Money is a sensitive topic.

Whether we’re worried about having too little, or wanting to make the most out of what we have, we usually avoid talking about it with people whom we aren’t that close to.

For some of us who are inclined to run away from our problems, we might even try to sweep it under the rug and not think about it, at least until the topic rears its ugly head one fine day.

Yet, the topic of money management is not something we can put off indefinitely.

Besides fulfilling our basic needs like food and transportation, we need to manage our finances to achieve long-term financial goals as well, like getting a Build To Order (BTO) flat or setting up a family of our own.

Shying away from the topic would simply be shoving the problem aside and pretending it doesn’t exist -- not a good idea if you’re hoping to get on top of the problem.

I talked to four Singaporeans, aged 25 to 32 (who wish to remain anonymous), to find out about their approach to money, and help us put things in perspective.

Despite them being at different life stages, they share some similarities among them that perhaps many would be able to relate to.

Not keeping track of savings

For instance, out of the four Singaporeans we spoke to, three admitted that they don’t really keep track of their savings.

28-year-old Roger said he doesn’t really “track or put money aside each month”.

He simply “peeks” at his bank balance at the end of the month before his salary comes in to see how much there is.

But he does have a rough idea of how much he actually has left over at the end of each month.

“I think every month it goes up by around 30 per cent of my salary after CPF deduction,” he said.

Same goes for 33-year-old Candice, who said she is “not sure” how much she actually saves. As she puts her savings into “many places”, such as insurance and investment programmes, which “auto-deduct” her money, she finds it “a tough question” to answer.

“So I mentally feel like I'm hardly saving, but I think I am,” she said.

Revealing that she’s “a lousy mess” with numbers, and spends too much time shopping online, Candice added that she doesn’t keep track of her expenses as well. This is probably why she feels like she’s living between paychecks.

While she did put in the effort to track her savings and expenses in the past by downloading some apps, she admitted that she gave up in the end, and doesn’t check them.

But Candice is not the only person we talked to who doesn’t keep track of her savings and expenses.

Stressing out over personal finance

29-year-old Yvonnne admitted that she gave up tracking her savings after trying it out for a while.

She said: “I’ve tried doing that and it gives me undue stress!”

Recognising that she prefers a more hassle-free lifestyle, she decided to “take it easy”.

“I just set a broad guideline to make sure my bank balance is a bigger positive number than the last month,” she explained, adding that while she doesn’t have a clear idea, she estimates that she saves at least 30 per cent of her paycheck every month.

Yvonne also said that there was a time when she took in “too much” finance advice-related content on the Internet, including the ones that teach people how to save, as well as the tired narrative that “millennials couldn’t buy a property as they spent too much money on avocado toast”.

The more she consumed such content, the more she found herself trying to penny pinch, and the more stressed she became.

“It took me a while to reorientate my perspective,” she said, adding that she found a tip that helped her to feel more at ease with her spending habits.

Instead of stressing over the “hole at the bottom of a bucket” and the amount of “water that flows out of the bucket” -- which refer to one’s expenses and savings respectively -- she said she tries to focus on “pouring more water” into the bucket, and that has helped her tremendously.

Shift in approach to finance

Yvonne now feels “a lot happier and at peace” after she stopped being so hung up over how much she spends or saves. Instead, she turned her focus towards earning more money by actively looking out for better job opportunities that allow her to bump up her paycheck substantially.

And it seems that her finance philosophy has worked well for her personally.

Just last year, she had managed to save up enough money to pay the downpayment for a 3-bedroom condominium apartment located somewhere in the central region.

She is now still actively saving up to pay off the remaining mortgage on her apartment, which will be ready in about two years’ time.

Saving up for a place to call their own

Like Yvonne, both Roger and Candice are also saving up for their own places.

Besides saving up for a BTO with his fiancée, Roger is also repaying his study loan, which he is “very much on track” for -- he had just crossed the halfway mark for that.

He added that he plans to have “the smallest, cheapest wedding possible” as he wants to make the most out of his savings.

“True friends would understand, and wouldn’t mind not getting invited,” he said.

On the other hand, while Candice is already living in a resale flat with her husband and their newborn baby -- she had previously bought it with her sister, who has since moved out -- she plans to move to a larger 5-room BTO flat.

This is because their current 3-room flat is too small for their growing family, as well as three pet cats.

Putting aside some money for investments

Roger added that for his passive income, he invests in some or exchange-traded funds, or ETFs, through his bank.

But investing in other asset classes, like bonds and stocks, is definitely an option that he’s considering for the future, Roger said, adding that since he’s quite new to it, he’s still learning more about the topic before getting started. But first, he’s looking into opening a Central Depository (CDP) Account to hold his investments.

Saving up for future plans

24-year-old Helen, however, is saving up for something different. Having worked for close to two years since she graduated from university, she is now saving up for a graduate school programme that she plans to attend in the future.

While she saves less than what she desires due to the “unavoidable” amount of money she has to fork out every few months for her medical bills, she still manages to save around 20 per cent of her pay.

Conscious of the importance of saving, she keeps separate bank accounts, one of which is meant for her personal spending.

While Helen does appear to have her finances under control, she only just started financial planning, and could probably do with some extra guidance.

A financial service for young working Singaporeans

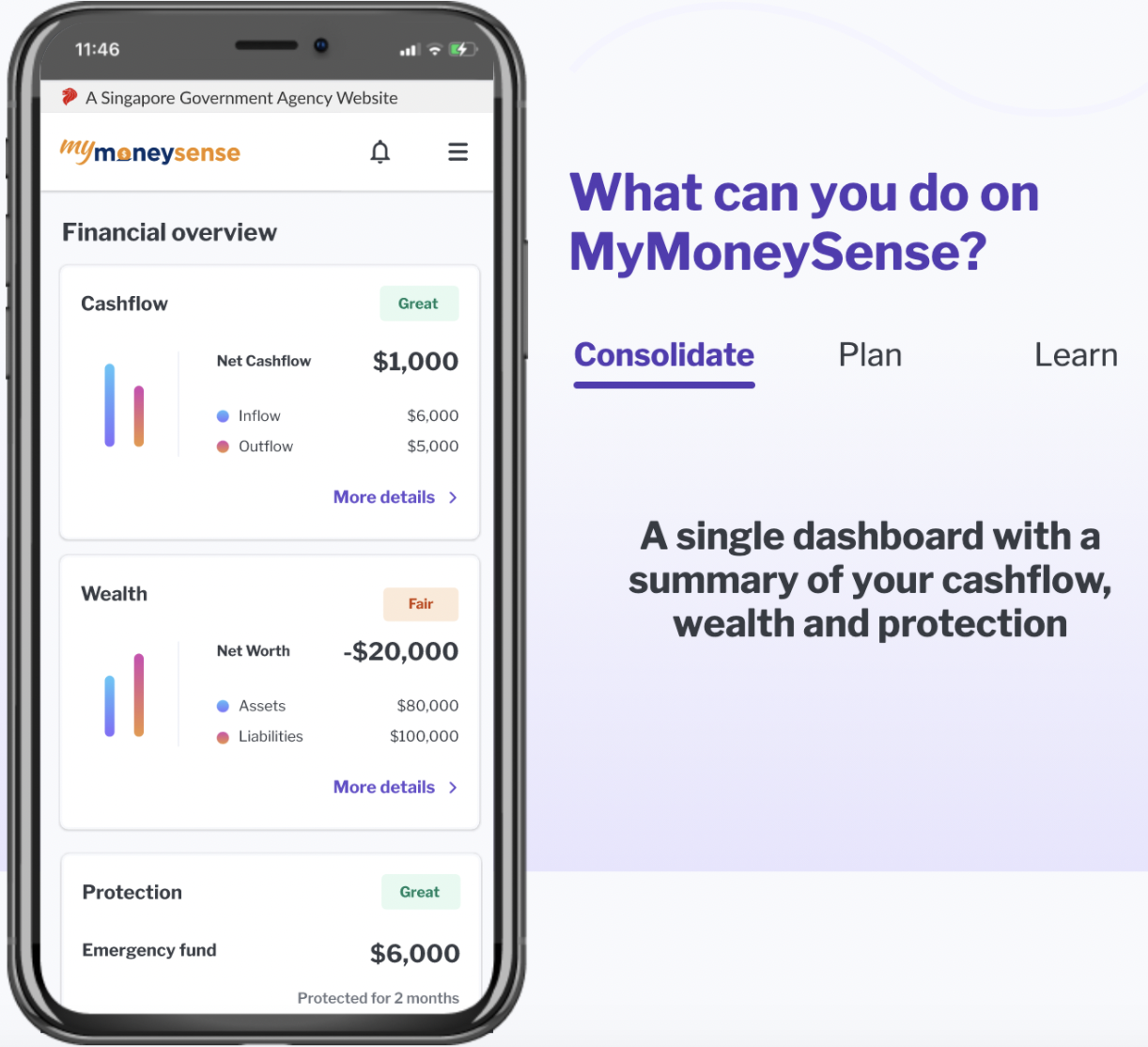

MyMoneySense, which is a digital service from the government to help Singaporeans with financial planning, can serve that role.

Image via MyMoneySense

Image via MyMoneySense

Here’s what it does.

Powered by the Singapore Financial Data Exchange (SGFinDex), it retrieves data from government sources, banks, and CDP, and allows you to view your finances all on one dashboard. That’s rather nifty if you have problems keeping track of your finances.

It can also help you set targets for how much to save, and make sure that you’re on track for your savings milestones.

If you’re looking to buy your first home, but am unsure of the financial considerations needed, you can check out the Home Purchase Guide (under the Resources tab) on MyMoneySense and create your own Home Financing Plan.

MyMoneySense also includes investment resources to help you learn the basics of growing your wealth.

Data stored on MyMoneySense is as secure as it can get too. Users log in with their Singpass, and all financial data retrieved can only be accessed by the user.

Perhaps most importantly, it’s a tool that helps you get on top of your finances and start improving your financial health so you don’t have to feel like running away from your money-related problems.

Sounds good if you’re looking for some guidance to kickstart your financial planning journey.

Top image by Mothership

This sponsored piece by MyMoneySense helps the writer not to panic each time she sees her bank balance.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.