Follow us on Telegram for the latest updates: https://t.me/mothershipsg

You might have seen the name "GameStop" in the news recently.

Battle of wills

The saga concerning it is the classic story of David versus Goliath, except that in this epic tale, it was a battle of wills between small investors and a bunch of Wall Street hedge funds.

Simply put, a bunch of retail traders (people who trade on the stock market for their own personal accounts, instead of an organisation) on Reddit pushed up the value of shares belonging to GameStop, a video game retailer.

In the process, the Redditors foiled the plans of several hedge funds who were betting that the GameStop's share value would go down, causing the hedge funds to lose billions of dollars.

This story might seem a bit complicated, but read on; we'll try our best to simplify it for you.

A video game retailer in decline?

We start with GameStop, the video game retailer who operates more than 5,000 stores in the United States.

GameStop had not been doing well for a variety of reasons, as explained by Vox: Malls that are dying out, threats from digital game downloads, and, of course, the Covid-19 pandemic.

However, in September 2020, Ryan Cohen, an investor and co-founder of a pet e-commerce company, acquired a 13 per cent stake in GameStop and urged the company to move its business online to rival Amazon, reported The Guardian.

"What an ambitious bet. Confirm will fail," thought several Wall Street hedge funds and investors who saw this as an opportunity to "short" GameStop's stock.

GameStop, the company whose stocks were shorted. Via Nasdaq.com

GameStop, the company whose stocks were shorted. Via Nasdaq.com

What is shorting?

This is when you borrow shares from someone and make a bet that the share price will go down.

You then sell the shares at the current price, buy them back once the price goes down, and make a profit in the process.

Importantly, the shares must be returned to whomever loaned them out after a period of time, along with some interest.

Complicated? Here's a simple analogy, using durians:

Peter has a basket of durians. The market price of durians is S$20 a piece. John comes along and takes one durian from Peter, promising that he would return the durian after a week.

John goes out and sells this durian for S$20, which he promptly pockets. It is durian season and he is pretty confident that the price of durians will go down.

He surveys the local durian shops closely and true enough, the price of durians falls by S$2 within one day. On the fifth day, the price of durians falls by another S$5.

Seizing the opportunity, John buys a durian for S$13, which he returns to Peter.

Receiving S$20 for the first durian and paying out S$13 for the second durian means that John made a profit of S$7 — all without needing a durian of his own.

Shorting shares is not illegal. In fact, many Wall Street fortunes have been made this way.

It is, however, very risky because the losses can be immense if the price goes up instead of falling.

Going back to the durian analogy, John would make a loss if the price of durians goes up to, say, S$30 — perhaps because of a blight that ruined a huge shipment of durians.

Buying a durian back at S$30 means that he makes a loss of S$10.

Redditors decide to mess with Wall Street hedge funds

Now, let's return to GameStop and the Wall Street hedge funds.

Many hedge funds and investors went to borrow GameStop's shares from the company's shareholders.

They then sold the shares, betting that the share price would drop. They expected that they would be able to buy back the shares at a lower price later.

Now, a bunch of amateur investors on the /wallstreetbets/ subreddit forum noticed that GameStop's stock was heavily shorted by many hedge funds on Wall Street and investors.

Redditors promoted the buying of GameStop shares, framing it as a battle between small investors like themselves and the big Wall Street firms and hedge funds, and spurred the price of GameStop shares upwards by buying and selling among themselves.

This is called a short squeeze.

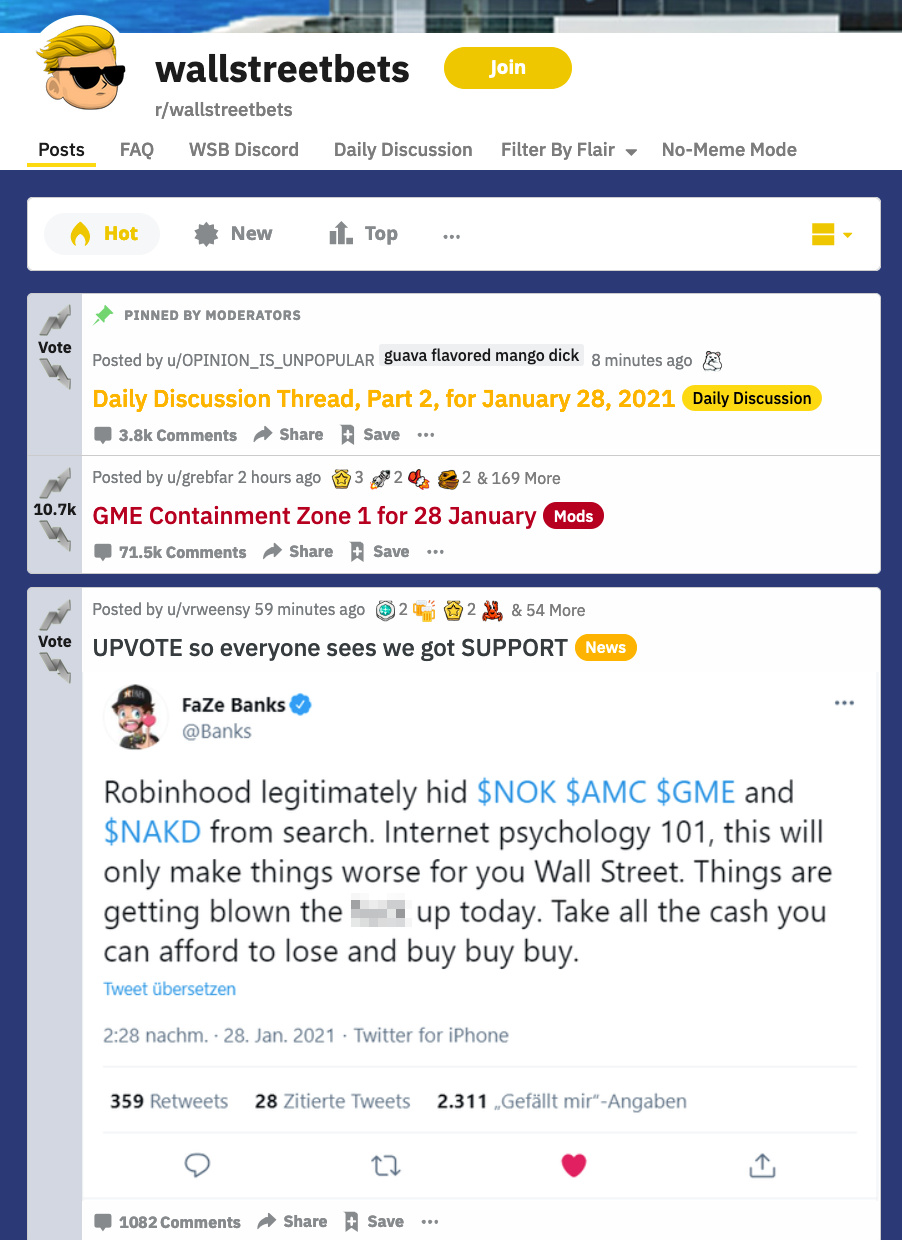

The subreddit forum.

The subreddit forum.

Using the durian-selling analogy again:

Encouraged by his success with Peter's durian, John decides to borrow Peter's entire stock of 1,000 durians, promising to return him 1,000 durians in a week's time.

John takes the durians and sells them for S$13 each. He makes 1000*13 = S$13,000.

John bets that the price of durian will fall even further, perhaps to S$10. Then, when he buys back all 1,000 durians, he would still make a profit of S$3,000.

Nice.

Now, a group of Redditors finds out about John's profit-making scheme. Together, they go around Singapore buying up all of the durians that they can find.

They then drive up the price of durian by buying and selling the fruits among themselves on Reddit.

By the end of the week, the price of durians is S$100 a piece.

John, having to return 1,000 durians to Peter by the deadline, has no choice but to spend S$100,000 to buy the durians back.

However, John does not have S$100,000. He would have to seek help from a buddy (a bailout) or suffer the losses and be declared a bankrupt.

Very big losers and very big winners

The same thing happened with the price of GameStop's shares.

On Dec. 31, 2020, each share cost about US$19 (S$25).

By Jan. 26, 2021, the price had soared to about US$148 (S$197).

Yesterday (January 28), it climbed to US$346.51 (S$462.71).

A meme circulating on Facebook.

A meme circulating on Facebook.

Reuters reported that GameStop's shares jumped by a staggering 1,600 per cent in the last few days.

At this point, the investors and hedge funds who shorted GameStop's shares would face huge losses if they bought back those shares to return them to GameStop shareholders.

One hedge fund in particular, Melvin Capital Management, lost 30 per cent of the US$12.5 billion (S$16.7 billion) it was managing. Other hedge funds came to bail it out, and it eventually stopped trading GameStop shares.

The Guardian reported that from the start of the year until now, these bets have cost professional investors (including hedge funds) a cool US$6.12 billion (S$8.15 billion). On Monday (Jan. 25) alone, the loss amounted to US$2.79 billion (S$3.72 billion).

Conversely those small investors who bought GameStop's shares — but not for shorting — would have made quite a tidy sum if they decide to stop holding on to the stocks and sell them.

One /wallstreetbets/ trader claimed that they turned US$50,000 (S$67,000) into US$11 million (S$14.7 million) by playing options, reported Vox.

Why did these Redditors do such a thing?

So why would this group of Redditors come together and do something that might even cause them to lose money (when GameStop's share price drops)?

An analyst told the BBC that he believes this battle is personal, that these group of average Joes hate hedge funds and are "hell-bent on taking on Wall Street".

"It's a generational fight, redistributive and all about robbing the rich to give to the millennial 'poor'," he opined.

Damn, actually on the sub rn and it's common sentiment. Just wow pic.twitter.com/uGb8gen2lY

— im a spoon 🥂 (@Velokx) January 27, 2021

And it's not just the small traders who have a bone to pick with short sellers.

Some millionaire and billionaire investors, also known as "whales" due to their ability to impact the stock market with their high liquidity, aren't the greatest fans of short sellers either.

One of them was Elon Musk, Tesla entrepreneur and also currently the richest man in the world, who apparently had a beef with short sellers who tried messing with Tesla's stocks by driving them down.

With a single tweet, he sent GameStop's shares soaring.

Gamestonk!! https://t.co/RZtkDzAewJ

— Elon Musk (@elonmusk) January 26, 2021

When will it stop?

Some investors are continuing to short GameStop's shares, in hopes that its price will stop climbing and plunge to its actual value.

According to The Guardian, about 71.66 million GameStop shares are currently shorted.

The founder of investing firm Citron Research — one of those who shorted GameStop's shares — put out a video (now deleted) on Twitter last week predicting that the stock would plunge to US$20 (S$25).

Today, Citron Research has also pulled out of the game.

Last night, GameStop's shares peaked past US$500 (S$664) before it dropped to US$193.60 (S$257.28)

It has dropped because some brokerage firms prevented traders from buying as the price fell.

Will the price of the GameStop's shares drop further? Possibly. The situation is now a game of chicken as investors on both sides continue to buy and sell off the company's shares.

Financial experts have warned that small investors — especially those who have made money — need to unload the shares and exit before they make losses.

Mothership Explains is a series where we dig deep into the important, interesting, and confusing going-ons in our world and try to, well, explain them.

This series aims to provide in-depth, easy-to-understand explanations to keep our readers up to date on not just what is going on in the world, but also the "why's".

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.