Follow us on Telegram for the latest updates: https://t.me/mothershipsg

Singapore needs a good mix of all three types of taxes: income-based, asset-based and consumption-based taxes, Finance Minister Lawrence Wong said in Parliament on March 2.

Speaking on the third day of the Budget Debate, he noted that the WP had offered a range of revenue options as alternatives to the increase in GST.

Wong replied, "The short answer is we cannot just ignore consumption taxes and put the entire burden on income and wealth taxes."

"Reality check" needed for WP MP Louis Chua's projection on corporate income taxes

Wong first turned to the topic of corporate income taxes (CIT), highlighting a projection given by Worker's Party Member of Parliament Louis Chua.

Wong noted that Chua had projected CIT revenue rising as high as S$71.5 billion, if the corporate tax rate is raised to 15 per cent, the global minimum tax proposed under the Base Erosion and Profit Shifting Initiative (BEPS 2.0), a landmark deal led by the Organisation for Economic Co-operation and Development (OECD) to develop a fairer international tax framework.

In calling such a figure "wishful thinking", Wong said that S$71.5 billion was the total amount of revenue collected from all taxes.

"Does Mr. Chua really believe that CIT revenue from the profitable non-SMEs, the larger companies, will jump by seven times from S$10 billion to S$70 billion? Really?" he asked.

He also noted that Chua had concluded that the impact of Pillar One of BEPS 2.0 — the reallocation of taxing rights of the largest and most profitable multi-national enterprises (MNEs) from where they conduct their substantial activities to where their customers are — will be "limited" because it only covered 100 entities.

Wong called Chua's assessment "premature", clarifying that while the number of MNEs affected are small, the fact that they are the largest and most profitable MNEs means that any reallocation of profits away from Singapore will have a significant impact.

A minimum effective tax rate will bring in more revenue but this is contingent on assumptions and a big "if"

The minister also said while the implementation of a minimum effective tax rate will bring in more tax revenue, this is contingent on the assumption that Singapore will have the same volume of investments and business activities.

"Yes, we will collect more but that is a very big "if". It is hard to estimate with any confidence, whether or how much net tax revenue we can collect from both Pillars One and Two. The eventual impact cannot be ascertained by a simple static analysis, and it will also depend on how governments and companies will respond, post BEPS 2.0."

Wong added:

"BEPs 2.0 represents a fundamental change in the competitive environment for Singapore. Hitherto, smaller economies like us could rely on tax incentives, not just non-tax factors to make up for our inherent disadvantages, like limited land and labor force.

But this is no longer as effective post BEPS 2.0. Companies will review their existing and new investments. Governments will also seek to compete via non-tax investment promotion in order to recover from the pandemic and to make up for what they can no longer do through tax incentives. Our engagement with investors is already revealing this."

Singapore will have to find other ways to stay competitive by building more infrastructure and incentivising research and development which mean additional government spending in turn.

"So even if we can generate additional revenue from Pillars One and Two, these will have to be reinvested towards ensuring Singapore remains competitive and attracts our fair share of investments to create good jobs for our people," Wong said.

He added, "I would therefore caution against jumping to conclusions or believing wild guesses on how much more revenue we can get from changes in global tax rules, and use that as a reason to avoid raising the GST."

Increasing personal income tax for top income brackets has its limits

With regard to personal income tax (PIT), Wong highlighted that at present, the top 10 per cent of taxpayers who pay PIT already account for about 80 per cent of Singapore's total PIT revenue.

"With the top marginal personal income tax rate at 24 per cent, we will be higher than the 17 per cent top rate of Hong Kong, and closer to the Asian average top marginal personal income tax rate of 28 per cent," he said.

There is a limit to how much the PIT rates can be increased for the top income brackets without touching the PIT rates for the income brackets that are further down.

The minister gave the following example to illustrate his point:

"If we were to keep GST at 7 per cent, and raise the same amount of revenue through PIT, the top marginal rate would have to go up from 22 per cent to 42 per cent; and that would apply to everyone with chargeable income of S$320,000 or more. That is assuming the tax base remains unchanged.

But we all know this sharp increase is untenable and will badly damage our competitiveness. Investments and jobs for everyone including lower- and middle- income earners will be impacted, not just taxes."

What about wealth taxes?

Here, Wong said that the changes made to property taxes are "not insignificant at all", although they have been structured in a "highly progressive" manner.

"Together, our property tax moves raise S$380 million more per year from a base of only 7 per cent of all owner-occupied residential properties, and all non-owner-occupied residential properties," he said.

As for owner-occupied residential properties, the increased tax rate only affects those with an annual value above S$30,000, which means that all owner-occupied HDB flats, along with two-thirds of private residential properties, like condominiums in the suburban areas and lower-value landed properties, are not affected.

"The remaining one-third of private residential properties which are affected are higher-end condominiums, as well as most landed properties," Wong elaborated.

In addition, all non-owner-occupied residential properties will also face higher property taxes as these properties include second homes and those held for investment.

The increases are also more significant for the higher-end non-owner-occupied residential properties, Wong pointed out.

As for raising enough revenue from these taxes to eliminate the need for GST, Wong explained:

"Well, we would have to tax all non-owner-occupied residential properties at a significantly higher rate. Suppose we taxed all non-owner-occupied residential properties at a flat 36 per cent. This would still not be enough. Because the number of non-owner-occupied residential properties is considerably less than that of owner-occupied residential properties. So, we will need to raise property tax rates significantly for owner-occupied residential properties including for HDB flats."

The minister also expressed his surprise that Chua had characterised the moves on property tax rates as "tokenism".

"S$380 million more per year, and he says it is tokenism," Wong said.

In addition, the current total property tax revenue from all residential properties is about S$1 billion.

"To raise another S$1 billion from just property tax alone, property tax rates may very well need to be doubled across the board. I suppose that is what the Workers’ Party is proposing," he added.

WP: "Mischaracterisation" to say that our tax proposals are aimed at the rich

In response to Wong's remarks, WP MP Leon Perera subsequently said it was never the intent of the WP to call for the entire burden of plugging the hole in the elimination of GST to fall entirely on personal income tax or property tax.

Perera added that it was a "mischaracterisation" and "caricaturisation" of the WP's proposals, noting that the bulk of the WP's proposals focused on the changes to the land sales, the changes to the NIRC (Net Investment Returns Contributions) and also the net effect on overall corporate tax from compliance with the BEPS regime.

This drew the finance minister's reply that he recognised that the WP's suggestions for revenue alternatives could entail mix-and-matches as they have highlighted "a bit from here and a bit from there".

"But I still say as I have highlighted, the sums will not add up. Why? Basically, you are asking to tax more from three possible groups as an alternative to GST: the wealthy, large companies and future generations. So that's what it comes down to," he said.

In reiterating his aforementioned points once more, Wong said he appreciated the alternative options the WP had put forward "in good faith."

"We've studied all of them before the budget. During the budget debate when these options were raised, we went into them again with my team, but we still are not able to make the sums add up."

Follow and listen to our podcast here

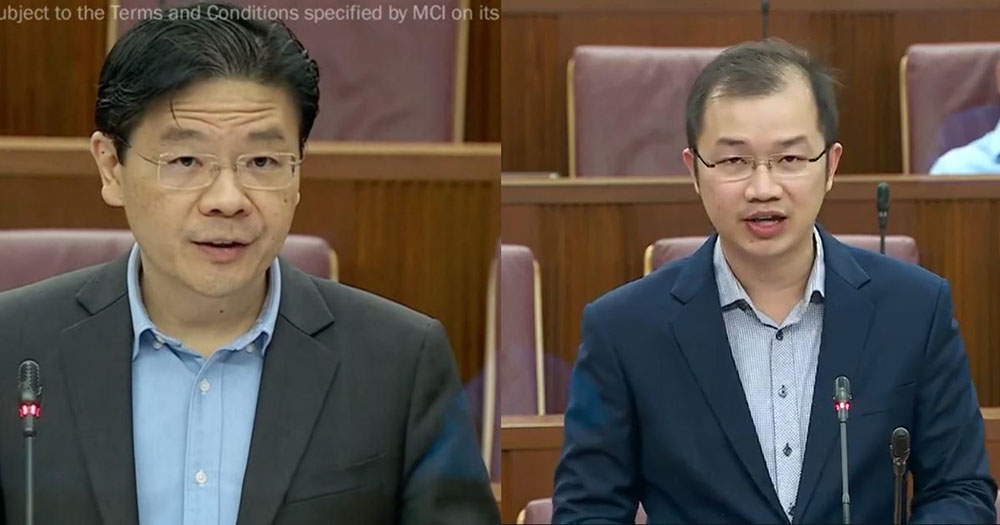

Top collage left image via MCI YouTube, right image via CNA

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.