Millennials in Singapore have money at the top and bottom of their minds it seems, the latest Financial Wellness Index 2020 survey by OCBC Bank has revealed amid the Covid-19 pandemic.

This is the second year the bank has conducted a survey to understand Singaporeans' financial wellbeing.

How survey was conducted

This year, a survey was conducted in September involving 2,000 working adults aged between 21 and 65 years old.

The survey consists of 44 questions crafted based on 24 indicators which fall under 10 pillars of financial wellness.

The 10 pillars include saving, investment, spending, and borrowing habits.

The survey correspondents are broadly categorised into three groups for analysis:

- Millennials, aged 21-39 years old

- Gen X, aged 40-54 years old

- Baby boomers, aged 55 years old and above

Millennials are worried about money

According to the survey, 49 per cent of the millennials were worried about money in the past week, compared to 37 per cent of Gen X and 26 per cent of Baby boomers surveyed.

The three key areas that millennials are most worried about:

- Worried about not being able to take care of their loved ones (67 per cent)

- Worried about not being able to afford a house for their own stay (55 per cent)

- Worried about not being able to keep up with peers (46 per cent)

Only 48 per cent of millennials, as compared to 70 per cent of the Baby boomers and 50 per cent of the Gen X, are able to sustain themselves financially for six months if jobless.

More millennials (38 per cent) are also having problems paying their housing loan on time as compared to 25 per cent of Gen X and 28 per cent of Baby boomers.

Not being prudent with spending

The results show that millennials have taken a hit on having regular passive income with a drop in index scoring from 43 to 26.

Millennials were also found to be the age group least prudent with their spending.

As compared to Gen X and Baby boomers, more millennials often borrow money from friends and relatives.

More millennials often pay only the minimum sum on credit cards too.

48 per cent of millennials are also spending to some extent, or large extent, to keep up with peers as compared to 40 per cent of Gen X and 30 per cent of Baby boomers.

Impatient with investment

The survey finds millennials driven to invest as they want to achieve more faster.

As a result, this group can be impatient with their investment.

42 per cent of millennials were found to not knowing how to best invest their money as compared to 35 per cent of Gen X and 30 per cent of Baby boomers, according to the survey results.

Among those who invest, more millennials (55 per cent) get their information about financial matters online as compared to older correspondents (47 per cent for Gen X and 36 per cent for Baby boomers).

They are also least likely to seek professional advice when making investment decisions and more likely to speculate excessively to make quick gains as compared to the older correspondents.

General findings

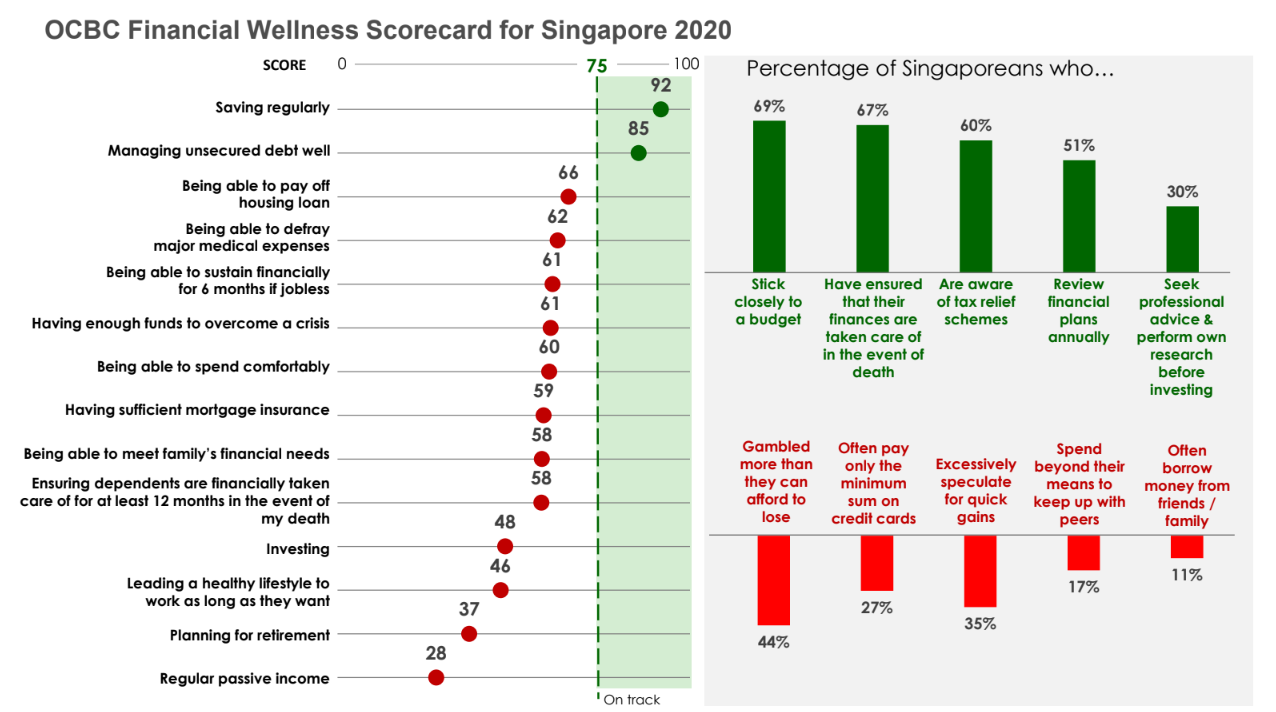

Overall, Singapore scores 61 out of 100 for its 2020 OCBC financial wellness index, down two points from 2019.

Image from OCBC Financial Wellness Index results.

Image from OCBC Financial Wellness Index results.

In 2020, OCBC finds most Singaporeans are saving regularly and can manage their unsecured debt well.

However, Singaporeans performed poorly at investing and retirement planning.

The Covid-19 pandemic which brought about a global economic slump, has affected Singaporeans' financial wellness.

There has been a drop in Singaporeans' ability to pay off housing loans and their regular passive income has been affected, as compared to that of 2019.

Regular passive income has taken a hit mainly due to the poor performance of dividends, which is the main source of passive income for most.

However, the pandemic has seen Singaporeans generally perform relatively well at saving regularly, being able to defray medical expenses, and being able to sustain themselves financially for the next six months in the event they lose their job.

You can read up more on OCBC Financial Wellness Index 2020 and tips to manage wealth better from the bank's financial experts here.

Totally unrelated but follow and listen to our podcast here

Top image by Andrew Koay

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.