Follow us on Telegram for the latest updates: https://t.me/mothershipsg

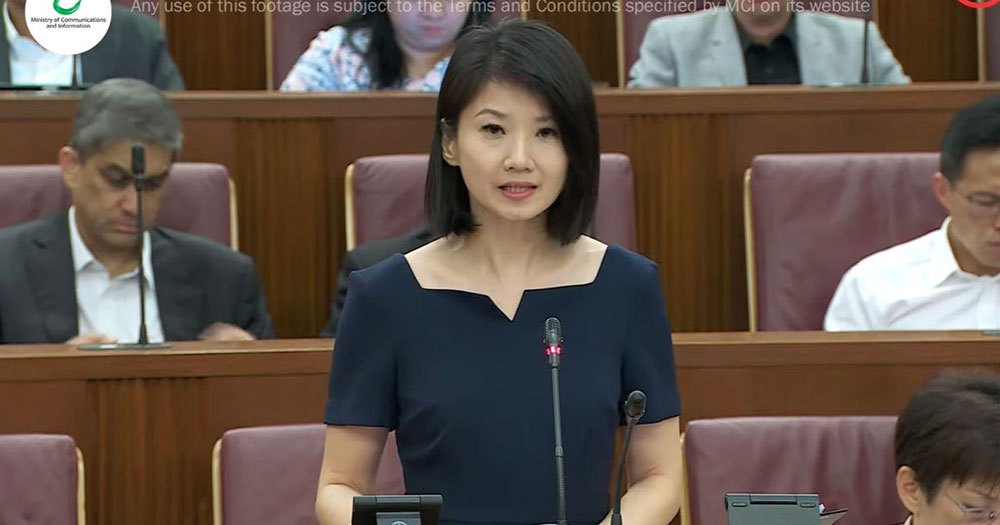

Debt collectors will be banned from threatening physical harm against a debtor or their families, Minister of State for Home Affairs Sun Xueling announced in Parliament on Sep. 13.

This extends to brandishing one's fist, sending threatening messages over text or social media, and pasting a notice with the debtor’s identity information on the door of the debtor’s neighbours.

Debt collectors will also have to verify that the person from whom they are attempting to collect debt is indeed the debtor.

They will also be prohibited from continuing to collect debt from a debtor, if he or she has already informed the debt collection business or collector, by any verifiable means, that the debt is in dispute or that a process has been started to settle the debt through other means, such as mediation or court proceedings.

Ban is part of a wider bill that seeks to rein in debt collection tactics

The incoming measures are part of a Debt Collection bill that was read by Sun in Parliament.

The bill seeks to introduce a regulatory framework on the debt collection industry in order to improve the conduct of the debt collection industry, and better address "dis-amenities" that might emerge from problematic debt collection conduct, according to the minister.

In setting the context for the bill's introduction, Sun pointed out that the number of police reports made against the conduct of debt collection businesses and debt collectors has remained high, with an average of 367 police reports lodged each year from 2018 to 2021.

Sun noted that the reports were mainly against debt collection tactics aimed at pressuring debtors into payment by causing public embarrassment and inconvenience to them.

Sun also cited two incidents as an example of how debt collection tactics had attracted significant attention and affected the public's sense of security.

Shouting loudly, chanting, dressed in a traditional funeral outfit

In the first incident in 2019, a debt collector visited a debtor’s home and workplace multiple times within a month to collect a debt.

The minister noted that on three occasions, the debt collector wore a traditional Chinese funeral outfit to the debtor’s workplace, while carrying accessories including a banner with the debtor’s face, a funeral lantern and incense paper.

The debt collector engaged in actions such as shouting loudly, chanting, kneeling, blowing a whistle, and refused to leave even when told that the debtor was not present. Sun noted that on one such occasion, he also shouted at the debtor’s colleague.

The second incident referenced by Sun occurred in 2015 when six debt collectors visited a debtor at a food stall in Funan Mall to collect a debt.

They unfurled a large banner stating that debt recovery was in process and proceeded to disrupt the stall’s business, including harassing the staff and damaging the stall’s equipment.

In calling such behaviour unacceptable, Sun pointed out that in both cases, the debt collectors were taken to task under the Protection from Harassment Act and the Penal Code.

Debt collection business and debt collectors will have to be screened by the police under new bill

The bill will therefore regulate the following:

- Debt collection businesses, which collect debt from a debtor either on behalf of another person, or where the businesses themselves had acquired the debt, and their debt collectors; and

- Bank and moneylenders, which Sun defined as entities with a business primarily in the lending and collecting of money owed to their own business, and which are already regulated by other government entities today.

With regard to regulating debt collection businesses, Sun said that this will include the introduction of a licensing regime.

This means that such businesses must apply for and obtain a licence to carry out debt collection activities.

In addition, an individual deployed by a licensed business as a debt collector must make a joint application with said business, and must obtain an approval to be deployed, before he or she can carry out any debt collection activity.

Sun added that a debt collector will not be restricted on the number of debt collection businesses that they are able to work for, and can work for multiple businesses at a time.

However, all debt collection businesses, including their key appointment holders, and the debt collectors, will be screened by the police and assessed if they are "fit and proper" before they can be granted a licence, Sun highlighted.

Factors like prior offences will be taken into account

During such an assessment, the Licensing Officer will take into account factors such as prior offences committed by the individual which could have involved violence or harassment.

The severity of the offence and the length of time that has passed since the commission of offence will also be considered, Sun added.

Applicants who fail to meet the criteria will not be allowed to carry on a debt collection business or carry out debt collection activities.

Sun said that these are relevant in determining the propensity of an individual to engage in problematic debt collection conduct.

In addition, should a debt collector be found to have engaged in the aforementioned prohibited conduct, he or she will be liable, on conviction, of being fined up to S$10,000 or jailed up to 12 months, or both.

For repeat offenders, the punishment will increase to a fine of up to S$20,000 or a jail term of up to two years, or both.

The offender may also have his or her licence suspended or revoked, Sun added.

Banks and moneylenders to be class licensed

As for licensed moneylenders and banks, they will be class licensed as they have been assessed to pose a lower law and order risk compared to debt collection businesses that are not currently regulated, Sun explained.

Such entities will be allowed to carry out debt collection activities if they comply with the class licensing conditions, and they do not need to apply for an individual licence.

This will minimise regulatory compliance costs, she added.

An individual who is employed by a class licensed debt collection business to collect debts does not require the approval of a Licensing Officer either, Sun said.

Businesses and individuals under the class licensing regime also need not be subject to screening by the police.

However, the bill still allows a Licensing Officer to take regulatory action against individual class licensees, including disapplying a class licence, if any class licence conditions have been contravened.

This serves as a safeguard against class licensed businesses that may engage in errant debt collection conduct, she added.

Offences and penalties for people who carry out debt collection without a licence will be introduced

The bill will also introduce offences and penalties for debt collection business carried out without a valid licence or debt collection activity conducted by an already-regulated business without a valid class licence.

According to Sun, such offences will attract a fine up to S$20,000 or imprisonment up to two years or both upon conviction.

For repeat offenders, the punishment is a minimum fine of S$20,000, up to a maximum of S$100,000 or imprisonment up to five years, or both.

As for individuals who act as debt collectors without approval, or on the behalf of unlicensed entities, they face a fine of up to S$10,000 or imprisonment of up to 12 months or both upon conviction.

Repeat offenders will be liable for a fine of up to S$20,000 or imprisonment for up to two years or both.

Bill also allows licence applicants to appeal

The bill will also licence applicants and licensees to appeal to the Minister against an appealable decision made by the Licensing Officer.

According to Sun, appealable decisions include the refusal to grant or renew a licence and the refusal to grant an approval for an individual to be deployed as a debt collector.

She added, "The Minister’s decision on an appeal is final. Unless otherwise directed by the Minister, the decision appealed against must be complied with until the determination of the appeal."

Related stories:

Top screenshot via MCI/YouTube

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.