Follow us on Telegram for the latest updates: https://t.me/mothershipsg

Details regarding the amount of compensation that OCBC Bank scam victims received cannot be made public after those who accepted payments signed a non-disclosure agreement that forbids them from making public such matters.

Mothership.sg understands from one of the victims, believed to be one of the first batch of customers to receive the payment, that accepting the compensation from OCBC entails agreeing to the non-disclosure clause.

Two OCBC Bank customers who lost money have also confirmed with The Straits Times that they have received goodwill payments from the bank and are bounded by the agreement.

The inability to speak about how much they have received, whether it was a full or partial compensation of money lost, also extends to not being able to comment if they are satisfied with the payment.

ST asked the two customers on whether they were satisfied with the payments, but they declined to comment.

However, it is understood that receiving compensation is tantamount to finding the settlement acceptable.

Currently, more than 30 customers have received the payments so far, according to the bank in a Jan. 17 statement, with payouts beginning since Jan. 8.

"The payouts to this group of customers are made on a goodwill basis after thorough verification, taking into account the circumstances of each case," OCBC said as well in their statement.

The process is still ongoing and affected customers will be contacted as soon as the review and validation process for their cases is completed, OCBC added.

The Jan. 17 statement did not reveal how much it has paid out or if it intends to fully compensate every victim.

Victims looking forward to Jan. 27, 2022

According to OCBC scam victims that Mothership.sg spoke to, they have been informed by the bank of the Jan. 27, 2022 deadline, which is when OCBC will let them know if they will be compensated.

The victims said they have received calls from the bank, but OCBC was unable to comment on factors upon which compensation is decided.

The content of the phone call is the same as the email that the victims received.

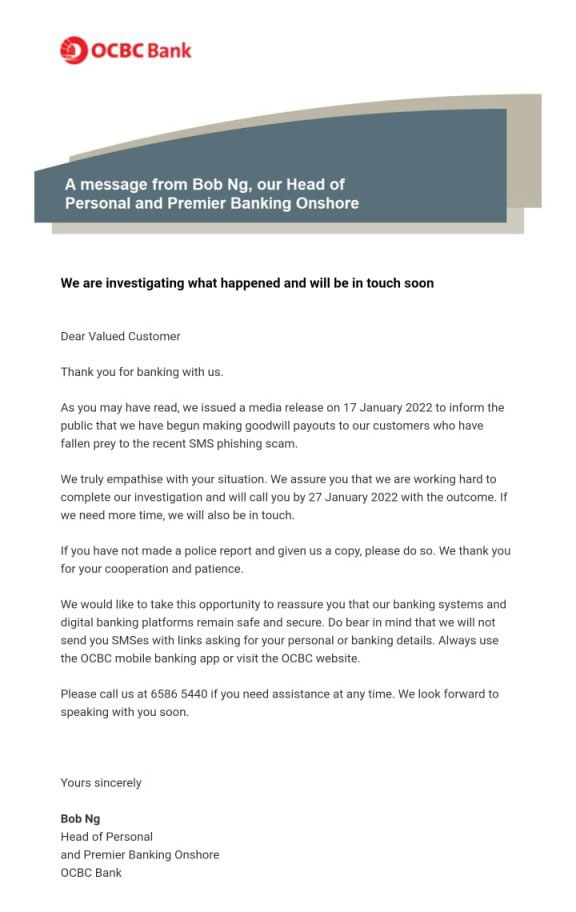

The OCBC email read:

A message from Bob Ng, our Head of Personal and Premier Banking Onshore

We are investigating what happened and will be in touch soon

Dear Valued Customer

Thank you for banking with us.

As you may have read, we issued a media release on 17 January 2022 to inform the public that we have begun making goodwill payouts to our customers who have fallen prey to the recent SMS phishing scam.

We truly empathise with your situation. We assure you that we are working hard to complete our investigation and will call you by 27 January 2022 with the outcome. If we need more time, we will also be in touch.

If you have not made a police report and given us a copy, please do so. We thank you for your cooperation and patience.

We would like to take this opportunity to reassure you that our banking systems and digital banking platforms remain safe and secure. Do bear in mind that we will not send you SMSes with links asking for your personal or banking details. Always use the OCBC mobile banking app or visit the OCBC website.

Please call us at 6586 5440 if you need assistance at any time. We look forward to speaking with you soon.

Yours sincerely,

Bob Ng

Head of Personal

and Premier Banking Onshore

OCBC Bank

Other victims that ST spoke to said their cases with OCBC are still pending.

How phishing scam works

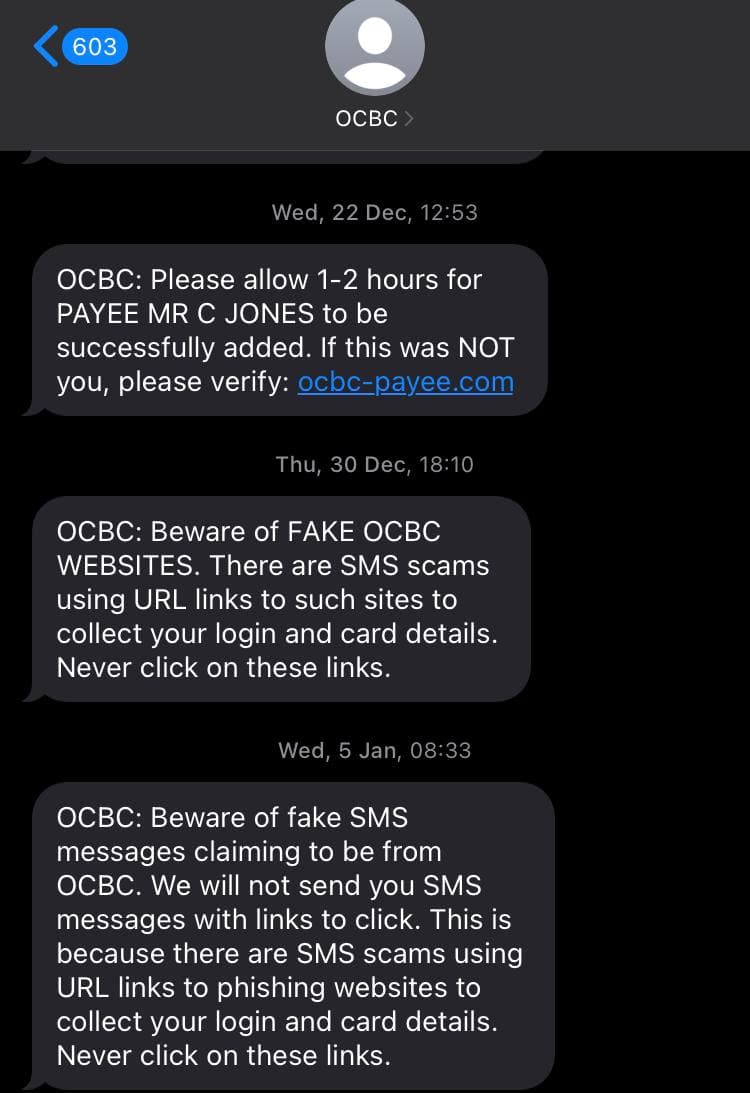

OCBC customers received an SMS informing them that a new payee has been added to their account.

The scam SMS appears in the same SMS thread that has been used to disseminate legitimate OCBC SMSes.

The victims are instructed to click a link to verify or refute the addition of the new payee, but will first be led to a phishing website disguised as the OCBC website, where they would type in their username and password, and also provide their one-time password.

Once the scammer gains access to the victims' accounts, daily withdrawal limits can be raised and money can be transferred out.

OCBC subsequently sent out warnings via SMS to alert customers to the scam.

The SMS warnings then appeared in the same thread below the scam SMS.

Top photo via Google Maps

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.