In property-mad Singapore, home ownership is a big deal.

Some 85 per cent of residents live under roofs that they own – after putting down good money for them.

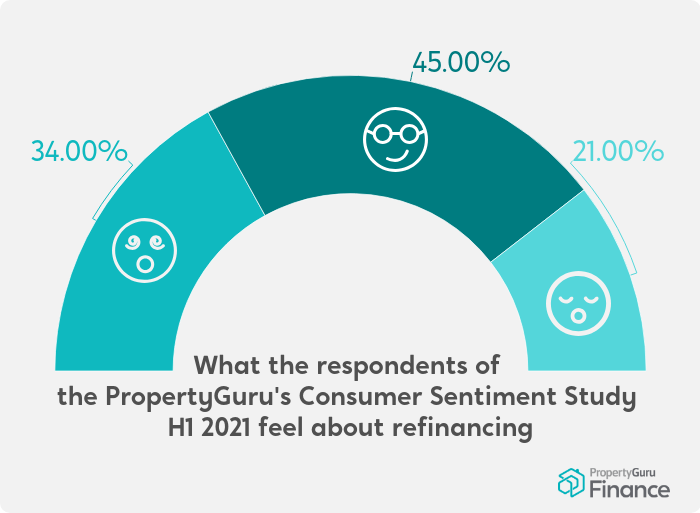

Oddly enough, refinancing a home loan is not something that occupies as much of people’s collective psyches as it should.

It is almost as if servicing the loan gets relegated to an afterthought after house hunting, negotiating the price, going through with the paperwork, and putting down the downpayment to secure a property and taking the next 15, 20 or even 25 years to fully pay back what is owed.

Why is refinancing not utilised more often?

Statistics don’t lie.

Homeowners in Singapore are not taking advantage of refinancing due to the fear that it is a complicated process from start to finish.

According to the PropertyGuru Singapore Consumer Sentiment Study concluded in the first half of 2021, it is the tedious paperwork that is stopping homeowners from refinancing.

Is there an easier way?

It does not have to be this way.

If refinancing options can be laid out on the table for you without you having to actively source for the information, would it be more attractive?

What if it took you just two minutes to find out if refinancing is going to work for you?

So, here’s the value proposition: If you can finish reading this article that covers 17 frequently asked questions about refinancing, it should work for you.

Here goes nothing.

1. What does it mean to refinance a home loan?

You’re switching your existing HDB or bank loan to another loan offered by a different financial institution or bank for greater savings and lower monthly repayments.

Essentially, when Bank B approves your application for a refinance property loan, Bank B will pay off your existing mortgage with Bank A, and bring over the prior loan balance.

For example, in 2019, you took a S$300,000 property loan with Bank A at 1.8 per cent (three-year fixed rate).

After the lock-in period has expired, you decide to shop around for a lower rate and find that Bank B is offering an interest rate of 1.5 per cent (three-year fixed rate).

If your refinancing application is approved and loan offer accepted by the borrower, Bank B will pay Bank A the S$300,000 that you owe.

You will now owe Bank B what remains of the S$300,000 loan that has been partially paid down after three years.

2. What do homeowners hope to achieve by refinancing their homes?

Homeowners in Singapore who actively manage their home loans are trying to cut costs by finding ways to get better deals, or simply to extend their repayment tenure.

In Singapore’s context, as a homeowner paying a few hundred dollars less on a monthly loan of a few thousand dollars sounds good, refinancing might be for you.

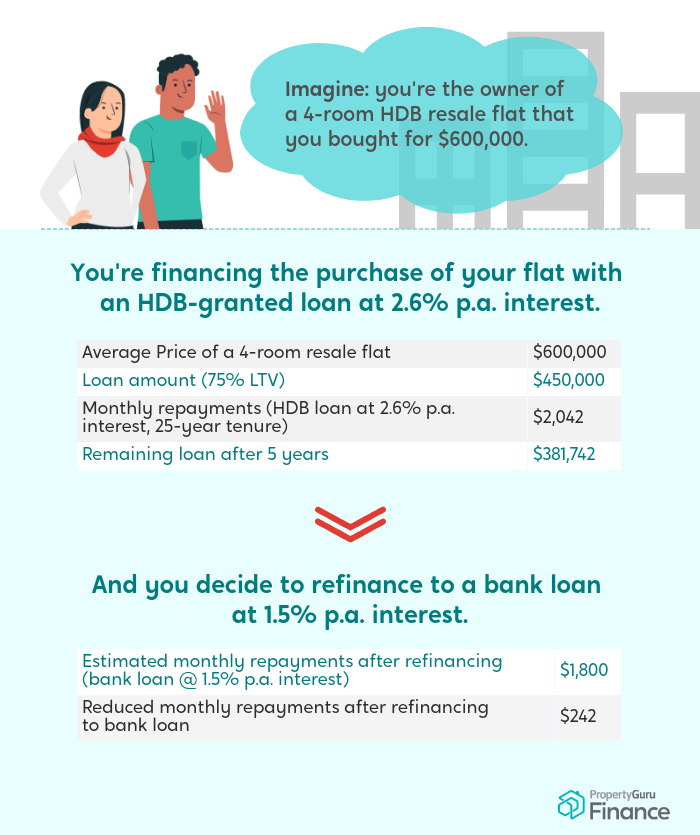

3. Is there an example of refinancing done right?

A HDB loan might allow homeowners to put down a lower downpayment initially.

However, the HDB loan comes with a 2.6 per cent interest rate, as compared to banks that offer lower interest rates of 1.4 to 1.8 per cent.

You can refinance from an HDB loan to a bank loan.

In fact, if you switch from an HDB loan to a bank loan, you could save thousands of dollars, as mortgage interest for HDB is typically one per cent higher than the current offerings from most banks.

Refinancing, say a S$300,000 loan, could save you more than S$9,000 in the first three years given present interest rates and packages available.

4. What is the most common outcome of refinancing?

Paying less can be achieved if the homeowner is going to get a lower interest rate, and hence, save more money over the entire course of the home loan.

Of course, adjusting the duration of a home loan by extending the loan term reduces the monthly payment in the short term, but it will lead to paying more interest over the duration of the entire loan.

The good news though: Trying to secure a lower interest rate is not just the only strategy.

Moreover, with fluctuating rates and the rise of online brokerages that cater to individual needs, monitoring loans has become easier, with free services that even ping homeowners the moment a favourable deal comes along.

5. What is the first thing all homeowners must know about refinancing?

The first key thing is to know that most home loans come with a lock-in period during which you do not have the option of switching to a better rate without incurring a pre-payment penalty.

Before refinancing, check whether your lock-in period has already expired.

If it has, then refinancing is something you can actively consider as you can potentially save some money.

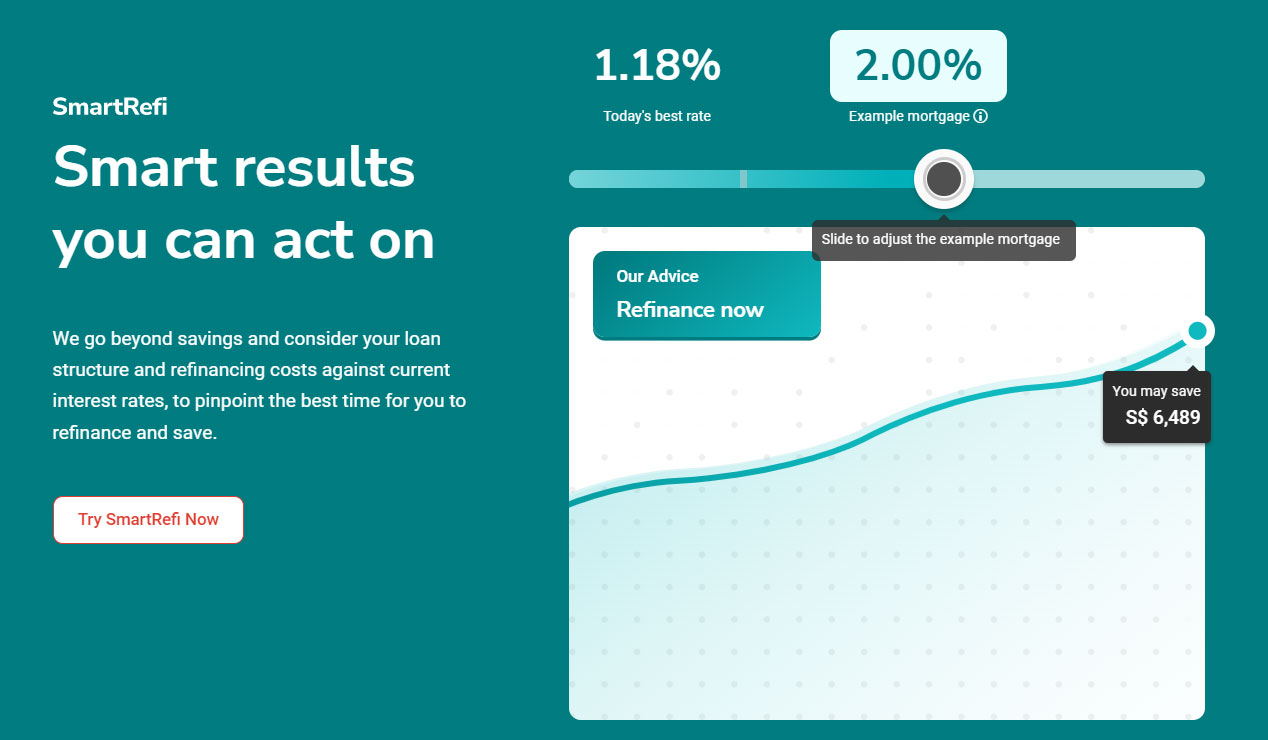

In fact, you can simply check if you are eligible to refinance in two minutes via PropertyGuru Finance SmartRefi.

SmartRefi tells you if you should refinance now or later, and provides you with a breakdown of your potential savings.

6. How do interest rates of home loans typically work?

For a bank loan, a lower interest rate tends to be offered until the lock-in period is over.

Interest rates tend to be higher after lock in periods are over, resulting in higher interest costs.

7. What should you do before you refinance your home?

Actually knowing why you want to refinance your home is the first step to refinancing your home.

If your answer is simply wanting to save money, you need to at least know why you are thinking of doing it.

The various reasons include, but are not limited to, lowering of monthly repayments, adjusting of loan tenure, reducing overall interest costs, and even to take on a smaller home loan.

8. How is refinancing utilised by homeowners?

A common experience: Homeowners in need of more cash on hand or who have difficulty keeping up with their current monthly repayments should take advantage of a lower interest rate through refinancing that extends the runway for the loan tenure.

Long-term interest costs might increase, but refinancing can serve as an interim solution.

The homeowner can consider refinancing again after a few years when cash flow is not as tight.

9. How should homeowners ensure they do not lose money from refinancing?

In essence, potential savings from refinancing due to the lower rates should be offset with the refinancing costs incurred, such as valuation fees, conveyancing (legal) fees, and any other additional fees and charges that stem from the process of switching banks.

There is also a need to factor in prepayment charges, clawback fees, and/ or cancellation fees into your costs as well.

Expect to pay up to S$3,000 for refinancing costs, such as legal fee and valuation fee, but banks usually offer subsidies.

10. When is it not worth refinancing?

Rule of thumb: If you have to take more than one to two years to save enough to offset the costs, it is probably not worth it to refinance now, unless you intend to not refinance again for many years to come.

11. Why does refinancing keep coming up as a topic of interest for homeowners?

There are essentially two primary reasons why refinancing is always a topic of interest for homeowners.

Market situations and offerings by banks are always constantly changing.

Moreover, individual circumstances are also always changing.

Simply put, where you were at when you took the loan many years ago is very likely different from where you are at now in life.

If your lot in life has changed, there is no reason your loan should remain fixed and the same.

12. How long is the refinancing process?

As a rule of thumb, the process of refinancing can take about four months – one to two weeks for loan application, approval and acceptance, and then three months’ bank notice period.

Give yourself three to four months prior to the expiration of your lock-in period to do your research and find the best home loan package.

The duration includes having the approval process completed, followed by having the property value appraised, settling legal fees, and any other payments or repayments.

Homeowners should not take on any large credit lines or loans during this process as it will affect the offer that the prospective bank will make.

Upon fulfilment of refinancing eligibility criteria, paperwork and the switching of loans may take two to three months to take effect.

13. What are the ways of starting the refinancing process?

Homeowners could cross-compare quotes from different banks by comparing rates on their own, which can be confusing and time consuming, or simply use SmartRefi refinancing tool to save time.

14. What is PropertyGuru Finance's SmartRefi?

SmartRefi is a proprietary tool that tracks one’s mortgage against daily market interest rates across all major banks in real time and notifies the homeowner at the optimum time to refinance for maximum savings.

The service is free.

To reiterate: The service comes with no risk, as there is no cost, and virtually no effort, as SmartRefi does the heavy lifting.

It takes just two minutes to try out SmartRefi to find out if refinancing now or later is viable.

What it does is inform the homeowner if refinancing now or later makes more financial sense.

SmartRefi nudges you at the right time, so you do not ever pay the bank more than you should.

It provides instant refinancing recommendations

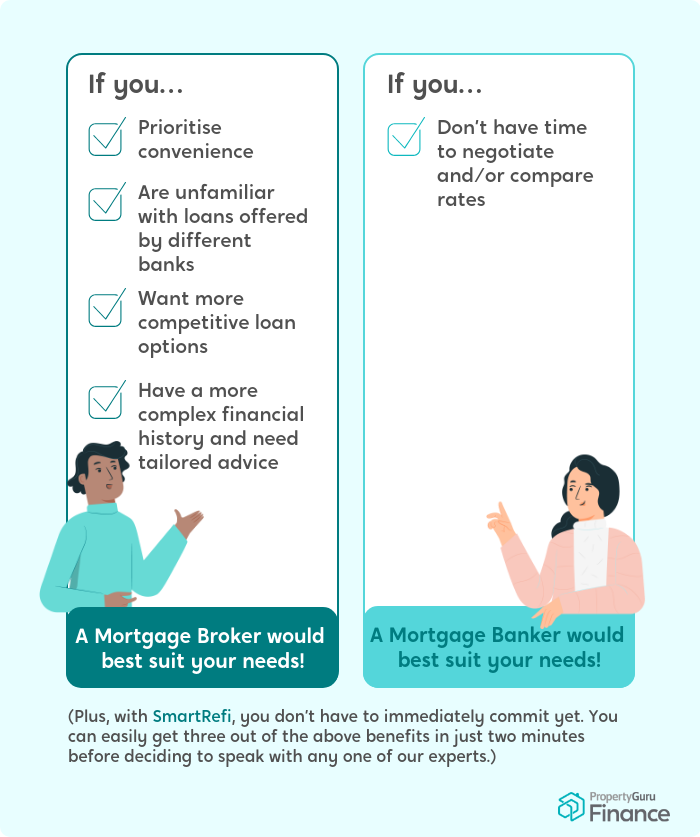

15. Why should homeowners refinance with a mortgage broker than repricing with a bank?

Refinancing with a mortgage broker allows for competitive rates to be made known and objective advice to be given as compared to repricing with a bank.

Even though banks can be a top-of-mind option, repricing a mortgage with a bank may limit one's potential savings as you will never know about any other loan packages offered by other banks that could be more suited to your needs.

A bank is also far less likely to inform a client about a lower interest rate offer from another bank.

PropertyGuru Finance, which is part of PropertyGuru, also does home loans and provides an array of deals.

16. Is it true that refinancing only benefits mortgage brokers and banks and mortgage aggregators that recommend such services?

According to Paul Wee, Vice President of FinTech, PropertyGuru Group, mortgage brokers do earn a little from touting their services, but only if refinancing is favourable for the client.

Paul said: “It is true that mortgage brokers and aggregators earn a small referral fee from the banks, while banks earn the interest income from the loans they manage to secure.”

“However, a credible mortgage broker would never encourage a client to refinance if there is no benefit for the client.”

17. What is the worst thing that can happen if a homeowner opts for refinancing?

According to Paul, there are scenarios where refinancing could end up with the homeowner being worse off.

He said, citing two possible outcomes: “The worst thing is that a homeowner fails to achieve the goals of the refinancing, or if they end up in a bind, just to name a couple.”

“An example of the first is if a homeowner refinances to mitigate against expected rising interest rates. If these rates never rise to expected higher levels, the homeowner would have ended up paying higher interest costs.”

“For the second scenario, there have been occasions when homeowners refinance to lower their interest costs, only to realise that they are unable to sell their property within the next six months, as they had originally planned due to penalty fees.”

18. Are there other refinancing strategies available that do not involve interest rates?

There are ways to make refinancing work that do not involve just one metric of lowering interest rates.

Paul explained that there are ways to restructure the loan, which involves extending the loan tenure and using one’s Central Provident Fund (CPF) monies.

He said: “Rising interest rate movements worry many because of the direct impact on monthly housing loan instalments. Certainly, repricing their home loan with their existing financier or refinancing to another is one strategy. Fixing the interest rates is another.”

“These are likely to involve some costs, which need to be measured against the possible benefits to see if repricing/ refinancing makes sense.”

“There are other non-interest-rate strategies one can use to reduce such an impact, including extending the loan repayment period, increasing the use of one’s CPF funds to reduce the negative impact of rising interest rates on fixed loans, as well as “paying ahead”.

“This is where one can budget and set aside a higher monthly amount for one’s home loans in order to create a buffer ahead of actual increase in loan instalments”

As you have made it this far, it appears you are intrigued by the prospect of refinancing your home loan and have grasped the logic of it.

Click here without further ado to find out more about PropertyGuru’s SmartRefi refinancing tool.

Top photos via Unsplash Jason Leung & Hanliang

This sponsored post was brought to you by PropertyGuru, where it has enthused the writer to save money by using the tools and finances modernity has to offer.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.