Follow us on Telegram for the latest updates: https://t.me/mothershipsg

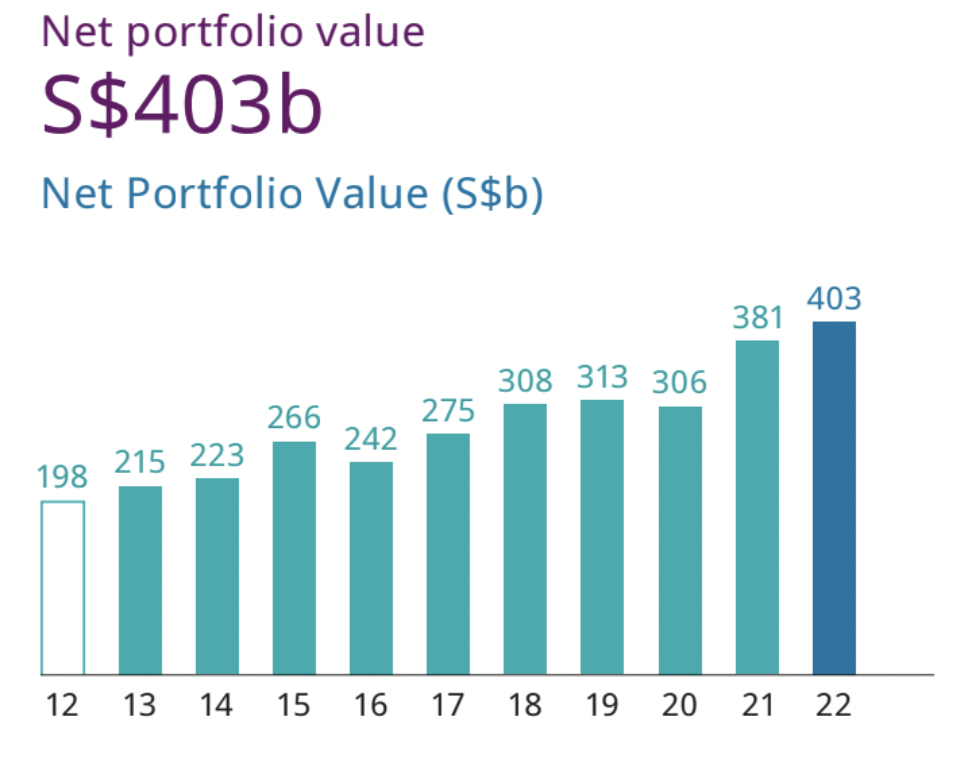

Temasek Holdings held its annual review on Jul. 12, revealing a net portfolio value of S$403 billion for its last financial year, which ended on Mar. 31, 2022.

This is the highest net portfolio value it has achieved, following its previous record high of S$381 billion in 2021.

Graph from Temasek Holdings

Graph from Temasek Holdings

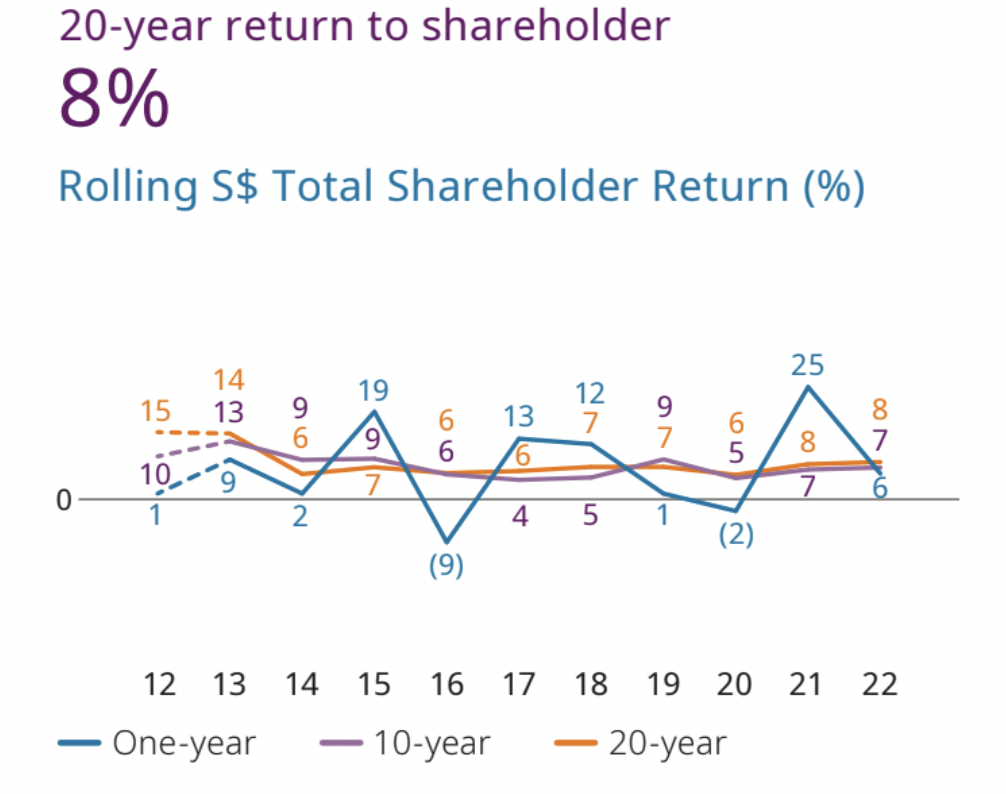

The company’s one-year Total Shareholder Return (TSR) was 5.81 per cent, down from the record 24.53 per cent in 2021.

Its 10- and 20-year TSR returns were seven per cent and eight per cent respectively.

Graph from Temasek Holdings

Graph from Temasek Holdings

This was the first time in three years that Temasek held its review in person, having held it virtually in 2020 and 2021 due to the Covid-19 pandemic.

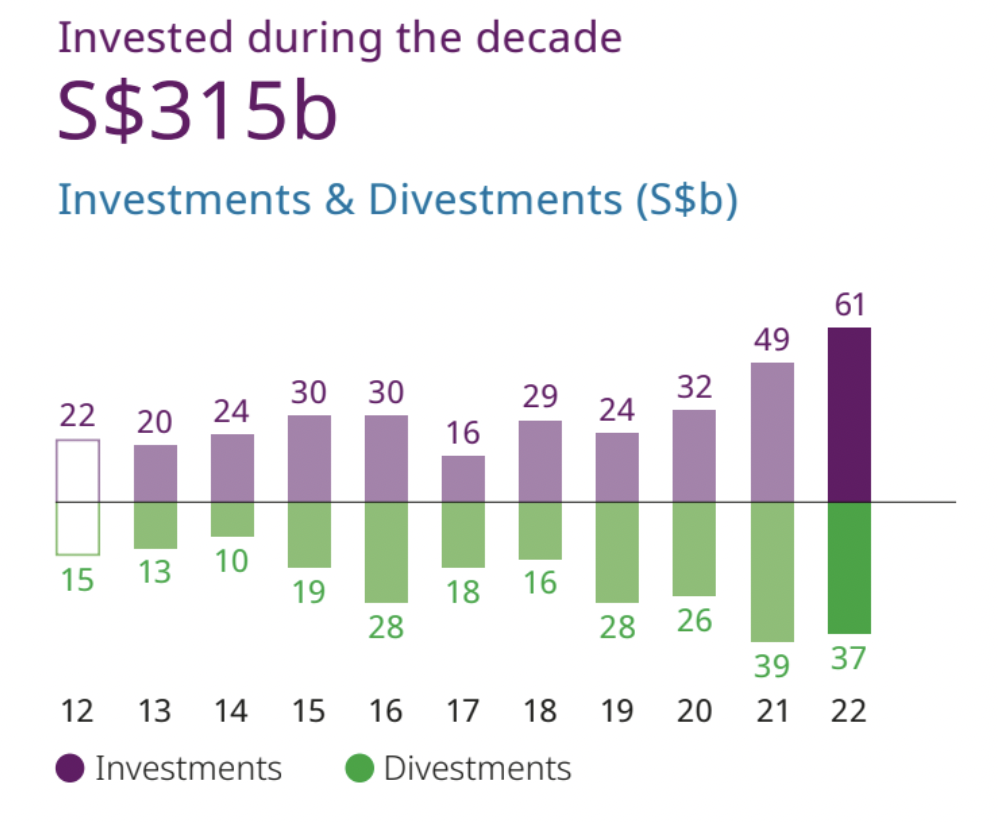

Record investments

Temasek was keen to stress its role as an active investor — it had invested S$61 billion, and divested S$37 billion.

Financial Services (23 per cent), Transportation & Industrials (22 per cent) and Telecommunications, Media & Technology (18 per cent) were its three largest sectors.

Transportation had moved up from the third place the previous financial year, to second place, due to Temasek's significant investment in Singapore Airlines (SIA).

Graph from Temasek Holdings

Graph from Temasek Holdings

Singapore has largest portfolio exposure

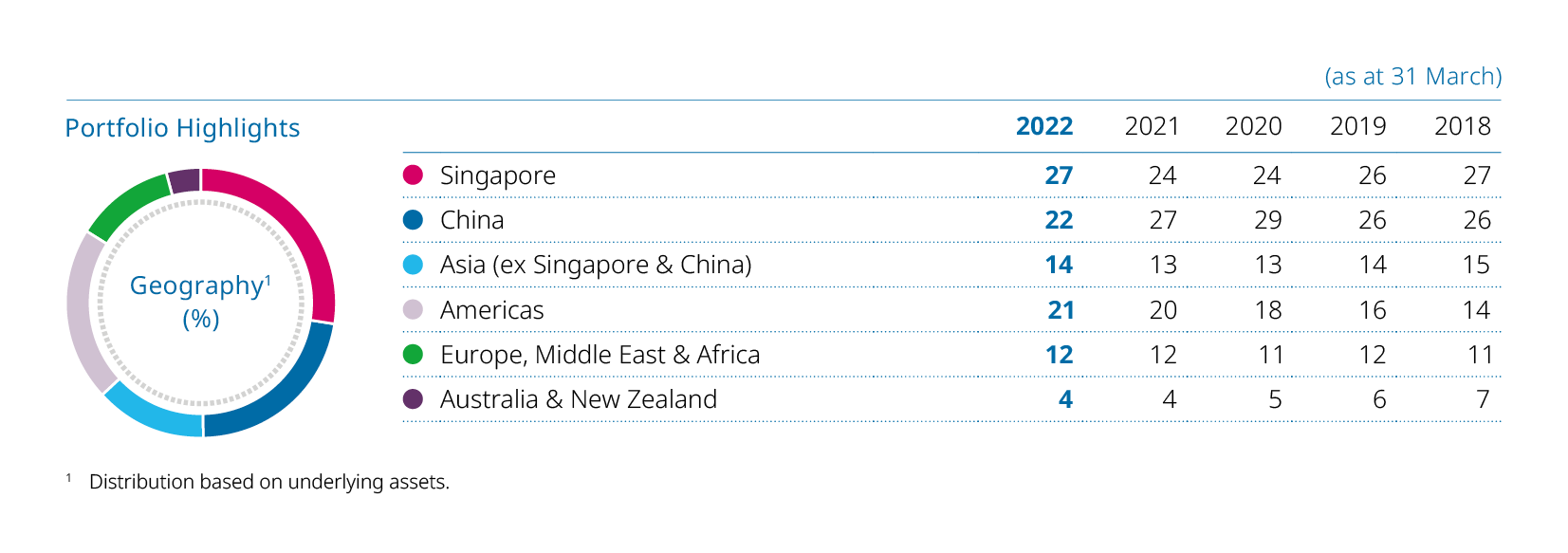

Temasek states that it "remains anchored" in Asia, with 63 per cent of its portfolio located in the region.

Singapore became Temasek’s largest country by exposure at 27 per cent, up from 24 per cent in 2021.

Graph by Temasek Holdings

Graph by Temasek Holdings

In 2021, Temasek participated in SIA’s S$6.2 billion mandatory convertible bond issue, as well as Sembcorp Marine’s S$1.5 billion rights issue.

The firm said that these investments would strengthen their balance sheets while helping them prepare the resumption of global travel, and accelerate their transition into the green economy, respectively.

China came in second place in terms of portfolio exposure at 22 per cent, down from 27 per cent the previous year.

Temasek said that it will continue to invest in new sectors focusing on new consumption patterns, sustainability and innovation. One such company it invested in is a hydrogen fuel cell developer.

However, Lim Ming Pey, managing director of Temasek’s Strategy Office, noted that the fall in portfolio exposure was due to a drop the market value of Temasek's China portfolio.

Temasek also emphasised that the country had performed well for the company over the decade, and that it remains confident in the country’s long term outlook. It would thus continue to invest in China in accordance with its structural trends.

Temasek's Chief Investment Officer Rohit Sipahimalani pointed out that since the end of the financial year, the geographies that had performed well last year had lost value.

Whereas in China, value had gone up in the same timeframe despite being a poor performer the year before. He commented that this was an example of balanced resilience in Temasek’s portfolio.

When questioned about whether Temasek’s approach to investment in China had changed in the past two years, the panel pointed out that the company approached the country consistently.

It continued to assess opportunities in China according to its four trends of digitisation, longer lifespans, sustainable living, and the future of consumption.

The panel also noted governments around the world were concerned with similar issues as the Chinese government, such as the strength of tech companies, and concerns over data collection, amongst other tech sector-related issues.

However China had dealt with its policy concerns in those sectors at a speed that was faster than anyone expected, the panel added.

Unlisted versus listed assets

Temasek's unlisted assets have grown steadily over the years.

Unlisted assets now make up 52 per cent of Temasek’s portfolio.

This is equivalent to S$210 billion, up from S$53 billion a decade ago.

Graph via Temasek Holdings

Graph via Temasek Holdings

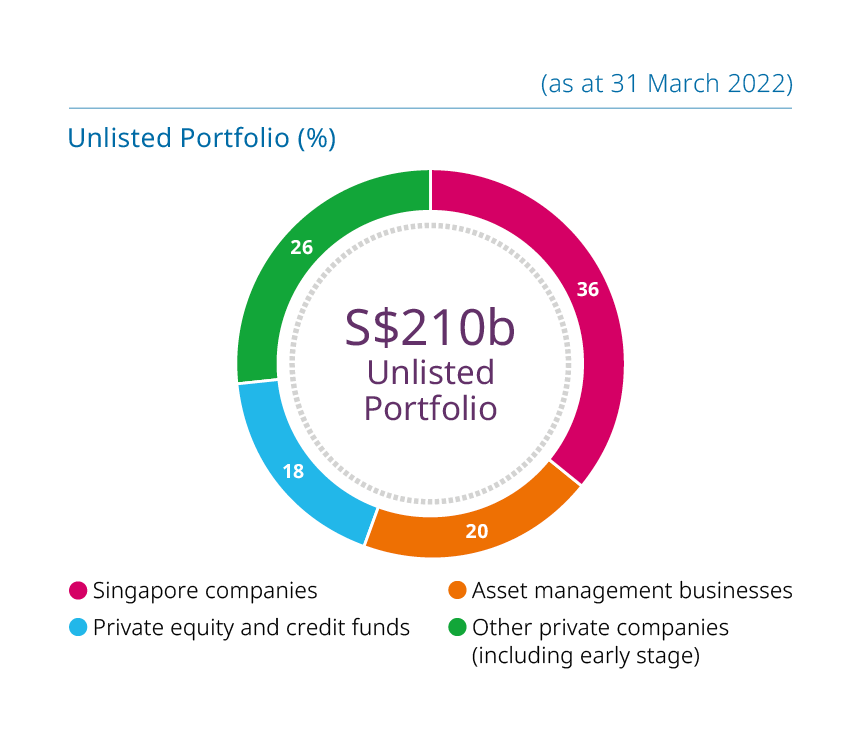

Temasek gave a breakdown of what its unlisted portfolio looked like, with 36 per cent being Singapore companies, 26 per cent being other private companies including those in early stages of development, 20 per cent being in the asset management business, and 18 per cent in private equity and credit funds.

The firm shared that its unlisted portfolio offers liquidity in the form of steady dividends from mature companies such as Mapletree, SP Group and PSA, the distributions from the portfolio of funds built up over the years, and the returns from when the unlisted assets are listed or sold.

Temasek also emphasised that the increase in value of the unlisted portfolio did not reflect an attempt to avoid listed assets due to the ongoing market downturn.

Instead, it reflected a situation where markets varied based on value and opportunity.

Temasek also pointed out that individual assets had been selected for different purposes, and purchasing unlisted assets because they were private was not in and of itself a goal.

Sustainability and sustainable growth

Temasek also gave an update on the status of its sustainability goals.

Having achieved carbon neutrality in 2020, it aims to attain net zero carbon emissions by 2050.

It had raised its internal carbon price to US$50 (S$70.38) as well, and will progressively increase this to US$100 (S$140.77) by the end of the decade.

Uncertain futures

All this came against the backdrop of a global economy that the Temasek described as being “in a fragile state”.

This is due to the ongoing geopolitical uncertainties, rising inflation and the central banks tightening monetary policies in order to counter it, increasing commodity prices, supply chain bottlenecks, geopolitical fractures, and the climate crisis.

However, Temasek expects that a recession, if one did occur, would be relatively mild, and that “private sector balance sheets were relatively healthy and should ride out the downturn”.

In light of these uncertainties, Temasek will continue to focus its efforts to "construct a resilient and forward looking portfolio", keep sustainability at its "core", and equip its workforce with the necessary skills for the future.

Covid-related initiatives

Temasek, through their philanthropic arm Temasek Foundation (TF), have continued their charitable efforts especially during the Covid-19 pandemic.

It has focused its support activities in five areas — testing and diagnosis, containment and contact tracing, care and treatment, protection and prevention, and enablement.

In the early days of the pandemic, TF focused on bridging gaps in critical supplies, distributing 150 million disposable and reusable masks, oximeters and mouth gargle medical-grade oxygen concentrators to community health providers.

The foundation also distributed large amounts of Covid-19 supplies to over 40 countries, including masks, test kits, and personal protective equipment.

Temasek has also used its oscar@sg fund to support vulnerable communities in Singapore, enabling over 300 projects to date.

Top photo from Temasek Holdings

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.