Follow us on Telegram for the latest updates: https://t.me/mothershipsg

A 65-year-old taxi driver has been held liable for damages sustained by another car after the cab's passenger opened the left-side rear door and it struck and damaged an oncoming BMW.

Feeling aggrieved that the taxi driver was made to cough up money and the passenger allegedly shirking responsibility, a Mothership reader wrote in to share about the Oct. 27, 2021 incident, which involved her father, who was driving the taxi.

Allegedly failed to exercise due diligence

According to the taxi driver's 36-year-old daughter, who declined to give her full name, the passenger had allegedly failed to "exercise his due diligence" when opening the door to alight, resulting in a collision with another vehicle.

She said her dad subsequently had to pay for the damages in terms of insurance excess, which amounted to S$1,070.

The collision

Lee shared that her dad has been a taxi driver for more than 18 years.

On the day of the accident, he was ferrying a man from Ang Mo Kio to 303 Alexandra Road.

The man alighted in front of the drop-off point of the building at the destination.

According to Lee, her father had cautioned the passenger to "be careful before opening the door".

The passenger, who was seated at the back, then alighted from the left-hand side of the taxi.

The taxi car door struck a BMW that was passing by almost immediately after the taxi came to a halt.

The cabby's daughter added: "My dad's left side door was so badly dented he had to call for a tow truck, while the BMW side window was shattered, and the side mirror was damaged."

Damages to Lee's dad's Trans-Cab taxi

Damages to Lee's dad's Trans-Cab taxi

Damages to Lee's dad's Trans-Cab taxi

Damages to Lee's dad's Trans-Cab taxi

Damages to the BMW

Damages to the BMW

A second car-cam video subsequently showed other cars driving past the two cars involved in the accident.

Lee alleged: "There was a big gap between my dad's vehicle and the wall, which meant there was more than enough space for other vehicles or even the BMW to pass through, and my dad was not stopping in the middle of the pathway [...] So another pointer is why was the white BMW driving so near to my dad's vehicle, [and] inching so much to the right?"

Repairs cost more than S$10,000, insurance excess activated

After the incident, the BMW driver informed Lee's dad that she would be filing a report against him to claim for damages as the passenger did not have motor insurance.

The repairs would reportedly require more than S$10,000, as the car was "damn jialat", Lee said, which meant that the car was "in dire condition".

Two days after the incident on Oct. 29, Trans-Cab sent Lee's dad a letter, stating that he had to pay 50 per cent of the insurance excess.

An insurance excess for motor insurance policies typically refers to the basic amount an individual has to pay when making a claim.

Lee said Trans-Cab had also told them that if they subsequently find the taxi driver at "total fault", her father would be asked to pay the other 50 per cent of the insurance excess.

When Lee called Trans-Cab and the insurance company to clarify the terms, she was told that while the passenger did appear to be at fault, the claim was against her dad's car, and the insurance excess would thus be on him.

Lee pointed out that this was unfair to her dad, who was now liable for others' negligence: "How is this fair to him when he did nothing wrong? He [had just] completely stopped the car to allow his passenger to alight."

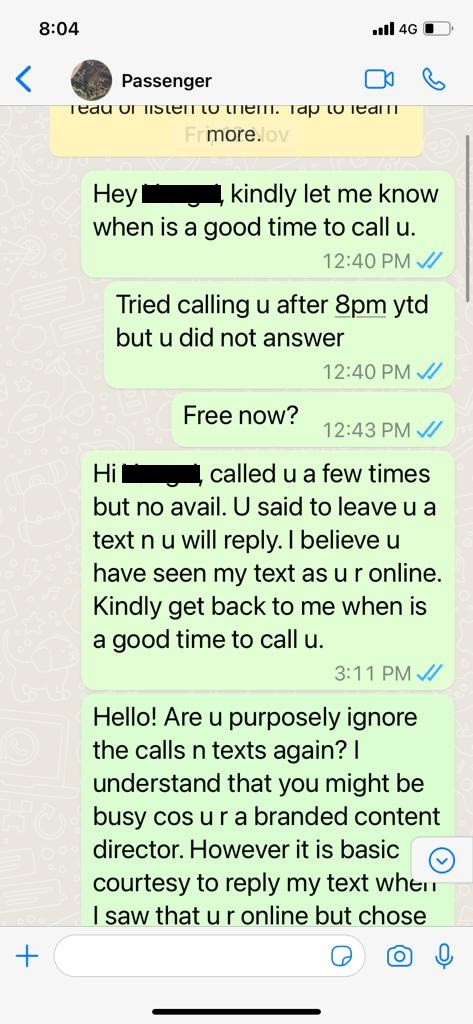

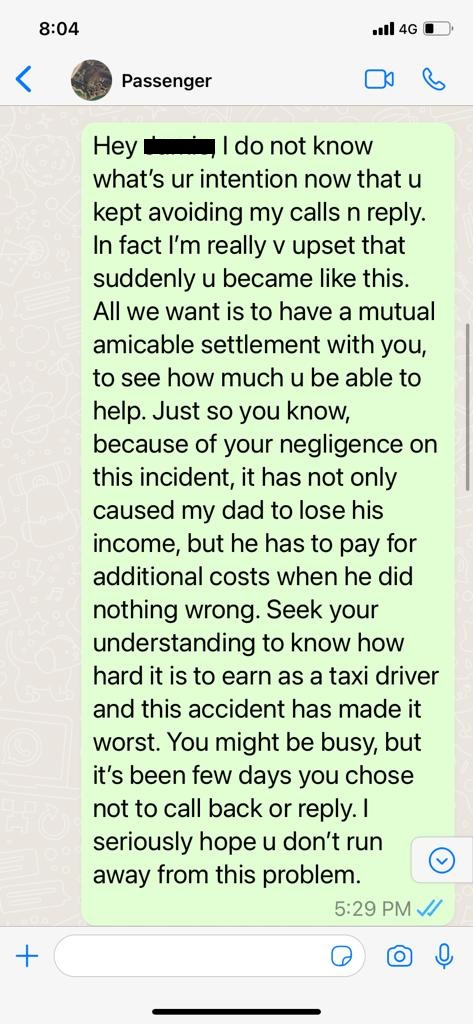

Passenger stopped responding

While the passenger had initially agreed to cooperate, and provided his number and full name, he subsequently stopped responding to calls and messages, said Lee.

"I tried texting him, but my messages were blue-ticked."

After multiple texts, Lee said she had also found and contacted the passenger's sister.

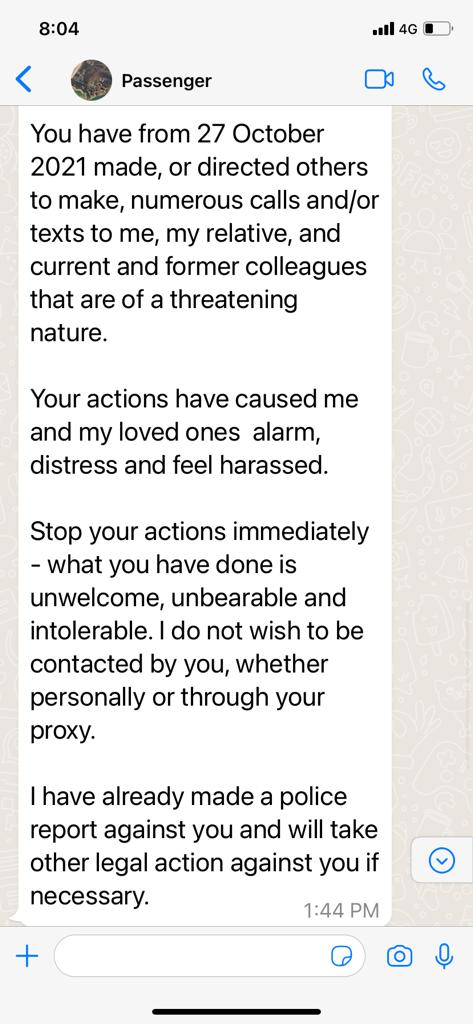

The passenger then replied to say that Lee was "causing distress" to him and that he had made a police report and might seek legal recourse.

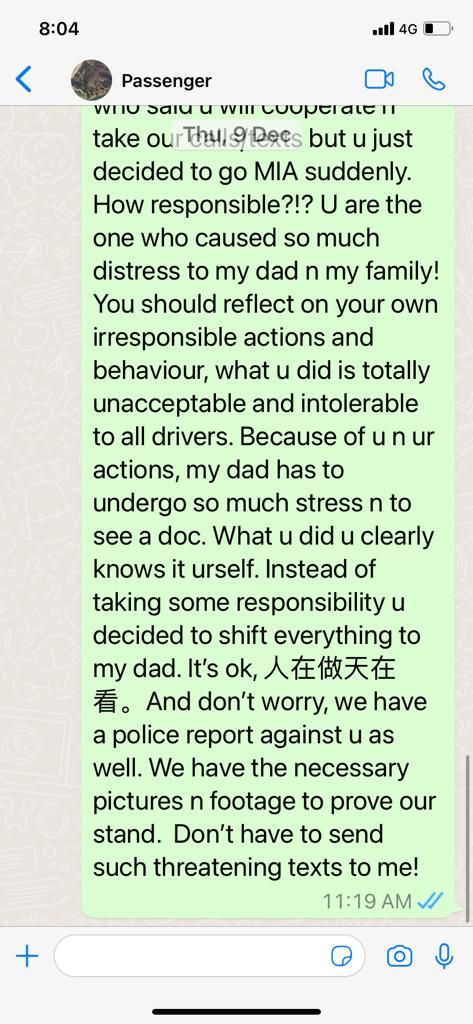

In response, Lee retorted that she had also lodged a police report against the passenger regarding the incident.

According to the screen shots of WhatsApp conversations seen by Mothership, the last text message between Lee and the passenger was sent on Dec. 9, 2021.

Lee and her dad are still waiting for the finalised bill from Trans-Cab for the incident.

Companies should have insurance protection for negligence due to passenger

Lee said she had eventually written in to the media to share her father's story as she wanted to inform other drivers to be wary of such incidents and their impact on people who rent a vehicle to make a living.

She said:

"... if negligence is due to passenger, they have to be prepared to be liable for damages and pay for the ridiculous insurance excess. Moreover, authorities like LTA [Land Transport Authority] or MOT [Ministry of Transport] will not be able to help. We are at total loss as we tried to approach many for help but to no avail."

Taxi driver deeply troubled

Following the incident, her dad had also reportedly underwent several sleepless nights and "a nervous breakdown".

He was deemed by a doctor to be unfit to drive temporarily.

Lee shared that the combination of having no income as a result of being no longer able to drive, and still having to pay for the insurance excess had greatly affected her dad.

"It upset and pains me to see how much he has been affected by this whole incident [...] So currently now I am hoping that his company also does not charge him rental for the days he did not drive, and also give him the required downtime that he [is] supposed to receive.

All in all, everything is currently at the company's/ GM [General Manager's] discretion. I am hoping that the company will not deduct any other costs from his deposit [S$1,500 + S$100 key]."

Lee emphasised that another problem she hoped would be addressed, was that more taxi companies should have the "relevant insurance" to protect drivers in cases of damage caused by a third party.

Similar incident occurred previously

In 2016, a similar incident was brought before the courts, where a cab passenger had to foot part of the bill after she opened the rear door, resulting in a collision.

The case eventually concluded with the taxi driver and passenger paying 50 per cent of the bill for damages.

The split in costs saw the passenger bear 30 per cent of the costs of damages.

The passenger's lawyer had explained then that the issue was "whether a cab driver owed a duty of care to his passenger to ensure not only the latter's safety, but also that the passenger is not liable as a third party for damage to the taxi and the plaintiff's car in a collision".

Mothership has reached out to Trans-Cab for comment three times on Jan. 5, Jan. 12, and Jan. 18, but have yet to hear back from them.

We will update this story with their response if we hear back from them.

Follow and listen to our podcast here

Top images via Lee

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.