Follow us on Telegram for the latest updates: https://t.me/mothershipsg

The Singapore government has announced a slew of property cooling measures that will affect the private residential and HDB resale markets.

The measures include

- raising the Additional Buyer’s Stamp Duty (ABSD) rates,

- tightening the Total Debt Servicing Ratio (TDSR) threshold, and

- lowering the Loan-to-Value (LTV) limit for loans from the Housing and Development Board (HDB)

Late night press release

The joint press release was issued by the Ministry of Finance, Ministry of National Development, and Monetary Authority of Singapore on Dec. 15, close to midnight.

The government noted that the private residential and HDB resale markets were healthy despite Covid-19 taking its toll on the economy.

Transaction volumes up

Transaction volumes in the private housing market and HDB resale market have also been high despite the Covid-19 situation and amid the low interest rate environment, the release said.

It added: "Even though House Price-to-Income ratios remain below their historical averages, there is clear upward momentum."

How much have prices risen?

Private housing prices have risen by about 9 per cent since the first quarter of 2020.

HDB resale flat values have also risen by about 15 per cent since the same time.

Ballooning prices have reversed a six-year decline in HDB resale flat values.

"The government has been closely monitoring the property market for several quarters," the authorities said.

"If left unchecked, prices could run ahead of economic fundamentals, and raise the risk of a destabilising correction later on. Borrowers would also be vulnerable to a possible rise in interest rates in the coming years."

The government said measures to tighten financing conditions "will encourage greater financial prudence", and it will increase public and private housing supply to cater to demand.

The measures to cool the private and public housing markets are meant to "promote continued housing affordability", targeting private residential property purchases for investment rather than owner occupation.

Measures applicable to all residential property

Raising Additional Buyer’s Stamp Duty (ABSD) rates

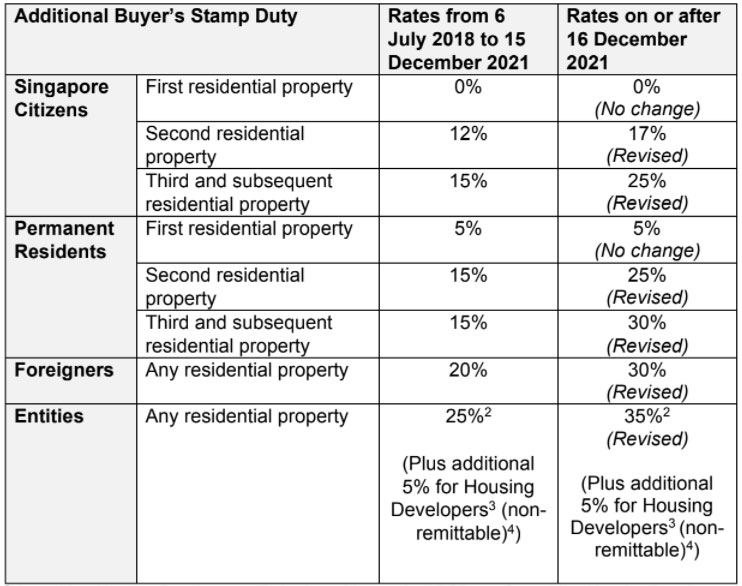

The current ABSD rates for Singapore citizens and permanent residents purchasing their first residential property will remain unchanged at 0 per cent and 5 per cent respectively.

Singapore citizens and permanent residents purchasing a second or a third and subsequent residential property will incur increased ABSD rates.

Singapore citizens will now pay an ABSD rate of 17 per cent for their second residential property, and 25 per cent for their third and subsequent residential property.

The previous rate used to be 12 per cent and 15 per cent respectively.

Permanent residents will now pay an ABSD rate of 25 per cent when buying a second property, and 30 per cent for a third and subsequent residential property, up from 15 per cent previously.

Foreigners and entities will incur even more ABSD at 30 per cent when purchasing any residential property.

For purchases made jointly by two or more parties of different profiles, the highest applicable ABSD rate will apply.

Married couples consisting of at least one Singaporean spouse can continue to apply for an ABSD refund when they jointly purchase a second residential property, subject to conditions.

The ABSD currently does not affect those buying an HDB flat or Executive Condominium unit from property developers with an upfront remission, if any of the joint acquirers or purchasers is a Singaporean. There will be no change to this.

Revised ABSD rates kick in Dec. 16

The revised ABSD rates will apply to cases where the Option to Purchase (OTP) is granted on or after Dec. 16.

There will be a transitional provision where old ABSD rates will apply for cases that meet all the following conditions:

- The OTP is granted by sellers to potential buyers on or before Dec. 15.

- The OTP is exercised on or before Jan. 5, 2022, or within the OTP validity period, whichever is earlier.

- The OTP has not been varied on or after Dec. 16.

Additional Conveyance Duties for buyers of equity interest property-holding entities will be raised from up to 34 per cent to a maximum of 44 per cent.

Tightening of Total Debt Servicing Ratio threshold (TDSR)

The TDSR threshold will be tightened from 60 per cent to 55 per cent, effectively restricting new mortgages so that borrowers' total monthly loan repayments cannot exceed 55 per cent of monthly income.

The new threshold will apply to loans for the purchase of properties where the OTP is granted on or after Dec. 16, and for mortgage equity withdrawal loan applications made on or after Dec 16.

Borrowers with existing property loans granted before Dec. 16 will not be affected by the revised TDSR threshold when refinancing their loans.

Measure specific to public housing

In a measure specific to public housing, the tightened LTV limit for HDB housing loans will be cut from 90 per cent to 85 per cent, effectively reducing the maximum amount potential homeowners can borrow from HDB.

Loans granted by financial institutions will remain at 75 per cent and not be affected by this revised limit.

The 85 per cent LTV limit will apply to new flat applications for sales exercises launched after Dec. 16 and complete resale applications received by HDB from Dec. 16 onwards.

More details to be released

The government will provide more details on Dec. 16.

The authorities said the measures undertaken in this cooling package will help promote a stable and sustainable property market, as the government remains vigilant to the risk of a sustained increase in prices relative to income trends.

Top photo via Unsplash

Follow and listen to our podcast here

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.