Follow us on Telegram for the latest updates: https://t.me/mothershipsg

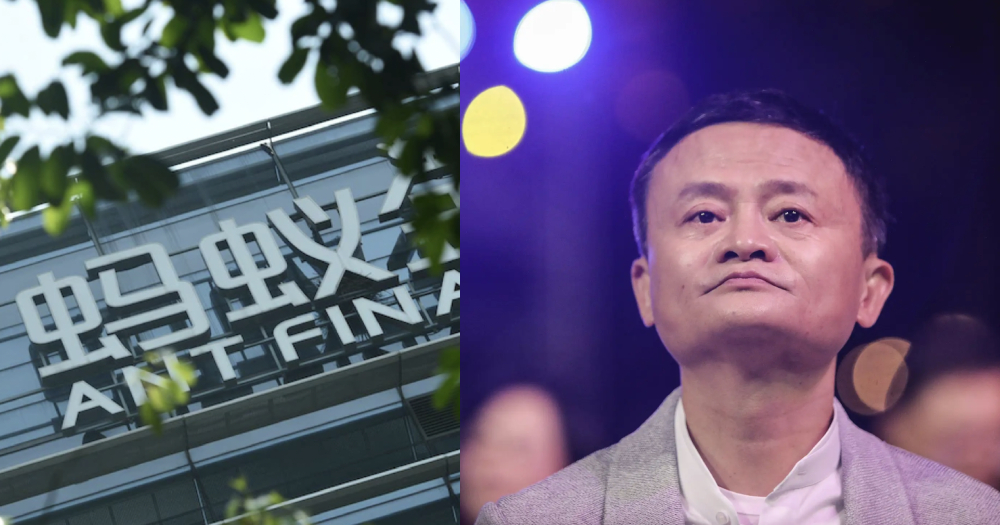

Ant Group, which is owned by Chinese billionaire Jack Ma, is restructuring itself as a financial holding company under the authority of China's central bank.

Move was in response to government pressure

The move is supposedly a response to pressure from the Chinese government to keep in line with financial regulations, according to The Wall Street Journal (WSJ).

Chinese regulators had reportedly told Ant -- which has mainly described itself as a technology company for years -- to become a financial holding company entirely, which means it will be subjected to more stringent capital requirements.

This would subject Ant to similar regulations that banks have to abide by, which might affect its growth and profitability.

The move was not planned by the company's top executives in its initial stages as Ant said it wanted one of its subsidiaries to become a financial holding company

Ant is the fintech spinoff from Alibaba that operates the Alipay mobile payments and lifestyle app which has more than one billion users in China.

Ant's US$34.5 billion (S$46 billion) dual listing in Shanghai and Hong Kong were abruptly shut down in November last year by regulators over what South China Morning Post reported as concerns that it posed a systematic risk and was violating consumers' privacy.

Xi Jinping reportedly ordered the crackdown on Ma's tech empire

According to another report by WSJ which cited Chinese officials with knowledge of the matter, the decision was reportedly made by Chinese President Xi Jinping himself.

Xi had reportedly learnt of the speech made by Ma at a Shanghai event, which government officials saw as an attempt to tarnish the reputation of regulators by criticising them for holding back technology development.

This apparently stirred Xi's ire, which led to the decision.

As Ma tries to get back into Beijing's good graces, similar moves to fall in line with government-mandated measures are to be expected.

Related story:

Totally unrelated but follow and listen to our podcast here

Top image via Wang He & Costfoto/Barcroft Media via Getty Images

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.