Follow us on Telegram for the latest updates: https://t.me/mothershipsg

A correction direction has been issued against Facebook page The Alternative View over a post that was put up on Sep. 1.

According to a press release by the Ministry of National Development (MND), the Protection from Online Falsehoods and Manipulation Act (POFMA) Office had been instructed by the National Development Minister, Desmond Lee, to issue the correction as the post communicated a "falsehood" which implied that the Housing Development Board (HDB) profited from the sale of the Central Weave @ Ang Mo Kio Build-To-Order (BTO) flats.

This means that The Alternative View will be required to insert a notice against the original post, with a link to the government’s clarification.

What did the post say?

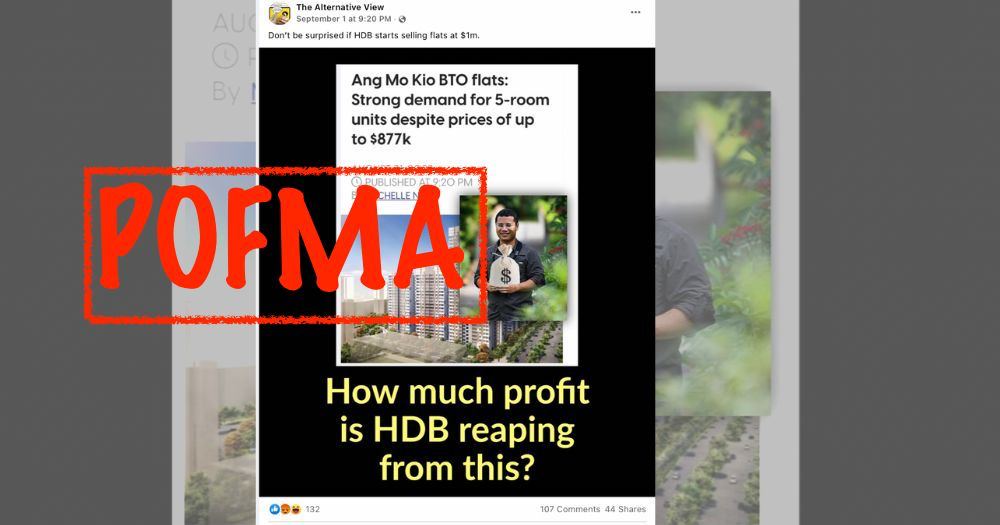

The post contained an image which reproduced the headline of a AsiaOne article published on Aug. 31 and titled, "Ang Mo Kio BTO flats: Strong demand for 5-room units despite prices of up to $877k".

This image shared on The Alternative View's Facebook also contained an additional picture of Lee holding a bag of money, with a caption posing the following question, "How much profit is HDB reaping from this?"

MND added:

"Implicitly this post is stating that HDB is making profit from the sale of the Central Weave @ AMK BTO flats, which are part of the August 2022 BTO sales exercise. This statement is false."

MND: HDB will incur loss from sale of Central Weave @ AMK BTO flats

According to MND, HDB will not profit from the sale of Central Weave @ Ang Mo Kio BTO flats.

Instead, HDB will incur a loss as the estimated amount to be collected from the sale is lower than the estimated total development cost of the project.

In addition, the deficit is expected to be higher once the CPF housing grants that HDB will extend to eligible buyers are taken into account.

The ministry also highlighted that HDB incurs a deficit every year as the amount it collects from the sale of flats in every financial year is less than the costs it incurs.

These costs include the total development cost, comprising land cost and construction cost, and CPF housing grants.

Average deficit incurred by HDB for the past three financial years is about S$2.68 billion

MND also pointed out that for the financial year (FY) of 2021/2022, HDB incurred a deficit of S$3.85 billion in its Homeownership Programme.

The ministry elaborated that for the past three financial years, starting from FY 2019/2020 to FY 2021/2022, HDB's average deficit was about S$2.68 billion per year.

The annual deficit, funded by government grants, is also reflected in HDB’s audited financial statements published annually.

In giving a breakdown of the deficit, MND explained that this is largely due to the significant subsidies extended for new flats and the disbursement of CPF housing grants for eligible buyers.

MND added, "Because of this, most first- timer buyers use less than a quarter of their monthly income to service their housing loans. Close to 90 per cent of first-timer families service their HDB loans using CPF with little or no cash payments."

Top image via The Alternative View Facebook

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.