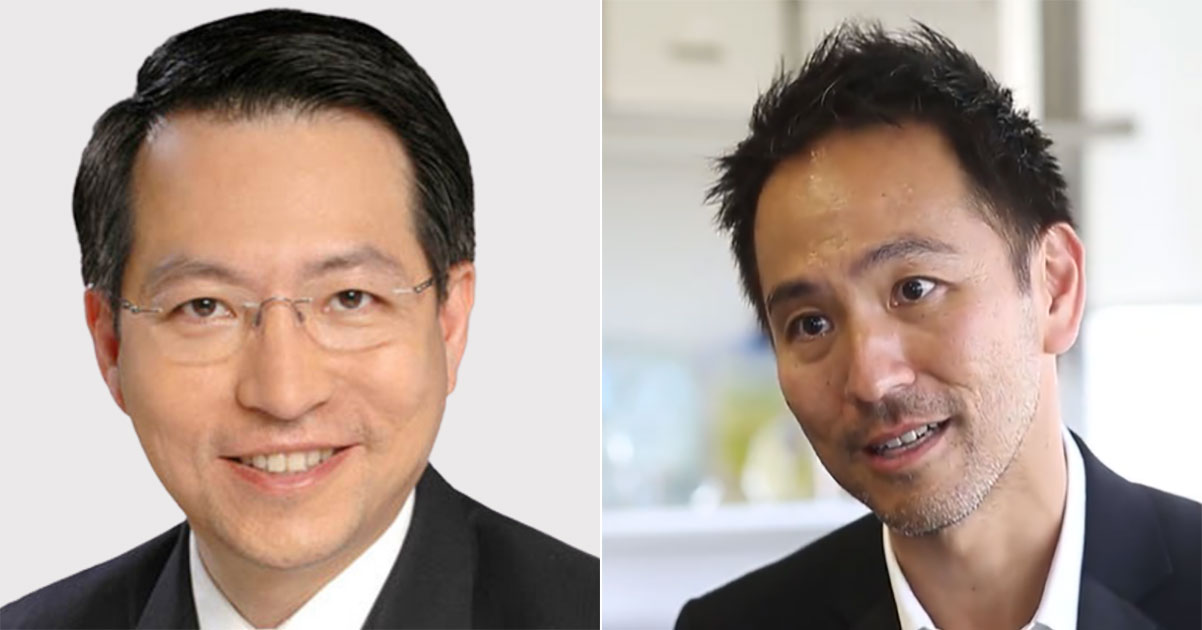

Two sons of former Singapore president Ong Teng Cheong are battling in court over the shares in their family business Ong&Ong Holdings.

Claimed his shares were undervalued

55-year-old Ong Tze Guan sued his younger brother Ong Tze Boon, 53, and six other shareholders for alleged minority oppression, as reported by The Straits Times (ST) on July 1, citing Lianhe Zaobao.

Tze Guan alleged that his shares in the family business were undervalued after he was removed as a director from nine companies between June 2018 and January 2019.

The shares were acquired by the seven defendants for S$1.65 million in Sep. 2020, based on the company auditor's valuation.

According to The Business Times (BT), Tze Guan had a 28.45 per cent stake in Ong&Ong Holdings while Tze Boon held a 70.43 per cent stake.

However, Tze Boon now holds a 90.28 per cent stake after the share transfer. The other six defendants hold stakes of between 0.12 per cent and 4.96 per cent each.

There were also other financial matters that Tze Guan alleged were unfair to him.

Tze Guan is asking the High Court to order the defendants to buy him out, either at an agreed price or at a price fixed by a court-appointed independent expert, according to ST.

Refuted the allegations

The civil case is currently at the pre-trial conference stage.

Tze Guan is represented by Daniel Koh of Eldan Law, while Tze Boon is represented by lawyers from Dentons Rodyk & Davidson, as reported by BT.

Tze Boon and the other defendants refuted the allegations made by Tze Guan, arguing that they are factually and legally baseless.

Tze Boon has also made a counterclaim against his older brother for loan recovery and defamation.

He is seeking the repayment of an outstanding personal loan (with interest) of S$700,000, which he had given Tze Guan in 2002 and 2003.

According to ST, Tze Guan has only repaid S$219,983.56.

Claimed his older brother was never actively involved in running the family business

Tze Boon had also claimed that his older brother was never actively involved in the running of the family business.

He alleged that Tze Guan's involvement and interest in the business has "solely been a personal financial interest and nothing more", as reported by BT.

Tze Boon further claimed that when Ong&Ong was struggling during the circuit breaker period last year, the shareholders ended up loaning S$1.1 million to aid with finances.

However, Tze Guan was said to be allegedly only concerned about the dilution of his share due to the loan.

Top images via Business China Awards website & Shin Min Daily News.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.