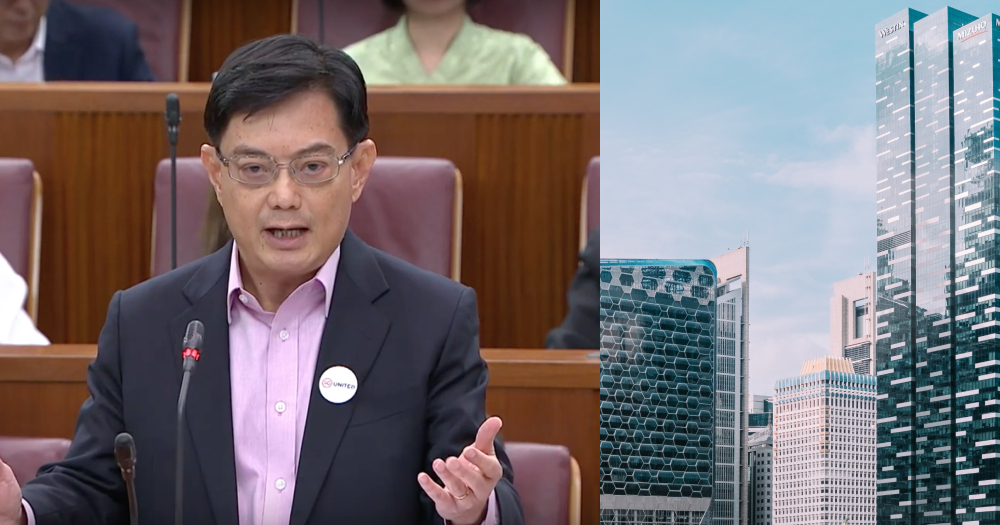

Companies in Singapore will receive their Job Support Scheme (JSS) payouts in end-May instead of end-July, Finance Minister Heng Swee Keat announced in his Budget 2020 Round-Up Speech on Friday (Feb. 28) in Parliament.

The Jobs Support Scheme (JSS), which will cost the government S$1.3 billion to cover all 1.9 million local employees, is meant to help businesses retain local employees during this period of economic uncertainty.

Heng responds to questions if JSS payout can be expedited

DPM Heng shared this update in response to Members of Parliament (MP) Saktiandi Supaat, Seah Kian Peng, and Gan Thiam Poh, who voiced their concerns over the flow of the JSS payout to businesses.

Seah had said in his speech on Wednesday, Feb. 26, that ground feedback on the JSS, which was initially slated to be given out in July 2020, is that it is "rather late" and does little to help mitigate cashflow issues for businesses.

JSS payout to be brought forward by two months

Heng explained that the ministry had initially projected for the JSS payout to reach companies by the end of July because the disbursement of the JSS payout is operationally more complex due to "the need to check and validate information on workers, employers, and payment mode".

In the last few weeks, however, the agencies involved have "redoubled efforts", and are now targeting to bring forward the payment for JSS from end-July to end-May, Heng said.

As for employers using bank crediting, Heng added they can get the payout a week earlier.

Wage Credit Scheme to be given in second half of 2020

Heng provided further details on the Wage Credit Scheme (WCS) as well.

The scheme is meant to support companies that have invested in increasing productivity, and encourages employers to share those productivity gains with their employees, by co-funding wage increases.

Heng said enhancements to WCS will be provided in the second half of the year 2020 so as to "spread out our support for enterprises in a more sustained way".

He added that these measures in the package come on top of the existing support schemes for firms.

For instance, there will be a WCS payout of more than S$600 million to firms next month, based on the parameters announced in Budget 2018, he said.

Tax rebates for property owners & rental waivers for government commercial tenants

In addition, Heng said the measures in the S$4 billion Stabilisation and Support Package should be looked at "in totality".

The ministry is providing a Property Tax Rebate to qualifying commercial properties, for which property owners will receive their revised tax bills in April, and refunds of any excess property tax paid by the end of May, he said.

Heng added they will also be giving rental waivers for government commercial tenants, the majority of which will apply to March and April rentals.

As for the Corporate Income Tax Rebate, companies will receive their revised tax bills by the end of March.

These measures will provide not just financial relief but also help with enterprises’ shorter-term cash flow needs, Heng said.

Top image adapted via gov.sg/Youtube & bady qb/Unsplash

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.