Follow us on Telegram for the latest updates: https://t.me/mothershipsg

Can 2022 be called the year where Singapore had its first post-pandemic budget?

Covid-19 is still with us, of course, but unlike 2020 (the Year of Five Budgets) and 2021 (with its S$11 billion Covid-19 resilience package), the biggest headline item of the "Charting Our New Way Forward Together" Budget was perhaps only indirectly related to the pandemic.

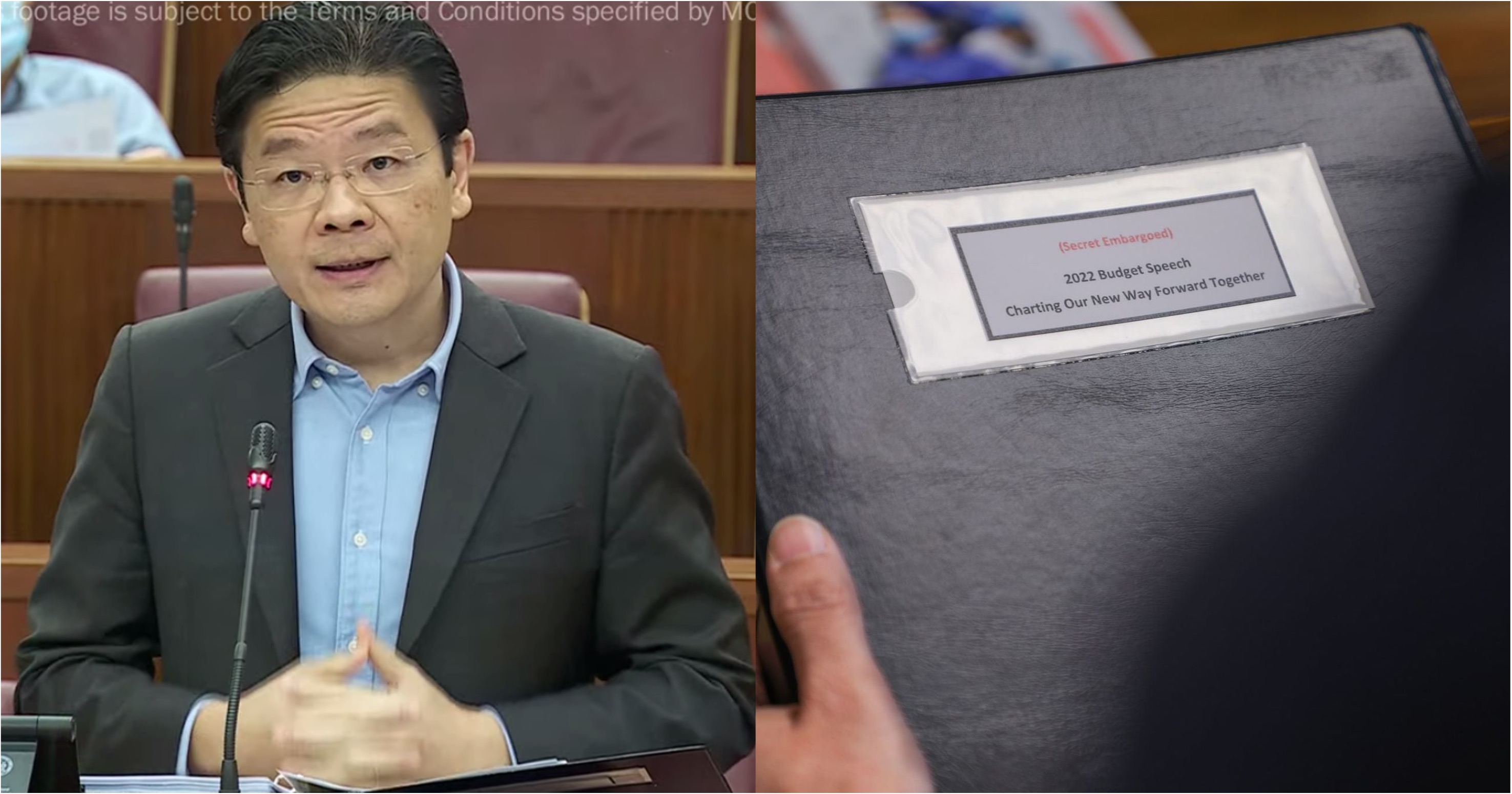

2022 also marked the maiden bow of Finance Minister Lawrence Wong on the budgetary stage.

While Wong had previously introduced supplementary financial measures, this is his first annual budget since Deputy Prime Minister Heng Swee Keat stepped down as finance minister and the Cabinet was reshuffled in early 2021.

He was able to give the country some good news, speaking of Singapore's recovery after the pandemic-induced recession.

Delayed GST hike

The centrepiece announcement was of course the timing and quantum of the hike in the Goods and Services Tax rate.

First announced in 2018, our government surely could not have imagined the economic pressures caused by first the pandemic and then the recent surge in inflation.

But after promising it would not rise in 2021, and with a deadline of 2025 before the next GE, Wong made the announcement that the GST hike would be delayed to 2023.

There will be a staggered increase, with the first increase taking place in Jan. 2023, from 7 to 8 per cent, followed by another increase from 8 to 9 per cent in Jan. 2024.

The government will continue to absorb GST on publicly-subsidised healthcare and education and will provide Town Councils with an additional S$15 million a year to absorb the additional GST payable on Service and Conservancy Charges.

Financial support for households

Eligible Singaporeans will also benefit from payouts.

Here's a look at the most eye-catching items in the Enhanced Assurance Package, worth S$6.6 billion.

- Singaporean adults to receive S$700 to S$1,600 in cash payouts over the next five years.

- S$600 to S$900 in GST Voucher Cash (Seniors' Bonus) over the next three years for eligible seniors aged 55 and above.

- S$330 to S$570 in additional GST Voucher U-Save rebates over next four years for eligible HDB households.

There will also be an increase in the Assessable Income threshold for the GST Voucher, from S$28,000 to S$34,000, thereby benefiting more Singaporeans.

Household Support Package

Along with the Assurance Package, Wong also announced the S$560 million Household Support Package.

The package includes additional GST Voucher – U-Save rebates, top-ups to education-related accounts (Child Development Account, Edusave Account, or Post-Secondary Education Account), and also another set of S$100 CDC Vouchers.

Caring and inclusive society

To support retirement, the increase in CPF contribution rates for senior workers aged 55 to 70 in 2023 will be continued, including the CPF Transition Offset.

The Basic Retirement Sum will be raised by 3.5 per cent per year for the next five cohorts turning 55 over 2023 to 2027.

The Enabling Masterplan 2030 will be launched to boost support for people with disabilities in areas like employment, training/education and respite care.

A S$100 million top-up to the Enhanced Fund-Raising Programme will last until end FY-2024 to match eligible donations, and the Charities Capability Fund will get a S$26 million top-up for five years.

Support for workers and businesses

Even if Singapore is moving towards an endemic footing, Covid-19 still left deep scars on local workers and businesses.

Wong announced immediate support for the local economy in the Jobs and Business Support Package.

S$500 million has been earmarked, with S$1,000 going to companies for each local employee, capped at S$10,000 per company.

Local sole proprietors and partnerships in eligible sectors, as well as SFA licensed hawkers, market and coffeeshop stallholders who do not hire local employees will also receive a S$1,000 payout.

The vaunted Jobs Growth Initiative, launched in Aug. 2020 and intended to support hiring in growing sectors like biomedical sciences, public healthcare and communications, will be extended yet again until Sep. 2022, albeit for specific groups.

The temporary bridging loan programme, providing access to working capital for local businesses, will also be extended.

S$200 million will go towards building digital capabilities, and S$600 million will go towards scaling up the Productivity Solutions Grant.

A new Singapore Global Executive Programme will be launched to attract more young local talent to join Singapore global enterprises.

Upskilling workers

The SkillsFuture Enterprise Credit will be expanded to an additional 40,000 SMEs by waiving the Skills Development Levy contribution requirement, and NTUC will get S$100 million for their Company Training Committees and a new grant to support company transformation plans.

Mid-career workers will be helped by making the SGUnited Mid-Career Pathways Programme (Company Attachment) permanent.

Foreign worker policy changes

The government will also be making substantial changes to foreign worker policies, with the minimum qualifying salary for an Employment Pass raised to S$5,000, and S$5,500 for financial services jobs.

This applies to new applications from Sep. 2022 and renewal applications from Sep. 2023.

The S Pass will also be changed, with a similar rise to S$3,000 and S$3,500 for financial services, and with the same timeframe as the EP.

The Tier 1 levy will be raised to S$650 in 2025.

Also, there will be a lower Dependency Ratio Ceiling from 1:7 to 1:5 from Jan. 1, 2024, for Work Permits for construction and process sectors.

There will be a new levy framework from Jan. 1, 2024.

Climate change

The fight against climate change got another boost with a pledge for Singapore to achieve net-zero carbon emissions by or around the mid-21st century.

The carbon tax will be increased from S$5 per tonne of Carbon Dioxide Emissions (tCO2e) to S$25/tCO2e in 2024 and 2025, and S$45/tCO2e in 2026 and 2027, with a view to reaching S$50-S$80/tCO2e by 2030, Wong announced.

Changes to personal income tax, property & luxury car taxes

Wong also announced changes to the tax system.

With effect from the Year of Assessment 2024, those earning more than S$500,000 to S$1 million will pay an income tax rate of 23 per cent for the portion of chargeable income in excess of S$500,000.

Those earning more than S$1 million will pay an income tax of 24 per cent for the portion of chargeable income in excess of S$1 million

The government will increase the property tax rates for non-owner-occupied residential properties, which include investment properties.

It will rise from 10 to 20 per cent currently, to 12 to 36 per cent.

Property and luxury car tax

For owner-occupied residential properties, the government will increase the property tax rates for the portion of Annual Value in excess of S$30,000,

This will rise from 4 to 16 per cent today, to 6 to 32 per cent.

The increases in property tax will be implemented in two steps, starting with tax payable in 2023.

Luxury cars will also be taxed at a higher rate by introducing an additional “Additional Registration Fee” tier for cars at a rate of 220 per cent for the portion of Open Market Value in excess of S$80,000.

The new rates apply to all cars registered with COEs from the second COE bidding round in February 2022.

Top image from MCI YouTube and Lawrence Wong's Facebook page.

Follow and listen to our podcast here

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.