Follow us on Telegram for the latest updates: https://t.me/mothershipsg

Prime Minister Lee Hsien Loong said that it is "very hard" to tax wealth in Singapore, given how "amorphous" it can be, with new instruments that store wealth popping up nowadays, such as in digital form.

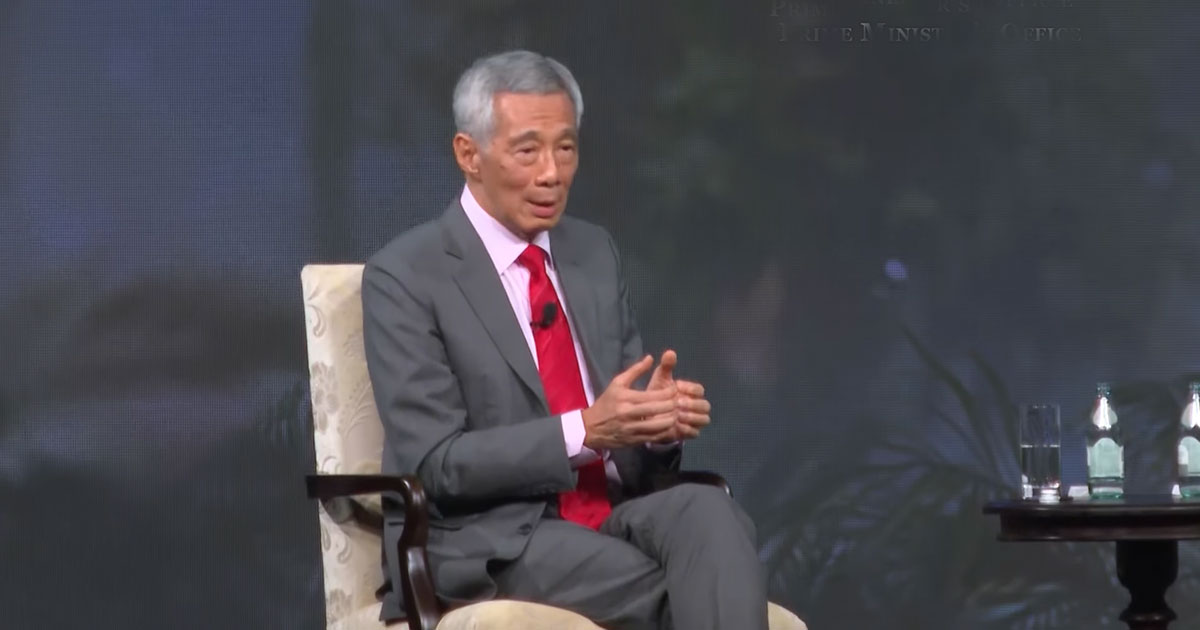

He was speaking to Bloomberg editor-in-chief John Micklethwait at a gala dinner at the Ritz-Carlton, Millenia Singapore on Day 1 of the Bloomberg New Economy Forum on Nov. 17.

A wealth tax in Singapore?

Micklethwait asked PM Lee on stage about Singapore looking at a wealth tax in a structural way, and the prime minister replied that it is an element in a comprehensive revenue system.

PM Lee said: "You tax consumption, you tax income, you tax sins, and you should tax wealth, whether in the form of property, ideally wealth in other forms."

But taxing wealth effectively is not simple, he added, even though there are established ways of doing so, citing property taxes as an example of taxing wealth in Singapore.

"Property taxes, we know how to do. Because we have them, we have refined them over the years," he said, adding that such forms of extraction make a valuable contribution to Singapore's "exchequer", referring to the national treasury.

Other ways of taxing wealth difficult

"Taxing wealth in other forms is very hard to do," PM Lee added. "You know in principle you want to do it. People have tried capital gains taxes, that has some downsides."

"People have tried other forms of direct wealth taxation -- I assess how rich you are and knock off a certain percentage -- it's not so easy to implement."

Wealth held in digital instruments

PM Lee added that wealth can be held in many different forms these days, especially digitally, making reference to Bitcoin and non-fungible tokens.

PM Lee explained: "But wealth is much more difficult. It's amorphous. You can squeeze it here and it pops up in different forms elsewhere. Nowadays, you may have a non-fungible token. How do you know? Or Bitcoin. So, it's not as easy to manage."

Tracking income easier

And this is where wealth and income are different, as income is easier to measure and track objectively.

PM Lee said: "Income inequality is somewhat easier to see and measure compared to wealth inequality. Because I can track your income and the Inland Revenue Authority has become very good at studying these things."

Tax and redistribute

Singapore, he reassured, will look at taxation in a progressive and fair way.

PM Lee continued: "So, we will study this, but we need to find a system of taxation which is progressive and which people will accept as fair. And fair means, everybody needs to pay some, but if you are able to pay more, well you should bear a larger burden of the tax."

Saying that taxes will be distributed to help the less privileged in society, PM Lee added: "And if you are less well-off, you should enjoy a greater amount of the government's support schemes and benefits."

"But it is something which we do want to be worried about because we would like to make sure that each generation starts off from as equal a starting point as possible."

"It's not possible to make it exactly the same, but within the limits of my ability, I will try to equalise if your parents can't provide everything which they need to for you."

The segment on PM Lee's take on a wealth tax can be viewed at the 37 minutes 40 seconds mark.

Background to wealth tax discussion

Finance Minister's recent comments on wealth tax

Discussions regarding implementing a wealth tax was brought up by Finance Minister Lawrence Wong on Nov. 17 as well.

He made his comments during investment banking company Morgan Stanley's 20th Annual Asia Pacific Summit, where he was asked how the government would mitigate the potential impact a wealth tax could have on the financial services industry.

Wong said the government will not focus on taxing individuals based on their net wealth if Singapore introduces a wealth tax.

Instead, the entire system will be looked at and strengthened, while being very mindful" that any new tax system or increase in taxes could become counterproductive if individuals are able to easily move their money elsewhere to avoid being taxed.

Jamus Lim's wealth tax idea in parliament

The idea of a wealth tax was reignited in the public consciousness by Workers' Party Member of Parliament Jamus Lim on Nov. 1.

Lim mooted the idea in Parliament by proposing a tax of 0.5 per cent on net wealth in excess of S$10 million, rising to 1 per cent for wealth above S$50 million and 2 per cent for wealth above S$1 billion.

His motion was titled, "Taxation for a Dynamic and Fair 21st Century Economy".

Second Minister for Finance Indranee Rajah responded on the same day, noting that Singapore will continue to review the wealth tax, but doing that in a way that strikes the right balance.

She said the government does not have any issue with wealth taxes per se but "want to make sure that whatever we put in place actually works".

The government "has to tax in a way that is competitive and allows people and companies to generate revenue in order to encourage them to stay here and that revenue can be used and allocated and redistributed", she said.

Top photo via Prime Minister's Office YouTube

Follow and listen to our podcast here

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.