Temasek Holdings closed its financial year ending March 31, 2020, with a drop in its net portfolio value from the previous year.

Shrink in net portfolio value

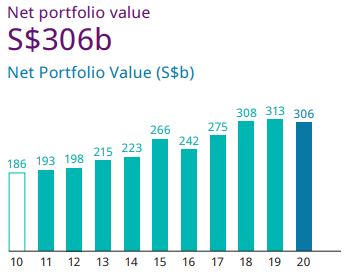

The Singapore state investment arm announced at its annual review on Tuesday, Sep 8, that its net portfolio this year was S$306 billion, which is a fall from the record S$313 billion in 2019, and slightly under 2018's S$308 billion.

The drop in its net portfolio is also its first in four years.

Graph via Temasek

Graph via Temasek

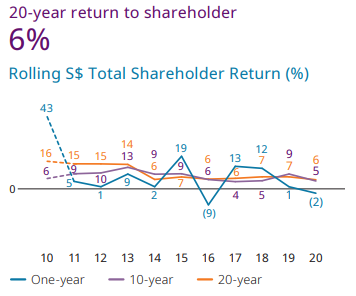

Its one-year return for shareholders took a dip too, from 1.49 per cent in 2019 to -2.28 per cent this year.

Its total shareholder return over 10 years was also down from nine per cent in 2019 to five per cent in 2020.

Graph via Temasek

Graph via Temasek

Still, Temasek noted that its net portfolio in 2020 was up S$120 billion over the decade, and is almost triple the value two decades ago.

Fall in net portfolio due to Covid-19

The shrink is mostly due to the impact of the Covid-19 pandemic on the last quarter of the financial year, which has cut short a promising end to Temasek's performance this year, said Yeoh Keat Chuan, Senior Managing Director of the Enterprise Development Group at Temasek.

Nevertheless, the resilience of its portfolio came through, he said.

The investment company has invested S$32 billion and divested S$26 billion during the year, therefore ending the year with a resilient balance sheet, according to a press release issued by Temasek.

Elaborating on the drop, Png Chin Yee, Deputy Chief Financial Officer of Temasek, said it was mitigated due to their resilient private book, or cash balance, which they had coming into the pandemic.

Cautious approach ahead to deal with global economic downturn

Looking ahead, Temasek will adopt a cautious approach in view of the global economic downturn.

The resurgence of Covid-19 cases has resulted in extended lockdowns, which contributes to continued uncertainty in the global economic outlook, Yeoh said, adding that it could result in a prolonged economic slowdown.

Furthermore, increased geopolitical tension and technology bifurcation could result in a more uncertain environment for long term investors and asset owners, he said.

This is why Temasek will remain cautious, and stay open to investment opportunities in resilient companies, he explained.

Png added that in view of the clouded outlook for economic recovery due to the "unpredictable paths of Covid-19 and geopolitical issues", Temasek will remain "watchful" and "disciplined" in their investment approach.

The company will focus on building a portfolio that will benefit from "policy tailwinds", and is resilient in the long term, she added.

Still optimistic on China

China still accounts for the bulk of Temasek's investments (29 per cent), followed by Singapore (24 per cent).

North America and Europe come up next at 17 per cent and 10 per cent respectively.

The United States accounts for the largest share of the company's new investments during the year, followed by China and Singapore.

China's economy has recovered strongly after the sharp downturn brought about by the pandemic, due to the steady resumption of industrial activity, and the continued resilience of exports.

But on the downside, some sectors continue to face headwinds, and for the first time in nearly 20 years, China did not set a GDP growth target.

Nevertheless, Yeoh said the investment company said it is still optimistic on China over the medium term.

This is because they expect Chinese authorities to remain focused on rebalancing the economy, even if upholding broadly accommodating policy to support the economy and boost jobs while implementing reforms may be challenging.

Yeoh also noted that while growth in Southeast Asia is likely to be muted due to the global economic downturn, coupled with a decline in trade and demand, the region remains fast growing, and its economic recovery will be boosted by structural reforms.

Internal wage freeze channelled savings to community

In the review, Yeoh also talked about the internal wage freeze Temasek announced back in February to "lend moral support to their portfolio companies".

These savings were then further channelled towards Covid-19 intiatives for the wider community, he said, raising examples of free hand sanitisers and face masks the company has offered to Singapore residents.

Beyond the provision of supplies, 400 staff have also volunteered for initiatives in Singapore and around the world. Yeoh said:

"When our colleagues and friends in China were heavily affected by the pandemic, our staff in Singapore and elsewhere rallied to provide supplies and support.

Later, when there was a spike in cases here, and in other places like London and New York, our China colleagues helped us. They procured supplies and shared what they had learned about the virus, so that we could all stay mentally prepared."

Closed the year with carbon neutrality

Temasek also emphasised that it has closed the year with carbon neutrality, saying that they are committed to halve the net carbon emissions attributable to its portfolio by 2030.

In addition, they aim to have a net zero emissions portfolio by 2050.

Besides intending to invest in negative emissions technologies and nature-based solutions, they said they are committed to using climate risk analysis to guide decisions on their new investments in the decade ahead.

Png said that research has shown that companies who focus on ESG (Environmental, Social, and Governance) factors which are pertinent to their industry actually produced better shareholder outcomes.

Dilhan Pillay Sandrasegara, CEO of Temasek International, added that "nine out of the 10 largest asset managers in the world" have said that they are going to put in place a sustainability framework, and require their investing companies to perform according to that framework. He said:

"So you know, every board, every management team has to think about this because it's no longer something in the periphery, it's actually mainstream."

Totally unrelated but follow and listen to our podcast here

Top image via Temasek

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.