Follow us on Telegram for the latest updates: https://t.me/mothershipsg

Instead of encashing your NS55 S$100 credits at Sheng Siong ATMs, you have another option of utilising the credits as a form of cash -- by transferring it into a YouTrip card.

The YouTrip card is a prepaid Mastercard -- which means that you have to load credits into it before it can be used -- and its main draw is its "mid-market exchange rate across 150+ currencies worldwide with no additional fees or markup".

In short, good exchange rate.

Currently, one method of encashing the S$100 NS55 credits is to withdraw S$90 in cash from Sheng Siong ATMs, incur a convenience service fee of S$0.20, and leave S$9.80 in the LifeSG app to be used another time.

However, if leaving behind credits is not your thing, you can transfer the full S$100 NS55 credits to your YouTrip card with no service charge.

How to transfer NS55 credits to YouTrip card

Here's how to do it.

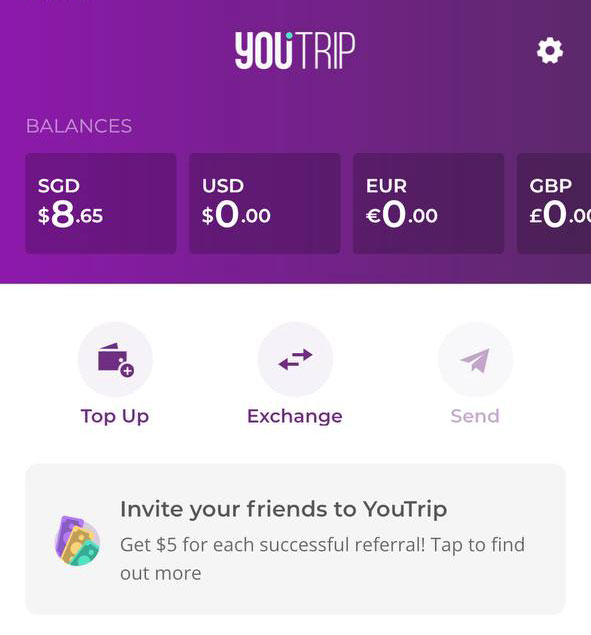

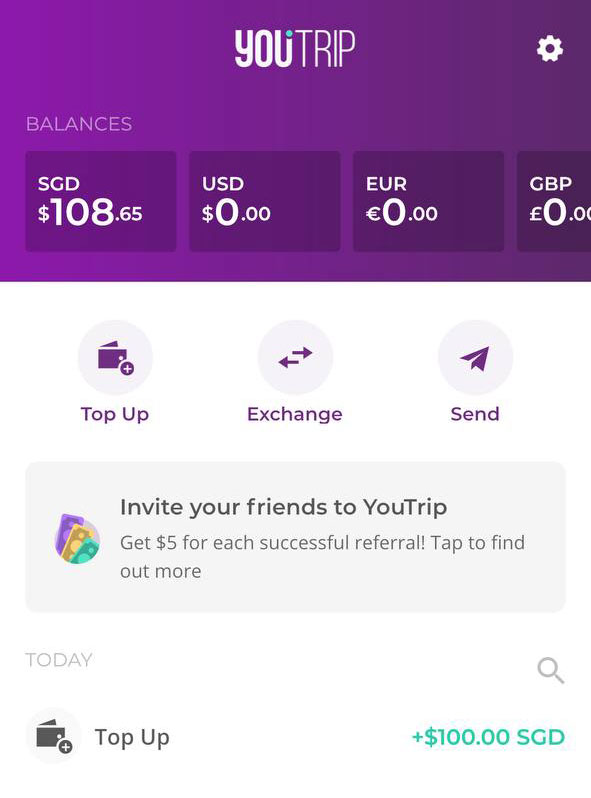

Step 1: Open your YouTrip app and log in to check your balance in Singapore dollars.

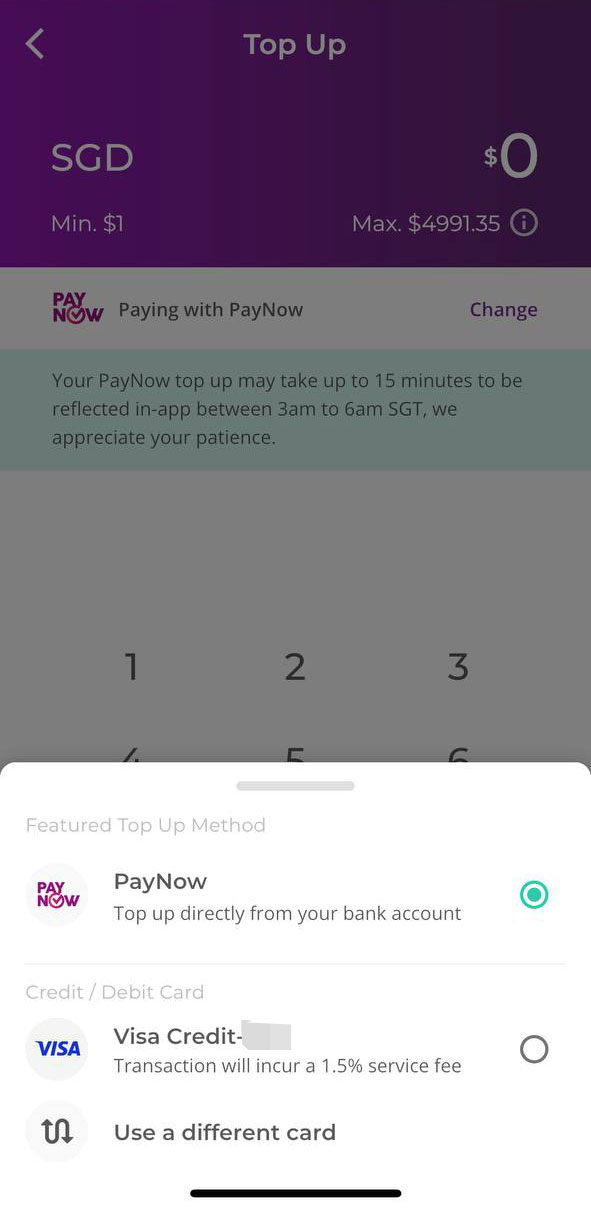

Step 2: Choose the PayNow option in the YouTrip app.

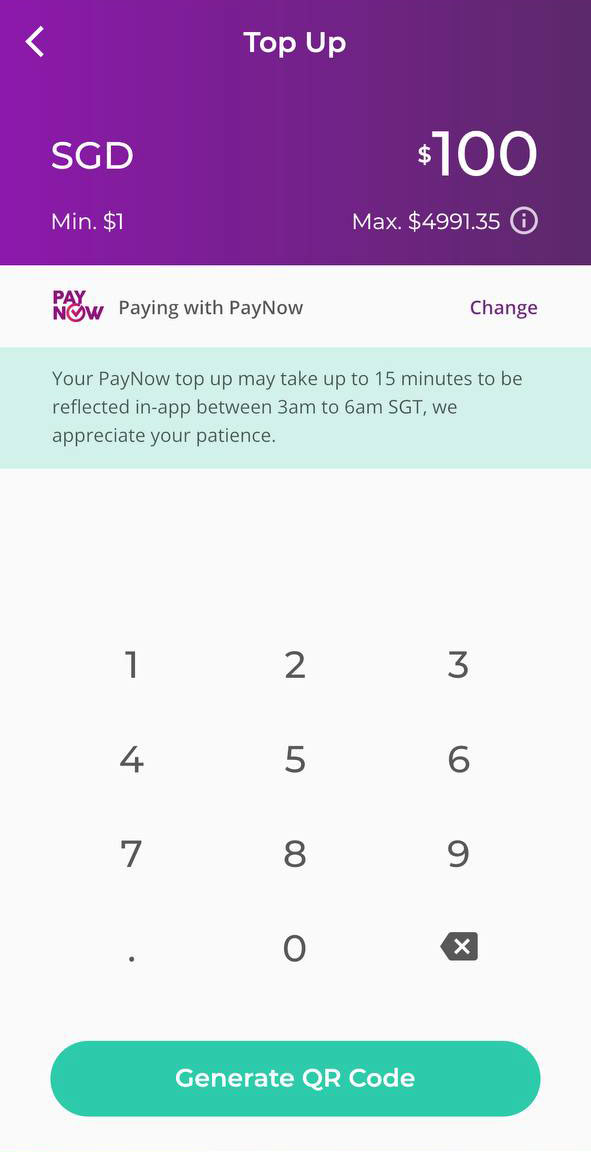

Step 3: Key in S$100 as the top-up amount.

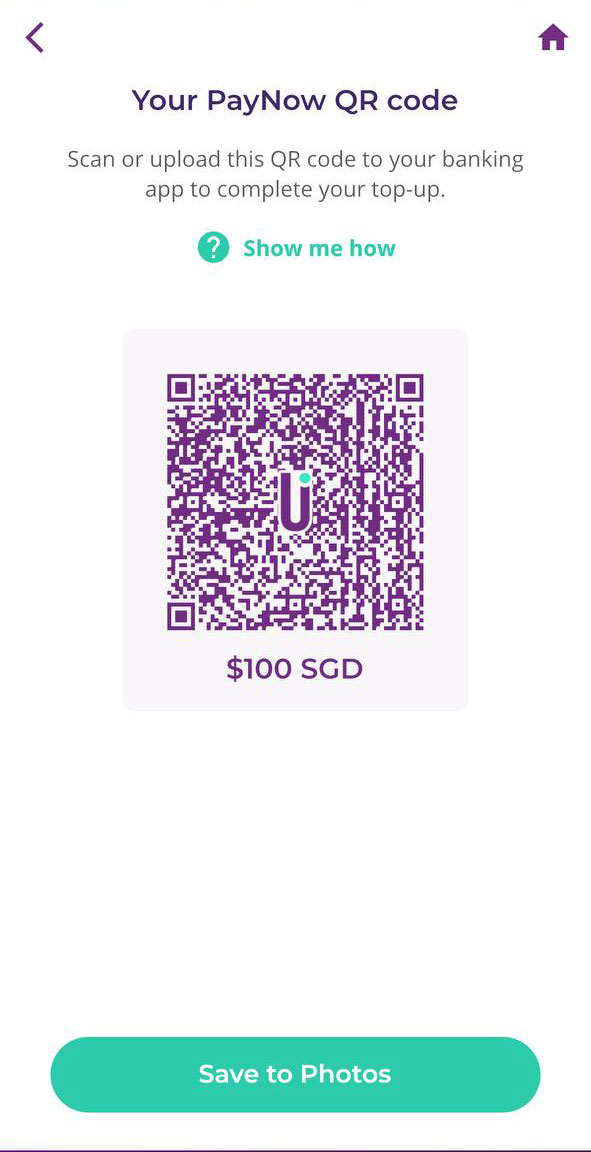

Step 4: Open your LifeSG app to scan the QR code generated in the YouTrip app.

If you're like most humans and only have one phone, save the QR code to your photos so that you can upload it to the YouTrip app.

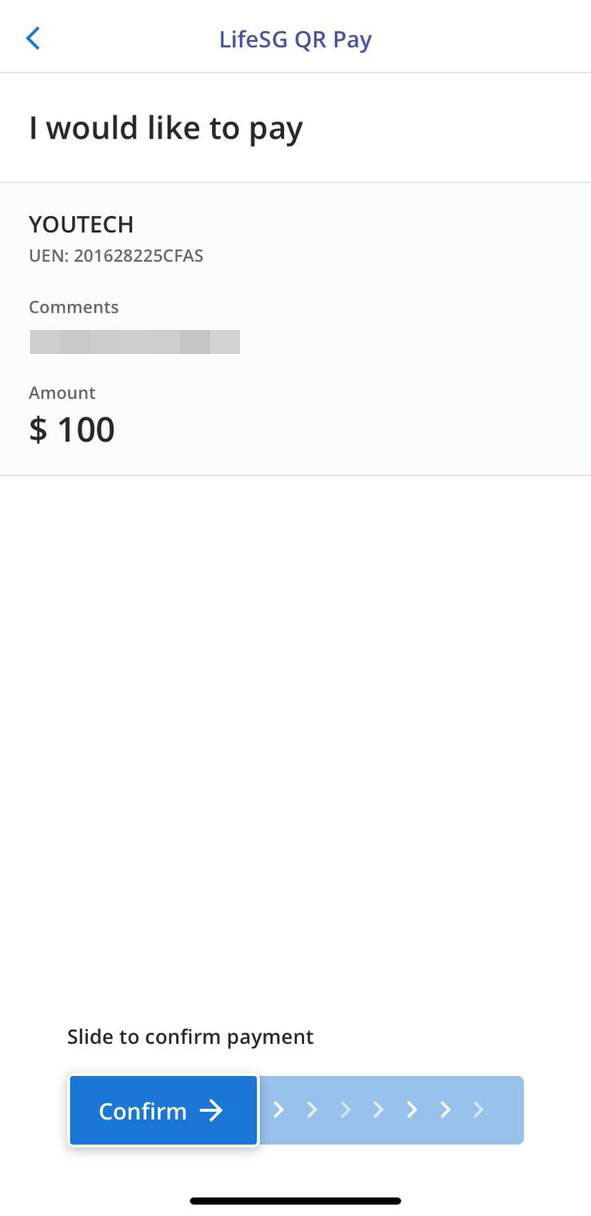

Step 5: Slide to confirm LifeSG app to make the transfer.

Step 6: See the transferred amount reflected as your new balance in the YouTrip app.

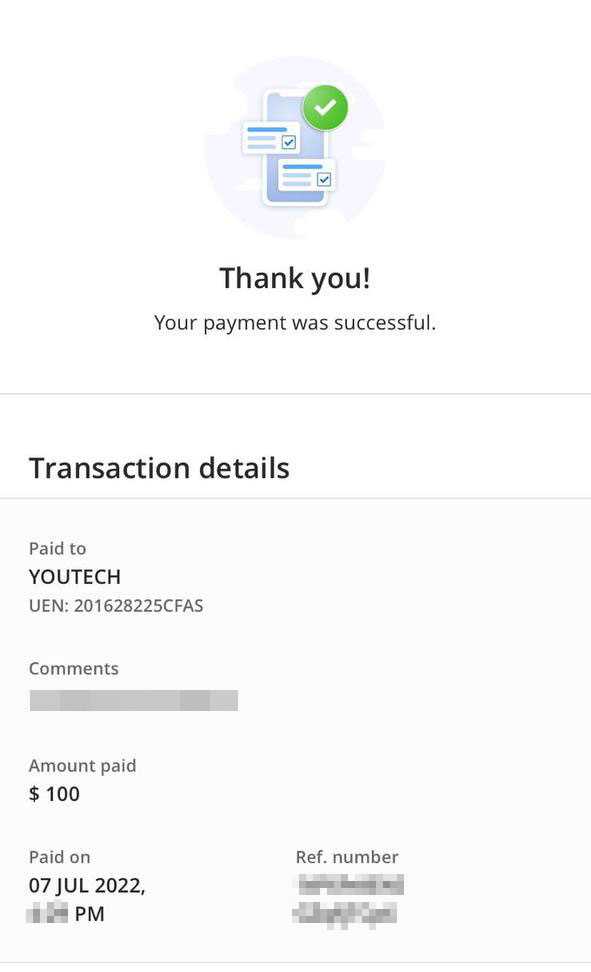

Step 7 (optional): Check the transaction is successful in the LifeSG app.

The money is now ready for you to spend.

The disbursement of the NS55 Recognition Package in credits and not cash deposited into bank accounts allows transactions to be made with Singapore-registered businesses via the LifeSG app.

Those eligible for the NS55 credits are to download the LifeSG app to access the credits.

Pros and cons

The upside of transferring the full amount to your YouTrip card is that you can spend it like you would with a normal debit card, and even enjoy good exchange rates if you're travelling overseas anytime soon.

The downside is that you cannot transfer the money to a bank account nor withdraw it at a local ATM.

You can, however, withdraw it in cash at an overseas ATM -- if that's what you really want.

But the biggest upside is that since the money is loaded into your YouTrip card, it will not expire within one year, which is what will happen if the credits are left in the LifeSG app.

Top photos via Mothership.sg & LifeSG

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.