The government needs to create more ways to help Singaporeans who live in private estates.

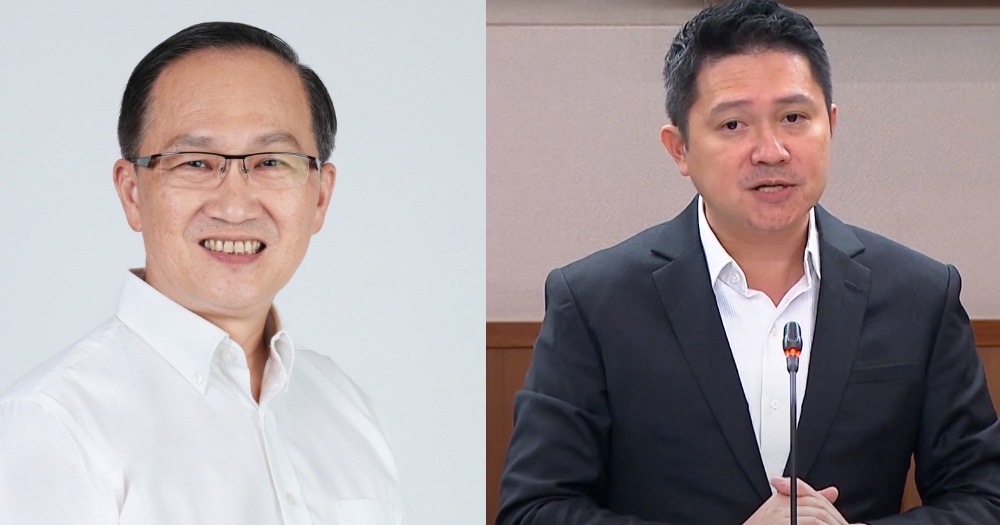

This is the view of Members of Parliament (MPs) Lim Biow Chuan and Henry Kwek, who delivered their first speeches for the 14th Parliament on Monday (Aug. 31).

Lim said that Singaporeans who live in homes above a certain annual value should not be deemed self-sufficient, as they may have other financial burdens, while Kwek urged the government to review means testing criteria for asset-rich, cash poor residents, who may still need financial assistance.

Policy of pegging assistance to annual value of property should be reviewed

According to Lim, while the government has dug into its reserves to help those adversely affected by the Covid-19 pandemic, those who live in homes above a certain annual value did not receive the help they require.

While he acknowledged that those who are of a lower income should get more help, he argued that Singaporeans who live in homes above a certain annual value should not be deemed "self-sufficient".

Lim said that when a Singaporean suffers loss of income, he requires help, "regardless of his house type".

He then brought up the fact that these individuals may need to look after sick elderly parents or look after children with special needs, and that they may not be able to sell their home during a financial crisis.

"During good times, he pays all his taxes dutifully. But when times are hard, should the government decline to help these people just because they have a house with higher value? Is the Covid-19 crisis something which they should have predicted?" he said.

He also brought up the fact that some of these residents may not own the property, and may simply be tenants, or are children of the actual owners of the property.

Lim argued that the government should not have the expectation that "people don't deserve help simply because they have bigger homes", and that the government should look into their loss of income as well, when deciding whether such individuals require financial aid.

He questioned whether the government must always insist that these individuals sell their homes, before they are eligible to get short-term Covid-19 aid, and urged the government to review the current policy of pegging assistance to annual values of properties.

Government needs to rethink social compact with private estate citizens

This was a view mirrored by Kwek, who also urged the government to start rethinking their social compact with private estate citizens.

He said that private estate residents fund the lion's share of tax revenues in Singapore, while consuming a limited amount of government assistance.

While he calls this the "right balance", given that they are the "economic winners" of Singapore's society, he said that a number of private estate residents may be in need of government assistance.

This includes retired seniors, whom he describes as "asset-rich but cash poor", residents above the age of 50 facing career uncertainty, residents who do not own the home they stay in, and residents who are deeply impacted by Covid-19.

Kwek urged for the government to actively work with the banking and insurance sectors to create reverse mortgage options for private estate residents, in order to help those are asset-rich but cash poor tap with their housing equity.

He also suggested that the government can work with banks to remove barriers for elderly individuals to borrow against their housing equity at a reasonable rate.

"If our people can tap on their housing equity effectively, I believe most Singaporeans in the private estates would prefer to stand on their own two feet, instead of relying on the government assistance," he said.

Government should review means testing criteria

Kwek acknowledged that while these individuals can technically sell their houses and downgrade in times of need, this would mean that they would have to be uprooted from the neighbourhoods that they "so cherish in their golden years".

He also emphasised that while there are seniors who are financially savvy and can make adequate financial planning to ensure that they benefit from annuities and dividends, not all seniors, especially those from the Pioneer generation, are financially savvy enough to navigate "the tricky global economic waters".

Kwek suggested that instead of using annual value of homes as a key determinant of means testing, the government can look into a combination of non-housing assets, income, and per capita housing equity of the occupants.

He also suggested tiering government benefits, in order to remove the large difference of benefits between public housing and private housing.

Kwek called for a review of government policies on housing grants for seniors and their next generation who want to move from private housing to public housing, and also suggested adding pathways for the downgrading of hospitalisation ward class.

He also suggested reviewing criterion on Covid-19 related assistance programs, such as the Self-employed person income relief scheme (SIRS) and the Covid-19 Support Grant (CSG).

We deliver more stories to you on LinkedIn

Top image via Lim Biow Chuan/FB and Gov.sg/YouTube.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.