On March 23, President Halimah Yacob announced that she had given her assent to Finance Minister Lawrence Wong's 2022 Budget.

President Halimah focused on the budget's measures to fund healthcare measures to fight Covid-19, including a draw of US$6 billion on past reserves.

But highlighting Covid measures, while important, is less interesting to me as compared to what the budget says about Singapore's future.

Former U.S. President John F. Kennedy once said that the government is the people and the national Budget is a reflection of their need.

Wong's first main budget statement since his appointment as Finance Minister is therefore a sneak peek into the kind of society that the ruling People's Action Party (PAP) and its 4G leadership wants to build.

Sustainability

Anyone who's paid a little attention to government messaging over the past couple of years will have noticed an increased emphasis on environmental issues.

In Feb. 2021, Sustainability & Environment Minister Grace Fu unveiled the Singapore Green Plan 2030, following a motion in Parliament on climate change.

Fu called it a major policy priority for the government, and said that Singapore needs to create a sustainable future for present and future generations.

One of the major initiatives came a little before that, with the Carbon Pricing Act kicking in on Jan. 1, 2019.

It included the groundbreaking Carbon Tax, which required industrial facilities emitting emissions above a certain level to pay S$5 per tonne of greenhouse gas emissions (tCO2e) from 2019 to 2023.

This was scheduled for a 2022 review, to give time for businesses to adjust.

Now, if you're keeping score, this law came in one year before the Covid-19 pandemic, where the entire table was overturned and all bets were off when it came to businesses.

'Larger-than-expected' carbon tax hike

It would have been easy for the government to cite the pandemic as a reason not to place an undue burden on businesses, who were struggling to mitigate their losses. Indeed, this was a point made by several Members of Parliament in their Committee of Supply speeches.

However, Wong went ahead and announced an upward adjustment to the tax, to S$25/tCO2e in 2024 and 2025, and S$45/tCO2e in 2026 and 2027, with a view to reaching S$50-S$80/tCO2e by 2030.

S&P Global called it a "larger-than-expected" increase, and one of the "largest government-mandated" carbon taxes.

The budget also includes other measures, such as support for electric vehicles. But the scale of the carbon tax, coming on the heels of a devastating pandemic, sends two clear messages.

The first, that Singapore is serious about combating climate change. The second, that the government is confident enough in Singapore's economic recovery to impose such a measure.

Reducing inequality

Another strong theme of Wong's speech was the need to strengthen Singapore's "social compact."

He briefly spoke of Singapore's previous efforts to reduce inequality, such as enhancing Workfare and introducing the Progressive Wage Model, and noted that Singapore's inequality after taxes and transfers, as measured by the Gini coefficient, has steadily improved over the years.

One of the biggest announcements this year was the long-anticipated news on the promised hike in the Goods and Services Tax (GST). First announced in 2018 by then-Finance Minister Heng Swee Keat, Singaporeans finally will experience the first GST increase next year.

The first GST increase will take place in Jan. 2023, from seven to eight per cent, followed by another increase from eight to nine per cent in Jan. 2024.

The PAP and the government's stance is that instead of hurting the poor, the way the GST is designed places it as part of a progressive system of taxes, due to the transfers back to lower-income households, among other offsets.

As far back as 2017, when Low Thia Khiang was still a Member of Parliament (MP) and Wong was the 2nd Minister for Finance, the latter had argued that the way the GST is designed makes it a progressive tax.

"GST is a progressive tax - the way we have designed it.

It's not a question of whether its offsets are sufficient to cover everything that the low income has to pay, but it's the overall progressivity of the system.

And the way we have designed the GST, with a permanent voucher, is to make it a progressive consumption tax."

In his wrap-up speech during the budget debate on March 2, Wong rebuffed a claim from the opposition Workers' Party (WP) that the GST hike would hurt the poor:

"The WP cites that the GST increase will hurt the poor - it doesn't, I've explained it - and on that basis, they say they cannot support the Budget but really, do you know what you're saying then?

...you don't want to support all the things we have in this Budget to uplift the wages of lower-income workers, workfare progressive wages to help vulnerable families with kidSTART, you're rejecting all of that."

Support for most households

The S$6 billion assurance package, which Wong increased by an additional S$640 million, is projected to cover the next five years of additional GST expenses for the majority of Singapore households.

For lower-income households, due to additional offsets, they can expect to be covered for the next 10 years of additional GST expenses.

It's only human to consider the GST hike in terms of how it will hit our own wallets, but governments don't have that luxury and need to consider the big picture.

Back in 2017, Wong spoke of the mounting spectre of increased healthcare costs as Singapore's population ages, and we are not getting any younger.

But in its explicit emphasis on strengthening the social compact, the government has signalled that it remains committed to narrowing the gap between the haves and have-nots in this budget.

And the announcement of additional wealth taxes "to build a fairer society", such as an adjustment to the personal income rates and the tax on luxury cars, was also heartening.

While not quite the extent to which some had hoped, like the return of the estate duty (brought up in 2020 by PAP MP Foo Mee Har), they still represent a welcome addition to Singapore's progressive tax system.

Investments in the future

We now have an idea about the kind of society the government is trying to shape. But we have a murkier idea of the technology tools which we will use in that society of the future.

It's impossible to think that our society today will remain static and unchanging, given the dizzying rate of technological progress.

While we have a general idea of the ideas and concepts and fields that will be important, such as big data, artificial intelligence and digitalisation, the benefits (and drawbacks) to spring from such advances.

As such, government investment in emerging technologies has to potential to unlock new advancements, whose far-reaching consequences we can only begin to imagine. After all, the Internet first began as a military project, funded by the U.S. government.

Multiple angles

Wong's announcement that government investment flows in multiple ways -- infrastructure, worker training and research & development - demonstrates that it is giving this issue the importance it deserves.

The emphasis on R&D in local companies, instead of leaving the lion's share to MNCs, may one day lead to a global innovation born right here in Singapore.

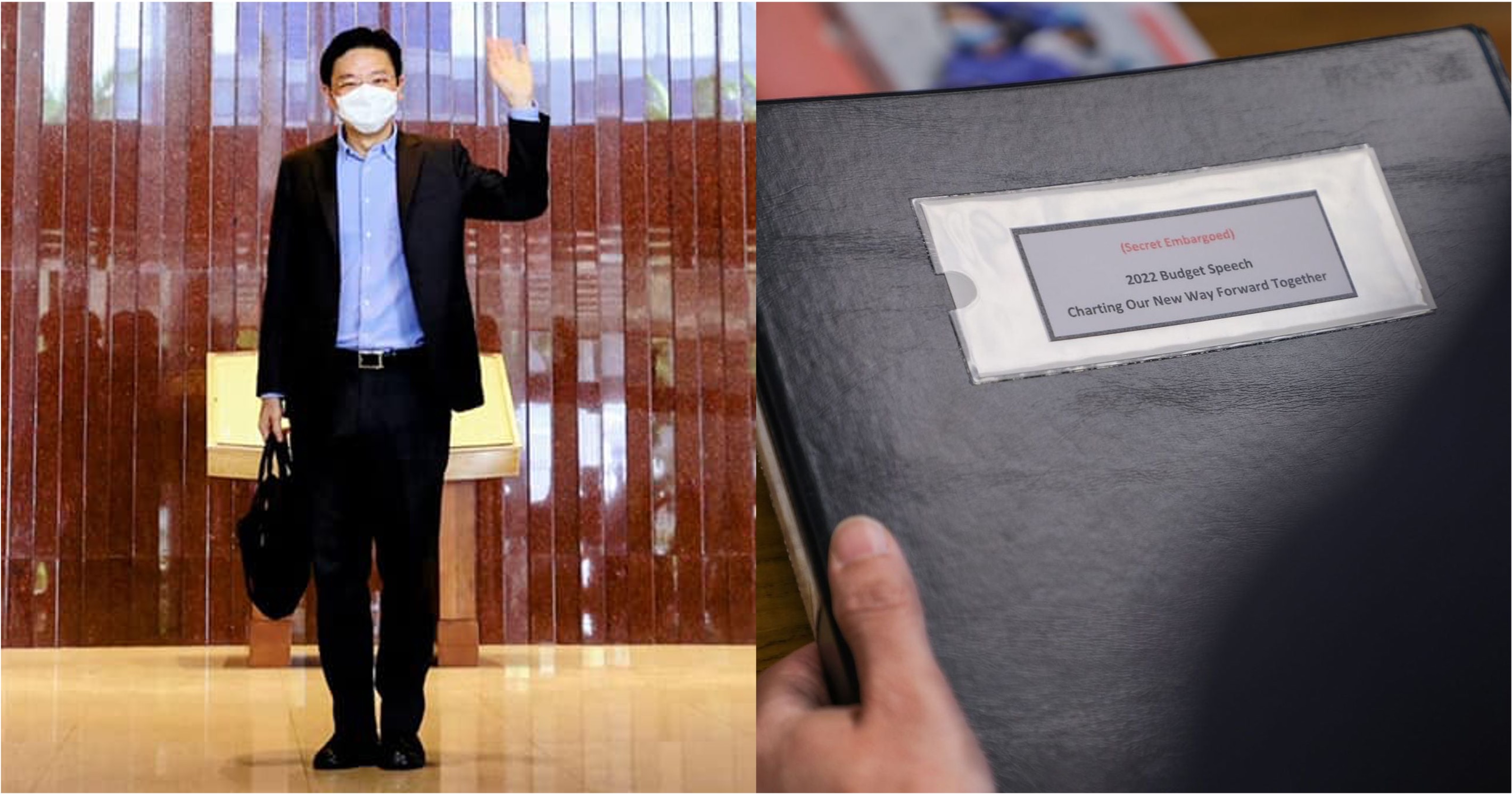

Top image

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.