In the face of a global pandemic and economic crisis, lower future returns and increased market volatility are expected, according to GIC.

In an article accompanying its annual report, the sovereign wealth fund laid out four major shifts that were likely to precipitate a challenging investing environment.

This included:

- Uncharted policymaking given high debt levels and low interest rates

- Intensified headwinds for globalisation

- Rising headwinds in Asia

- Increasing industry consolidation

"In this environment, GIC continues to proactively seek opportunities that will generate good long-term risk-adjusted returns, as well as ensure that the total GIC portfolio remains resilient to uncertain outcomes," said Chief Executive Officer Lim Chow Kiat.

Lim added that GIC had to stay true to its mandate of achieving good long-term returns above the global rate of inflation while preserving and enhancing the international purchasing power of Singapore's reserves.

According to Lim, prior to the pandemic, GIC became increasingly concerned with "high valuations, weakening economic cycle fundamentals, limited room for policy flexibility, and geopolitical tensions".

This caused the sovereign wealth fund to position itself defensively, a stance that has helped the portfolio withstand the more extreme market movements caused by the unexpected arrival of Covid-19.

Yet as their feature article "A Changing Global Investment Environment" points out, the outlook for investors was "particularly uncertain".

1. Uncharted policymaking given high debt levels and low interest rates

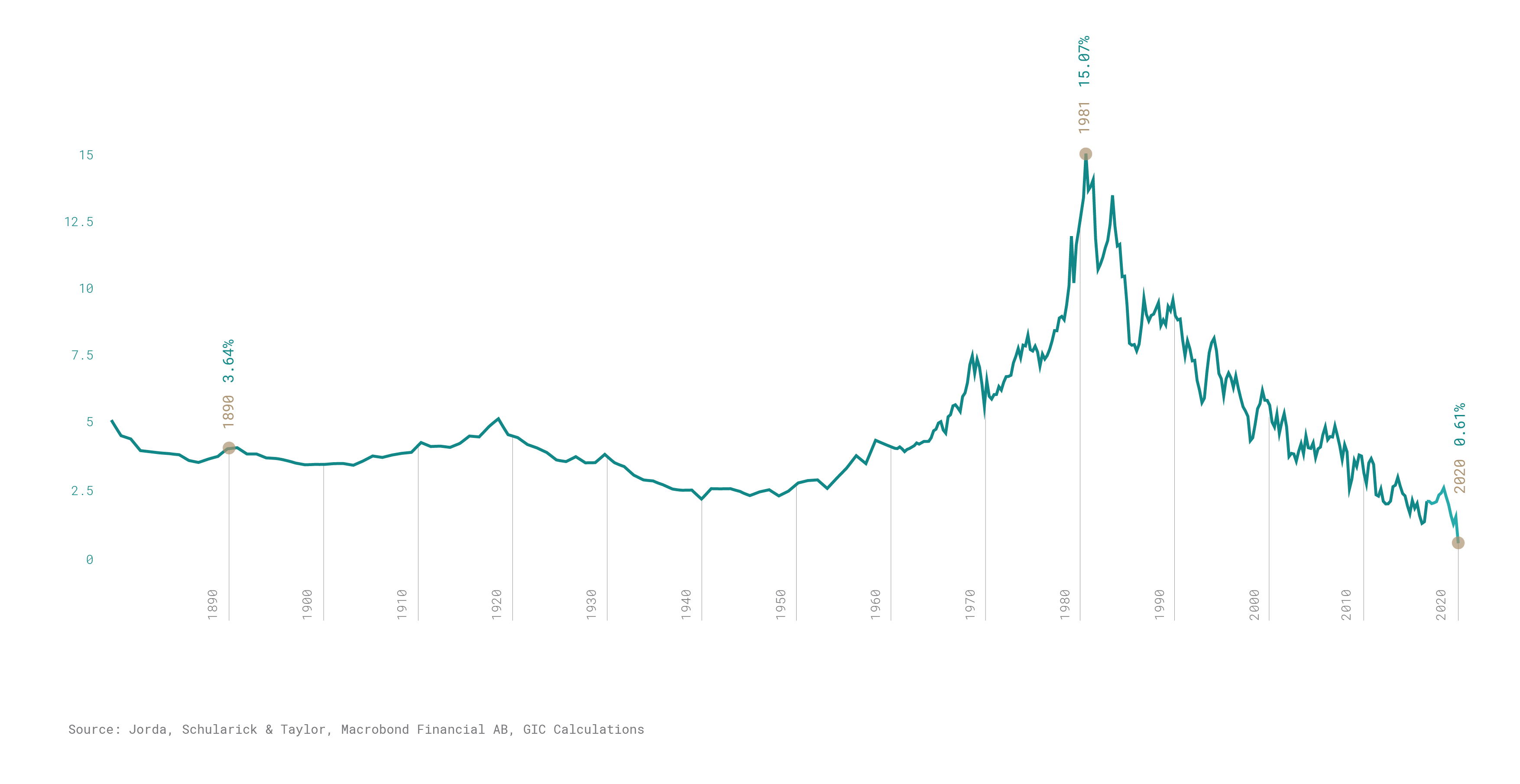

Noting that pre-Covid-19 global interest rates were "already at their lowest levels for at least 140 years", GIC said steadily increasing levels of debt were expected to be amplified in the post-crisis world as companies borrowed to stay afloat.

"Such elevated levels of debt, in turn, limits the extent interest rates could rise without causing a significant slowdown in the economy," wrote GIC.

This quandary means that central banks have turned to "unconventional measures to support the economy".

Specifically, GIC pointed out two fundamental changes to policymaking:

- With regards to monetary policy, the major central banks were now unlikely to respond pre-emptively to signs of higher inflation, instead willing to accommodate periods of above-target inflation.

- Fiscal policy is set to play a bigger role in stimulating the economy, given the limited policy room for central banks to cut rates.

However, GIC warned that while these policies had been "critical" in propping up the economy, they may yet prove difficult to calibrate and reverse when the economy returns to normal.

The article further spelt out two ways that the policies could change the investment environment:

- Increasing the risk of higher inflation over the medium term

- Increasing the role currency moves play in asset return for a global investor

Global long-term interest rate. Image by GIC.

Global long-term interest rate. Image by GIC.

2. Intensified headwinds for globalisation

With corporations looking to create greater resilience, GIC explained that global supply chains were being re-thought with a view towards increased reliability and reduced complexity.

Supply chains could be shortened by the adoption of emerging technology while companies would also look to diversify their production geographically or bring production closer to home, said the firm.

"In the post-COVID-19 world, global supply chains are likely to undergo significant structural change."

GIC pointed to national security concerns that had already led to pressure to "re-shore supply chains for products such as pharmaceuticals, medical equipment and technology".

"Restrictions on the movement of labour and capital could also tighten to protect domestic interests," they added.

Yet, GIC said that while the pandemic had highlighted the necessity for more robust systems, a major retreat in globalisation would hurt productivity growth.

This was because, according to the firm, reduced globalisation prevented:

- more efficient global allocation of resources

- more competition between companies

- knowledge and technology transfers

3. Asia to see rising headwinds, but still outperform over the long term

GIC reaffirmed its belief in Asia's "growth story" and resilience despite acknowledging the pandemic's significant hit on the region's economic growth,

"As we have seen in the past, even in the face of large uncertainties, the Asian governments, businesses, and people have shown the resourcefulness to adapt and adjust their growth models," stated the article.

The firm also noted the "important differences across Asian economies with respect to the level of development, economic structures, and institutional capabilities".

Speaking in general terms, GIC noted that the region's handling of Covid-19 demonstrated maturity in Asia's institutions and governance.

Further positivity could be drawn from what GIC saw as longer-term solid growth derived from:

- Urbanisation and middle-income growth

- Investments in infrastructure and human capital

- Deeper regional integration of economies and capital markets

The sovereign wealth fund encouraged governments across the region to remain steadfast in their efforts to introduce structural reforms even in the face of headwinds to globalisation.

In their 2019/20 report, GIC disclosed that 19 per cent of its portfolio's assets were allocated in Asia sans Japan.

Japanese assets made up 13 per cent of the portfolio.

Geographical distribution of the GIC Portfolio. Image by GIC

Geographical distribution of the GIC Portfolio. Image by GIC

4. Industry consolidation to increase

The default rate of global listed companies — already risen to the highest level since the Global Financial Crisis — will continue to rise in the short term, perhaps even accelerating, said GIC.

With Covid-19 drastically weakening the finances of many companies, smaller companies were particularly vulnerable to consolidation, wrote the investment firm.

"Barring regulatory action, large companies, with stronger financials and technological advantages, may be better positioned to become even bigger and stronger."

In addition, GIC noted that private equity dry powder reached record highs in June 2020, providing further support for industry consolidation going forward.

Dry powder refers to cash that private equities may have already drawn from the funds they manage or the commitments which investors have pledged to funds but have yet to be drawn by the private equity.

Either way, the term represents undeployed capital that is available for investments.

According to GIC, long-term investors could also play an important role in providing capital to sustain good businesses through these difficult times.

Private equity groups with record dry powder. Image by GIC

Private equity groups with record dry powder. Image by GIC

Image collage from Andrew Koay

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.