You always hear people say that you should invest your money to manage your savings well.

But the idea of investment conjures up images of coloured lines of red and green moving up and down, and these images can seem quite daunting for the uninitiated.

Investment does not necessarily require staring at charts and figures all day. In fact, this resembles day-trading more than longer term investing.

But what is the difference between investing and trading? In this article, we will try to decipher the key differences between investing and trading, with as little jargon as possible.

What is investing?

One of the key differences between investing and trading are the goals and the time period involved with each trade.

A traditional goal of investing is to gradually build wealth. This is usually accomplished by holding stocks for an extended period of time — usually years or even decades.

As such, investors are more likely to hold out their stocks during broader downtrends caused by economic recessions, with the expectation that any initial losses in the value of the stocks are not actualised. These losses can then be potentially reversed to gains when the economy recovers and the stocks are sold at the appropriate time.

Investing is usually done as an alternative to keeping your money in a savings account because the long term returns on investments can be higher than interest rates offered by banks.

What are the risks of investment?

Investing generally has a lower risk, with traders usually looking to invest in reputable companies with sound fundamentals such as stable revenue and earnings growth.

The share prices of these companies tend to be less volatile despite still being subjected to fluctuations caused by the longer-term broader economic cycle.

Hence, it is easier for the investor to calculate and establish beforehand how much money they are personally willing to lose.

Furthermore, investors usually expect to hold these assets over a longer period of time. This means that even if the value of the assets drop below the price they paid for it, they can continue to hold the assets and sell it when it is at a higher price.

Investors also do not have to bother about shorter-term fluctuations in value, making it a more appropriate strategy for those who do not want to constantly monitor the market.

What is trading?

The goal of trading is to generate returns higher than investing, by buying and selling assets more frequently.

The time frame for traders tends to be much shorter in order to capture the short-term opportunities and fluctuations in the price movement of stocks, or their other chosen products (such as currency or commodities).

Traders can deploy trading strategies that involve several short-term time periods; ranging from multi-weeks to multi-days, and even within several minutes or seconds. One of the common strategies is ‘day-trading’, which is when the trader buys and sells their assets within the same trading day.

Traders can also use “leveraged products” to reduce their initial costs and increase potential returns.

With leveraged products, traders only need to deposit a small percentage of the full value of the assets you intend to purchase.

A Contract for Difference (CFD) is one such product. A CFD is an agreement to exchange the difference in the value of an asset from the time the contract is opened until the time it is closed.

In other words, when you purchase a CFD, you are not purchasing the actual asset but rather the agreement to trade at particular price points with the provider. This means that traders can also go ‘short’ and trade when the prices are going down — unlike traditional investments that only generate a profit when the stock-price goes up.

CFDs are also not restricted to shares in companies. This means that you can trade on other assets such as commodities like gold or coffee, or even currencies.

What are the risks of trading?

Trading — especially through CFDs — are generally more risky.

This is because CFDs allow you to trade assets at a fraction of the price, hence magnifying your returns. However, losses are also magnified as they are based on the full value of the trade. This means that traders could lose more than their initial deposits.

Traders should also be aware of the other costs involved with products like CFDs. Some CFDs charge a holding cost, which is a cost imposed for holding a position past a trading day. Some providers of CFDs also charge commissions on positions taken.

These costs can add up, and they can affect potential profits and losses.

Do your homework

The two strategies are not mutually exclusive.

People who want to trade but also stay invested for the long-term can opt to use a portion of their liquid cash on hand to do short-term trading.

Both trading and investment definitely involve risks, so ensure you do your homework before trading to understand the risks and how they play into your own strategies and goals.

It can also be useful to practise with a demo account before you trade with actual money. This gives you the opportunity to get comfortable with the trading platform and trial different strategies before putting down a deposit.

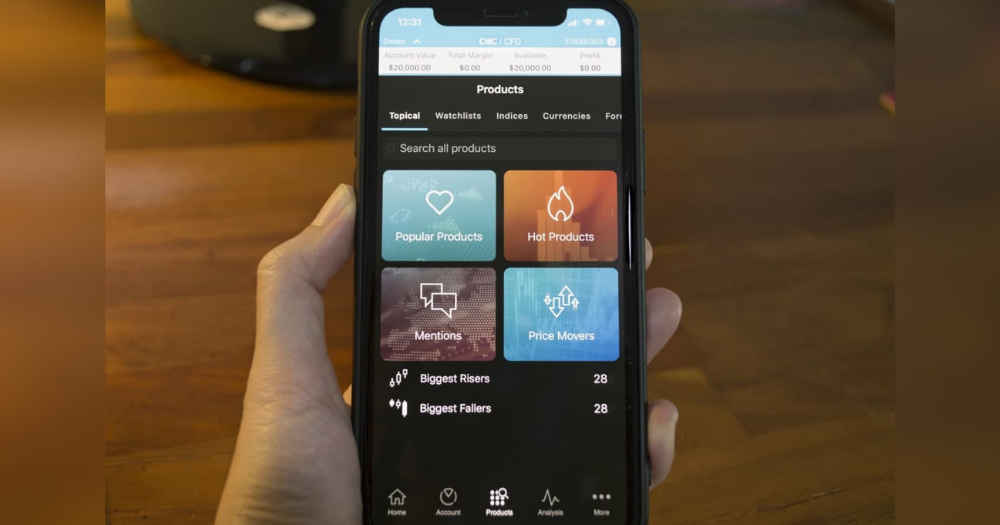

CMC Markets, an online trading provider that offers CFDs, allows users to create a free demo account to practise trading with virtual money before using actual money.

They also provide a suite of free education tools and resources, such as platform guides, webinars, and insights from global analysts.

And in case you are worried about the legitimacy of CMC Markets, they are licensed and regulated by the Monetary Authority of Singapore.

This sponsored article is brought to you by CMC Markets.

This advertisement is for information only, not an investment recommendation or financial advice. Losses can exceed your initial deposit. See risk warning/disclosure & other important information on www.cmcmarkets.com.sg. This advertisement has not been reviewed by the Monetary Authority of Singapore (MAS). CMC Markets is regulated by MAS.

Top image from CMC Markets.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.