Follow us on Telegram for the latest updates on Covid-19: https://t.me/mothershipsg

GIC has just released its annual 2020/2021 report.

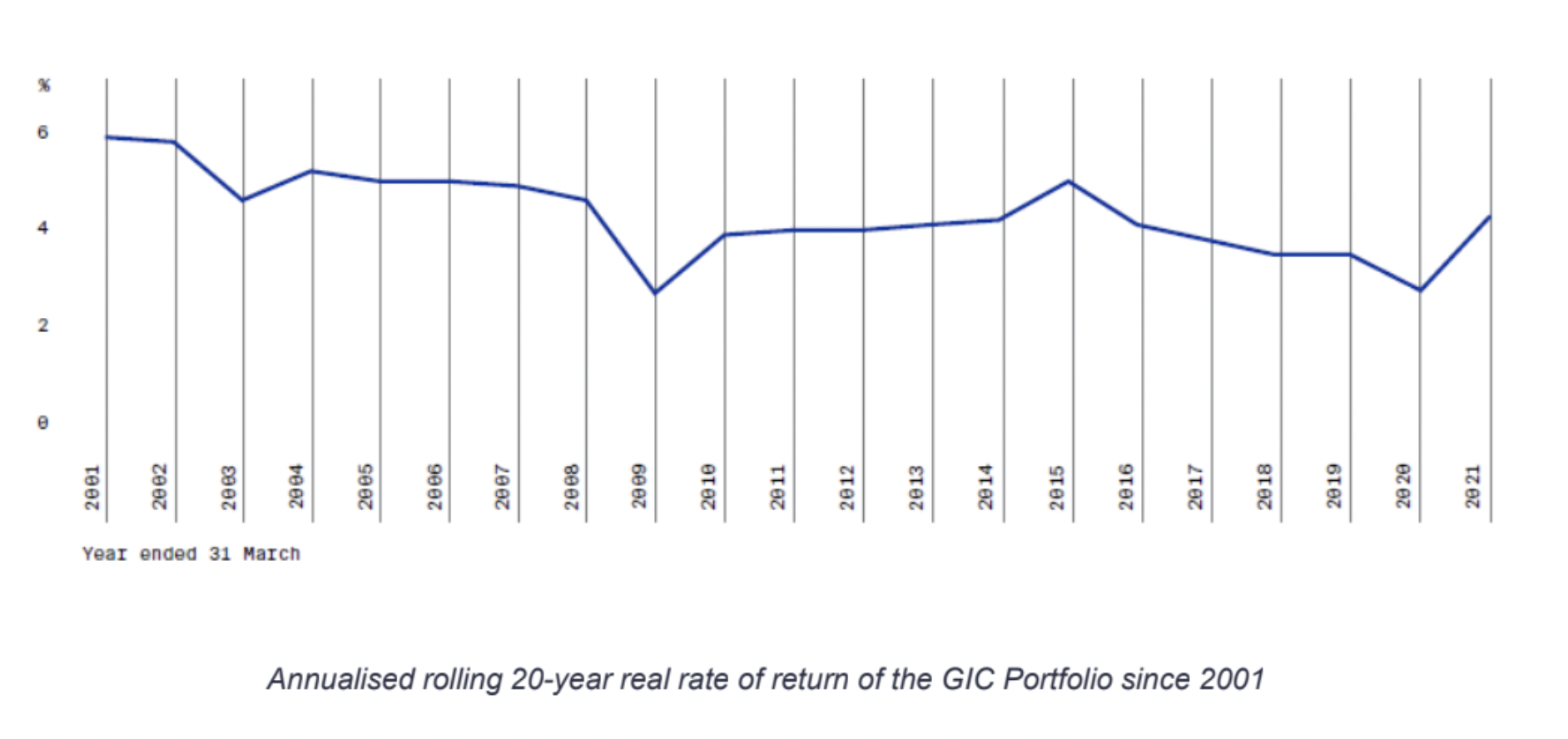

The magic number this year, is 4.3 per cent.

This figure stands for the annualised real rate of return over a 20-year period, after accounting for global inflation.

It is up 1.6 percentage points from the figure reported last year (2.7 per cent).

The rolling 20-year return is the highest recorded since 2015, according to the GIC.

Wait, rolling 20-year?

For context, the annualised real rate of return or rolling 20-year return referred to, is the primary way GIC measures its investment returns.

Instead of reporting the investment returns in yearly blocks, GIC reports its performance over a period of 20 years, thus using the metric of an annualised 20-year real return.

Here's a helpful visual to help you understand:

Via GIC

Via GIC

For 2021, the annualised real rate of return was 4.3 per cent, for the period of April 2001 to March 2021.

You can also approach it this way – based on this, say you invested S$100 via GIC in 2001, and left it with them for 20 years, you would have S$232 buying power in 2021.

The term "real" refers to the rate of interest when global inflation is taken into account.

Okay, so what contributed to the improved real rate of returns?

According to GIC's annual report, the 20-year real rate of return experienced an uptick this year, above and over the global inflation rate.

Via GIC

Via GIC

This was partly due to a poor year dropping out of the 20-year window (FY2000/01 when the dot-com bubble burst happened), but also because of a strong rebound in risk assets last year.

Lim Chow Kiat, the Chief Executive Officer of GIC, elaborated during a media briefing on July 22:

"It [the strong rebound last year] was a global phenomenon.

There were a lot of policy actions which helped asset markets to recover strongly, and thankfully, the advancement in the vaccines helped to mitigate [some of] the problems of the pandemic.

So the equities responded to that, but it wasn't just the equities, almost all the risk assets have done really well. And even those assets that sort of directly had negative impact from the pandemic also held up reasonably well.

So you have a lot of assets performing, and that I guess, contributed to the good performance of the portfolio."

GIC: Being "macro cautious" and "micro positive"

In its annual report, GIC also said it has still maintained a cautious investment stance, due to an uncertain macro environment.

Jeffrey Jaensubhakij, Group Chief Investment Officer of GIC, explained during the media briefing that this was in part due to:

- Elevated equity and asset valuations (i.e. higher priced assets)

- Uncertainties around the trajectory of the pandemic

- Inflation concerns, and

- The slight rise in bond yields

GIC said it was positive however, about micro aspects of the investment environment, especially regarding three long term trends it believed would drive new areas of growth.

These include an "emphasis on sustainability, accelerating technology transformation, and growing needs for businesses to reconfigure their supply chain".

To diversify its portfolio, it would also continue to grow its private market investing, global partnerships, as well as sustainability integration efforts.

Background of GIC

GIC is a fund manager that manages Singapore’s foreign reserves, with its biggest client being the Singapore Government.

It was set up by then Deputy Prime Minister Goh Keng Swee in 1981, and celebrates its 40-year anniversary this year.

According to GIC, it aims to achieve "good absolute real returns" over 20 years within the Client's risk parameters.

According to the Sovereign Wealth Fund Institute, current assets for GIC amount to USD$453 billion (S$616 billion).

Top image courtesy of GIC

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.