Follow us on Telegram for the latest updates: https://t.me/mothershipsg

A 75-year-old Singaporean woman lost S$1 million to scammers pretending to be China officials.

Her story was reported by CNA.

What happened

Madam Fong received a call from overseas in December 2021.

The caller claimed that she was involved in money laundering in China.

The retiree said the caller asked for her cooperation and she agreed, she admitted.

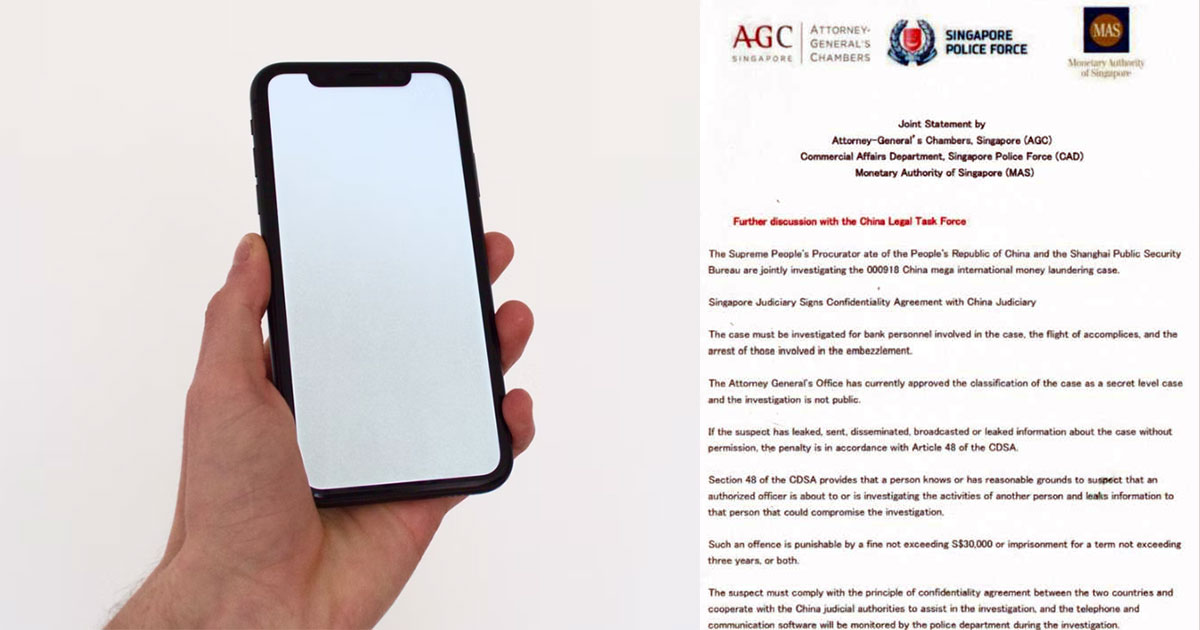

Fong was subsequently sent documents bearing official-looking logos suggesting they were by the police, Monetary Authority of Singapore, and Attorney-General’s Chambers.

Shin Min Daily News published the fake letters in full on their Facebook page.

Communication kept from family

A mobile phone and SIM card was also delivered to the woman.

She received calls thrice a day on a pre-downloaded app to check in on her only when her family was not around.

The rapport-building conversations were reportedly friendly and to win Fong's trust and lasted over two months.

Gave away SingPass login credentials

In the course of these exchanges, Fong somehow gave the scammers access to her two-factor SingPass login -- how exactly, she cannot recall.

A withdrawal request was made to transfer S$1 million from her CPF account to her bank account, which she was not even aware of.

The scammers also instructed her to apply for Internet banking for the bank account, which required her to visit an UOB bank branch.

Over four days, from Jan. 30 to Feb. 3, multiple S$50,000 transactions were made to local and overseas accounts.

Fong said: “They just asked me to transfer, but they did not give an explanation, just wanted to accumulate the amount for later use."

Fong thought the scammers were trying to help her family as they said her husband and children could get involved.

Did not believe Singapore police

The case came to light when UOB flagged the suspicious activity to the Singapore police’s anti-scam centre.

Police officers then visited Fong to speak to her, but she was not convinced she had been scammed.

But she believed she was a scam victim when she messaged the scammers about the police informing her about the scam, and she got ghosted with no response.

Husband aggrieved

Her husband, in his late 70s, who also spoke with the media, said they are slowly getting over losing all their wealth overnight.

Mr Fong said: “For 50 years, you have to work day and night... And it’s wiped out in days."

"Not only is it just an issue of money, but also mental suffering. After this, I had so many quarrels with my wife and I kept on scolding her... because it is a big sum, it’s life savings... struggled with so much blood and sweat to accumulate wealth for retirement and leave some for our children, but it’s gone."

The elderly couple are coming to terms with their loss.

Fong added: “Now over time, we are slowly getting over it and taking it as it is now. Whatever is gone is gone."

The husband said his wife could not recall various details about what happened as it could have been due to the psychological impact of an injury his wife suffered from a few years ago.

Such scams making comeback

The Singapore police said in less than four months in 2022, 109 victims in Singapore have lost a total of at least S$14.6 million to scammers impersonating Chinese officials.

On March 4, the police warned against the re-emergence of this type of scam.

Is lump sum withdrawal of CPF monies allowed?

All CPF members can withdraw up to S$5,000 of their CPF savings from age 55.

On top of that, members have the option to withdraw their remaining CPF savings -- the combined balances in the ordinary, special and retirement accounts -- after setting aside the required retirement sum for their cohort.

Those who own a property will need to set aside a basic retirement sum (BRS), while those who don not own a property need to set aside the full retirement sum (FRS).

Members can also choose to set aside the enhanced retirement sum to enjoy higher monthly payouts in retirement.

Even if members do not have the BRS, they will still receive monthly payouts when they reach their payout eligibility age.

Top photos via Unsplash & Singapore police

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.