A 60-year-old widow in Singapore has allegedly lost about S$55,000 to a scammer who pretended to be from DBS Bank.

Horrified by the experience, the woman's daughter took to Facebook to share what happened to her mother in an attempt to seek help to get the money back.

Bogus DBS staff scammed S$55,000 via call

In a Facebook post on Jan. 14, one Labina Fariah wrote that her mother received a call via messaging app "Viber".

The caller claimed to be a staff member from DBS Bank and lied to the victim that her bank account had been hacked.

The victim was wary initially, and questioned why he was calling via "Viber" and not with a local number.

But she eventually relented when the caller urged her to trust him with her bank card number and iBanking pin so that he could help rectify the matter, as she supposedly had been having issues with her iBanking app for some time.

The victim realised something was amiss when she received an email informing her that about S$18,000 was sent to this person called Sunita.

Scammer wanted more

That's when she called Labina and told her what happened. In the meanwhile, the brazen scammer was still on the phone with the victim and wanted more.

The two of them were in disbelief and "thought it was just an error" until they updated the bank book.

Labina said that her mother's "entire saving(s) was wiped out" after losing a total of S$54,999.06 and was only left with S$99 at the end.

"She broke down and I am not sure how to make things right for her", Labina added in her post.

Labina elaborated that the family has not been in a good financial state after her father passed away.

What happened to her mother was exceptionally devastating as she "had saved whatever she could" and life as a single mum has not been easy.

Lodged police report & informed DBS

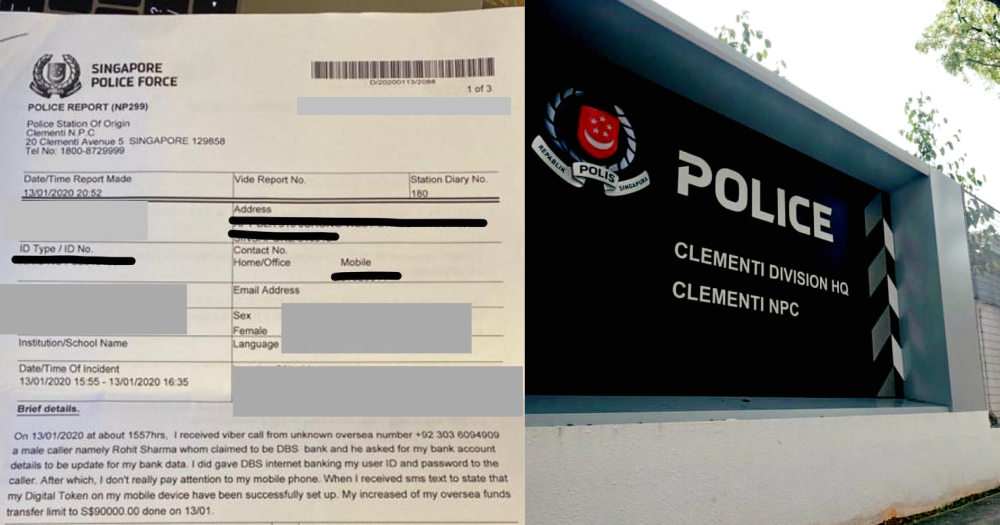

Along with the post, Labina uploaded photos showing that a police report was made at Clementi Neighbourhood Police Centre.

Image from Labina Fariah/Facebook.

Image from Labina Fariah/Facebook.

Mothership confirmed with the police that a report was lodged and investigations are ongoing.

The report detailed that the incident happened between 3:55pm to 4:35pm on Jan. 13.

A total of four payees were allegedly added after she gave away the banking details and her transfer limit was also raised to S$90,000 that day.

These payees were traced to accounts under the State Bank of India, according to Labina's subsequent Facebook posts.

The last transaction was made at 4:13pm and Labina noted that they were seeking help at a DBS branch office at Westgate by 5:00pm.

Mothership understands that DBS Bank is in touch with Libana and her mother to look into the matter.

DBS urged bank users to be vigilant

In response to media queries, a spokesperson from DBS Bank also urged bank users to always be vigilant and never give out their personal security information, enter sensitive information into unknown websites, click on URL links originating from unknown sources, or reply to unsolicited SMSes, e-mails or calls.

They highlighted that DBS/POSB will never request for customers to download software, disclose their Internet Banking access credentials (such as username or password, OTP, Digital Token approval), or to conduct any fund transfers over the phone.

Customers can call us at 1800 111 1111 (24-hour hotline) if they notice suspicious or unusual activity in their accounts.

Scammers are actively targeting bank customers in Singapore via automated calls, voice calls and SMSes, phishing for bank account and personal information that could lead to a loss of money.

Top photo collage from Labina Fariah/Facebook and Clementi NPC/Facebook

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.