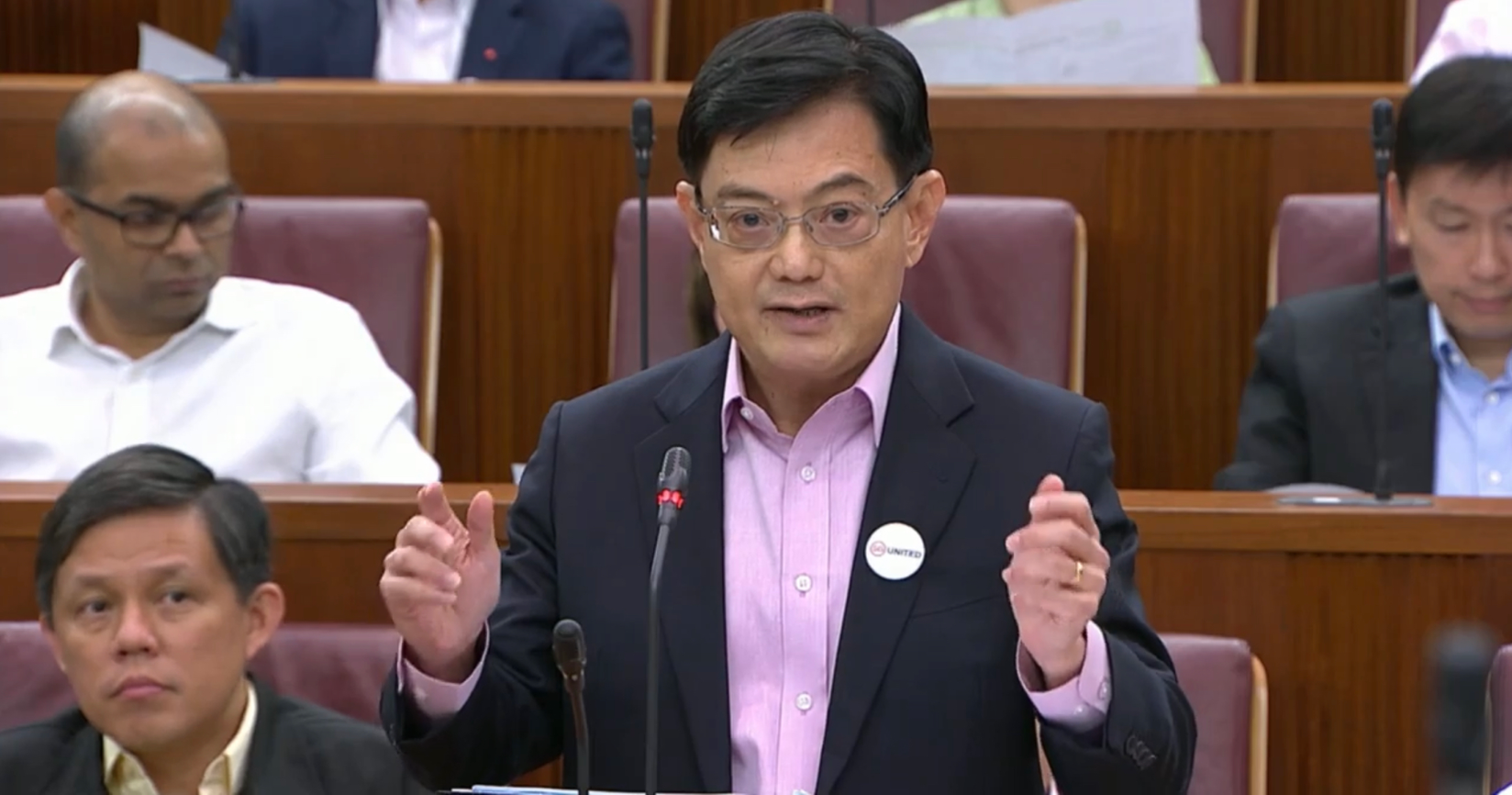

Deputy Prime Minister and Finance Minister Heng Swee Keat delivered the 2020 Budget Statement on Tuesday, Feb. 18, at 3:00pm in Parliament.

The speech came while the Covid-19 outbreak, a potential recession and a possible general election loomed in the background of many Singaporeans' minds.

This is the fifth time DPM Heng is delivering the Budget statement, since he took over as Finance Minister in 2015.

1. GST not increasing in 2021

Heng said after reviewing the government's revenue and expenditure projections, he had decided that the GST rate hike will not take effect in 2021.

This means the GST rate will remain at 7 per cent in 2021.

However, Heng said that the hike will still be needed by 2025.

2. S$800 million for frontline operations battling Covid-19

Next comes a series of schemes that intend to support frontline operations dealing with the Covid-19, as well as to cushion the impact on the economy, and to help sectors hit most heavily by the viral outbreak.

Heng said the government's immediate concern is to protect Singaporeans and their families.

He added that they will "put in every effort to slow down the spread of the virus".

To do this, S$800 million will be set aside in the Budget to support the efforts of frontline agencies which are fighting to contain the outbreak

The bulk of the amount, which is on top of the "substantial resources already committed each year to public health", will go to the Ministry of Health (MOH).

3. Stabilisation and Support Package

The Stabilisation and Support Package, amounting to S$4 billion, will help stabilise the economy and support the country's workers and enterprises by helping workers stay in their jobs, and helping enterprises with cash flow.

To help workers stay employed, their wage cost will be defrayed through two schemes.

Jobs Support Scheme

A Jobs Support Scheme will be introduced to help enterprises retain their local workers.

- For each local worker in employment, the ministry will offset 8 per cent of the wages, up to a monthly cap of S$3,600, for three months.

- The amount will be given to employers by the end of July in 2020.

The scheme, covering 1.9 million local employees in Singapore, will cost the government S$1.3 billion.

Wage Credit Scheme

To support wage increases for local employees, the Wage Credit Scheme will be enhanced.

- The monthly wage ceiling for Singaporean employees will be raised from S$4,000 to S$5,000 a month, for qualifying wage increases given in 2019 and 2020.

- The enhancements, amounting to S$1.1 billion, will go to about 90,000 enterprises, benefiting more than 700,000 local employees.

Corporate Income Tax Rebate

Under the Stabilisation and Support Package, economy-wide support to help enterprises with cash flow will be given too.

- For instance, a Corporate Income Tax Rebate for Year of Assessment 2020 will be granted at a rate of 25 per cent of tax payable, capped at S$15,000 per company.

- The rebate will benefit all tax-paying companies, and cost about S$400 million.

Support for sectors hit by Covid-19

The five sectors directly affected by the Covid-19 will get additional support as well.

They are tourism, aviation, retail, food services, and point-to-point transport services.

Here are more details for the support given:

Food services and retail business

The National Environment Agency (NEA) will provide a full month of rental waiver to stallholders in NEA-managed hawker centres and markets.

The Housing and Development Board (HDB) will provide half a month of rental waiver to its commercial tenants.

A 15 per cent Property Tax Rebate will also be granted for qualifying commercial properties.

Heng urged landlords to pass the rebate on to their tenants by reducing rentals.

Tourism sector

- A Temporary Bridging Loan Programme will provide for cash flow support

- There will be up to 30 per cent Property Tax Rebate for 2020

Aviation Sector

- Rebates on aircraft landing and parking charges will be implemented, assistance will also be given to ground handlers

- Rental rebates will be provided for shops and cargo agents at Changi Airport

4. Care and Support Package

Heng said the Care and Support Package, amounting to S$1.6 billion, will provide "additional, timely help" to more households with their cost of living.

- All Singaporeans aged 21 and above in 2020 will be given a one-off cash payout of S$300, S$200 or S$100, depending on their income.

- Additional GST voucher -- U-Save rebates will be given to all eligible HDB households to help with their utilities expenses.

For lower-income Singaporeans:

- Under the Workfare Special Payment, Singaporeans on Workfare will receive 20 per cent more for work done in 2019, with a minimum payment of S$100.

- Grocery Vouchers worth S$100 each year will be given in 2020 and 2021, for use at major supermarkets

For families taking care of children and elderly parents:

- S$100 for each Singaporean parent with at least one Singaporean child aged 20 and below will be given in 2020.

- S$100 PAssion Card top-up for all Singaporeans aged 50 and above in 2020.

5. Assurance Package

Although GST will inevitably rise by 2025, the government will provide support to buffer Singaporeans against the impact of the increase.

When it is raised, a S$6 billion package will be instituted to help Singaporeans.

But the money for this package will come from this year’s Budget.

Heng said that the majority of Singaporean households will receive offsets to cover at least five years’ worth of additional incurred GST expenses.

Lower-income households will receive more, with those living in one to three room HDB flats standing to receive 10 years’ worth of additional incurred GST expenses.

Also under the package, every adult Singaporean will receive a cash payout of S$700 to S$1,600 over five years.

Heng also reiterated his commitment to the permanent GST voucher scheme and said he will enhance it.

6. Senior support

Senior citizens will also enjoy a number of benefits from this Budget.

Singaporeans aged 40 to 60 will receive a special S$500 SkillsFuture Credit top-up.

Employers will also have an incentive to hire local jobseekers aged 40 and above through reskilling programmes.

A Senior Employment Credit will also provide wage offsets for firms hiring Singaporean workers aged 55 and above.

The government will also introduce a Matched Retirement Savings Scheme, where up to $S600 in CPF cash top-ups will be matched dollar-for-dollar by the government annually.

7. Environment spending

The Budget also devoted a significant amount to environmental efforts, including the fight against climate change.

An initial S$5 billion will be provided for Singapore’s coastal defences.

Heng also expressed Singapore’s commitment to phase out vehicles with Internal Combustion Engines by 2040, and announced a new Road Tax scheme for electric vehicles as Singapore looks to transform the vehicle landscape in Singapore.

Top image from MOF.

Other Budget 2020 stories you need to know:

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.