More bad news for Singapore Airlines (SIA) Group as it reported a net loss of S$142 million in the third quarter of 2020/2021.

Revenue for 3rd Quarter

According to a press release from SIA on Feb. 4, they recorded a total group revenue of S$1.067 billion in the third quarter.

This was a major drop from the S$3.404 billion recorded in the third quarter of one year previous, mostly due to the global Covid-19 pandemic affecting passenger numbers.

However, SIA earned revenue from cargo flights, with strong demand for pharmaceutical and e-commerce goods. SIA stepped up capacity with passenger aircraft operating cargo-only flights.

Expenditure and net loss for 3rd Quarter

SIA spent S$1.398 billion in the third quarter, with net fuel costs clocking in at just S$274 million.

Therefore, its operating loss for the third quarter is S$331 million, as compared to a profit of S$449 million the previous year.

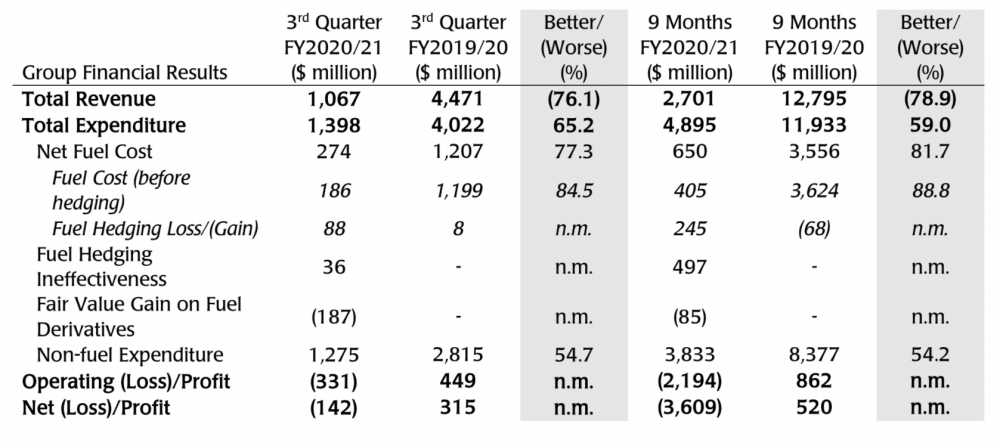

But SIA reported a net loss of S$142 million for the quarter due to a swing from tax expense to tax credit. You can see a summary below:

Screenshot from SIA.

Screenshot from SIA.

Overall loss recorded for nine months ending in Dec. 31, 2020

The overall picture looks similar when you look at the nine months from the end of March to the end of December, 2020.

The overall net loss recorded for this period is S$3.609 billion, as compared to a S$520 million profit in the same period the previous year.

SIA recorded a staggering 98.5 per cent drop in traffic because of the pandemic, leading to losses.

It also recorded various charges for things like the liquidation of NokScoot.

However, SIA spent less on non-fuel expenditure, which it attributed to cost-saving initiatives and government support schemes.

The aviation sector received substantial support from the government from its various Budgets and other measures in 2020.

Balance sheet

As at Dec. 31, 2020, the Group shareholders' equity is S$15.7 billion.

This is actually an increase of S$6.3 billion, as compared to March 31, 2020.

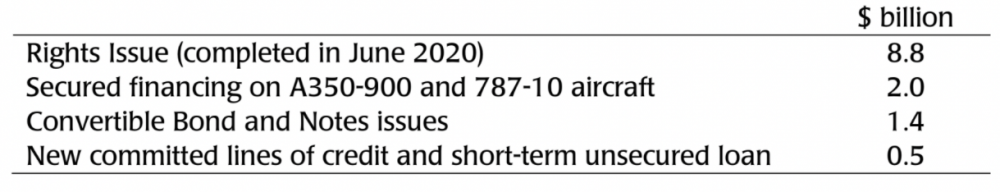

"In the first nine months of the financial year, SIA increased its liquidity by approximately $12.7 billion. In December 2020, SIA closed a five-year convertible bond issuance for $850 million and a private placement of 10-year Notes that raised $500 million."

Screenshot from SIA.

Screenshot from SIA.

In addition, SIA also issued its first USD-denominated bond in January 2021, raising US$500 million (S$666 million).

To-date, SIA has raised approximately S$13.3 billion in additional liquidity since the beginning of the financial year.

SIA also has access to over S$2.1 billion in committed credit lines, along with the option to raise up to $6.2 billion in additional mandatory convertible bonds before the Annual General Meeting in July 2021.

"These liquidity measures will allow the Group to be in a position of strength as it emerges from this crisis," SIA said.

Preparing for a post-Covid world

SIA Cargo transported the first Covid-19 vaccines to Singapore in Dec. 2020, demonstrating its ability to move delicate cargo like vaccines. As vaccine production ramps up, SIA is looking to capture a share of the traffic to Asia and the Southwest Pacific region.

The aviation sector in Singapore has been prioritised for vaccinations, with over 90 per cent of the operating crew in all three airlines having signed up.

SIA also expanded its use of digital technology, offering digital verification of Covid-19 test results and vaccination information.

It also achieved a Diamond rating, the highest in the Airline Passenger Experience Association (APEX) Health Safety audit, displaying world-class health and safety standards of both on-the-ground procedures and in-flight measures.

Related stories:

Top image by Yeo Kai Wen via SIA's Facebook page.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.