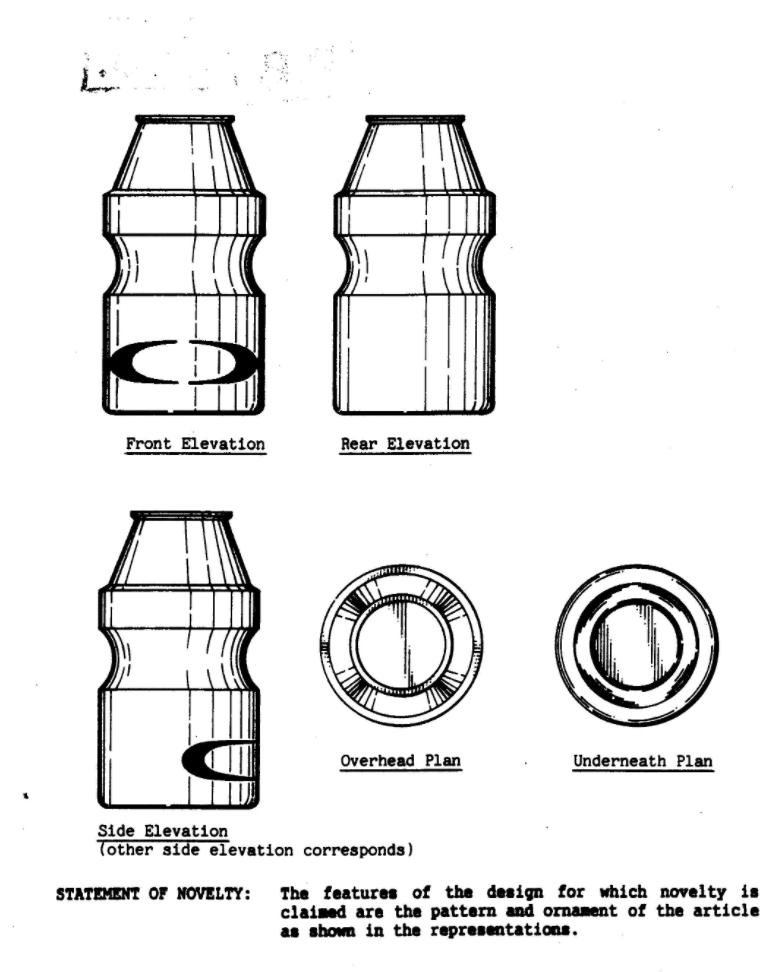

Here's a sketch of a novel container with an intriguing pattern and ornament:

Image from Gov.UK registry

Image from Gov.UK registry

When you see this picture, some of you might think of Yakult, while others might guess Vitagen. Any other answer would probably be few and far between.

In some ways, it was the bottle itself that would prove to be the first salvo in a battle that has lasted nearly half a century, but we'll get to that later.

For the purposes of this article, we'll start off somewhere around the mid-70s — before either of the two eventual cultured milk giants really took hold in Singapore.

Breakthroughs

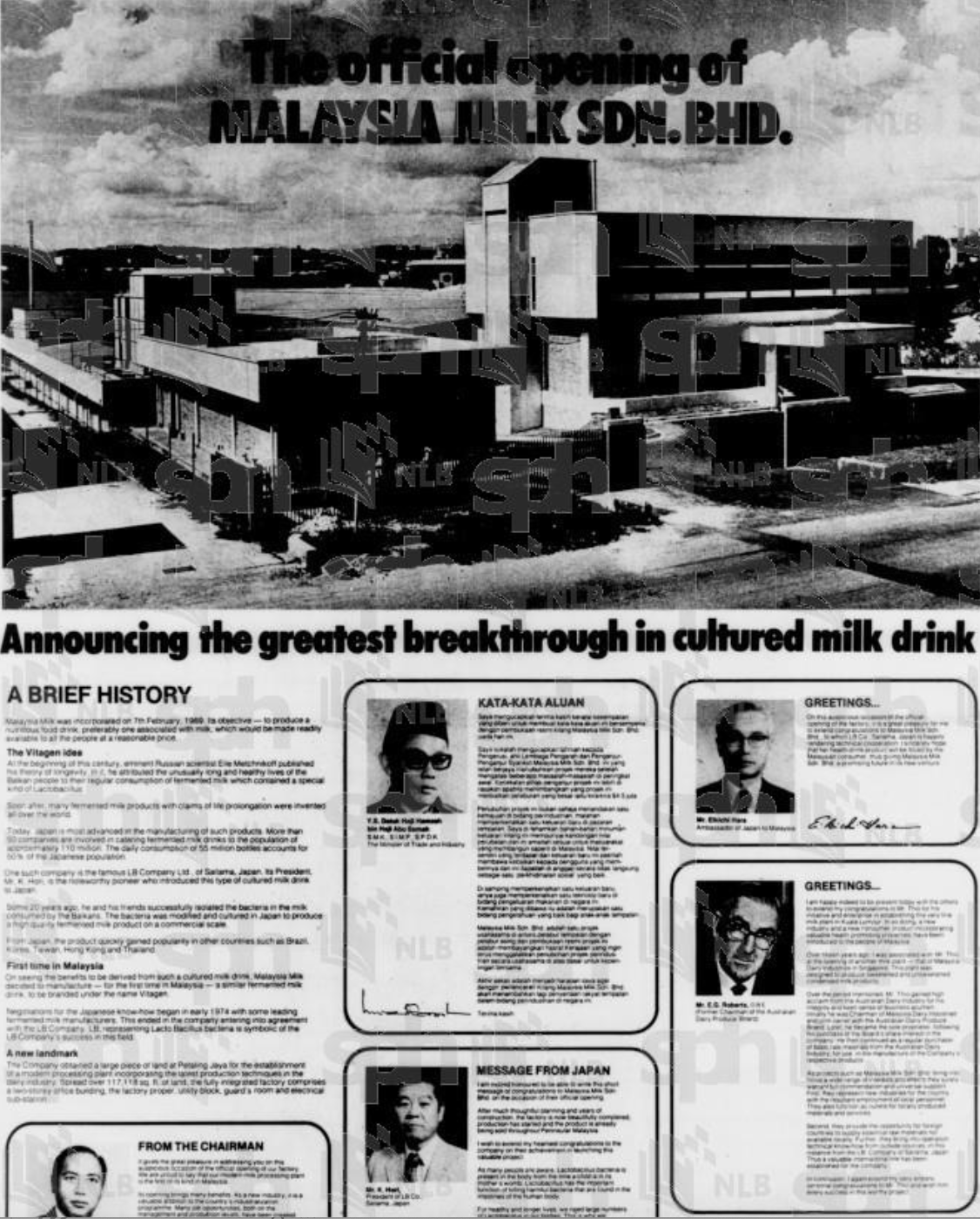

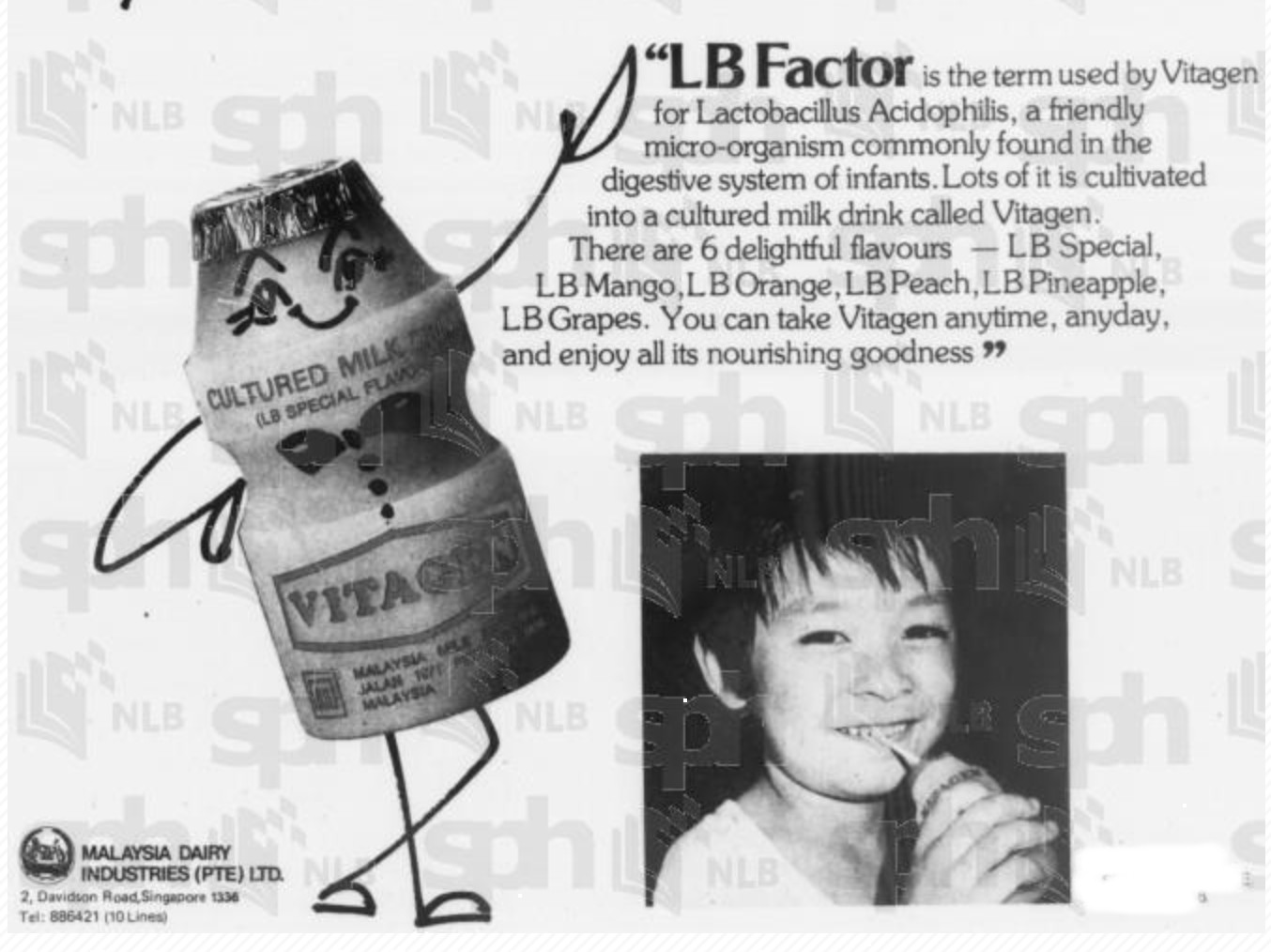

On June 22, 1977, Singaporeans flipping through The Straits Times (ST) would have been greeted by news of increased police presence in Jakarta after football riots, a Bangkok high school closing following student demonstrations, and if they had flipped to page 24, "the greatest breakthrough in cultured milk drink".

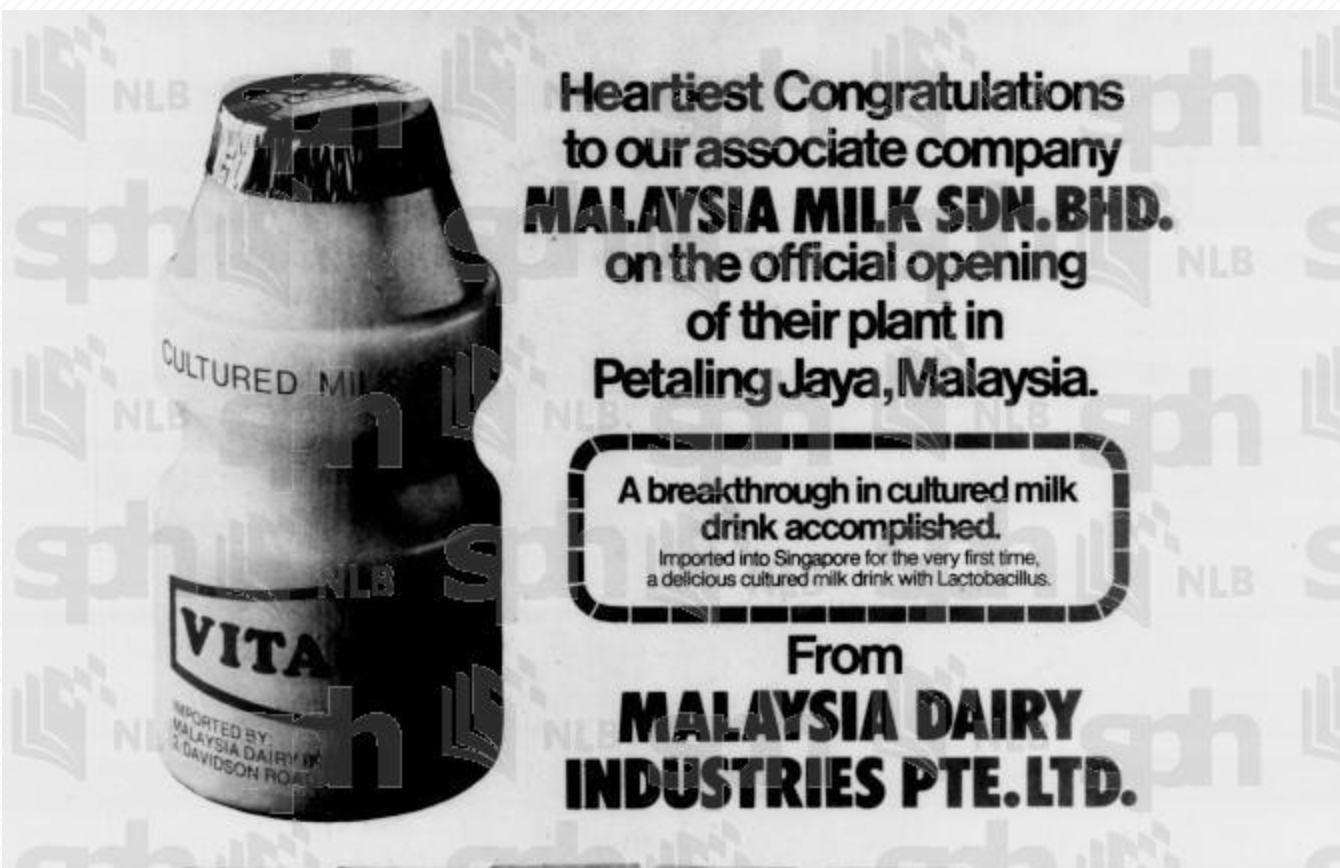

The next page was a congratulatory message on the opening of the factory in Petaling Jaya by Malaysia Dairy Industries (MDI) to their associate company.

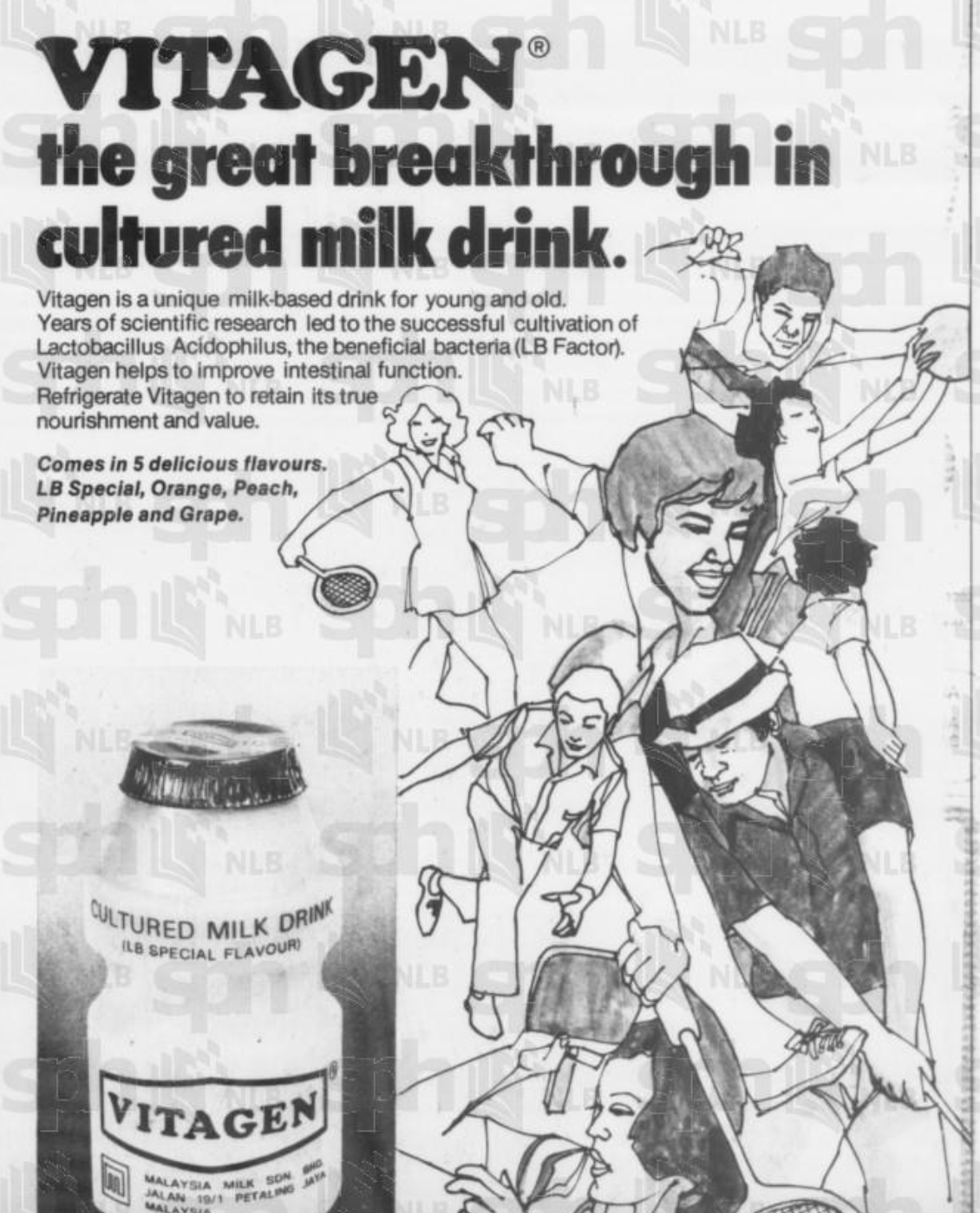

Ads for the product itself would soon follow.

There were quite a few of them, but they mostly tended to skew towards Vitagen complementing a healthy lifestyle.

Drink Vitagen if you're playing tennis, golf, or have recently been turned into a Titan.

While it wasn't splashed all over the papers, Yakult was also making moves, having conducted a market research project in Singapore back in 1972 to see whether Singapore enjoyed the taste of Yakult.

They would eventually launch their product in 1979.

The foundational blocks of the two's clash in Singapore were almost set, but perhaps we are skipping over an important question.

Why Singapore?

Proxybiotics

Singapore is many things/hubs to many people. But even they wouldn't claim to be the land of probiotic cultures, or any Lactobacillus-driven industries.

Those were then, for the most part, an intensely Japanese game.

Minoru Shirota had discovered the presence of bacterial flora that survived passage through the gut after ingestion, which eventually led to the first fermented bacteria-containing drink. It was commercially marketed as Yakult in 1935.

They might have been the first, but were by no means the only probiotic proselytisers on the Japanese market.

In fact, as recently as 2006, there were reportedly 65 probiotic products in Japan containing one of the 16 approved bacterial strains.

Some of the probiotic producers over the years in Japan apart from Yakult include Meiji, Morinaga, and LB Co.

Now if you found the last name familiar, you might have at some point in your life browsed page 24 of the June 22, 1977 edition of ST.

This particular part.

LB.Co is now better known for their healthier green tea drinks, but started their life as a producer and distributer of probiotic drinks.

In 2005, Asahi acquired a majority stake in LB (Nagoya) Ltd. and LB (Tokyo) Ltd., eventually integrating them into one entity. According to Nikkei, they would then "unload" LB after it "failed to generate the expected synergies".

But everything was hunky-dory back in the 70s, and they would offer their "technical expertise and experience" to Malaysia Milk.

Yakult would also team up with a Singapore entity to peddle its products here.

Cerebos Singapore — a joint venture company between Temasek Holdings and RHS, a British food MNC — teamed up with Yakult in a 50-50 joint venture.

The venture involved an investment of S$6 million, an extensive half million dollar advertising campaign, and installing equipment worth S$1.9 million at Cerebos factory at Hillview Avenue.

This too would only be temporary, as the company had taken up land at Jurong to build a S$2m factory, which was expected to be ready in 19 months.

And just like that the pieces were set, partnerships had been forged, and the cultured milk titans would engage in a decades-long struggle for supremacy.

Claim to claim

Yakult officially started selling in Singapore at around August, 1979.

This would soon lead to a deluge of advertisements and press releases by both sides hyping up their own products, and subtly, real real subtly, casting a tiny bit of shade on other unnamed probiotic drinks.

The battle that went into most of the 80s could broadly be categorised in two stages which they fluctuated between:

1. Why should you drink me?

2. They drink me more.

Why should you drink me?

One of the first ads (if not the first ad) Yakult took out in Singapore papers was on August 12, 1979, and it involved a declaration of their worldwide popularity, as well as the reasons you should give the new kid on the block a chance.

Followed by what appears to be a now-dropped slogan:

Freshen up.

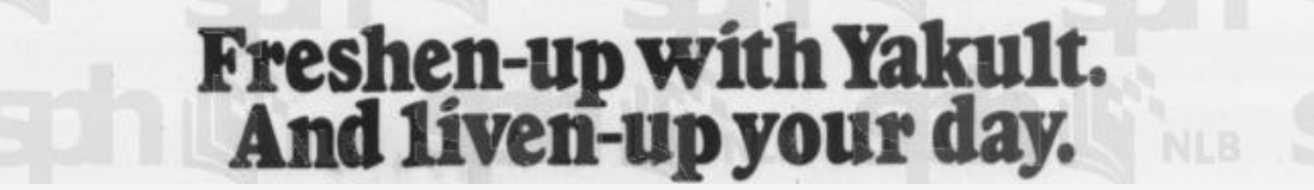

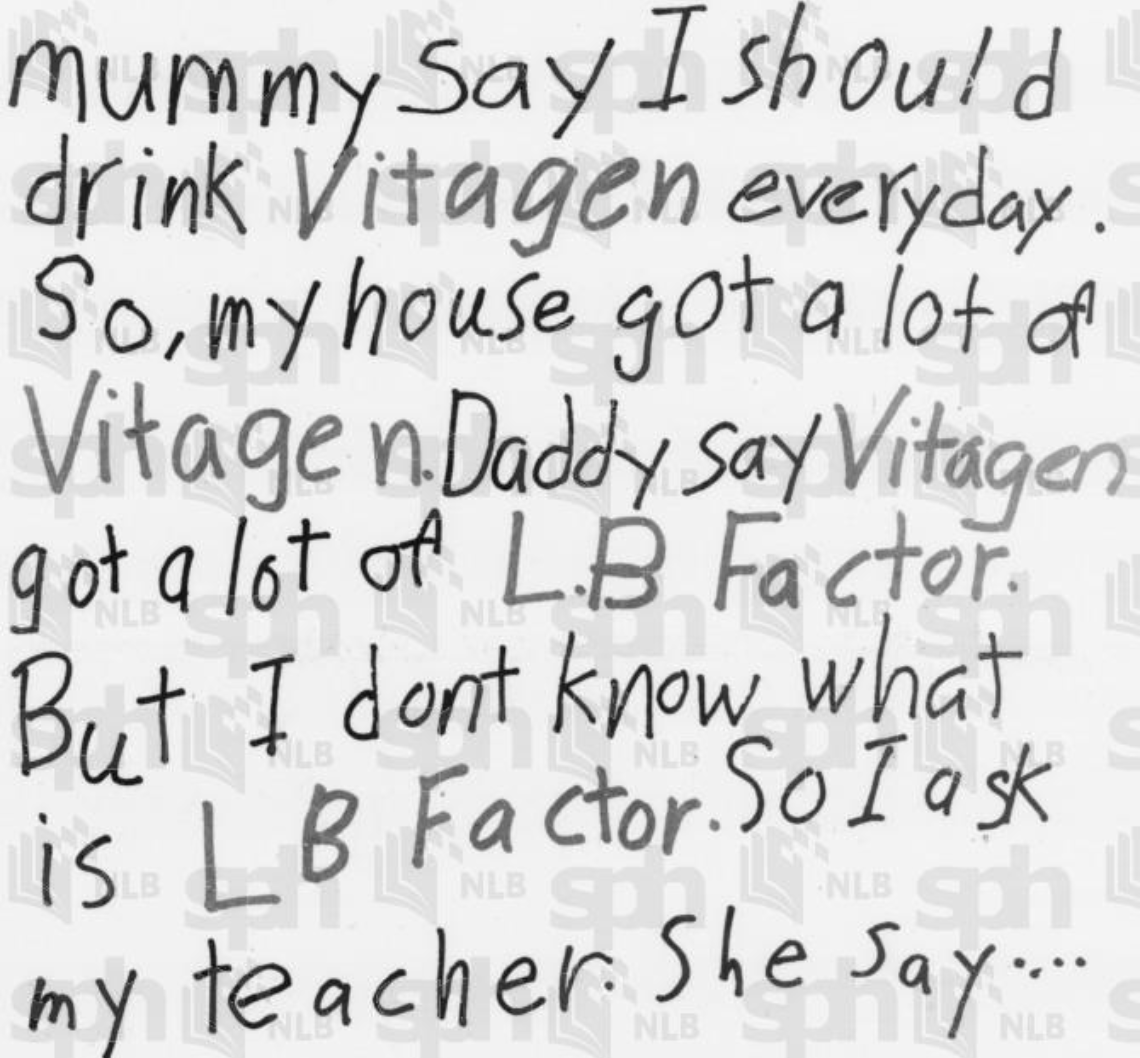

Perhaps in a sign of things to come, or a quick establishment of the "this city state ain't big enough for the both of us cultured milk drinks" mantra, Vitagen ran an ad on the same day on ST as well.

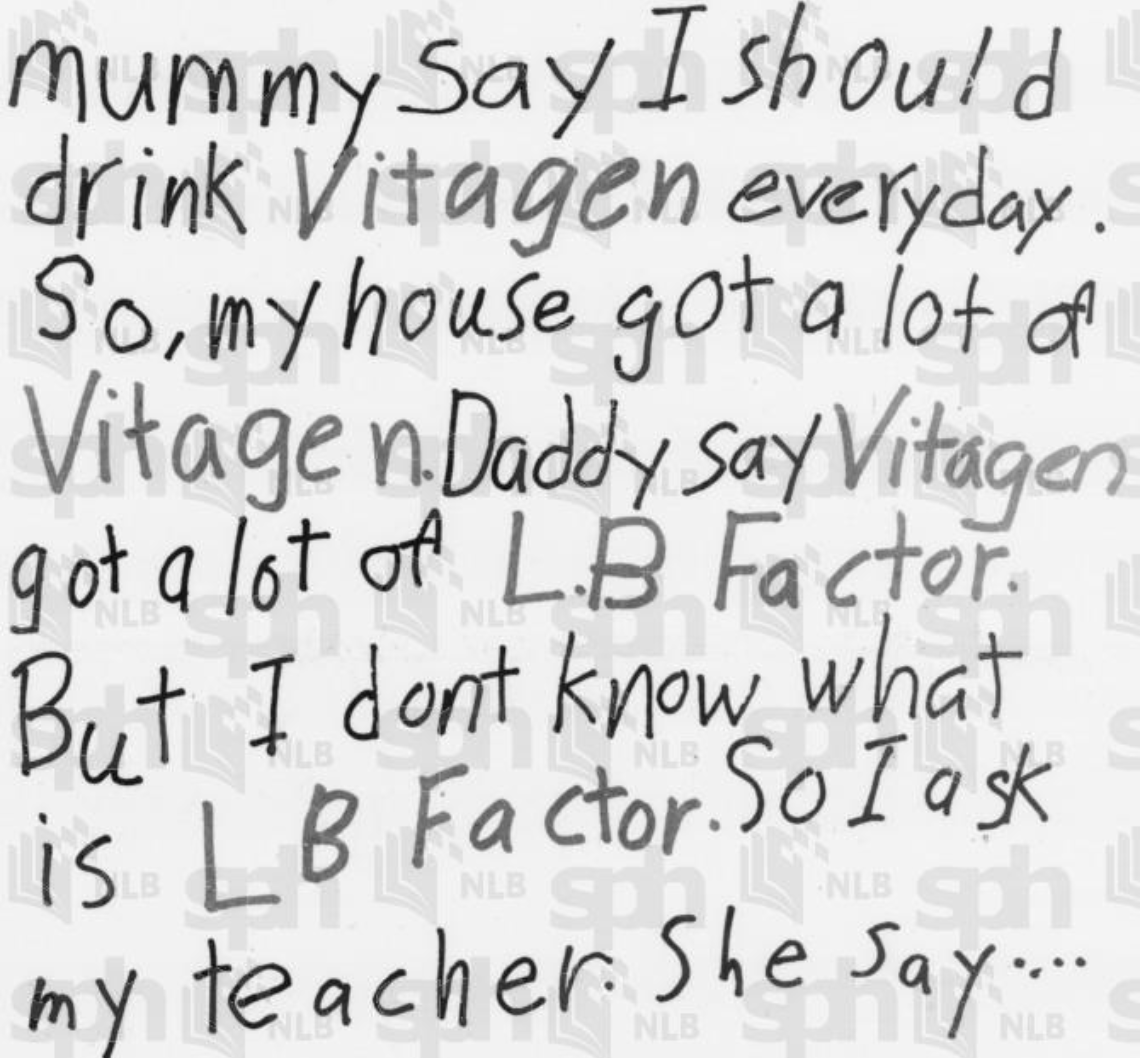

An ad with what might be the most innocent child-like scribbling you will ever see.

That particular sentiment was provided by a young man named Benny:

The ad spoke volumes: a contented child, Benny, with parents supportive of a strong Vitagen regime, and a teacher almost too well-versed in the benefits of any of the available flavours of Vitagen in Singapore.

Over the next couple of years, ads explaining why one should buy one drink over the other popped up.

Happy kinda-the-start of a new year from Vitagen, the 'NUMBER ONE LB CULTURED MILK" proclaimed:

Great, you might be thinking, I know which of the cultured milk drinks to buy now.

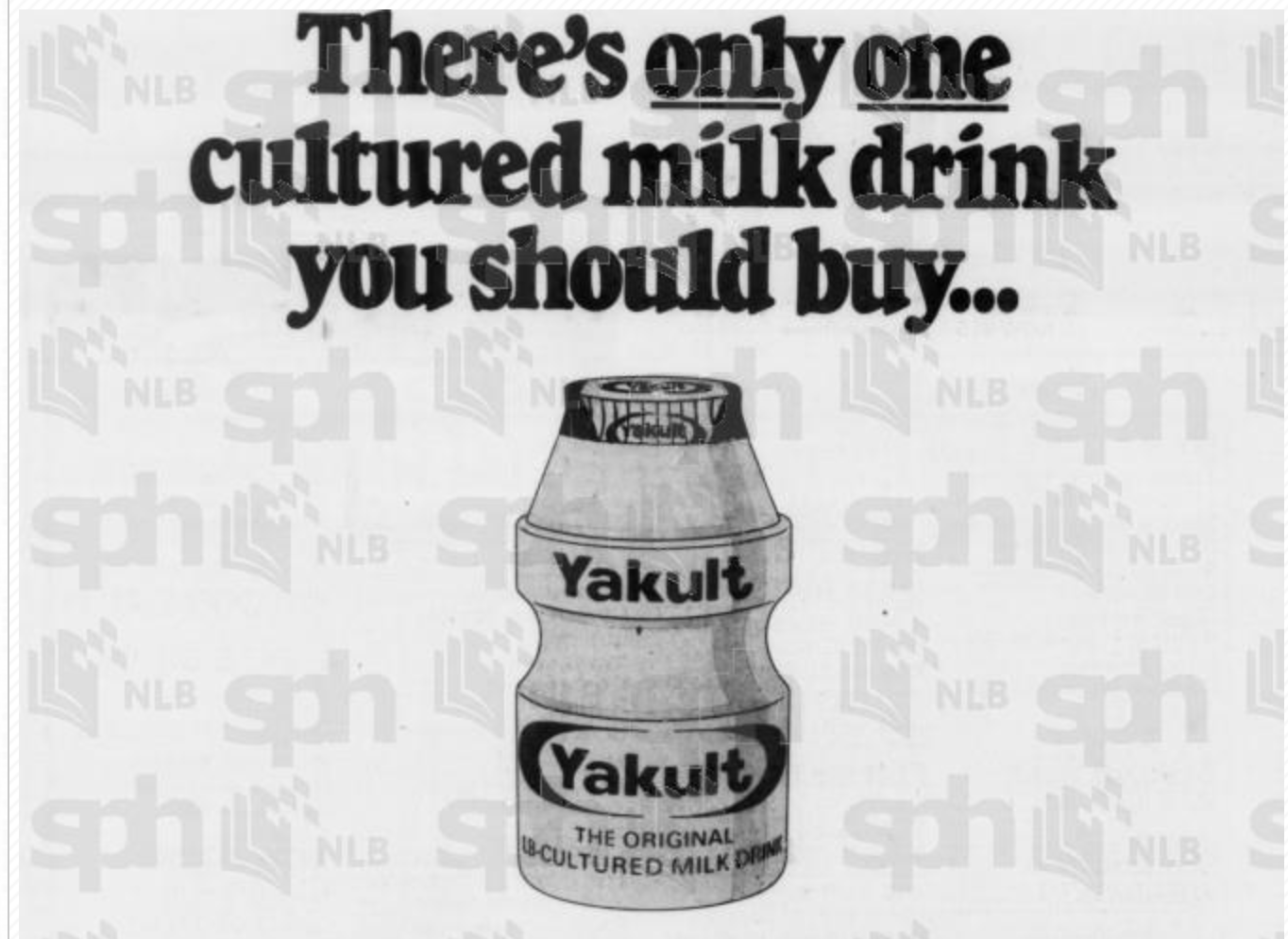

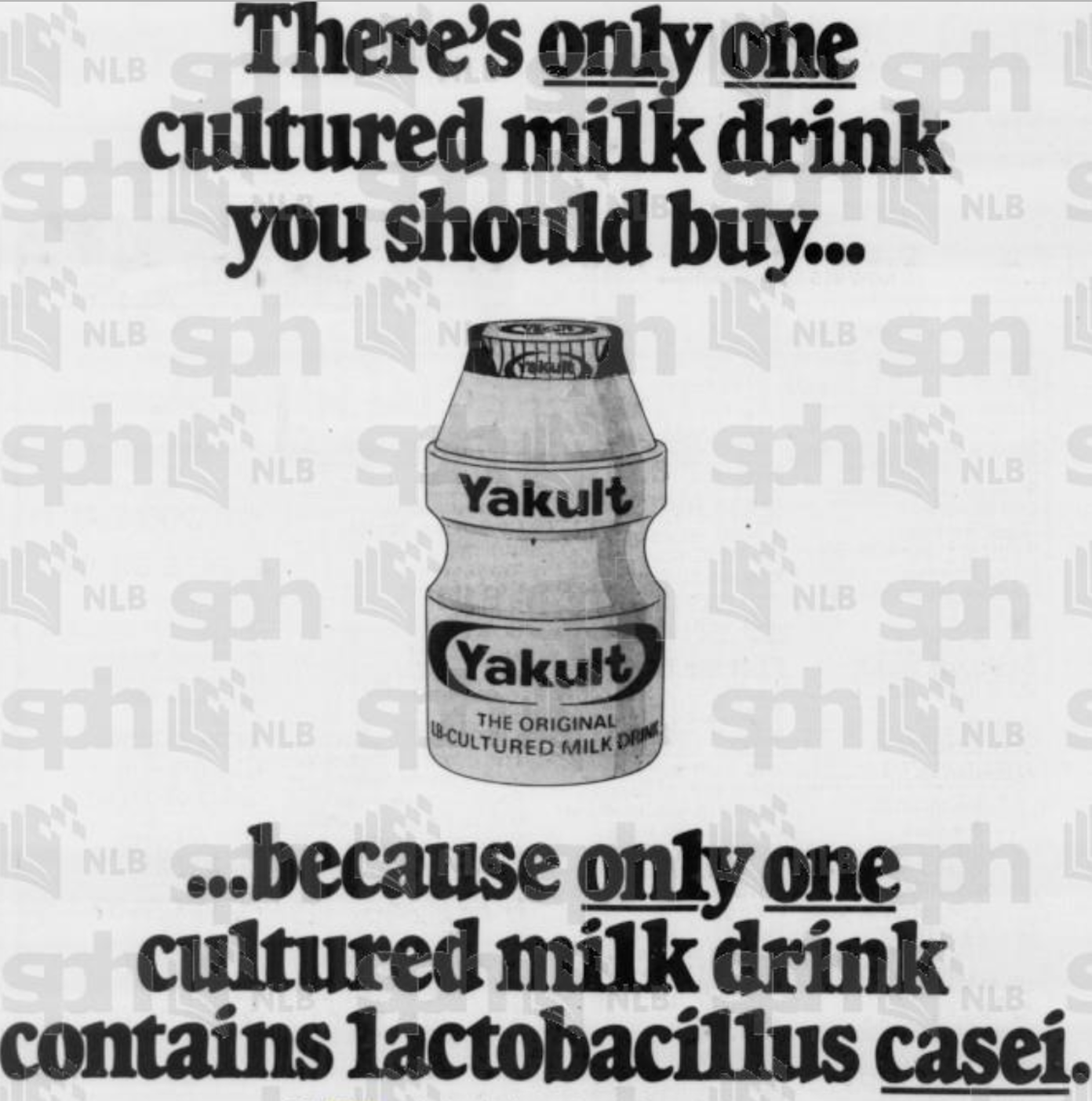

"Not so fast", a Yakult executive dressed in era-appropriate attire might have said:

An explanation is given later:

The burden of choice.

While there were other types of ads going on during that decade, these little jibes would more or less signal the first half of the battle for the hearts and minds of Singaporeans.

They drink me more

Special offers and prize giveaways were also common offerings from the two for a while, and in some ways it must have felt like two products slowly finding their place in Singapore.

But then, on May 15, 1986, a gauntlet was thrown down.

Image from NLB/ Business Times

Image from NLB/ Business Times

It was not the first time sales numbers had been bandied around, but it would arguably be the declaration that would make the biggest waves so far.

In a Business Times article, Yakult claimed to have had amassed 75 per cent of the cultured milk market in Singapore. In the same article, CP Lim, then-general manager of MDI was cited saying Vitagen's sales had stagnated.

Overall, it appeared that the battle had been decided. Yakult, which came into the market later than Vitagen, had seemingly vanquished their foes. Vitagen stood on the brink of extinction.

But you, who probably have seen both brands lined up together in your nearby NTUC/Giant/Sheng Siong/ Cold Storage in today's world, would know better than to count them out.

Vitagen's Lim later fired back with some quick math — it took a bit more than a year, but time moved slower back then — on July 22, 1987.

He threw into question Yakult's much-vaunted 75 per cent figure, instead pushing for what he considered to be a more accurate 45 per cent number.

To get to that percentage, Lim ran through a series of numbers. We'll try to summarise it for you.

Lim claimed that the total market for cultured milk was about 1.6 to 1.8 million bottles per month. According to Lim, the past nine to 10 months had seen Vitagen sell between 750,000 to 850,000 bottles a month.

Which, Lim concluded, meant Vitagen controlled about 40 to 50 per cent of the market.

Undeterred by the numerical volley, Yakult's Managing Director, Don Tierney, stepped up to the plate with a rapid response (seven days later).

He placed Yakult's sales volume for July at around 1.7 million bottles. Which would call into question Vitagen's previous estimate of the cultured milk market being around 1.8 million bottles per month.

That point itself was highlighted by Tierney in the article, calling Vitagen's estimate "a gross understatement".

Tierney further stated that Yakult's sales had not gone below one million bottles since April 1986, achieving a 1.4 million sales figure the month before.

Numbers swirled around like a Lactobacillus strain under the watchful gaze of Shirota's microscope.

Vitagen would question the 75 per cent figure yet again, saying Yakult's own numbers didn't back that percentage up, claiming their market share would hover around 63 to 70 per cent even with the numbers Yakult themselves provided.

"We want more back-and-forth quibbling over minor percentage points," demanded the common man. This was very much top-tier entertainment back in the pre-World Wide Web era.

Yakult obliged, claiming the numbers had been taken out of context, and further flexing the fact that they had doubled sales in three years.

Mothership reached out to both Yakult and Vitagen for more up-to-date sales figures and market share.

Their representatives, whom were both unfailingly nice in the face of a rather out-of-the blue request about market share, gave a quick summation of each of their positions.

The Yakult spokesperson placed their current numbers in the "total cultured milk category", according to data from a market research company, at around 70 per cent.

The remaining 30 per cent, according to them, went to Vitagen and other cultured milk drinks.

Here's the thing though: Yakult's statement to our queries came about a few hours earlier than Vitagen's.

In their statement, Yakult made a point to note that Vitagen claims to be the number one selling cultured milk drinks, but only in the "less sugar" cultured milk category.

And wouldn't you know, Vitagen's statement a few hours later did in fact highlight that very achievement:

"Until today, Vitagen Less Sugar remains the No. 1 less sugar cultured milk drink in Singapore."

It felt almost like long-term sparring partners, perfectly predicting each other's moves 10 steps in advance.

Vitagen's spokesperson also kindly elaborated on the healthier options it presented for its customers, including having eight times "less white sugar" compared to regular cultured milk drinks, as well as being the first cultured milk drink to be awarded the Healthier Choice Symbol.

If Yakult's numbers are to be taken at face value then, it means the percentage points haven't really changed much from over 30 years ago.

Which means like with any roughly competent/equally matched adversaries, victories would be declared over inches gained, rather than any decisive deathblow.

That doesn't mean attempts weren't made to strike a significant blow early on.

Let's backtrack just a bit, to a time before Yakult's first ad, or Benny's proclamation of a house full of Vitagens.

A bottle to remember

On February 15, 1979, Yakult wrote to MDI signalling their intent to enter the Singapore market.

They would do so with the same bottles currently being stocked in shelves around Japan, Hong Kong, Taiwan, and more.

However it was this very bottle that would prompt MDI to try and file an injunction against Yakult.

On Apr. 19, they took legal action against Yakult

There were factors involved such as trademark registrations in U.K., but basically the general premise was that customers might confuse Yakult for Vitagen, and buy it by mistake.

Vitagen claimed that that the bottle's unique design had been important in making their product familiar to consumers.

To this, the judge argued that the bulk of their advertisements had focused less on the shape of the bottle, but rather the brand name itself. He noted that there was no statement in the advertisements to say the public could recognise the product by the shape of the bottle.

Another point of contention brought up in the case was the design of the bottle itself, specifically who designed it.

The plaintiffs claimed that the then-plant manager for MDI had produced the design.

The judge expressed his surprise at this assertion, noting that from advertisements from other countries that had Yakult, "it appears to be the same as the Yakult design".

He also acknowledged evidence that it was E Fujimoto who designed the Yakult bottle.

Speaking of those credited with designing the Yakult bottle...

Image from Annual Yakult Report 2009 PDF

Image from Annual Yakult Report 2009 PDF

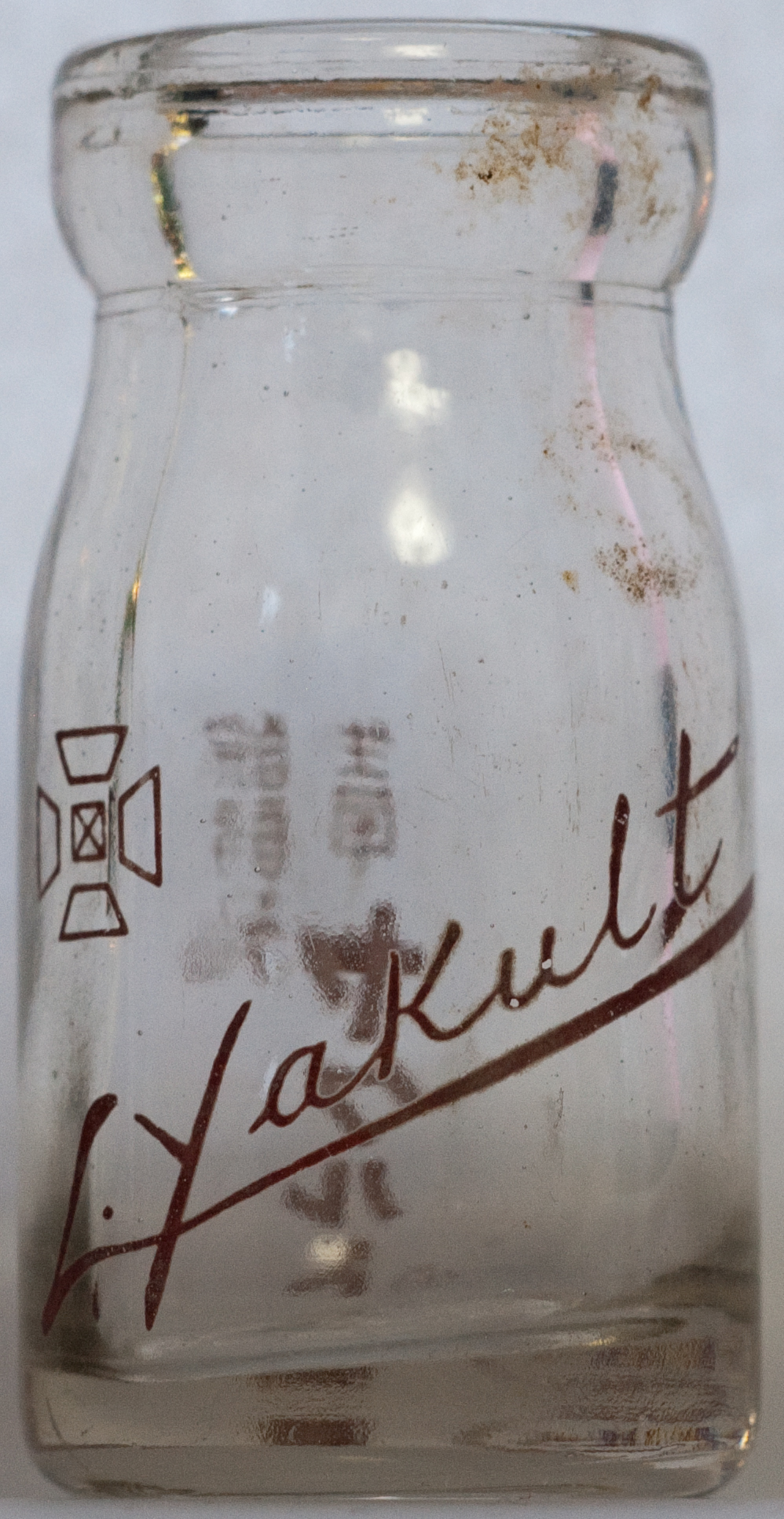

Two of the credited designers, Matsumoto and Kenmochi, in an interview archived on PLAT, shared some insights into the creation of the Yakult bottle as we know it.

They talked about how the shift from the original glass Yakult bottle to the now-familiar plastic Yakult bottle was done with some restrictions placed on production.

They had to compensate for the difference in materials used for the bottle, while utilising the same height and width from the previous glass production line.

Which resulted in this:

Ironically, the interviewer referred to the design as "world famous" and instantly recognisable as a Yakult bottle.

Back in Singapore, the judge had dismissed the motion, effectively paving the way for all the aforementioned events to take place.

A period of time Vitagen highlighted in their statement to Mothership as well:

"The lawsuit referenced in this article between MDI and Yakult is from more than 40 years ago and has since been superseded by events."

A settlement agreement was reached as well:

"Thereafter, MDI and Yakult have agreed to resolve their intellectual rights dispute on a Global basis by way of a Settlement Agreement in March 1993.

While we are bounded by the confidentiality clause in the said Settlement Agreement and not able to share details of the resolution, we are able to share that following the settlement, both companies have separately agreed to mutually co-exist in various other jurisdictions."

A mutual co-existance.

House got a lot of Vitagen

In the many, many, advertisements taken out by both sides, one really stood out to me.

This one:

By Benny.

But it wasn't because of Benny's handwriting, or the pro-Vitagen parents, or even the teacher who graduated with a Masters in Vitagen-ology.

It was this line:

"So, my house got a lot of Vitagen."

If you recall, the ad was taken out shortly after Yakult had just entered the Singapore market. So, if indeed cultured milk drinks were needed by a family in Singapore, what else was there to do except get some Vitagen?

A result of the lack of choice back then.

The competition that did come when Yakult entered the market might have ultimately placed a dent in Vitagen's market share over the years, but you could argue that it was this competition that forced the two to adopt measures that they might not have if they were mutually co-existing from the start.

Yakult, for example, offers a variety of flavours in Singapore. This is unheard of anywhere else.

So follow this very loose hypothesis with me:

It's the late 70's, Yakult sets up shop in Singapore.

Their biggest competitor offers something they currently don't: variety.

Six flavours out there to compete against.

Perhaps you counter with a flavourful rebuttal as well.

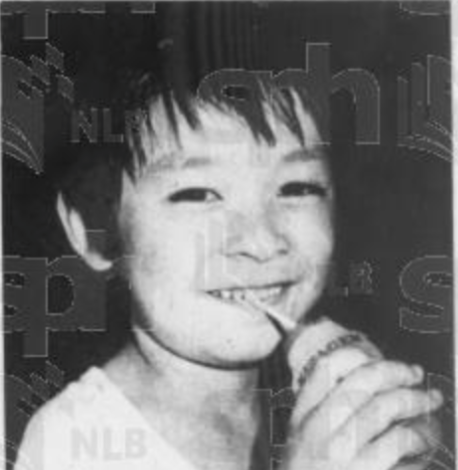

Here's an ad taken out in 1980:

New flavours, yummy.

Now of course, Yakult does not seem to have publicly acknowledged Vitagen's role in this introduction of flavours, so this is very much just conjecture.

But just to add to this possibility, here's a quote by Tierney in an ST article from May 17, 1984.

"When Yakult came to Singapore in 1979, Vitagen, another cultured milk drink, had set themselves up as a novelty drink with different flavours"

ST noted that this "forced them to sell Yakult as a refreshing children's drink as well", to get a foothold in the market.

On a lighter note, this is the paragraph right after the market line:

"But today, according to Mr Tierney, Yakult has beaten its main competitor, Vitagen, with a market share of over 55 per cent."

These guys love their percentages.

Similarly, you could question if Vitagen would have made such a hard pivot towards being a healthier brand, even becoming the "No. 1 less sugar cultured milk drink in Singapore", without the presence of Yakult.

There's an argument to be made that the fierce competition ultimately gave rise to better products on both sides, which is always a positive for consumers.

So instead of viewing it as the 70 per cent, or the 65 per cent, or the 48 per cent, or whatever number you want to throw out, you could also view the competition as providing a decent alternative to someone who maybe did not feel like freshening up with Yakult that day.

Ditto for a Vitagen drinker craving a Yakult.

However no one understands clearer how impactful the presence of choice can be than the consumers themselves, so we tried to contact a Vitagen supporter, scratch that, an incredibly staunch Vitagen supporter, from back in the day.

Legend has it, his house got a lot of Vitagen.

After a few random messages to what must have been some very confused Benny's, we managed to find the man himself.

He very nicely took the time to answer some of the questions we had as well.

Firstly, yes, that was his actual handwriting, he appeared in the ad because his family friend had approached him about it, and on a side note he recalled Vitagen being the more prominent brand growing up, which he notes might not be the case now.

And as to which brand of cultured milk drink he likes?

"I am more of a Yakult fan now."

Image adapted from Vitagen Facebook, Wikimedia Commons (DezzaWong), and NLB Archives

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.