Follow us on Telegram for the latest updates: https://t.me/mothershipsg

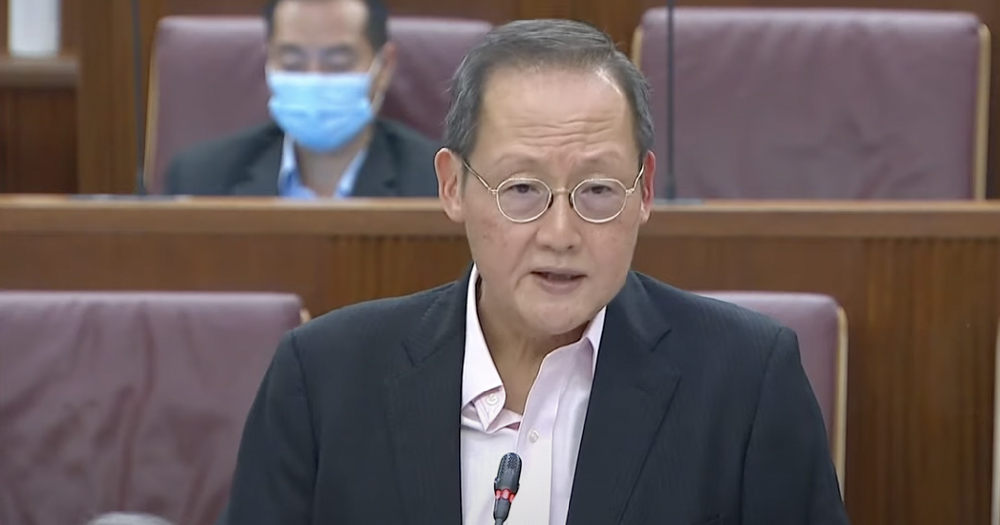

The "unusually high" number of recent exits by electricity retailers in Singapore reflects the severity of the global energy shock, Manpower Minister Tan See Leng said in Parliament on Nov. 1.

However, there will be no disruption to electricity supply for affected consumers, he added.

Tan: Five electricity retailers have exited in the past three weeks

Speaking in his capacity as the Second Minister for Trade and Industry (MTI), Tan noted that there were concerns over the exit of five electricity retailers — iSwitch, Ohm Energy, Best Electricity, UGS, SilverCloud Energy — during the past three weeks.

In pointing out that these five retailers supplied about nine per cent of all electricity consumers, Tan elaborated that their exits were due to the following factors:

Under-hedged when wholesale electricity prices spiked

According to Tan, several retailers were under-hedged when global energy shocks and disruptions to Singapore's piped natural gas (PNG) supply caused wholesale electricity prices to spike.

As such, "these retailers now find themselves having to buy the unhedged portion of electricity at the high wholesale electricity prices and sell them at much lower contracted rates to consumers," he added.

Liquidity in the electricity futures market

In addition, liquidity in the electricity futures market has also been affected.

He said, "Given the huge volatility, market makers were not prepared to take on significant positions. This is similar to the situation in other commodity markets."

This resulted in some electricity retailers no longer being able to sustain their operations and choosing to exit the market.

Tan further noted:

"The entry and exit of retailers are features of an open and competitive retail market. The unusually high number of exits reflects the severity of the global energy shock. We have observed the same phenomenon in other countries, such as the UK and Spain."

So what is behind the global shocks to Singapore's PNG supply?

Tan highlighted a "conflation" of four factors:

- An unexpected surge in demand as economies begin to recover following the easing of Covid-19 restrictions,

- Unusual weather events impacting the generation of wind and solar power in Europe,

- Lower than expected coal production, notably in China, and

- A series of gas production outages around the world.

The effects of these have been most intensely manifested in the market for natural gas, which is a "fallback fuel" for the generation of electricity in many countries, he added.

This has resulted in spot gas prices rising by around five times, since Mar. 2021. Tan also pointed out another factor exacerbating the issue:

"Many major economies across Europe and Asia have low inventory levels and are moving quickly to secure sufficient fuel supplies for the winter. These have compounded the impact on prices of fuel and electricity around the world."

No disruption to electricity supply, smooth transition

Tan said that the most important issue is ensuring that there is a "fair and robust system" for a smooth transition for consumers affected by the exit of their retailers.

Tan said:

"Retailers who wish to exit the retail electricity market are required to first approach other retailers to take on those consumers at the same terms and conditions. Failing which, the consumer will be transferred to SP Group."

As of the end of Oct. 2021, about 140,000 households and 11,000 business accounts will either be transferred to another retailer, or back to SP Group.

Consumers who are transferred to the SP Group can choose to purchase electricity from another retailer, he added. Security deposits from household consumers will also be safeguarded and refunded after outstanding charges are outset.

Retailers are also not allowed to charge customers an early termination fee.

Tan added:

"There will be no disruption to electricity supply. EMA (Energy Market Authority) will direct consumers who wish to seek compensation or file claims under their supply contracts with the retailers to the available channels."

EMA is working closely with the remaining nine retailers in the OEM

Tan then pointed out that the EMA is working closely with the remaining nine retailers which are still operating in the Open Energy Market (OEM).

This includes facilitating their efforts to hedge against future price volatility, such as easing the sale of electricity futures contracts between retailers that are exiting the retail market and those that are staying.

In addition, the EMA is also working closely with SGX to incentivise more market makers to participate in the electricity futures market.

As for the retailers facing challenges, Tan added that the EMA is open to allowing them to suspend their operations by transferring their customers to SP Group while they strengthen their business, in light of the current challenging circumstances.

In exchange, such retailers will commit to provide ex gratia payment to ease their customers’ transition.

Thus far, three of the five retailers which have exited — Best Electric, Ohm Energy and UGS Energy — have joined this arrangement.

Can SP continue to honour the existing prices and terms of affected customers?

On this matter, Tan said that transferred household will need to pay the same regulated tariffs as all other households and businesses.

Tan explained:

"This reflects the price SP pays to the generating companies for the electricity. Thus, for the transferred customers to pay less, the other consumers with SP will have to pay more than the regulated tariffs to cross-subsidise them."

What does the exit mean for the OEM?

Here, the minister said that the benefits of the Open Electricity Market (OEM) remain and has continued to benefit Singaporeans, notwithstanding the recent exits.

Tan noted:

"Consumers who switch to retail price plans have been able to enjoy savings of up to 30 per cent off the regulated tariff. To date, about half of all households, or (around) 746,000 households accounts, have switched to buying electricity from electricity retailers."

The foundations of the OEM must also be strengthened, he added.

Requirements for retailers

Currently, retailers operating in the OEM must meet the following requirements before they are licensed to serve OEM customers. These include:

- Demonstrating that their respective management team possesses relevant experience in energy retailing/trading,

- Consistently hedging at least 50 per cent of their wholesale electricity price risk, and

- Submitting financial statements to EMA, which allows EMA to monitor their financial health.

Such requirements on hindsight, he said, are necessary but insufficient to withstand a severe stress test, such as the current circumstances, in which some retailers were ill-prepared to weather.

He added that MTI would consider suggestions that had been raised on how to improve these requirements.

Tan reiterated the OEM's viability however, highlighting that nine retailers still remained, although more may either exit or enter the market, depending on the severity and duration of the energy crunch.

As for the number of electricity retail licensees needed to sustain the OEM, Tan replied that there was "no magic number".

"There is sufficient competition in OEM today and EMA is committed to ensuring this," he said.

Follow and listen to our podcast here

Top screenshot via MCI YouTube

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.