The previously-announced 2 per cent hike in Singapore's Goods and Services Tax (GST) will not be raised in 2021.

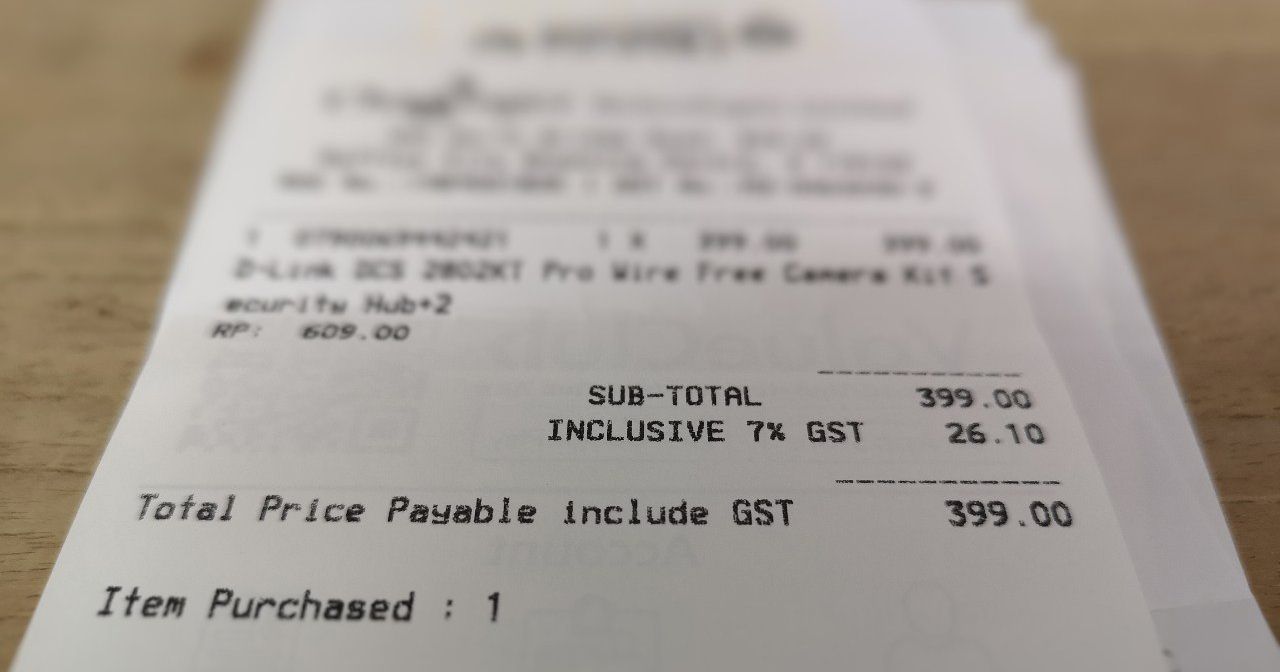

GST to remain at 7% in 2021

Deputy Prime Minister and Minister for Finance Heng Swee Keat announced this in his 2020 Budget speech on Tuesday (Feb. 18), as part of fiscal measures the Singapore government will be undertaking to support Singaporeans in the ongoing Covid-19 outbreak.

"After reviewing our revenue and expenditure projections, and considering the current state of the economy, I have decided that the GST increase will not take effect in 2021. In other words, the GST rate will remain at 7 per cent in 2021."

The planned 2 per cent hike was previously announced in the 2018 Budget.

Last year, Heng said the tax hike is in preparation for anticipated expenditures in healthcare, infrastructure, security and education from 2021 to 2030:

“Between 2021 to 2030, if we do not take measures early, we will not have enough revenue to meet our growing needs.”

But 2 per cent GST increase is still happening by 2025

Make no mistake, the hike will still be happening, though — and it will still be needed by 2025, said Heng, adding that the Covid-19 outbreak has reinforced the importance of continued investment in Singapore's healthcare system.

"We still require recurrent sources of revenue to fund our recurrent spending needs in the medium term," he said.

DPM Heng said the government will assess the appropriate time for the increase, and it will provide Singaporeans with "sufficient lead time" before it is implemented.

$6 billion Assurance Package for S'poreans, with S$700 - $1,600 payout over 5 years

Heng added that the tax and transfer system will remain progressive even after the GST increase.

"We will continue to absorb GST on publicly-subsidised healthcare and education," he said.

To help Singaporeans cope with the increase when it is implemented, Heng says the government will also provide what it refers to as a S$6 billion Assurance Package to cushion the blow. This is distinct from the permanent GST Voucher scheme.

In this, every Singaporean adult will receive a cash payout of between S$700 and S$1,600 over five years.

The majority of Singaporean households will receive an offset which will cover at least five years' worth of additional GST expenses.

Lower income households, such as those living in one to three-room flats, will receive an offset projected to cover about 10 years' worth of additional GST expenses.

"This is the government’s way of ensuring our system of taxes and transfers remains progressive and supports Singaporeans through the change," said Heng, "while enabling us to fund our future needs in a sustainable way."

Top photo by Joshua Lee

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.