peaks earlier in the year, but remain high due to ongoing supply constraints. Also, labour markets in major, advanced economies are still tight, which means that wage pressure is strong.

Singapore's imported inflation is expected to remain significant for some time.

Unit labour costs will continue to increase, together with robust wage growth, in the short term. The cost of utilities is also likely to remain elevated.

The cost increases for cars and accommodation are also expected to stay "firm" due to tight COE quotas and strong demand for rental housing.

"MAS Core Inflation is projected to stay elevated in the next few quarters before slowing more discernibly in H2 2023 (second half of 2023) as the current tightness in the domestic labour market eases and global inflation moderates," the press release said.

Top image by Joshua Lee.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.