Finance Minister Lawrence Wong confirmed that financial support measures for Phase 2 and Phase 3 (Heightened Alert) will cost the government S$1.2 billion.

He also announced the extension of the Temporary Bridging Loan Programme and Enhanced Enterprise Financing Scheme –Trade Loan for an additional six months from Oct. 1, 2021 to Mar. 31, 2022.

The parameters for both schemes remain unchanged, including the government risk-share of 70 per cent. The Monetary Authority of Singapore (MAS) will also extend the MAS Singapore Dollar Facility for Enterprise Singapore Loans accordingly.

However, there will be no need to draw on Singapore's Past Reserves to fund these measures, as it will be funded by a reallocation of other funds instead.

Support for businesses and workers during Phase 2 and Phase 3 (Heightened Alert)

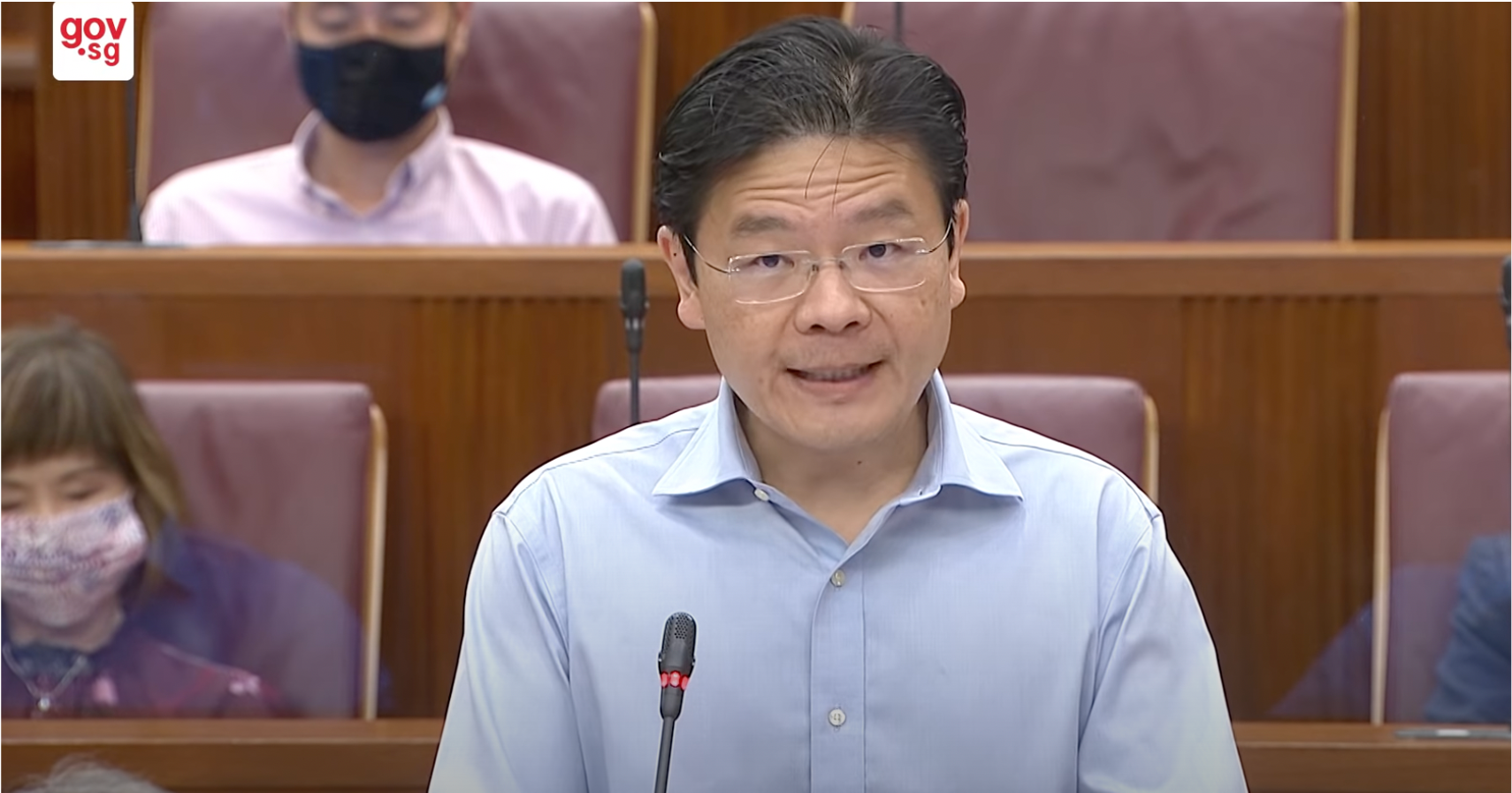

Speaking in Parliament on July 5, Wong delivered his first Ministerial Statement after being appointed as Finance Minister.

He spoke about the measures to help Singaporean companies and workers tide through this part of pandemic.

Wong drew a contrast between the Circuit Breaker of 2020 and the recent, less pervasive restrictions implemented under Phase 2, Phase 2 (Heightened Alert) and Phase 3 (Heightened Alert).

Measures such as F&B and gym restrictions helped to curb the spread of Covid-19 while still allowing other parts of the economy to remain open. Nevertheless, companies and workers received support such as Jobs Support Scheme (JSS) enhancement, and rental waivers.

Certain sectors also received targeted relief, such as taxi drivers, hawkers and those who experienced sudden and significant income loss.

Funding the support measures

While these measures need payment, Wong emphasised that the package is sized appropriately for the circumstances, which are different from the deep impact of the Circuit Breaker.

Also, other measures implemented during the Circuit Breaker such as the Jobs Growth Initiative, the SGUnited Jobs and Skills Package and the Covid-19 Recovery Grant are still ongoing.

"Under these circumstances, I do not believe there is a need to draw on our Past Reserves," Wong said.

He pointed out that this should be reserved for exceptional circumstances, such as 2020 when the economy shrank by 5.4 per cent, the largest fall since independence.

However, Singapore is not in the same situation this time round. The economy is opening up and the employment situation is improving.

On the health front, improved testing and tracing capabilities and a steady rate of vaccinations helps the government to curb the spread of infection using targeted restrictions.

Saving for the future

While Wong said that the government will not hesitate to use the "full measure of our fiscal firepower" to protect Singaporean lives and livelihoods, there is also a pressing need to ensure that public finances are sustainable for the future.

He said that public debt levels in other countries have risen sharply, and a "day of reckoning" will come when interest rates increase, and the burden will most likely fall on the younger generations.

Wong said the government expects to draw up to S$53.7 billion from Past Reserves, which is an amount unlikely to be replenished anytime soon. The government also incurred its biggest budget deficit last year.

However, circumstances have improved and such measures are not necessary.

Reallocating funds

In lieu of the reserves, these latest measures will be funded by reallocating other funds.

About S$600 million out of the S$1.2 billion will come from the capitalisation of development expenditure under the Significant Infrastructure Government Loan Act, or SINGA in short.

Previously, the S$600 million was allocated under the previous budget for two infrastructure projects --the Deep Tunnel Sewerage System and the North-South Corridor.

Now that SINGA has been passed, the projects will be funded by SINGA loans instead.

The money originally allocated for them will help to fund the financial support measures.

The remaining S$600 million will be reallocated from underutilisation of development expenditure, mainly due to delays in projects as a result of Covid-19.

Top image from Gov.sg.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.