Singapore may be small, but due to our outsize influence in the world of finance, we can exert some influence on global trends -- including helping businesses to go green.

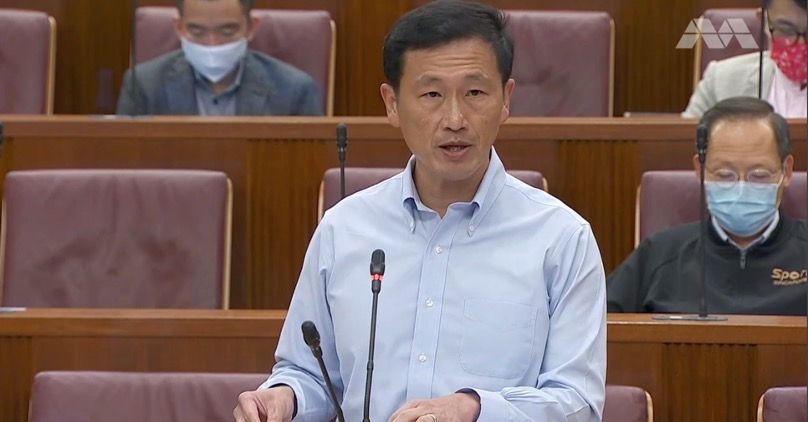

Transport Minister Ong Ye Kung, who is also a board member of the Monetary Authority of Singapore (MAS) spoke about how Singapore could wield influence in the fight against climate change.

During the Committee of Supply (COS) debates for the Ministry of Finance (MOF) on March 2, Ong said that as an international financial services sector, Singapore could mobilise capital towards solutions that cut greenhouse gas emissions.

This could take the form of investments in renewable energy, battery technology, or carbon-efficient food production methods, to give a few examples.

Suggestions for more transparency

Ong was responding to a few cuts from Members of Parliament, including Desmond Choo of Tampines GRC, who suggested having a green investment board disclosure of listed companies, to allow investors to support sustainability aims.

In his cut, Leon Perera of the Workers' Party (WP) also suggested a set of sustainability standards to fulfil before Singapore's sovereign wealth funds could invest in them. He mentioned that Norway's sovereign wealth fund does not invest in companies that do not meet ethical and environmental standards.

In a recent press conference (Feb.9), the incoming Temasek Holdings CEO Dilhan Pillay Sandrasegara, said that Temasek Holdings has made the commitment to have sustainability and climate as part of their T-2030 plan.

In response to the MPs' suggestions on disclosures, Ong replied, "The ability to achieve this and not disclosures alone is what will move the needle, and make a significant impact beyond Singapore."

MAS aims to develop Singapore as a leading centre for Green finance

He noted that some observers have pointed out that not all the initiatives and targets in the recently-announced Green Plan are new.

While this is a "fair and accurate observation", Ong said it's only right that the plan also incorporates new initiatives, because Singapore has been implementing strategies to preserve the environment for "many years."

According to Ong, the plan attempts to synthesise and consolidate all the disparate initiatives and elevate their importance.

Each Green Plan initiative is a "major, multi-year undertaking" and MAS's strategy is to develop Singapore into a leading centre for Green finance, announced in Nov. 2019.

If Singapore is able to successfully mobilise capital and new investments into the green economy, it can bring about a "virtuous cycle" of economic growth, and create environmentally-sustainable jobs.

Ong added:

"In the coming years, we will need to work very hard with the industry and all our partners, to build environmental risk resilience into the financial system, of which quality disclosures play an important part, expand green finance solutions and markets, and leverage innovation and technology. The work is cut out for MAS and the financial services sector."

You can watch his full remarks at this link.

Related story:

Top image from CNA video.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.